Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Freetrade is one of the UKs most popular investing apps. It’s raved as a great option for beginners to test their skills in the market and even gets you a free share when you sign up.

If you’re looking for a fun, cheap and engaging investment app, look no further than FreeTrade.

The app has gone from strength to strength since launching and it’s user experience is excellent.

I personally downloaded FreeTrade and had a general investment account for 9 months before writing this review.

In this Freetrade review UK we will delve into the business, the trading platform, what we like and what we don’t.

Table of Contents

Freetrade Review - Company Overview

FreeTrade is looking to capitalise on the rise of retail investment (investors like you and me) by offering commission-free trading and low entry points.

Accounts can be set up for as little as £1, and they provide account types such as ISAs and general investment accounts that are similar to traditional brokers.

The app-only-based platform is designed with colourful displays and an engaging trading experience with beginners clearly in mind.

They are also authorised and regulated by the Financial Conduct Authority, and all accounts are covered by the Financial Services Compensation Scheme.

Will FreeTrade IPO?

The company has gone through several crowdfunding rounds, allowing them to continue growing its user base with aggressive advertising campaigns and expansion into Europe.

We don’t however hear of any plans for the app to go public just yet.

Since its inception, FreeTrade has acquired over a million users. They also offer a free share worth up to £200 for each person that signs up and deposits over £1.

They have also won several awards, winning the best online trading platform at the 2019 & 2020 British Bank Awards. They’re highly rated on most comparison websites, including Trust Pilot, with a 4.3-star rating.

With FreeTrade, you can buy fractional shares which means you don’t need to buy a full share to own. accompany. This means you can invest in companies like Apple, Tesla and Google with just a small amount.

Types of accounts and pricing

FreeTrade Basic / Standard / Plus

FreeTrade recently updated their pricing tiers to house three different type of plans which are basic, standard and plus accounts.

We felt the way it was didn’t really need updating but hey they feel like it’s better as they’ve added a cheaper layered option in for those who didn’t want to pay the full £9.99 a month option (we’ve stayed on basic).

FreeTrade Basic

This allows you to open a GIA (general investment account) and gives you access to around 1500 stocks and ETFs. There is no monthly subscription fee.

FreeTrade Standard

On the standard option you get wider access to more stocks and ETFs (around 6000) and can also open a Stock and Shares ISA subscription as part of the package. This sets you back £4.99 a month.

One cool thing which they’ve added is 1% interest on up to £2000 worth of uninvested cash which is better than a lot of high street banks right now.

FreeTrade Plus

Stepping it up a notch now FreeTrade plus offers you access to SIPPs (Self invest person pensions) and also priority customer service.

One of the major plus sides is a 3% interest (paid monthly) on deposits of up to £4,000. You can also set limit orders and stop losses on your trades, providing further protection. This feature is not available on the platform without FreeTrade Plus.

The cost is £9.99 a month (£119.88 a year), so only get into this if your deposits vastly outweigh this and you want to access the broader features available to you.

GIA – General Investment Account

These accounts are helpful for those who perhaps have maxed out their shares ISA elsewhere and are looking to hold another account.

You are subject to capital gains tax after earning £12,300 and dividend tax after earnings dividends of more than £2000 per annum.

Whilst these accounts are low cost and free to set up, we suggest using stocks and shares ISAs first before opening a GIA to ensure you’re maximising the tax benefits available to you.

Stocks and Shares ISA

Having these types of accounts available is a game-changer for FreeTrade. Stocks and Shares ISAs allow investors to put £20,000 into their accounts each year tax-free.

They’re also not subject to capital gains, income, and dividend tax but offer the same trading experiences found on a GIA.

FreeTrade charges a fee of £4.99 a month (£59.88 a year) to hold a Stocks and Shares ISA as part of the standard plan.

This amount isn’t worth worrying about when you consider how much you save on tax but it’s important to check.

SIPP – pension

SIPPs or self-invested personal pension is an account you manage for your pensions. Whilst most people think oh god, retirement, often most people’s pensions are with providers that control where the money is going.

SIPPs allow you to take back control and invest directly into the assets you want to have.

You can have a SIPP alongside your workplace pension, and some make use of both to keep their employer contributions.

The UK government encourages pension contributions and tops up your personal SIPP by 20% (at the time of writing), just like they do in your workplace.

FreeTrade charges £9.99 a month for a self-invested pension plan (£119.88 a year).

What do we like?

Freetrade’s app design is exceptional. It’s intuitive, easy to navigate and actually terrific fun too. This is firmly backed up by the awards its won, and when you use it, you can see why.

Beginners can feel at ease, and if you’re used to using apps like Amazon Video or Facebook, you’ll be totally fine.

Overall I would say the platform design is a casual investor’s dream. You can quickly check your overall portfolio performance and create watchlists to track the price of stocks that you might be looking to buy.

The’ discover’ tab is a nice feature if you’re looking for an investment to choose from. It shows assets by popularity, category and industry, or you can simply search directly for something if you know the name.

FreeTrade referral scheme is also available. If you refer a friend both you and the referral receive a free stock into any of your selected accounts so it’s good to get your friends involved.

Is FreeTrade FCA regulated?

Yes, it is. This means that our customer accounts are covered up to £85,000, providing added security.

Make the most of their free share upon signing up to the value of £200. When we signed up, we received a free share of Nike, which was valued at $97 at the time, but most receive something around the $20 mark. Not bad for 5 minutes of work!

FreeTrade also has a great community with over 50,000 people signed up for their Honey free newsletter subscription.

Honey provides daily updates on the stock market and commentary from key analysts at The Guardian, Forbes and The Telegraph.

What don't we like?

The app is lacking in research tools and more in-depth analysis to make wider decisions meaning you may need to use other websites to get the full picture before placing trades.

I’m sure this is something they’re looking to improve, but for now, it remains a slight annoyance.

The platform is solely app-based, which is quite restrictive if, like me, you like seeing charts on larger screens.

For example, I like comparing two charts within the same sector, meaning I’ll need to have them open on my desktop and then use my phone or iPad to place the trade.

The other thing about being just an app is the charts are quite restrictive. For example, on eToro, the desktop version provides a wide suite of chart tools to be able to assess an asset in more detail.

I think this is largely down to the app being beginners only focused, and whilst this is understandable, as beginners grow in skillset, they may look elsewhere to find wider tools.

If you’re coming from a more traditional broker, it might be important to assess whether switching to FreeTrade to save on fees would mean you’ll need to stay subscribed to another platform elsewhere.

What I’d like to see is a desktop version come out sooner rather than later, and the chart tools perhaps are added to the FreeTrade Plus subscription.

Trading Experience

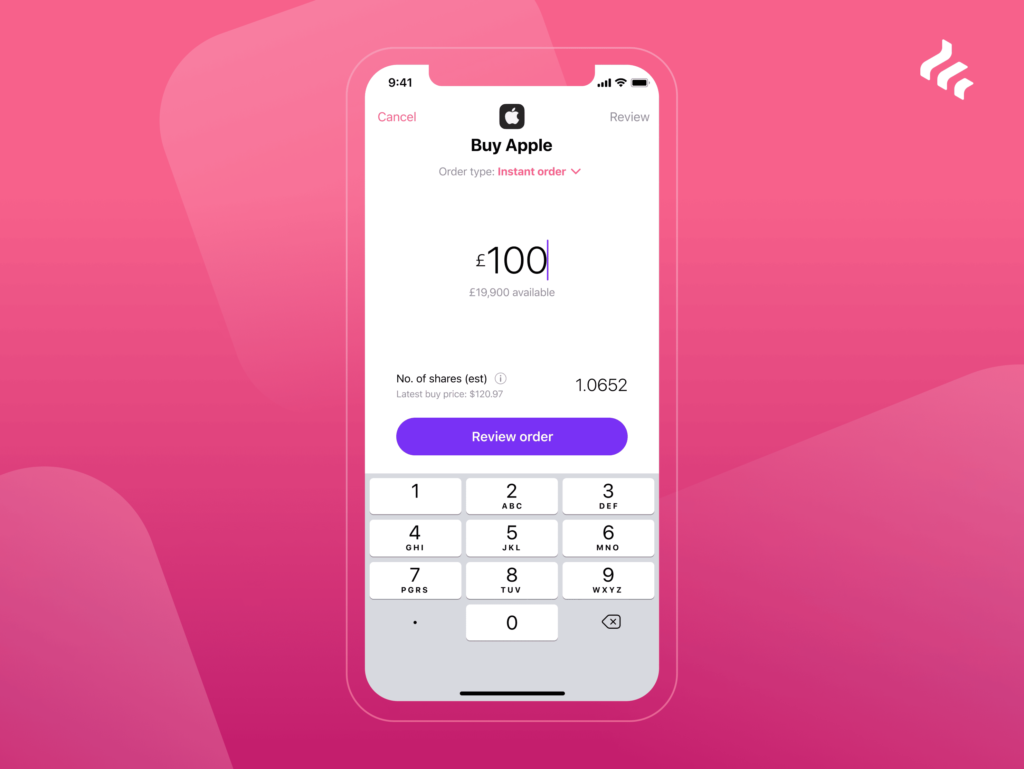

It’s effortless to buy and sell assets on FreeTrade with a fast response once you’ve placed them.

It shows up immediately in your portfolio, and you can see the different prices you’ve purchased in just a couple of taps on your device, which we like a lot.

As you find on other digital apps, the trading experience could be likened to a video game, but you’re playing with real money this time.

You can get carried away buying and selling as it’s almost rewarding to place one. It’s essential to do your research before starting to trade, as trading often can lead to significant losses and quickly too!

If you’re interested in learning the stock market basics check out our investing for beginners page.

Trading charges

No commissions for buying and selling assets

0.45% currency conversion surcharge for purchases placed outside the UK. This is quite reasonable, with other providers like Hargreaves Lansdown charging up to 1%.

There is no charge for putting money into your account or withdrawing, which is a big tick for us.

Withdrawal fees can stack up, especially if you’re using your Stocks and Shares ISA to withdraw regular passive income from your dividends.

Opening an account

Freetrade’s account process is sick, friendly and fast. Usually, it takes around 5-10 minutes to fully open an account and, in some cases, can take up to 48 hours if you’re not instantly verified.

We suggest having your ID, such as your passport or driving license, with you if you fail digital verification. You’ll also need proof of address, such as a utility bill, bank statement or tax bill.

The app is available to download on both Android and IOS. It’s easily found on both stores with a quick search.

What can you trade?

In comparison to other platforms, you might say Freetrade’s availability is limited. This still doesn’t stop you from having access to 6000+ US, UK and some European stocks.

The access you get is tiered and paid user get wider access to stocks.

Freetrade has been widening its selection a fair bit each year as the community calls for more obscure names to be added.

Currently, the offering is very US & UK heavy and is lacking in its selection across Europe and Asia, but there is still plenty to choose from without those full markets.

If you’re a Freetrade Plus member, this number increases even further as you get access to a much wider range of small-cap stocks and ETFs.

One thing we do like is that Freetrade does have some REIT funds (real estate investment trusts) on there alongside Investment Trusts like the famous Scottish Mortgage Investment Fund.

<p

UTG Rating - 9/10

Overall we highly rate FreeTrade. Its app is fantastic to use, and we have great fun using it.

They’ve done a great job making it feel like a community and galvanising a demographic that perhaps would never have invested.

Having a Stock and Shares ISA and SIPP available on there is a real draw for those looking to make the most of tax wraps. The fees are reasonable, and commission-free trading is a huge draw.

There are certainly some similar alternatives to FreeTrade but it’s a solid option and with the innovation that they keep injecting into the project we can only predict great things for its future.

To get it up to 10/10, we’d like to see a desktop version with some wider tools and research available. We’d also like to see a few more major stocks from Europe and Asia added in.

But to answer ‘is FreeTrade good for beginners’ our answer is a big YES!

Check out all our favourite investing apps here.

Share with your friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.