Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Buckle up, football aficionados, including my fellow Arsenal supporters! Today, we’re delving into the economics of football – specifically, how to buy shares in a football club.

Yes, you got it right. As unusual as it might be for an Arsenal fan like myself to venture into this territory, we’re ready for the challenge.

I’m sure many of us have dreamt of buying shares in Arsenal, but that option is currently not available to us. So, we need to pick a different club if we want to own shares in a football team. Luckily there’s plenty to choose from.

What football clubs can I Buy Shares In?

- Manchester United

- Juventus football club

- Borussia Dortmund

- Rangers

- Celtic

- Ajax

- Benfica

- Sporting CP

- Lazio

- AS Roma

- Important Notice

When you invest the value of your shares can go up or down. If you are unsure about your investment decision you should always look to seek financial advice. Past performance is not a future indicator and always do your own research.

Where to buy shares in football clubs?

|

|

|

|

|

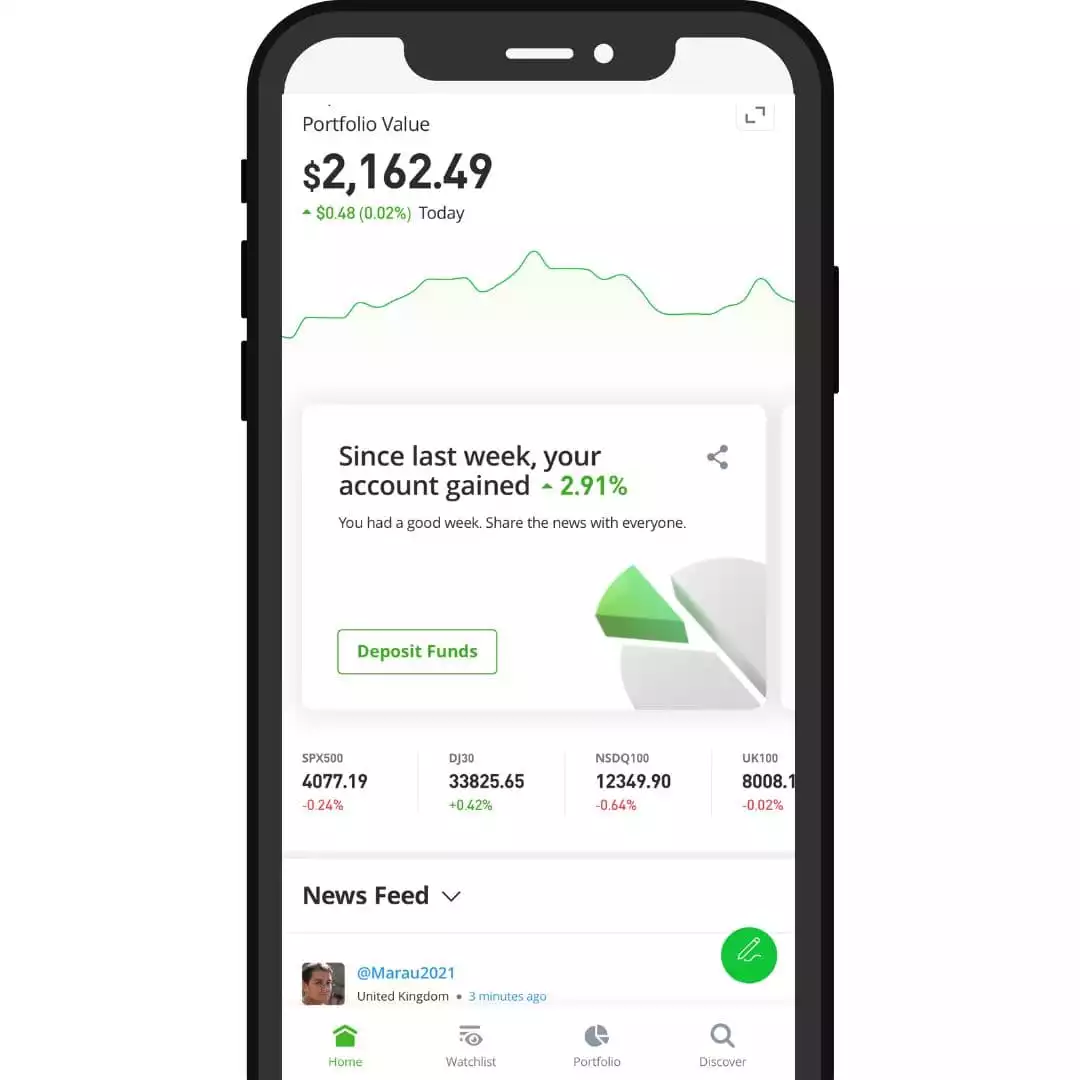

30 million users worldwide enjoy social investing with over 3000 stocks, funds, trusts and cryptocurrencies available. Fantastic mobile app, research and academy.

Award-winning investing service with access to SIPPs, ISAs and more. Expert financial advice and research are also available.

How To Buy Shares In A Football Club (Quick Guide)

- Initiate the account opening process. Keep your national insurance number, personal ID, bank details and proof of address handy for this step.

- Set up payment methods. You can typically do this through a debit card or direct bank transfer to fund your new trading account.

- Locate the different clubs shares. Now you’ve got an account you need to decide which football team you’re going to invest in. (see below for the listed football clubs)

- Investigate the football clubs share details. Utilise your trading platform to access the most recent football club shares information.

- Proceed to purchase your desired football clubs shares. If everything checks out and you’re comfortable, go ahead and invest.

How To Buy Shares In A Football Club (Full Guide)

Choosing the Right Brokerage Account

Your first move towards purchasing shares in a football club is to find a reliable brokerage. Different clubs might be listed on various stock exchanges, so it’s important to select a broker that provides access to a wide array of exchanges.

Platforms such as eToro, Plum, and Hargreaves Lansdown are often favoured due to their user-friendly interfaces and their extensive range of listed stocks, covering multiple exchanges.

Account Creation

Once you’ve decided on a broker, the next step is to create an account. This process typically involves providing personal information, such as your personal information, bank details, national insurance and proof of address. It’s a simple procedure, much like setting up a bank account.

Be sure to read the terms and conditions carefully to fully understand the fees and services associated with the account.

Account Funding

After your account is successfully set up, you’ll need to fund it. You deposit money into your brokerage account to purchase shares. This is generally done via bank transfer, although some brokerages also accept checks or wire transfers.

The time it takes for your deposit to appear in your account can vary, so planning ahead is recommended if you want to take advantage of a specific buying opportunity.

In-depth Football Club Analysis

Before buying shares in any football club, it’s essential to conduct thorough research. Evaluate the club’s financial health, performance in recent seasons, and their commercial partnerships.

Financial statements and other investor-focused information can usually be found on the club’s official website. You can also consult market analyses and expert opinions to get a sense of the potential of the club’s stock.

Investment Amount Determination

Lastly, decide on your investment amount. It’s important to remember that investing in stocks always involves risk, and you should never invest more than you can afford to lose.

When deciding on your investment amount, consider your financial goals, your risk tolerance, and the current price of the football club’s shares.

If you’re new to investing, starting with a small investment and gradually increasing it as you grow more comfortable with the process can be a wise approach.

Football club shares price UK

Manchester United Shares

Manchester United are the 2nd biggest club in the world just behind Real Madrid but is by far the most valuable football club in the Premier League.

They trade on the New York Stock Exchange and are accessible on most investment platforms.

The current owners are the Glazer family but the club is up for sale and there are plenty of suitors. These include billionaires like Jim Ratcliffe and full states from Saudi Arabia and Qatar.

It might be a good time to buy shares in Manchester United if you’re confident any new owner can improve their fortunes on and off the pitch.

Manchester United plc was first listed on the stock exchange in 2012 and had an initial public offering of $14 a share.

Borussia Dortmund Shares

The yellow wall is one of the most incredible sites in world football! Borussia Dortmund is the only German football club listed on the stock market and trades on the Frankfurt Stock Exchange.

The interesting thing about this German club is that it’s fan-centric meaning that the fans have huge sway on things like the club’s direction, name and ticket prices.

Over the years Dortmund has lagged just behind fierce rivals Bayern Munich but has a unique approach to signing players by taking young, exciting talents from ages as low as 16 and starting them in their first team.

Players such as Erling Haaland, Jude Bellingham and Jadon Sancho have all played first-team football for Dortmund under the age of 20.

Juventus Shares

Juventus football club SPA are one of the most successful clubs in Italian football. They recently won the Serie A a record 9 times in a row but of late have been clouded in controversy as often seen in Italian football.

The club trade on the Milan Stock Exchange and is one of three Italian clubs listed on the stock market.

Looking back at their share price the impact of major signings like Cristiano Ronaldo can’t be ignored. When he signed for the club they saw an incredible 87% rise in share price.

Whilst it’s great to hold shares in football clubs or your favourite team beware if they are selling key players or have shady dealings like Juve have had recently.

Lazio Shares

Ah Rome, what a place and what a club Lazio is! It’s probably the 2nd biggest club in the capital city of Italy with Roma being the biggest but it’s a club steeped in history.

The club is managed by its parent company, SS Lazio SpA and is traded on the Italian Stock Exchange.

Lazio have been up and down in terms of performance in recent years but secured 2nd place in Serie A during the 22/23 season meaning they will have Champions League Football next season and the revenues that come with it.

Rangers Shares

Rangers Football Club is a team that you’ll find difficult not to love. Having been liquidated to the lowest league of Scottish Football in 2012 the club fought its way back to win the championship again just a few years later.

Their biggest rivalry is with Celtic and the match is referred to as the Old Firm Derby which is said to be the best atmosphere at a football match worldwide.

Rangers have seen their share prices fluctuate a lot in recent years and are often dictated by on-field success. It is one of the most valuable football clubs in Scotland with Celtic just behind.

It is much harder to buy shares in Rangers with the club listed on the JP Jenkins Exchange for unlisted securities across Europe.

Celtic PLC Shares

The hoops of Celtic are very difficult to miss and they are the second largest club in Scotland in terms of valuation.

Their rivalry with Rangers is quite incredible and we would encourage you to get to a game if you can!

In recent years Celtic have dominated Scottish football and have even performed very well for their stature in the Champions League.

Celtic shares are available to purchase via the London Stock Exchange which are available on most investing apps or brokers.

Ajax Shares

Ah Ajax, the birth place of some of the most incredible footballers on the planet. Think Kluivert, Marco Van Basten, Frank Rijkaard, Edwin Van Der Saar and Johan Cruyff!

Equally the club are located in one of the best cities in the world – Amsterdam!

Alongside this they are the most successful club in Dutch football and trade on the Amsterdam stock exchange.

Benfica Shares

Benfica is the most successful club in Portugal of all time even if it’s fierce title rival FC Porto have enjoyed the lion share of titles in the last decade.

Benfica, as the Portuguese club with the most extensive fan base, has earned a distinct position in European football by having the highest proportion of supporters from its home country.

The club boasts an impressive global following of approximately 14 million fans. With over 250,000 registered members, it stands as the biggest sports organization in Portugal in terms of membership and ranks as the second largest globally.

It’s one of 3 Portuguese teams that are listed football clubs and is listed on Euronext Lisbon the Portuguese stock exchange. Its parent company Sport Lisboa e Benfica Futebol SAD manages the day-to-day operations.

FC Porto Shares

Ah Porto, what a city and what a football club. For me, FC Porto was put on the map by Jose Mourinho when he managed them to a European title.

They are one of the most successful clubs in Portugal just behind Benfica but are one of those football stocks that are a bit nostalgic for me personally.

If you are looking to buy football club shares then Porto would certainly be on the list as they regularly feature in the UEFA Champions League and have a constant stream of fantastic youth prospects which often go on for big transfer fees to the larger European football teams.

FC Porto is listed on the Euronext Lison the Portuguese Stock Exchange.

AS Roma

Now managed by Jose Mourinho Roma is back with a bang. Their stock price has fluctuated a lot in recent years and they are what you might call a penny stock but we had to feature them because of Mourinho!

The club is a regular in European competitions and in the 22/23 season was in the UEFA Europa League Final after winning the Europa Conference league in the 21/22 season.

If you are looking to trade football stocks then Roma perhaps isn’t one of the biggest but if they are your favourite football team then you might just want to buy them because you love them.

Roma shares are found on the Milan Stock Exchange.

Common mistakes to avoid when investing in Football Clubs

Every now and again, even the savviest of investors might cock things up. It’s a bit of a downer when it does happen, so it’s crucial to keep those blunders to the bare minimum. A good way to do this is to take a look at the common errors made by your fellow traders.

For instance, here’s what often leads to a right muddle:

Not doing your homework: The bulk of flubs tend to happen because folks haven’t done enough digging. Never take a punt in the market without having all the relevant facts at your fingertips;

No clear game plan: Before you dive in, have a clear picture of your investment goal to really make the most out of your venture.

Too much short-termism: Impulsive decisions made in the heat of the moment can cost an arm and a leg in this market. Keeping a cool head and playing the long game is the order of the day;

Putting all your eggs in one basket: Sure, there’s nothing to stop you from going all in on, say, Manchester United shares, but staking your entire investment on one horse can be a risky business and is best avoided;

Inexpert use of leverage: Leverage might promise sky-high returns in the blink of an eye, but you’re essentially betting with someone else’s dosh. If things go pear-shaped, it can leave a right hole in your pocket. If you don’t know what you’re doing, it’s best to steer clear of leverage;

Getting taken for a ride: Avoid dodgy deals and murky platforms like the plague. If something doesn’t feel right, backtrack and double-check all the information at your disposal.

Are football clubs a good investment?

Yes, football clubs are a serious investment vehicle albeit they are prone to more risks than a stable blue chip stock.

A club’s share price can fluctuate hugely and is affected by on field performance, transfers and scandals alongside the business affairs it conducts.

As an Arsenal fan, I find it difficult to seriously own UK football club stocks simply because I don’t want to own shares in Manchester United. It’s nothing personal I just can’t do it for moral reasons!

The best football club shares are ones that have sustained on field performance, huge sponsorship deals and consistently attract top talent.

Manchester United are one of those clubs but I would also say Borussia Dortmund are too albeit nowhere near United’s financials!

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Pros and cons of buying football club shares

Pros

Profit Potential: Successful football clubs can generate significant revenue from a variety of sources, such as TV rights, merchandise sales, ticket sales, and sponsorship deals.

Prestige and Involvement: Ownership in a football club, even partial, can offer a sense of pride, prestige and personal involvement in the club. You may also get the opportunity to influence the direction of the club.

Access to Exclusive Benefits: Shareholders may get special benefits such as priority ticket access, exclusive meetings, or discounts on merchandise.

Potential for Capital Appreciation: If the club performs well, its value can increase over time, leading to an increase in the value of your shares.

Cons

Performance Risk: The financial success of a football club can be closely tied to its performance on the pitch. Poor performance can lead to reduced revenue, which can harm the value of your shares.

Market Volatility: Just like any stock, the share price of a football club can be volatile. You could potentially lose a significant portion of your investment.

Limited Liquidity: The market for football club shares may not be as liquid as other markets. This could make it difficult to sell your shares when you want to.

Overspending Risk: There’s a risk that a club could overspend on players and wages, leading to financial instability. This could potentially affect the club’s ability to pay dividends or could dilute your shares if they need to raise more capital.

Regulatory Risks: Changes in league regulations, broadcasting rights, or even tax laws can impact the club’s revenues and profitability.

Remember, while investing in a football club can be exciting and rewarding, it’s essential to conduct thorough research and consider getting advice from a financial advisor before making such an investment.

How to sell shares in a football club?

Selling publicly listed shares, such as those of a football club, is generally straightforward and done through an investing platform. Here are the simplified steps:

Log into Your Account: Sign into your investment account where you hold the shares.

Locate Your Shares: Find the shares of the football club you wish to sell in your portfolio.

Choose to Sell: Select the ‘sell’ option. This should be clearly displayed within the platform.

Decide Quantity: Determine the number of shares you want to sell. You can choose to sell all or part of your holdings.

Set Price Type: Choose your price type. You can generally select ‘market order’ (sell at the current market price) or ‘limit order’ (sell when the shares reach a specific price).

Review & Confirm: Check all details of the transaction are correct, then confirm your order.

Wait for Execution: Your order will be placed into the market and executed when your conditions are met.

Check the Confirmation: After your shares are sold, you’ll receive a confirmation in your account. Make sure to verify that the transaction was carried out as intended.

Why can’t I buy shares in other football clubs?

While some football clubs are publicly listed and you can buy their shares on the stock market (like Manchester United or Juventus), many are not. There are a variety of reasons why you might not be able to buy shares in a particular football club:

Private Ownership: Most football clubs are privately owned. This means that their shares are not available on the public stock exchange. Instead, they are owned by individuals or groups, who control if and when they want to sell their shares.

Fan Ownership: Some clubs, especially in countries like Germany, are largely owned by their fans or members. For example, the “50+1” rule in Germany states that, in order to obtain a license to compete in the Bundesliga, a club must hold a majority of its own voting rights. This is to ensure that the club’s members (i.e., its fans) hold a majority of the voting rights.

Limited Listings: Even when a club is listed on a stock exchange, it might be listed on a foreign exchange that is not accessible via your brokerage account. Some clubs might be listed on smaller, regional exchanges which may not be accessible to all investors.

Lack of Financial Transparency: Football clubs often have complex financial structures, with multiple revenue streams and high costs, which can deter some investors. Clubs can also carry significant amounts of debt, which can impact their financial stability and investment potential.

FAQs

Can you buy shares in sports teams?

Yes, you can buy shares in sports teams that are publicly listed on a stock exchange. However, the majority of sports teams, particularly football clubs, are privately owned and their shares are not available for public purchase.

Is it worth buying shares in a Football Club?

The worth of buying shares in a football club can vary greatly. It largely depends on the club’s financial health, its performance both on and off the pitch, and the overall conditions in the stock market. Just like any other type of investment, purchasing shares in a football club carries inherent risks and potential rewards.

Why do billionaires buy football clubs?

There are several reasons why billionaires might purchase football clubs. These reasons often include the prestige associated with owning a popular sports team, the potential for high returns on investment if the club is successful, and personal passion for football and the particular club.

Can I buy shares in Arsenal Football Club?

No, you can’t buy shares in Arsenal Football Club as it’s privately owned by Kroenke Sports & Entertainment, an American sports and entertainment holding company. The shares of Arsenal are not publicly listed on a stock exchange.

Can you buy shares in Man Utd?

Yes, you can buy shares in Manchester United. The club is publicly traded and its shares are listed on the New York Stock Exchange, which means they can be bought and sold like shares in any other publicly traded company.

Can you buy shares in Liverpool FC?

No, you can’t buy shares in Liverpool FC. The club is privately owned by Fenway Sports Group, an American sports investment company. Their shares aren’t publicly listed on a stock exchange.

Can you buy shares in football players?

No, you can’t buy shares in football players in the traditional sense of investing in a publicly traded company. However, there are certain platforms and investment opportunities that allow you to speculate on the future performance and value of football players, but this is a unique and often risky form of investment.

Do football club stocks pay dividends?

Whether or not football club stocks pay dividends depends on the specific club’s financial health and policies. Some publicly-traded football clubs, like Manchester United, have been known to pay dividends to shareholders, but it’s not a universal practice across all clubs. It’s crucial to research a club’s dividend policy before making an investment.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.