Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

If you’re lucky enough to have a million stashed away somewhere and are looking for the answer to how much can you make from interest then you’ve come to the right place.

Why? Well, the interest on 1 million pounds is said to be more than enough for most to live off. But, is that true?

Most of us will have to work for it (yes, I’m afraid so) or get extremely lucky.

In this post, we will unpack how tiny changes in interest rates can significantly affect your returns from a million pounds.

If you’re lucky enough to have a million stashed away somewhere and are looking for the answer to how much can you make from interest then you’ve come to the right place.

Why? Well, the interest on 1 million pounds is said to be more than enough for most to live off. But, is that true?

Most of us will have to work for it (yes, I’m afraid so) or get extremely lucky.

In this post, we will unpack how tiny changes in interest rates can significantly affect your returns from a million pounds.

Table of Contents

How much interest on 1 million pounds?

Firstly we need to say that the returns on your interest will vary depending on the rate of return.

You can expect different interest rates from different savings accounts and even more variables (both up and down) if you invest your million.

If you’re lucky you get somewhere between 3-5% which depending on the current economic environment could be easy or slightly harder to find.

Below we’ve included a table that shows you the monthly and yearly returns as you move up the interest rate.

| Interest Rate | Monthly Return | Yearly Return |

|---|---|---|

| 1% | £833 | £10,000 |

| 2% | £1,666 | £20,000 |

| 3% | £2500 | £30,000 |

| 4% | £3.333 | £40,000 |

| 5% | £4,166 | £50,000 |

| 7.5% | £6250 | £75,000 |

| 10% | £8,333 | £100,000 |

As you can see the interest on 1 million pounds varies by quite a bit each month. Somewhere above 3+ interest is a very decent monthly return and move than enough to live on.

Looking at this 10% a year is an actual possibility and if you invest your money that is a possibility. There are many investors and financial institutions that achieve 10% a year on average over a number of years.

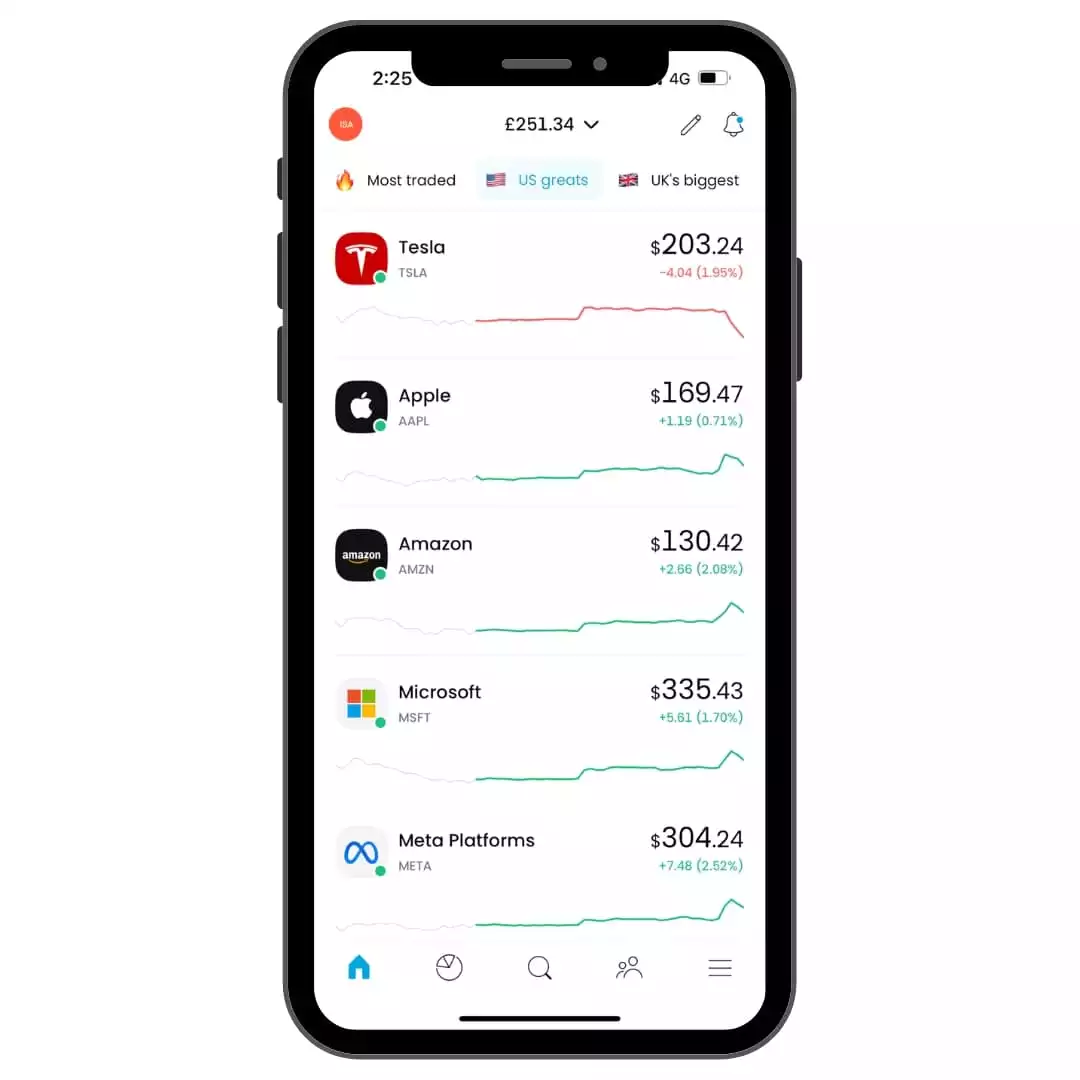

Stop waiting and start investing with the best UK investing apps on the market right now.

We’ve covered all levels with expert managed and DIY options available.

Is a million enough to live on?

According to research, a 66 year old who has a pension pot of £1million would be able to live of £67,000 a year until he’s 87.

This is assuming he’s drawing down his pension, has a growth rate of 5% and a calculation to factor the average inflation rate increase.

That doesn’t sound too bad at all, does it? I think most of us would be happy with that.

That being said, when we first heard this many years ago, it made me realise how much effort was needed to make my first million.

If you want to retire earlier with that same yearly amount of £67,000, then you’ll most likely need even more.

It really depends on:

- The lifestyle you want to live

- How much that lifestyle costs you per year?

- How long you want to be retired for?

- When do you plan on passing away?

Where to keep a million pounds?

There are many ways to secure your financial future when you have a million pounds. The returns you generate will depend on the risk and type of account you adopt.

Essentially you’re looking for the best interest rate possible from the lowest-risk approach.

Standard high street bank saving accounts will give you a meagre amount vs the returns stocks and shares could bring you. The difference is once you invest you could make lots of money but you could also get out less than you put in.

Suppose I don’t want to re-invest the money?

In that case, you’ll need to shop around for a high-interest savings account that doesn’t have a minimum monthly contribution.

I’m sure many banks would be willing to take your money and if you’re unsure seek advice!

Are there any tax problems I should know about?

If you put the money directly into a general savings or investments account, the returns you generate could be considered taxable income.

You will need to ensure you can get your funds secured into an ISA, but they also have only £20,000 tax-free entry limits per year. Not ideal.

So, where do you go?

The only real way is by re-investing the money into businesses, stocks or bonds. Your money is then being used, which can limit the tax you pay depending on how much return you get from those investments.

In this situation, 100% speak to an accountant or financial advisor.

How to get your first million?

Unless you have some unknown advantage making your first million is done by increasing income through investments.

That could be via the stock market or by investing in businesses and growing them.

If you’re starting your financial journey, making a million should be a landmark target by setting smaller targets on the way up.

Psychologically if you break it down, each goal becomes more achievable as you move one step closer towards each target.

Moving in baby steps, allows you always to have something to reach for that’s achievable.

Can I retire at 55 with 1 million pounds?

Retiring at 55 with a million pounds sounds like a dream, but let’s break it down.

Life expectancies are on the rise, and the cost of living keeps climbing. So, can you really call it quits at 55 with a cool million?

First, consider your lifestyle and financial goals. If you want to maintain a comfortable standard of living and potentially travel or pursue hobbies in retirement, a million pounds might not stretch as far as you think.

Next, think about investments. While it’s tempting to stash that million away, it’s crucial to make your money work for you. Sensible investments can help grow your wealth and ensure a more secure retirement.

Also, factor in inflation. Over time, the purchasing power of your million pounds will diminish. So, make sure your retirement plans account for the increasing cost of goods and services.

What can I do with 1m pounds?

So, you’ve got a million pounds burning a hole in your pocket – what’s next? Well, here are some exciting possibilities:

Invest for Growth: Consider investing in stocks, bonds, or even starting your own business. Smart investments can potentially grow your wealth over time.

Travel the World: With a million pounds, you can indulge your wanderlust. Explore exotic destinations, experience new cultures, and make unforgettable memories.

Buy Property: Invest in real estate, whether it’s a comfortable home, a rental property, or even a holiday retreat. Property can be a stable and appreciating asset.

Support Causes: Consider giving back to your community or supporting causes close to your heart. Philanthropy can be incredibly rewarding.

Early Retirement: If you’ve reached a financial milestone, retiring early and enjoying life on your terms is a possibility.

Secure Your Family’s Future: Use your wealth to provide for your family’s future, whether it’s funding education, helping with a down payment on their homes, or ensuring their financial security.

Start a Passion Project: Always wanted to write a book, open a cafe, or launch a tech startup? Now’s your chance to pursue your dreams.

Diversify: Don’t put all your eggs in one basket. Diversify your investments and financial strategy to safeguard your wealth.

Remember, managing a million pounds requires financial acumen and possibly professional advice.

It’s an opportunity to enjoy life, make a difference, and secure your future. So, choose wisely and make the most of your newfound wealth.

Conclusion

As we’ve come to see the interest on 1 million pounds varies hugely depending on the rate you can get.

We hope this has helped you set some goals and work towards something.

MORE LIKE THIS

Share this article with friends

Facebook Twitter LinkedInDisclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.

Table of Contents

How much interest on 1 million pounds?

Firstly we need to say that the returns on your interest will vary depending on the rate of return.

You can expect different interest rates from different savings accounts and even more variables (both up and down) if you invest your million.

If you’re lucky you get somewhere between 3-5% which depending on the current economic environment could be easy or slightly harder to find.

Below we’ve included a table that shows you the monthly and yearly returns as you move up the interest rate.

| Interest Rate | Monthly Return | Yearly Return |

|---|---|---|

| 1% | £833 | £10,000 |

| 2% | £1,666 | £20,000 |

| 3% | £2500 | £30,000 |

| 4% | £3.333 | £40,000 |

| 5% | £4,166 | £50,000 |

| 7.5% | £6250 | £75,000 |

| 10% | £8,333 | £100,000 |

As you can see the interest on 1 million pounds varies by quite a bit each month. Somewhere above 3+ interest is a very decent monthly return and move than enough to live on.

Looking at this 10% a year is an actual possibility and if you invest your money that is a possibility. There are many investors and financial institutions that achieve 10% a year on average over a number of years.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Is a million enough to live on?

According to research, a 66 year old who has a pension pot of £1million would be able to live of £67,000 a year until he’s 87.

This is assuming he’s drawing down his pension, has a growth rate of 5% and a calculation to factor the average inflation rate increase.

That doesn’t sound too bad at all, does it? I think most of us would be happy with that.

That being said, when we first heard this many years ago, it made me realise how much effort was needed to make my first million.

If you want to retire earlier with that same yearly amount of £67,000, then you’ll most likely need even more.

It really depends on:

- The lifestyle you want to live

- How much that lifestyle costs you per year?

- How long you want to be retired for?

- When do you plan on passing away?

Where to keep a million pounds?

There are many ways to secure your financial future when you have a million pounds. The returns you generate will depend on the risk and type of account you adopt.

Essentially you’re looking for the best interest rate possible from the lowest-risk approach.

Standard high street bank saving accounts will give you a meagre amount vs the returns stocks and shares could bring you. The difference is once you invest you could make lots of money but you could also get out less than you put in.

Suppose I don’t want to re-invest the money?

In that case, you’ll need to shop around for a high-interest savings account that doesn’t have a minimum monthly contribution.

I’m sure many banks would be willing to take your money and if you’re unsure seek advice!

Are there any tax problems I should know about?

If you put the money directly into a general savings or investments account, the returns you generate could be considered taxable income.

You will need to ensure you can get your funds secured into an ISA, but they also have only £20,000 tax-free entry limits per year. Not ideal.

So, where do you go?

The only real way is by re-investing the money into businesses, stocks or bonds. Your money is then being used, which can limit the tax you pay depending on how much return you get from those investments.

In this situation, 100% speak to an accountant or financial advisor.

How to get your first million?

Unless you have some unknown advantage making your first million is done by increasing income through investments.

That could be via the stock market or by investing in businesses and growing them.

If you’re starting your financial journey, making a million should be a landmark target by setting smaller targets on the way up.

Psychologically if you break it down, each goal becomes more achievable as you move one step closer towards each target.

Moving in baby steps, allows you always to have something to reach for that’s achievable.

Can I retire at 55 with 1 million pounds?

Retiring at 55 with a million pounds sounds like a dream, but let’s break it down.

Life expectancies are on the rise, and the cost of living keeps climbing. So, can you really call it quits at 55 with a cool million?

First, consider your lifestyle and financial goals. If you want to maintain a comfortable standard of living and potentially travel or pursue hobbies in retirement, a million pounds might not stretch as far as you think.

Next, think about investments. While it’s tempting to stash that million away, it’s crucial to make your money work for you. Sensible investments can help grow your wealth and ensure a more secure retirement.

Also, factor in inflation. Over time, the purchasing power of your million pounds will diminish. So, make sure your retirement plans account for the increasing cost of goods and services.

What can I do with 1m pounds?

So, you’ve got a million pounds burning a hole in your pocket – what’s next? Well, here are some exciting possibilities:

Invest for Growth: Consider investing in stocks, bonds, or even starting your own business. Smart investments can potentially grow your wealth over time.

Travel the World: With a million pounds, you can indulge your wanderlust. Explore exotic destinations, experience new cultures, and make unforgettable memories.

Buy Property: Invest in real estate, whether it’s a comfortable home, a rental property, or even a holiday retreat. Property can be a stable and appreciating asset.

Support Causes: Consider giving back to your community or supporting causes close to your heart. Philanthropy can be incredibly rewarding.

Early Retirement: If you’ve reached a financial milestone, retiring early and enjoying life on your terms is a possibility.

Secure Your Family’s Future: Use your wealth to provide for your family’s future, whether it’s funding education, helping with a down payment on their homes, or ensuring their financial security.

Start a Passion Project: Always wanted to write a book, open a cafe, or launch a tech startup? Now’s your chance to pursue your dreams.

Diversify: Don’t put all your eggs in one basket. Diversify your investments and financial strategy to safeguard your wealth.

Remember, managing a million pounds requires financial acumen and possibly professional advice.

It’s an opportunity to enjoy life, make a difference, and secure your future. So, choose wisely and make the most of your newfound wealth.

Conclusion

As we’ve come to see the interest on 1 million pounds varies hugely depending on the rate you can get.

We hope this has helped you set some goals and work towards something.

MORE LIKE THIS

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.