Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

For those perhaps looking to buy BT Group stock you’ve come to the right place.

In this article, we’ll show you how to buy shares in BT Group and also how to sell BT shares too. We’ll include information on the latest BT share price, the current BT market cap, sentiment and more.

For those looking to trade BT Shares right away, we will also include some links to top investment platforms for you to open your own share dealing account.

- Important Notice

When you invest the value of your shares can go up or down. If you are unsure about your investment decision you should always look to seek financial advice. Past performance is not a future indicator and always do your own research.

Where to Buy Bt Group Shares?

|

|

|

|

|

30 million users worldwide enjoy social investing with over 3000 stocks, funds, trusts and cryptocurrencies available. Fantastic mobile app, research and academy.

Award-winning investing service with access to SIPPs, ISAs and more. Expert financial advice and research are also available.

BT (BT-A.L) Live share prices

The stock price will change at points during the day so be sure to check the BT share price again before you purchase any stocks.

How To Buy BT Group Shares - Quick Guide

- To buy BT Group PLC shares, you’ll need a trading account. Make sure you have your personal identification, national insurance number, banking details, and residential proof ready for this phase.

- Next, you need to establish your payment preferences. This is usually done with a direct bank transfer or via a debit card to fill your newly set-up trading account with funds.

- Now you need to find the shares of BT Group PLC on your trading platform. You can do this using the BT Group PLC stock symbol, which is “BT.AL”.

- Make sure you delve into the details of the BT Group PLC shares. Your trading platform will provide you with all the latest information about these shares.

- Lastly, when you are convinced and comfortable with all the details, you can proceed to purchase your BT Group PLC shares. And just like that, you’re now a shareholder of BT Group PLC!

Buying BT Shares: A Step-by-Step Guide

Choose a Suitable Brokerage

To kickstart your journey into purchasing BT Group PLC shares, you must first pick a trustworthy broker to invest in them or in fact anything on the stock market.

Do remember that not all brokers enable share purchases for all companies listed across various exchanges, and BT Group PLC is listed on the London Stock Exchange (LSE:BT.A).

Online trading platforms like eToro, Hargreaves Lansdown, and Plum are favored choices due to their easy-to-navigate interfaces and a broad spectrum of listed stocks, including those on the LSE.

Set Up an Account

Having chosen a broker, your next step is to establish an account. This typically involves submitting some personal details, such as your address, ID or social security number, and employment information.

It’s quite a simple process, comparable to setting up a regular bank account.

Be sure to thoroughly read the terms and conditions to comprehend the account-associated services and fees.

Deposit Funds Into Your Account

Following account setup, your subsequent move is to fund your account. Depositing money into your brokerage account enables you to buy shares.

This is generally accomplished via a bank transfer, but some brokerages may also accept checks or wire transfers.

The timeframe for the money to reflect in your account can differ, so it’s prudent to plan in advance if you aim to capitalize on a specific investment opportunity.

Examine the Business

Before procuring shares in BT Group PLC, or any company for that matter, it’s crucial to research BT Shares thoroughly. Evaluate the company’s earnings, recent performance, and its business deals.

Information about BT Group PLC’s financial records and other investor-related data can be found on their official website.

You can also peruse market analyses and expert views to gain insight into the potential of the company’s stock.

Determine Your Investment Size

Lastly, decide the amount you wish to invest. Bear in mind that investing in stocks always involves risk, and it’s crucial not to invest more than you can afford to lose.

When deciding on your investment size, factor in your financial objectives, risk appetite, and the current price of BT shares.

If you’re a novice investor, it might be advisable to begin with a smaller amount and gradually elevate your investment as you grow more familiar with the process.

BT Group PLC Overview

Positioned in the bustling heart of London, BT is a formidable presence in the British telecommunications sector.

With services spanning nearly 180 countries, BT reigns as the leading provider of fixed-line, broadband, and mobile services in the UK, while also offering subscription television and IT services.

The BT lineage harks back to 1846 with the Electric Telegraph Company. Transforming into BT Group started in 1912 when the General Post Office became the sole telecommunications provider in the UK.

The BT brand emerged in 1980 and gained independence from the Post Office a year later. British Telecommunications was privatised in 1984, and by 1993, it was completely investor-owned.

Holding a royal warrant, BT proudly features on the London Stock Exchange and is part of the FTSE 100 Index.

The company’s influence extends through its major subsidiaries. BT Business serves global corporate and government clientele, while BT Consumer provides telephony, broadband, and subscription television services to around 18 million customers in the UK.

The current Chairman of BT is Adam Crozier and the current Chief Executive is Allison Kirkby.

BT Group Shares Information

BT shares pack a punch in the investment arena, carving out a solid reputation for themselves on the London Stock Exchange.

As a major player in the FTSE 100 Index, the telecom giant provides a valuable option for investors seeking to add a tech-based asset to their portfolio.

Whether you’re a seasoned trader or a budding investor, tracking BT shares offers an engaging glimpse into the vibrant world of the UK’s telecommunications sector.

The stock ticker for BT is BT.A – if you type this into your broker account this will bring them up.

BT Share Dividend Payments

BT, like many corporations, dispenses dividends to its shareholders. Dividends are essentially portions of a company’s profits distributed to shareholders, proportionate to their share ownership.

They are typically dispensed as cash but BT also offers a unique dividend plan where shareholders can opt for additional shares instead of a cash dividend.

The usual practice is to distribute dividends every quarter, but it’s advised to review BT’s specific dividend policy for precise payout times.

The dividend yield, a ratio representing the percentage of the share price paid out as dividends, can be calculated by dividing the annual dividends per share by the price per share.

BT typically disburses dividends twice a year: final dividends in September and interim dividends in February.

Starting September 2022, dividend payments will not be made by cheque, and shareholders will need to provide bank or building society account details for direct dividend payments.

How are BT dividends paid?

Dividends, forming a part of the return from investing in shares, are paid from the profits a company has already been taxed on.

Companies may choose to retain part of their profits to expand the business or increase their reserves, and pay out the remainder as dividends.

Dividends are usually paid after the half-year and full-year financial results, with the exact dates announced at the same time.

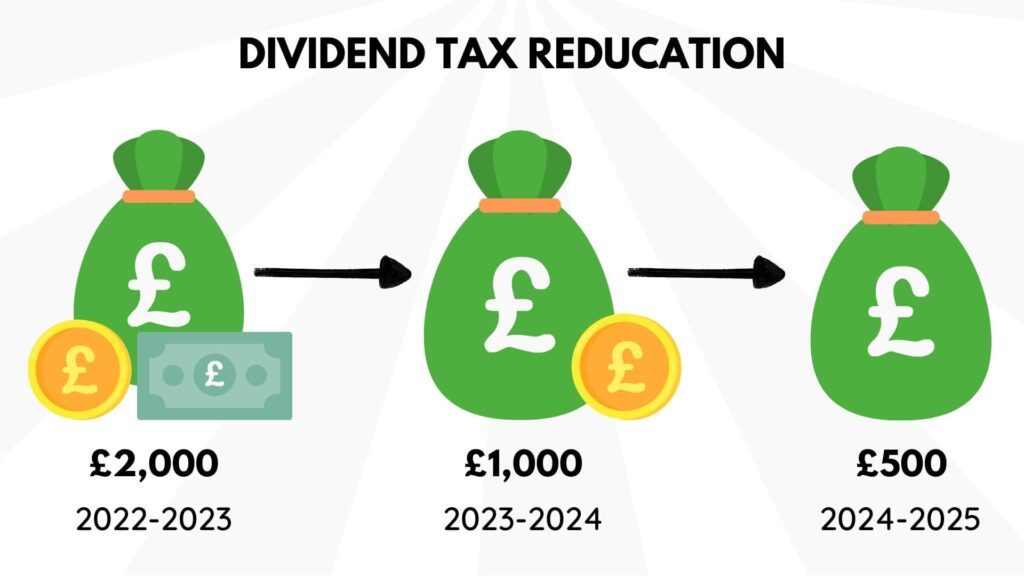

Starting April 2023, the tax-free allowance for dividend income in the UK will be reduced from £2,000 to £1,000, further dropping to £500 from 6 April 2024.

This will have implications for shareholders, with tax rates applied to dividend income over £1,000. Dividends received on shares held in an Individual Savings Account (ISA) continue to be tax-free.

Are BT Shares Overvalued or Undervalued?

If you’re looking to invest in BT but are wondering whether the current share price is overvalued or undervalued then use this sentiment calculator as a measure of what the markets are currently thinking.

Remember not to use this as a sole indicator and always research what other analysts are saying too. These are not price forecasts and past performance is not a future indicator of company performance.

Should I buy BT Group Shares?

BT Group’s stock currently displays a promisingly low valuation.

Analysts anticipate the company to yield earnings per share of 18.4p for the fiscal year ending 31 March 2024, resulting in a forward price-to-earnings (P/E) ratio of just 8.5. This falls notably below the UK market’s average.

However, BT Group’s shares have experienced a turbulent ride lately. In 2022, the stock witnessed a 32.3% decrease, though it rebounded with a 38% growth in 2023, indicating that the journey hasn’t been entirely smooth for retail investors.

The BT share price has steadily dropped since reaching its peak of £1.60 in April, coupled with the potential risk of dividend reduction, it brings forth questions on the worthiness of retaining BT shares.

It certainly doesn’t pose a clear picture right now but if the company does reach its expectations it could be said to be undervalued.

Pros & Cons Investing In BT

Pros

Low Valuation: Currently, BT Group’s stock boasts a low valuation with a forward price-to-earnings (P/E) ratio of 8.5, below the UK market’s average. This could present a good buying opportunity for investors looking for undervalued stocks.

Resilience: Despite experiencing a considerable 32.3% drop in 2022, the shares bounced back with an impressive 38% growth in 2023. This resilience could indicate a potential for future recovery and growth.

Established Market Position: BT is a leading multinational telecommunications company with a strong foothold in the UK market. It provides a range of services from fixed-line and mobile communication to broadband and TV services.

Diverse Services Portfolio: BT’s diverse portfolio spans across multiple areas of telecommunication, including IT services and TV subscriptions, in addition to its core telecom services.

Cons

Market Volatility: BT Group’s shares have demonstrated significant volatility recently, undergoing both steep declines and sharp increases. This level of unpredictability could pose a risk for those investors seeking more stable, predictable returns.

Declining Share Price: The share price has been on a steady decline since its peak in April. If this trend continues, it could negatively impact investors.

Potential Dividend Cut: There is a looming risk of a dividend cut. For investors who rely on dividends as a source of income, this could be a significant disadvantage.

It’s crucial for potential investors to perform thorough due diligence and consider their own risk tolerance before making any investment decisions.

What Should I Consider Before I Buy BT Shares?

Before investing in BT shares, it’s crucial to thoroughly analyse a range of factors.

The company’s established market presence and diversified service portfolio are undoubtedly appealing, contributing to its resilience despite market volatility.

However, the recent decline in the share price, potential dividend cuts, and significant stock volatility pose risks.

It’s also worth noting the company’s current low valuation, which may suggest an attractive entry point for investors who believe in the long-term prospects of the company.

It’s essential to align these considerations with your personal investment goals, risk tolerance, and financial situation.

How To Sell BT Shares?

Offloading shares in BT Group PLC, much like acquiring them, is a pretty straightforward task. Here’s a simplified guide on how to sell stocks in BT:

Access your trading account: This is the account you used to purchase the BT shares. If you don’t possess one, you’d have to establish a brokerage account with a firm that supports the trading of international stocks.

Locate your shares: Upon logging in, direct yourself to your portfolio page where you should see all the shares you currently hold. Your BT shares should be listed under the ticker symbol ‘BT.A’.

Choose ‘Sell’: Adjacent to your BT shares, there should be a ‘sell’ option. Click on this.

Determine the number of shares to offload: You will then need to state the number of shares you intend to sell. This could range from parting with a fraction of your shares to disposing of your entire holding.

Price your shares: This step is optional. If you opt to set a specific price, referred to as a ‘limit order,’ your broker will only offload your shares when they reach this price. If you decide for a ‘market order,’ your shares will be sold at the present market price.

Validate the sale: Once you’re satisfied with all the particulars, approve the sale. Your broker will then carry out the order on your behalf.

Keep in mind, the procedure might slightly differ based on your selected brokerage platform. Always take into account the transaction fees that your broker may impose when selling shares.

Equally selling BT shares may make you liable for capital gains tax if not invested inside an ISA or self-invested personal pension.

More Like This

FAQs

Can I Find BT Group on the London Stock Exchange?

Yes, BT Group PLC is listed on the London Stock Exchange. The stock is traded under the ticker symbol “BT.A”.

It’s one of the constituents of the FTSE 100 Index, which includes the 100 companies with the highest market capitalisation listed on the London Stock Exchange.

Anyone interested in buying or selling shares of BT can do so through a broker that has access to the London Stock Exchange.

Are BT shares still valid?

Historically, shares have been kept as physical certificates – tangible proof of share ownership. If you’re planning to sell your BT shares, typically, you’d be required to present this original share certificate to your broker.

Once the broker finalises the sale of your shares, you would receive your payment, minus any broker’s commission, within a few days.

In the case of buying shares, such as those of BT, your payment to the broker needs to be completed within a few days of the transaction.

You will receive a share certificate eventually which evidences your ownership. It’s important to note that until you receive this certificate, selling the shares isn’t usually possible.

Telephone dealing services, on the other hand, might not demand a share certificate to sell your shares thanks to their stringent security identification protocols. However, they may still issue traditional certificates following a purchase.

Can I sell my BT shares online?

Yes, you can sell your BT shares online. Most brokers offer online trading platforms where you can easily buy and sell shares, including those of BT Group.

If you hold your BT shares in a brokerage account, you can log into your account and place a sell order for the number of shares you wish to dispose of.

The exact process can vary between different brokers, so it’s best to refer to the specific instructions provided by your broker. If you’re unsure, you can usually contact your broker’s customer service for assistance.

Keep in mind, it’s important to ensure you have the right to sell the shares (i.e., they’re not held in a restricted state) and that you’re aware of any potential tax implications or brokerage fees that might apply to the sale.