Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Just consider for a moment, some of the highest-grossing films, successful tech start-ups, or record-breaking sports contracts. Each of these domains has seen transactions and earnings in the region of 100 million pounds.

But what happens after the deal is done, the contract signed, or the investment made? With careful management, the interest on 100 million pounds could potentially become a self-sustaining income source.

Acquiring wealth of this magnitude may not be commonplace, but it’s not a realm solely inhabited by celebrities or Silicon Valley elites.

Countless business ventures, wise investments, or strategic moves in the financial markets have seen ordinary individuals join this elite club.

In this piece, we’ll delve into the influence of varying interest rates on the returns from a colossal sum of 100 million pounds. We’ll also explore potential challenges and strategies to successfully manage and grow this wealth.

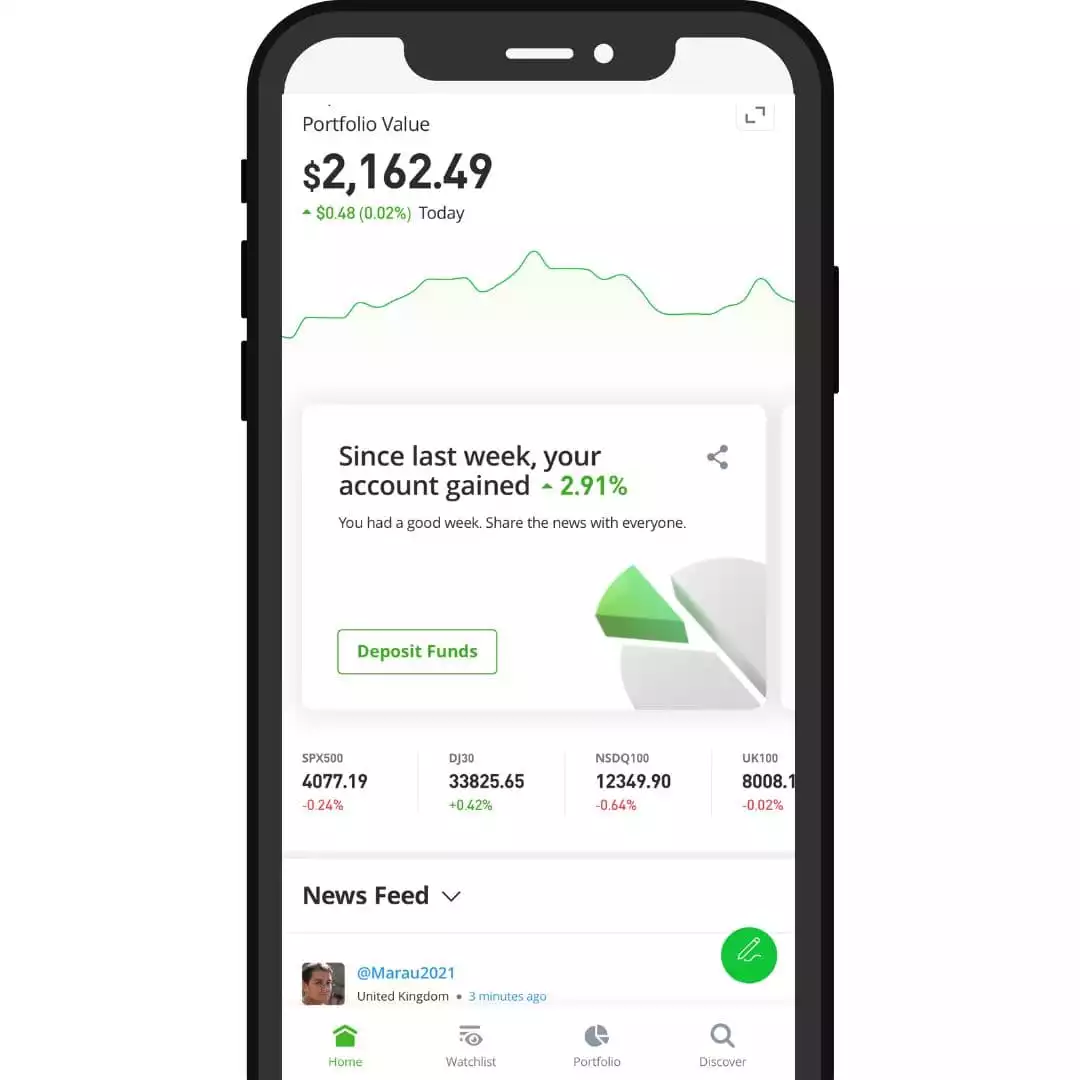

Open a FREE account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Table of Contents

How much interest on 100 million pounds can you make?

Consider the following table showing potential monthly and yearly returns on a 100 million-pound investment at different interest rates:

| Interest Rate | Monthly Return | Yearly Return |

|---|---|---|

| 1% | £83,333 | £1,000,000 |

| 2% | £166,666 | £2,000,000 |

| 3% | £250,000 | £3,000,000 |

| 4% | £333,333 | £4,000,000 |

| 5% | £416,666 | £5,000,000 |

| 7.5% | £625,000 | £7,500,000 |

| 10% | £833,333 | £10,000,000 |

Is 100 million enough to live off?

Simply put, yes! If you fail to live off 100 million pounds then you have some serious spending issues!

Now, let’s consider what life could actually look like with the interest on 100 million pounds.

Using a platform like Chip, and assuming an annual interest rate of 3.82%, this sum could provide a staggering £3,820,000 in pre-tax interest each year.

Here’s a breakdown of the numbers:

- Annual Interest: £100,000,000 * 0.0382 = £3,820,000

- Monthly Interest: £3,820,000 / 12 = £318,333.33

- Weekly Interest: £3,820,000 / 52 = £73,461.54

- Daily Interest: £3,820,000 / 365 = £10,465.75

That’s over £318k a month, nearly £73.5k a week, or over £10k each day!

Such an immense interest income not only provides financial freedom but also ensures that the principal amount remains intact.

This wealth can be passed on to future generations without depleting the capital. However, it’s crucial to take inflation into account as it can gradually erode the purchasing power of your 100 million pounds.

A portion of the wealth can be invested in avenues offering higher returns, such as real estate or property, the stock market, or business acquisitions. This strategy can maintain and even increase the value of your money over time.

Open a FREE account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

The Best Place to Store 100 Million Pounds

Successfully managing your 100 million pounds largely depends on your risk tolerance and the type of account you prefer. Your primary aim should be to secure the highest possible interest rate while mitigating the risk.

High-street bank savings accounts might not offer attractive interest rates when compared with potential returns from stocks and shares.

However, if reinvestment isn’t on your agenda, high-interest savings accounts, without a minimum monthly contribution, could be an alternative.

Tax Considerations to Keep in Mind

Storing your wealth directly in a standard savings or investment account may subject your returns to taxation.

While Individual Savings Accounts (ISAs) can be an option, they do come with an annual tax-free contribution limit of £20,000.

Consequently, diversifying your investments into businesses, stocks, or bonds might be a more tax-efficient strategy. In such scenarios, professional advice from a financial advisor or accountant can prove invaluable.

Building Your First 100 Million

Accumulating a sum of 100 million pounds is a marathon, not a sprint. It generally involves smart, consistent investing in avenues such as the stock market or businesses.

The ultimate goal might seem intimidating, but breaking it down into smaller, more manageable targets can make the journey seem achievable. Celebrating small victories along the way can help keep you motivated and on track towards your financial goals.

If you want the 411 on how to build wealth in your 20s or building wealth in your 30s then click those links there.

Conclusion

While acquiring a wealth of 100 million pounds might seem like a far-off dream, it’s not entirely unattainable. With the right financial strategies and disciplined approach, such a goal can be within reach.

The interest from such an amount can provide a life of luxury and stability, especially if managed effectively. By staying alert to inflationary pressures and diversifying your investments, you can not only safeguard but also grow your wealth over the long haul.

Whether you’re already a multi-millionaire or just beginning your financial journey, remember that building wealth is a process that requires patience, time, and smart financial decisions.

MORE LIKE THIS

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.