Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Today we’re stepping into Red Devil territory today – specifically, how to buy shares in Manchester United.

Yes, you heard it right. As peculiar as it sounds for a Gooner like me to guide you through this process, that’s the game plan.

Owning Manchester United shares might seem as far-fetched as my hope for Arsenal to top the league again (hey, a fan can dream, right?).

However, it’s surprisingly achievable and just a few clicks away. After all, beneath the glory, a football club is essentially a business and so buying shares in a football club should be treated like one.

In this guide, I’ll take you through buying Manchester United stock. Plus, I’ll share the ins, outs, pros, cons, and a handful of fail-safe tips to navigate this investment journey.

We’ll even explore a few reliable investment platforms to make your process smoother than a Bruno Fernandes penalty kick.

So, whether you’re a die-hard United supporter or a curious investor, lace up your boots, let’s put our footballing differences aside (yes, even you, fellow Gunners), and let’s deep-dive into the Old Trafford stock market.

- Important Notice

When you invest the value of your shares can go up or down. If you are unsure about your investment decision you should always look to seek financial advice. Past performance is not a future indicator and always do your own research.

Where To Buy Manchester United Shares?

|

|

|

|

|

30 million users worldwide enjoy social investing with over 3000 stocks, funds, trusts and cryptocurrencies available. Fantastic mobile app, research and academy.

Award-winning investing service with access to SIPPs, ISAs and more. Expert financial advice and research are also available.

You can also check out the full eToro review here and also our best investing apps list.

How To Buy Shares In Manchester United (Quick Guide)

Initiate the account opening process. Keep your national insurance number, personal ID, bank details and proof of address handy for this step.

Set up payment methods. You can typically do this through a debit card or direct bank transfer to fund your new trading account.

Locate the Manchester United shares. Use the Manchester United ticker symbol “MANU” to find them on your trading platform.

Investigate the Manchester United share details. Utilise your trading platform to access the most recent Manchester United share information.

Proceed to purchase your Manchester United shares. If everything checks out and you’re comfortable, go ahead and invest in Manchester United. Boom you’re a Manchester United shareholder!

Manchester United Share Price

How To Buy Shares In Manchester United (Full Guide)

Find A Brokerage Account

Your first step towards buying shares in Manchester United is to identify a reliable brokerage either physical or online (these days mostly online).

Not all brokers offer the ability to buy shares in companies listed on different exchanges, and Manchester United is listed on the New York Stock Exchange (NYSE:MANU).

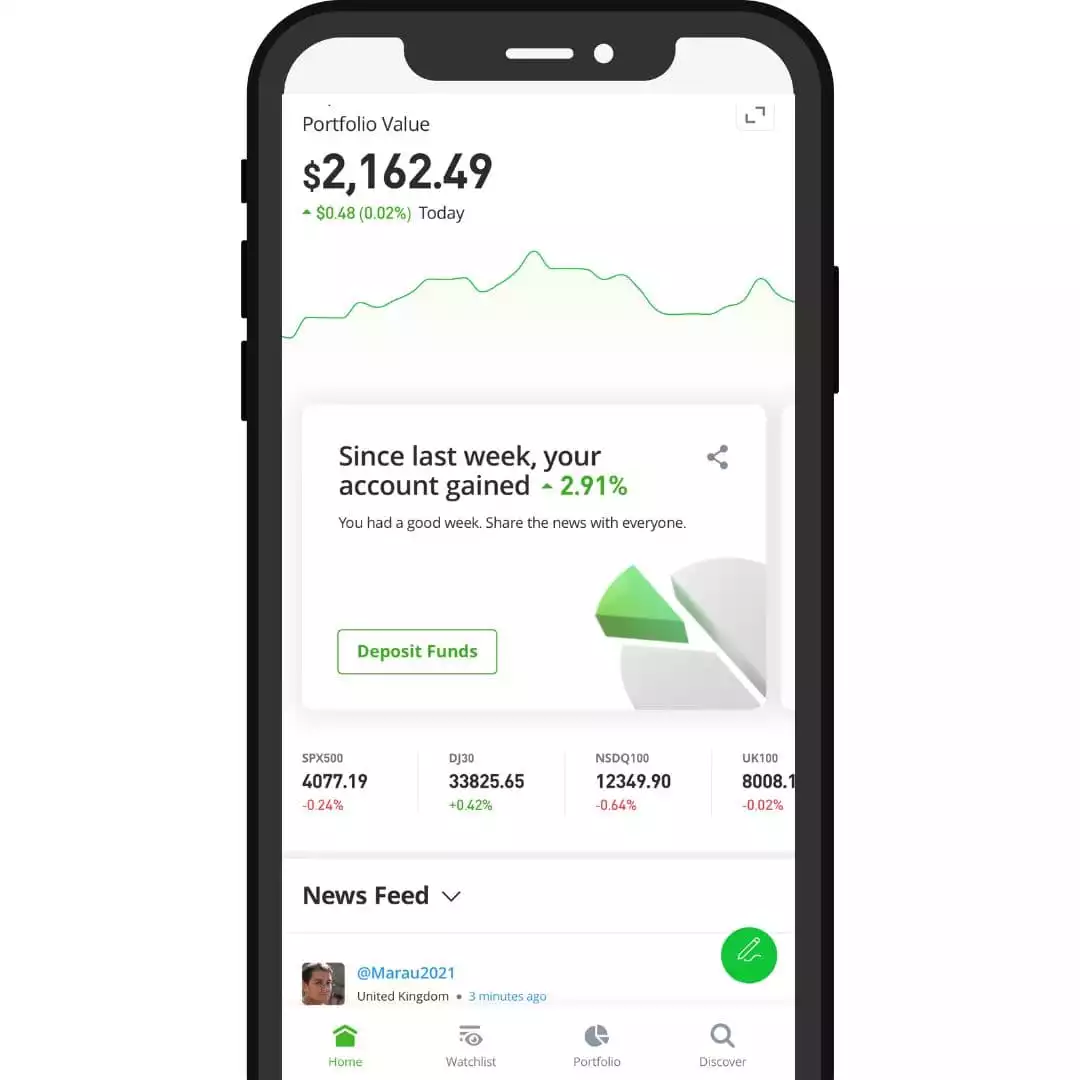

Online platforms such as eToro, Plum and Hargreaves Lansdown are popular options due to their user-friendly interfaces and wide range of listed stocks, including those on the NYSE.

Open an Account

Once you’ve decided on a broker, you’ll need to open an account.

This usually involves providing some personal information, including your passport or driving license, proof of address, bank details and national insurance number.

It’s a relatively straightforward process, much like setting up a bank account.

Just be sure to read the terms and conditions carefully to understand the fees and services associated with the account.

Fund Your Account

After your account is opened, the next step is funding it. You’ll need to deposit money into your investment account to buy shares.

This is typically done via bank transfer, though some trading platforms also accept debit cards.

These days with smart transfer and card payments the money shows up in your account instantly but just be sure to check if you decide to use an alternative payment method.

Research the Club

Before buying shares in Manchester United, or any company for that matter, it’s important to do your research. Look at the club’s financial health, performance in recent seasons, and their commercial deals.

Manchester United PLC’s financial statements and other investor-related information can be found on their official website.

You can review market analyses and expert opinions to get a sense of the club’s stock potential. Most of the time this is inbuilt to the trading platform you decide but if not easily found by Googling it.

Decide on Your Investment Amount

Finally, decide how much you want to invest. Remember investing in stocks always carries a risk, and it’s crucial not to invest more than you can afford to lose.

When determining your investment amount, consider your financial goals, your risk tolerance, and the current price of Manchester United shares.

If you’re new to investing, it might be a good idea to start small and gradually increase your investment as you become more comfortable with the process.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Manchester United PLC Breakdown

Who are Manchester United?

Manchester United is not just a professional football club; it’s a leader in world football.

Nestled in the North West of England, Manchester United, affectionately known as the ‘Red Devils’, boasts a towering record of 20 top-flight league titles and a tally of 66 major trophies.

This illustrious track record has cemented them as one of the most triumphant football clubs on the globe. In fact, it is the second most valuable club in the entire world just behind Real Madrid.

A Short History of the Club

The story of Manchester United is one steeped in rich history and decorated with an impressive array of silverware.

The club are one of the most successful football clubs on record and clinched its first major trophy way back in 1908 and since have continued to add to its collection with a second title in 1911.

Manchester United truly emerged as a powerhouse in European football post the Second World War. The team, under the leadership of Sir Matt Busby, earned their third league trophy in 1952.

The Busby era also saw Manchester United become the first English club to claim the coveted European Cup.

The baton of success was then passed to Sir Alex Ferguson, under whose stewardship the club amassed a staggering 26 major titles, which included thirteen Premier League trophies.

1999 marked a particularly noteworthy year in the club’s history when they clinched the Champions League, Premier League and FA Cup – all in a single season, a phenomenal feat yet to be replicated.

Today, under the ownership of the Glazer family, the club continues to be a dominant force in football, with the spirit of the ‘Red Devils’ burning as brightly as ever.

Are they a big football club?

You bet they are! With a vast fan base exceeding 1.1 billion and a home ground – the ‘Theatre of Dreams’, a.k.a Old Trafford – that hosts approximately 76,000 spectators, Manchester United’s footprint is colossal.

In terms of financial muscle, Forbes ranks them as the fourth most valuable football club in the world, tailing just behind Bayern Munich, Real Madrid, and Barcelona. That puts their valuation at a jaw-dropping $6 billion (around £4.75 billion).

What are the current owners like?

The reins of this behemoth are currently in the hands of the Glazer Family, who have been at the helm for a significant 17-year stint. In a potentially game-changing move, they announced in November 2022 that they might be open to selling the club.

The potential successors? An elite list that includes figures such as Sir Jim Ratcliffe, technology giants Apple and Amazon, and even nations including Dubai, Qatar, and Saudi Arabia.

Manchester United Shares Information

When it comes to the business side of the pitch, Manchester United isn’t just playing in the Premier League.

They are also competing in the financial big leagues on the New York Stock Exchange (NYSE), where their shares are publicly traded under the ticker symbol ‘MANU’.

This allows fans and investors worldwide to score a piece of this legendary club. With potential new ownership on the horizon, the future of Manchester United is not only exciting on the football field, but also on the trading floor.

As the club navigates these uncharted waters, the shares could present some tantalising opportunities for those willing to embrace the unpredictability of this thrilling game.

ESG Breakdown

In the current investing climate, stakeholders are becoming increasingly conscientious, looking beyond mere monetary returns to the social and environmental implications of their investments.

This has brought the ESG (Environmental, Social, and Governance) score into the spotlight, acting as a barometer of a company’s ethical stance.

When it comes to Manchester United, they shine in their ESG scorecard, with ratings of 63 for the environment, 51 for social, and 49 for governance.

These figures underscore Manchester United’s commitment to not only excelling in the sport but also operating as a socially responsible and environmentally-friendly company.

How To Sell Shares In Manchester united football club?

Selling shares in Manchester United Football Club, much like buying them, is a relatively straightforward process. Here’s a step-by-step guide on how to go about it:

- Log into your brokerage account: This is the account you used when you bought the Manchester United shares. If you don’t have one, you would need to open a brokerage account with a firm that allows the trading of international stocks.

- Find your shares: Once logged in, navigate to your portfolio page, which should list all the shares you currently own. You should find your Manchester United shares listed under the ticker symbol ‘MANU’.

- Select ‘Sell’: Next to your Manchester United shares, there should be an option to ‘sell.’ Click on this.

- Decide on the number of shares to sell: You will then need to specify how many shares you want to sell. This could range from selling a portion of your shares to liquidating your entire stake.

- Set your price: This is optional. If you choose to set a specific price, known as a ‘limit order,’ your broker will only sell your shares when they reach this price. If you opt for a ‘market order,’ your shares will be sold at the current market price.

- Confirm the sale: Once you’re happy with all the details, confirm the sale. Your broker will then execute the order on your behalf.

Remember, the process may slightly vary depending on your chosen brokerage platform. Always consider the transaction fees that your broker may charge when selling shares.

Pros & Cons of Buying Manchester United Stocks

Pros

- Direct stake in one of the most successful and globally recognised football clubs.

- Potential for significant returns if the club's value or profitability increases.

- Second most valuable football club in the world with good on pitch performance

- Potential dividends from profit distributions.

- Possible benefits from changes in ownership structure or management strategy.

Cons

- Stock price can be influenced by on-field performance, which is unpredictable.

- Football clubs can be heavily impacted by changes in league structures, regulations, or broadcasting deals.

- Dependence on key personnel like players and managers, whose departure can affect club performance and stock value.

- Risk of financial instability due to high operating costs, debts, and unpredictable revenue streams (like matchday income).

Are Manchester United Shares Over or Under-Valued?

The stock price of Manchester United changes every day and below we have included the current analyst sentiment on the club right now.

Alternative Football Team Stocks

| Club | Country | League | Link To Invest |

|---|---|---|---|

| Juventus | Italy | Serie A | Invest Now |

| AS Roma | Italy | Serie A | Invest Now |

| Rangers FC | Scotland | Scottish Premiership | Invest Now |

| Celtic | Scotland | Scottish Premiership | Invest Now |

| Borussia Dortmund | Germany | Bundesliga | Invest Now |

FAQs

Can anyone buy shares in Man Utd?

Yes, anyone can buy shares in Manchester United. The club is a publicly-traded company listed on the New York Stock Exchange under the ticker symbol ‘MANU’.

This means that anyone who has a brokerage account that allows the trading of international stocks can purchase Manchester United shares.

Is it a good time to buy Man Utd shares?

Personally I believe it’s an interesting time to look at buying Manchester United shares if you believe that the owners will improve the club. Significant investment is required in the playing squad and club infrastructure but this will only help the club long term.

Erik Ten Haag is a fantastic manager with a proven record at Ajax and I do believe if he is given the funds to improve the squad Manchester United will be a power house in English football again in the next few seasons.

That being said, there is significant risk the current squad doesn’t perform which could mean in the short term there is some volatility to consider.

How to become a shareholder in Manchester United?

To become a shareholder in Manchester United, you simply need to:

- Open a brokerage account with a platform that allows international trading.

- Fund the account with money you wish to invest.

- Search for Manchester United using their ticker ‘MANU’ on the platform.

- Decide how many shares you want to buy and execute the purchase.

You’re now a Manchester United shareholder! Always remember to do your research and consider seeking financial advice before investing.

Who is the largest shareholder in Manchester United?

The Glazer family holds the title of the largest shareholder in Manchester United. They took control of the club in 2005 and have maintained majority ownership since. However, as of 2023, the tides may be changing.

The American owners announced that they are willing to entertain offers for the club, signalling the potential end to their reign that has spanned nearly two decades.

This development has opened the door to a host of potential suitors, from wealthy businessmen to tech giants and even sovereign nations.

This potential change in ownership adds an extra layer of intrigue and potential opportunity for potential and current investors in Manchester United shares.

Is Man Utd a publicly traded company?

Yes, Manchester United is a publicly traded company. It is listed on the New York Stock Exchange under the ticker symbol ‘MANU’.

Is Manchester United A Good Investment?

Manchester United have an incredible history with Champions League and Premier League titles. However, since Alex Ferguson retired in 2013 the club have failed to scale the same heights.

That being said, United have stabilised the club of late with Erik Ten Haag joining the club as manager and doing a great job in his first season to help the club quality for the Champions League.

With the Glazer family currently considering selling the club and a sale somewhat imminent it may provide opportunity for the new owner to invest in the playing squad alongside the stadium and club infrastructure.

This could see on pitch performance improve and the value of the club increase alongside this.

More Like This

Conclusion

In this article, we’ve delved into the world of football finance by exploring how to buy shares in Manchester United PLC.

From quick guides to detailed breakdowns, the process of becoming a shareholder in one of the world’s most renowned football clubs is not as far-fetched as it may seem.

Manchester United isn’t just playing in the Premier League but also competes in the financial big leagues on the New York Stock Exchange (NYSE).

With a strong ESG scorecard and potential changes in ownership on the horizon, Manchester United’s shares present tantalizing opportunities for fans and investors worldwide.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.