Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

HyperJar is a technology services and data company that offers a smart family spending account, designed to help individuals, families, and groups improve their financial wellbeing.

It provides powerful tools to budget, track, and visualise spending, allowing users to put money aside for specific purposes, point to specific brands, and access card-linked merchant rewards.

With group saving, sharing, and spending capabilities, HyperJar offers an all-in-one platform that makes money when consumers use its services to access rewards, incentives, and services that align with their financial intent.

If you’ve been looking for new ways to manage your money, then HyperJar may provide the answer.

They are essentially a company that allows you to save, track your spending, and even get your kids on board to develop some positive financial habits.

This app-based service has some unique features that make it highly appealing on the eye.

In this HyperJar review, we’ll be taking a look at all this app has to offer.

Hyperjar Rating

- Customer Feedback

- Customer Service

- Suitable For Beginners

- User Experience

- Useful Features

- Price / Fees

I’ve rated Hyperjar 4.08 out of 5 stars.

The app has some cool features and those who use it rate it very highly.

Personally I’m not blown away by them just yet, but that’s just personal preference. I am not a parent yet or do I require visual aids to budget correctly.

If that sounds like you though HyperJar may well be perfect for you.

Pros & Cons

Pros:

- HyperJar offers a free budgeting service

- Anyone can open an account with no credit checks required

- Children’s cards are available with no fees and no top-up charges, making it easy to monitor their spending

- It is a digital version of traditional money in a pot or envelope budgeting, which can be a helpful tool for those who prefer this method

- It can be used to save money towards specific goals, such as a holiday or university

- Money can be placed and locked in jars, providing a visual representation of where it sits and helping users stay on track with their budgeting goals

Cons:

- While the Jars concept is cool, it’s not very unique compared to what other providers offer

- Other providers offer similar features along with additional benefits, making HyperJar’s offering less compelling

- The commitment you need to make to spend money with a particular partner when using the jars concept limits freedom and flexibility to move your money around

Table of Contents

The HyperJar review - Company overview

Any HyperJar review needs to take a look at the company behind the service, and so that’s exactly what we’re going to do here. The company itself is a UK-based fintech that provides a money management app.

The company trialled its service back in 2019 and went ahead with a full launch in October 2020.

The first thing to note here is that HyperJar is not a bank. When you pay any money into HyperJar, it is managed by Modulr FS, an authorised Electronic Money Institution.

This means that with HyperJar, you’re getting an e-money account and not a bank account as such.

Along with your HyperJar account, you are also given a prepaid card from Mastercard. This means transactions are processed securely, and the card is accepted at almost any location you can think of.

Is HyperJar safe?

Before deciding whether HyperJar is a company you’d like to deposit money with, you’ll need to know whether or not it is safe.

Well, as HyperJar isn’t an actual bank, it isn’t covered by the Financial Services Compensation Scheme (FSCS). However, it is regulated by the Financial Conduct Authority (FCA), so dealings can be trusted.

When it comes to the app itself, just like many other financial apps, it uses 256-bit encryption. It also allows for fingerprint and facial recognition, meaning that the app, and more importantly, your money, are as secure as the high street banks.

The current TrustPilot review put them on 4.5/5, with over 710 reviews at the time of writing which isn’t bad for a relative newcomer.

The types of HyperJar accounts

When it comes to what’s offered in terms of account types, it’s important to remember that HyperJar isn’t a bank. Really when you take a step back it’s more a digital wallet with features.

Not being a bank has it’s positives as it means that there are no credit checks and that acceptance is pretty much guaranteed. It also means that it comes with a standard account type that is open to everyone.

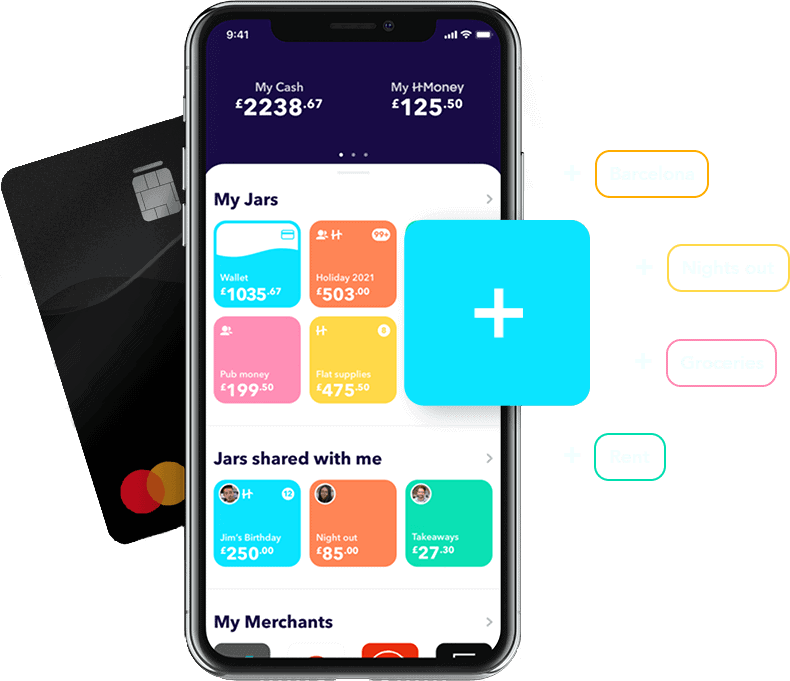

The account you open comes with a UK sort code and account number so people can pay into it. Then once you have the account open, you can split your account into numerous mini-accounts known as jars.

How Does Hyperjar work?

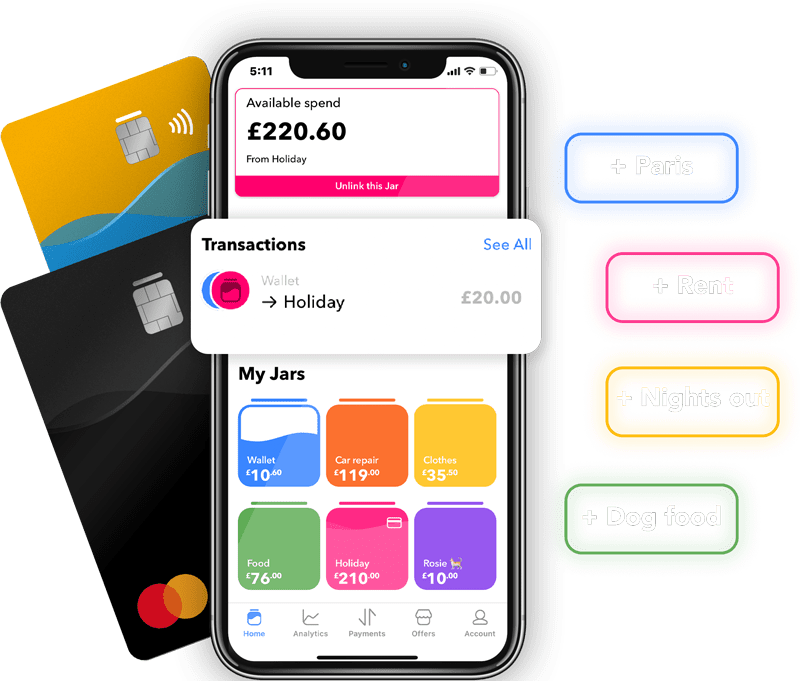

- HyperJar allows users to allocate money into separate jars with a set purpose, like a digital version of the envelope budget concept.

- Distributing funds into separate jars can help manage spending more efficiently and track spending habits.

- Users can connect the jars to their HyperJar card to spend from any of them.

- HyperJar also offers a child card for children aged six and above, with a separate jar that parents can allocate money to, and receive notifications every time their child spends.

- Children can use the HyperJar app to track their spending and add their card to Apple Pay and Google Pay if they’re over 13.

- HyperJar offers a viable alternative to Go Henry.

HyperJar fees

What we’ve really liked as we’ve gone through this HyperJar review is that what’s on offer is free. That means you can download the app, receive your primary card, and use your account free of charge. The only fees that come into play are:

• A replacement card – £5

• Recalled bank transfer – £25

While being practically free of charge to use, you may be wondering how HyperJar goes about making money. After all, it is a business just like any other.

Well, HyperJar doesn’t need to charge any fees to its customers because it makes money from its partners.

We’ll be covering these partners shortly, but they pay HyperJar a monthly fee for being able to use the service, and they also pay a small percentage of each transaction. With this money coming in, HyperJar does not need to charge customers for using its service.

What about opening an account?

If this HyperJar review, so far, has left you wanting to explore how to open an account, you’ll be pleased to know that it’s a painless and straightforward experience.

The first thing to note is that if you’re looking to open an adult account, you must be at least 16 years old. Below this age, you can be added as a child by your parents.

You can find the HyperJar app over on both Apple and Google stores, so you must visit your relevant one and download the app. With the app installed, it’s now time to create your account.

For this, you will need to provide your email address, mobile number, name, address, and employment details. You click verify, and you’re good to go.

With your account open, it’s time to work at creating Jars. As well as ones for everyday use, it’s worth exploring longer-term goals such as holidays and even a deposit for a mortgage.

While you’re busy doing this, HyperJar will be processing and sending out your new Mastercard, which should reach you within a few days.

Special features

When we looked at how HyperJar manages to keep its services free for customers, we mentioned that it makes its money from partners. Well, this is where they come into play.

HyperJar has partnered with a wide range of retailers so that you can earn your money. HyperJar isn’t a bank, so it’s not allowed to refer to it as interest. Instead, it’s called the Annual Growth Rate (AGR).

The AGR offered is an impressive 4.8%. You get this by committing to spend with one of hyperJar’s partners and placing funds into a specific Jar.

Let’s say you create a Jar for Lidl and place £100 in there. After a year, that will have grown to £104.92. A huge gain? No, but it’s undoubtedly highly competitive in terms of what traditional banks offer.

The difference here, though, is that you can’t withdraw the AGR: it is used to spend at your chosen partner. We contacted HyperJar about this, and they said they only really offer refunds in the case of an emergency like an utter financial ruin.

Not ideal, and to be honest, this is slightly worrying, but then again, if you were planning on buying something at one of the partners anyway, then it could be an excellent way to save a bit extra.

You’ll find that there are big and small brands to choose from when it comes to partners. Some of these include:

• Lidl

• Shell

• Beer52

• Dyson

• Not on the High Street

• TUI

• My Protein

There are far too many partners for us to list them all here, and the good news is that the list is growing all of the time.

FAQs

Is HyperJar any good?

HyperJar is a money management app that’s a great option for those who struggle with visual budgeting and enjoy setting money aside for larger purchases.

It provides powerful tools to track and visualise spending and lets users put money into specific jars for specific goals.

However, it doesn’t offer anything particularly new, and it’s important to note that HyperJar isn’t a bank, so users may want to consider additional banking services alongside it.

Really you are using the app for the user experience and that is very good.

Can you withdraw cash with HyperJar?

No, you cannot use HyperJar card to withdraw cash in the UK or abroad.

The travel card has the ability for you to spend in 36 million locations across 200 countries so the need to carry cash isn’t required.

With the UK becoming a cashless society very quickly you can use other banking services for your cash withdrawals.

Does HyperJar have a monthly fee?

No, one thing is great about HyperJar is the fees. There are no monthly, transactional or transfer fees which makes it ideal for savers.

HyperJar makes its money through referrals to partners. For example, if you use the money in a jar at a particular retailer HyperJar will earn a small commission for referring you.

Can you use HyperJar in shops?

Yes, HyperJar can be used in shops as it offers a digital wallet linked to a physical card, allowing users to make payments just like any other debit card.

What age is HyperJar for?

HyperJar is suitable for anyone over the age of 18 as it requires a full UK bank account and identity verification. However, the service also offers a child card for users to monitor their child’s spending, making it a great option for families with children.

Conclusion

We certainly think the concept was born to help people, but as a millennial with no kids (yet), the app still has a long way to go for me to use it personally.

Having your money locked in with a provider to achieve the ‘interest’ of 4.8% doesn’t sit that well with me as someone who likes to have full control of my money at all times.

That being said, planned purchases ahead of time could be a great way to utilise the app and interest (AGR). It really depends how happy you are to have money locked in.

The only way I’d see myself using this right now is for my future kids. Keeping track of them and having immediate blocking capabilities is an excellent idea, but they’re not the only ones doing this, so I’m hoping for some new products.

Introducing kids to payments in a controlled way is a fantastic scheme, and we back every company that brings financial literacy into children’s lives early on. This part is very similar to another cool brand in GoHenry.

I can certainly see the benefits and like what the company stands for so it’s definitely one to watch. We hope you enjoyed our HyperJar review.