Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Gohenry is a fantastic tool for parents who want to teach their children financial literacy and responsibility from a young age.

By giving children the opportunity to manage their own money with a debit card and real-time notifications, parents can monitor their child’s spending habits and guide them towards making responsible financial decisions.

The app also allows parents to set spending limits and savings goals, which can encourage children to learn about budgeting and saving money.

It get’s a big tick from me!

If you’re looking for ways to educate your children about money, this GoHenry review is well worth a look.

There is such a thing as a cash app for kids nowadays and GoHenry are doing it well!

While other kids’ cash apps have appeared on the scene, it’s safe to say that GoHenry was the true original.

We’re going to look at the features that this company offers, consider the costs involved, and sum up all that’s good and not so great about what’s on offer.

If you’d like to know all that there is to know about GoHenry but first the important bits!

GoHenry Rating

- Useful Features

- User Experience

- Suitable For Beginners

- Customer Service

- Customer Feedback

- Price / Fees

I’ve scored GoHenry 4.25 out of 5 stars using our six pillar system which we use to rate all our financial apps.

It scored best on it’s useful features, user experience and suitability for beginners. There’s a tiered monthly fee (£2.99 or £4.99) and a 50p transfer fee to be aware of.

Having played around with the features on the app we certainly think the cost is worth it to essentially educate your kids how money works. Something we unfortunately weren’t afforded when growing up!

If you’ve heard enough ready we have an exclusive offer when you enter code >> ( AFUKFNACC) you get one month of GoHenry for free and a free custom card. >> Click here to grab the offer <<

Pros & Cons

Pros:

- It allows you to teach your children about good money management

- Children love the fully customisable cards that are on offer

- The app is slick, fast and responsive

- There is an option to open a Junior ISA which you can invest up to £9,000 tax free a year for your child inside a Vanguard fund

- They have excellent customer service

- As a parent, you have exceptional levels of control

- GoHenry is regulated by the FCA

- GoHenry runs a referral program refer a friend and get £20

- Deals and discounts on family days out and more

Cons:

- The monthly fee is expensive, especially if you have more than one child

- The 50p charge for loading money

- Although your child can save, they can’t earn any interest

- There is no protection under the FSCS

ONE MONTH FREE + A FREE CUSTOM CARD

WITH THE CODE ( AFUKFNACC )

Table of Contents

GoHenry Review - Company Overview

When looking at anything cash app for kids related, you’ll soon see that GoHenry is the grandad of this scene. Launched in 2012, this company has been operating and expanding for two decades.

What makes this company so remarkable is its founders. Rather than a corporate high flyer, GoHenry was formed by a group of parents who wanted to educate their children.

They wanted them to learn all about money and how to manage it, all while avoiding debt.

It has to be said that GoHenry has been more than just a little successful in its aims. It now has over 2 million members spread across the US and the UK and has managed to secure millions of pounds worth of investment to allow it to continue to develop.

While it may be true that high street banks already provide bank accounts for children, this GoHenry review will show you how what this company offers is different.

Its wealth of features allows you to track spending as well as teach kids about money management.

What's in store?

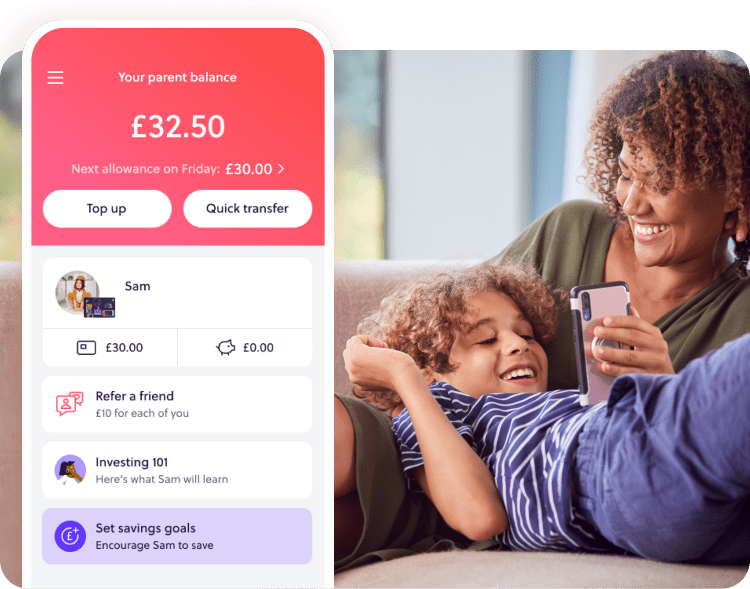

As a parent, it is you that sets up the GoHenry account. When you’ve done this, these are the features that you and you’re child have access to:

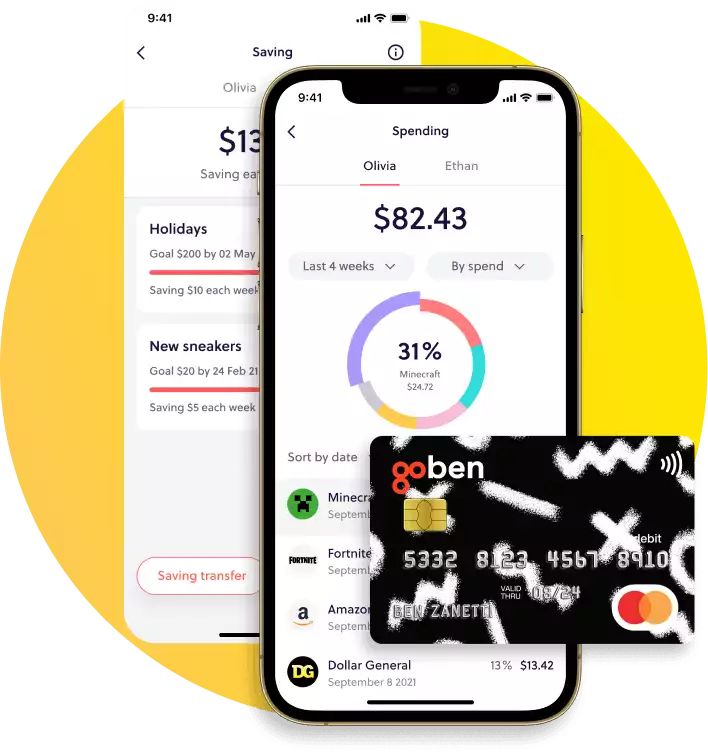

- Visa prepaid debit card – this can be the standard GoHenry card or it can be customised. Your child can use this in shops, online, and at ATMs. They can also add the card to Google and Apple Pay

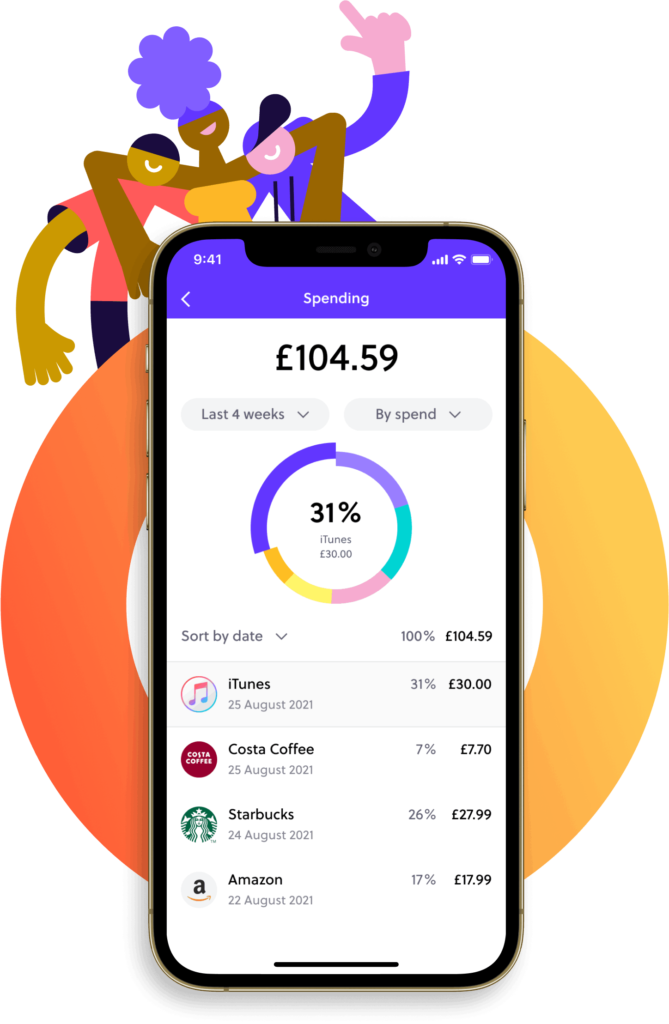

- A great mobile app – you can use the app to monitor all that’s going on with your child’s account. The app is extremely easy to navigate and use

- Set up regular payments – you can arrange for your child to be paid pocket money every week. If you’re not sure how much you should be paying, GoHenry will give you an insight into the averages according to a child’s age

- Other ways to earn – you can set up tasks for your child to complete that they are paid for when they’re finished

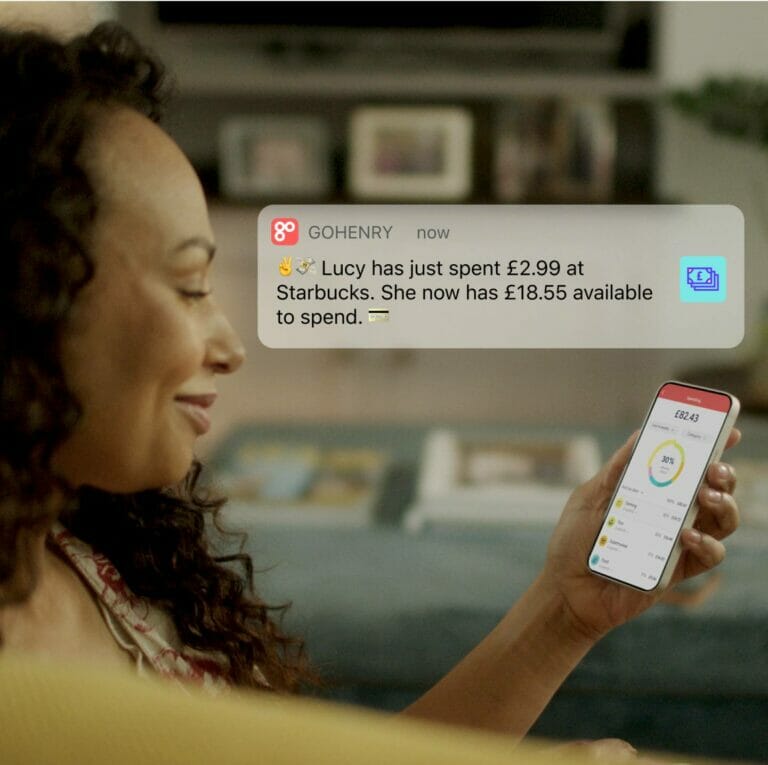

- Instant notifications – anytime anything happens with your child’s account, you and they will be notified

- The ability to block – If your child loses their card, or if you’re concerned about them going on a spending spree, you can block the card in an instant

- Decide where the card can be used – don’t want your child shopping in a certain kind of shop? You can block and allow these by category

- Set limits – you can set how much your child can spend in a single transaction or across the course of a week

- Savings – your child can set a saving goal and see money set aside until it’s achieved

- Money missions – a learning program that teaches children all about managing money

GoHenry Money Missions

Introducing a new feature to help children develop good money habits and save money – Money Missions.

This feature consists of a series of engaging videos and quizzes that help children learn about essential money skills such as investing, saving, compound interest, borrowing, giving, and more.

With Money Missions, children can earn points and badges as they progress through the videos and quizzes, making the learning process even more fun and rewarding.

This feature is designed to teach children the basics of money management while also encouraging them to cultivate healthy financial habits.

If you’ve heard enough just a reminder that we have an exclusive offer when you enter code >> ( AFUKFNACC) you get one month of GoHenry for free and a free custom card. >> Click here to grab the offer <<

GoHenry Junior ISA or JISA

GoHenry offers a new Junior ISA (Individual Savings Account), which is a great way to save and grow money for your child’s future.

It’s a long-term and tax-efficient investment option that only takes a minute to set up through the GoHenry app.

Here’s what you need to know about the Junior ISA:

- You can start your investment with as little as £1.

- You can deposit up to £9,000 this tax year (2023-2024) through monthly contributions or one-off payments, and you won’t pay any tax on the interest or returns on your investment.

- You can manage your GoHenry Junior ISA through your parent app, making it easy to keep track of your investment.

- The money you add to your child’s Junior ISA is locked away until they turn 18, so there’s no risk of them spending it on things like gaming, a new phone, or an expensive bike.

GoHenry’s Junior ISA is a tax-efficient and hassle-free option for parents looking to save for their child’s future.

The easy management through the GoHenry app is a plus, and the fact that the money is locked away until your child turns 18 is a great way to ensure they won’t spend it impulsively.

Opening a GoHenry account

If this GoHenry review leads to you wanting to open an account, this is something that can be done with ease.

First off, you can choose to other head over to the website or download the app. For us, the app is a must. That’s because when your child’s account is up and running, it is via the app that you’ll receive all of the notifications to your smartphone.

Whichever way you choose to go, you’ll need to enter some personal details such as:

- Name

- Address

- Mobile number

- Password

- Your child’s details

Once this is done, you click and wait for your account to be confirmed. This takes a matter of minutes, and once it happens, your child’s GoHenry card will be processed and posted.

It will usually reach you within 5-7 days.

When the card arrives, it needs to be activated just as you would with any Visa card. As soon as you’ve done this, you’ll need to add a minus of £5 to the account before you can start setting limits and creating tasks.

ONE MONTH FREE + A FREE CUSTOM CARD

WITH THE CODE ( AFUKFNACC )

Is GoHenry safe?

The first point here is that GoHenry is not a bank, which means that it doesn’t come with cover from the Financial Services Compensation Scheme (FSCS). However, there’s no need to be alarmed by this.

GoHenry itself has stated that Visa regularly monitors how it acts to ensure that it’s compliant. Also, any money added to GoHenry is secured in a NatWest account. As a traditional bank, NatWest is, of course, regulated by the FCA.

How much does GoHenry Cost?

It was all going so well.

We’re not big fans of the fact that GoHenry is not free. That being we think the features of the app make it worthwhile for the education it brings alone!

- GoHenry charges £2.99 per month for each child’s account, and you can have up to four accounts.

- For this charge, you will have access to all the features offered by GoHenry.

- Topping up your child’s card once a month is free. But, if you load money more than once, there is a transaction fee of 50p.

- To avoid this fee, load your balance at the start of the month with what you need.

- Customizing your child’s GoHenry Visa card with different backgrounds and your child’s name costs £4.99, but it is not necessary. The standard card is free.

Can you use GoHenry abroad?

You certainly can. That means that if you’re going on an overseas holiday, there’s no reason why your child can’t continue to manage their money.

While GoHenry doesn’t charge for this, it’s worth noting that some foreign ATMs may apply a fee. While abroad, your child’s GoHenry card can be used anywhere that accepts Visa.

ONE MONTH FREE + A FREE CUSTOM CARD

WITH THE CODE ( AFUKFNACC )

GoHenry alternatives

There are several alternatives to GoHenry, each with their own unique features and benefits. Here are a few popular options:

- Osper

- RoosterMoney

- Nimbl

- Revolut Junior

- Starling Kite

Each of these platforms offers a similar service to GoHenry, allowing parents to teach their children about money management and financial responsibility in a safe and controlled way.

It’s worth researching each of these alternatives to see which one best suits your needs and preferences.

FAQs

Is GoHenry any good?

In my opinion, GoHenry is a great tool for parents who want to teach their children about financial responsibility in a fun and interactive way.

With features such as the GoHenry card, chores and tasks, and Money Missions, children can learn about budgeting, saving, and spending in a safe and controlled environment. Additionally, the easy-to-use parent app makes it simple for parents to manage their child’s account and monitor their spending.

I think GoHenry is a fantastic way for parents to help their children develop positive financial habits that will benefit them for years to come.

Does all shops accept GoHenry?

Yes, aslong as a shop takes VISA which in the UK is pretty much every single store bar the cash only ones.

Abroad you may find that VISA accepting stores are slightly less but again the majority of places now accept VISA transactions.

How does my child withdraw money from GoHenry?

Your child will be able to withdraw cash from a cash machine in the same way you would.

The difference is that you receive a notification with the name and location of the transaction allowing you to take action if required.

What can't you buy with a GoHenry card?

GoHenry relies on the merchant category to accurately identify the types of businesses where your child can spend their money.

By enabling the strict merchant block, you can prevent transactions from going through at locations like restaurants, bars, and convenience stores that sell age-restricted items such as alcohol.

With this feature turned on, your child won’t be able to purchase any items, including innocent treats like ice cream or magazines, from these establishments.

This provides an added layer of control and peace of mind for parents who want to ensure their child’s money is being spent responsibly.

What bank is behind GoHenry?

IDT financial services are the card provider for GoHenry. They are a VISA member and also regulated by the financial conduct authority.

How does GoHenry Make Money?

GoHenry makes its money from subscription fees and transfer fees. It also has relationships with partners that it can earn a commission for should you make a purchase with them.

How long is GoHenry Free For?

One month. You can get a free trial with Gohenry but you will need to cancel it before the end of the calendar month.

How to cancel GoHenry?

GoHenry is there for children aged from 6 up to a maximum of 18. Once your child turns 18, they won’t be able to carry on using the account, so you’ll need to cancel it.

If you decide to cancel at any time before this, the process is the same, and it can be done quickly.

All that you need to do is make a call to customer services. They will close your account with immediate effect. Made a mistake? Fear not. They allow you a three-day cooling-off period in case you change your mind.

If any money is left in the account when it’s closed, it is sent back to your nominated bank account in around 7 – 10 days.

Final Thoughts

What GoHenry offers is pretty amazing. The only issue is the pricing.

When you look at the likes of the NatWest rooster account and the offerings of HyperJar, paying £2.99 a month isn’t necessary, but then again, every business has its running costs.

However, the cost of an account over one year is just £35.88 a year. Personally, it’s worth it knowing your child is spending safely, and your children are learning along the way.

If you liked this review check out our article ‘5 Fun Ways To Teach Kids About Money‘.

We hope you enjoyed our GoHenry review!