Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

If you have a low income, you may have wondered if it’s possible to get a mortgage and buy your own home.

The good news is that some lenders will offer a low-income mortgage.

These low-income mortgages may not be the easiest to get, and you’ll need to jump through some additional hoops, but it can be done.

Getting a mortgage is a major step for would-be homeowners. Mortgage lenders have strict criteria that they must adhere to and, if you don’t tick all of the boxes, they’ll simply turn you away.

When you submit your mortgage application it can be a tense time as you wait for the outcome.

This is the case even more if you have a low income and it takes time to explore how to get a mortgage on a low income.

I’m going to take a look at how you can get a mortgage on a low income.

I’m going to explain the options that are available to you, and what you can do to boost your chances of success.

Match with a mortgage advisor that suits your unique financial goals, and when you do, Unbiased donates to the Samaritans.

Table of Contents

How to get a mortgage on a low income?

A low income mortgage is more than possible to get, you just need to pass the criteria. Sounds simple, but it literally is all it takes.

Mortgage lenders can be a little twitchy if you have a low income. That’s because, as part of the application process, they need to be sure that you’re able to meet your mortgage repayments.

A lower income doesn’t automatically mean you fail to keep up with these, but lenders start looking for more reassurances.

The mortgage process is often a tricky one and, when you’re looking to overcome an issue of low household income, it’s vital that you have the right support and that you seek advice.

How to get approved for a mortgage with low income?

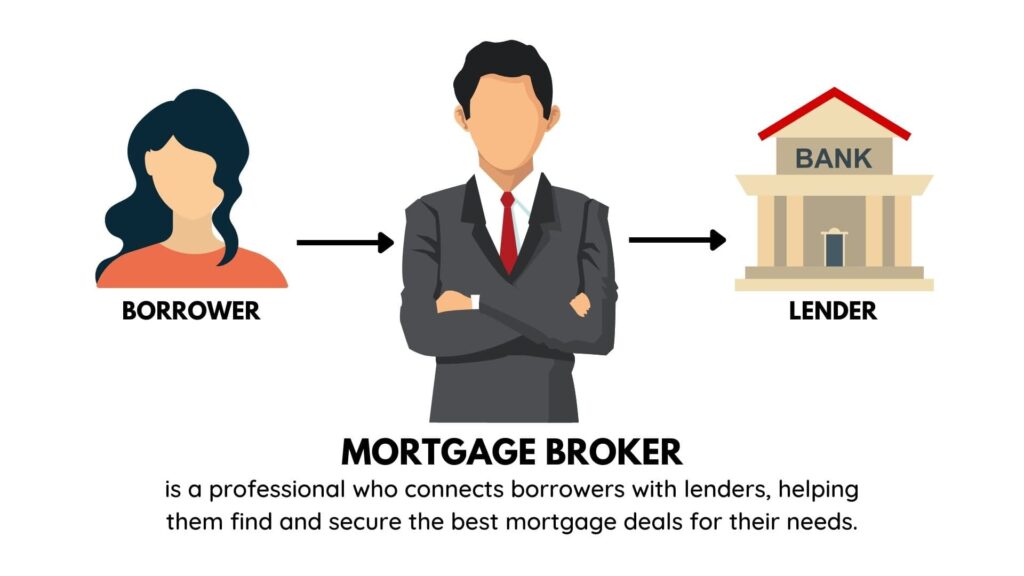

When it comes to securing a mortgage deal while having a low income, the best thing you can do is contact a specialist mortgage broker.

As specialists themselves, these brokers will know all about the specialist lenders that are in a position to assist.

Some of the major high-street lenders may not be happy to offer a low-income mortgage. A mortgage broker will know of those that are worth approaching so that you’re not wasting your time.

They’ll also know how to secure the best offers and interest rates.

What do mortgage providers classify as income?

Each mortgage lender has their own rules regarding what can be included in your income. Given those income multiples are used to decide how much you can borrow, the more sources that count, the better.

Here’s a look at what could be accepted:

- Your salary/wages

- Pension income

- Universal Credit

- Rental income

- Income from overseas

- Child maintenance

- Bonuses

- Overtime payments

- Disability benefit

- Industrial injuries benefit

You’ll find that mortgage lenders will accept anywhere from 0% to 100% of the value of these income sources.

Match with a mortgage advisor that suits your unique financial goals, and when you do, Unbiased donates to the Samaritans.

How to prove your income to mortgage lenders

When you try to get a mortgage, just remember that the lender’s biggest concern is that you’ll be able to meet the monthly repayments.

Lenders have minimum income requirements so that they can feel more confident that this is the case.

So, how much do you need to earn to get a mortgage?

Well, you can actually earn very little but many lenders will worry that a low income means that payments aren’t affordable, especially when considering other living costs.

To prove your income, and show that you can afford repayments, you’ll need to provide:

- A passport/driving licence to prove your identity

- Bank statements, usually going back at least 3 months

- Payslips

- P60 as this will show your annual income including any bonuses

- If you’re self-employed, you’ll need to provide 2 or 3 years’ worth of SA302s

- Utility bill

- Council tax bill

Remember, your income level is only one part of the mortgage application process. Before you can get on the property ladder you’ll also need to have your credit history looked at.

A history of bad credit and missed payments, when combined with a low income, make it even more difficult to get a mortgage.

The role of mortgage underwriters

Mortgage underwriters verify your income claims. They will then look at income multiples, alongside credit scores, and other information, before they come back and say how much you may be able to borrow.

A major part of this for low-income applicants is looking at how much deposit has been saved.

Typically, the minimum deposit will be set at a higher level for a mortgage with a low income.

What if I'm self-employed?

When you’re self-employed, it’s not always about low income. Instead, the problem faced is proving your income to a mortgage lender.

You will need to provide accounts from the last 2-3 years and having a good credit rating can really help.

The best thing you can do as a self-employed mortgage applicant is to seek the advice of a broker.

What can I do to boost my chances of getting a mortgage with low income?

To get a mortgage on a low income can certainly be tricky.

However, if you follow these steps you can boost your chances of being accepted:

Get to grips with your credit history

Your credit history will have a major impact when it comes to how a mortgage lender will view you.

If you have a low income, also having a bad credit history will set alarm bells ringing as you’re seen as an even bigger risk.

Check your credit file regularly. Ensure that what’s recorded is accurate and keep it healthy.

Match with a mortgage advisor that suits your unique financial goals, and when you do, Unbiased donates to the Samaritans.

Understand your income

A lender will use an income multiple to decide how much they will let you borrow. They will generally base this on the last 3 years.

Understand where you’re at and use our mortgage calculator to see how much you may be able to access.

A bigger deposit

A bigger deposit can help you to secure a low-income mortgage. It shows that you’re able to save money for a deposit and this can open up other deals with lower interest rates.

Use a specialist broker

A specialist broker will understand your situation and can give you the best chances of getting a mortgage with a low income.

They will have access to specialist lenders who are more likely to be open to working with you.

Are there any schemes that can help with low-income mortgages?

The good news is that there are specialist mortgage products and government schemes that can help you get onto the property ladder.

These include:

- Help to buy equity loan – the government grants you an equity loan to help with buying a new build house. You can get access to 20% of the property value (this has now ended for new applications from October 31st 2022)

- Right to buy – this allows council tenants to purchase their council house at a discount

- Shared ownership – with this scheme you buy part of a house from the council or housing association. You then pay rent on the part that you haven’t bought

- Mortgage guarantee scheme – a new government scheme that means that first-time buyers and home movers can access borrowing with a 5% mortgage deposit

- Guarantor mortgages – a guarantor mortgage is where you ask family members if they’re prepared to act as a guarantor. They become liable for the mortgage if you miss payments and this gives the lender more security

- Joint mortgages – a joint mortgage can be taken out with family members. Everyone on the agreement is responsible for making monthly repayments but you’re classed as the sole owner

FAQs

What is the lowest income that a mortgage lender will accept?

If you’re looking to get a mortgage on a low income, there is no set minimum income that will be accepted.

What matters is that you’re able to meet the monthly repayments and the more that you can do to show that you can, the better.

Can I get a mortgage with only Universal Credit?

If you have a minimum income and it’s made up solely of Universal Credit, there may still be lenders who can help.

Again, it’s about showing that the mortgage repayment won’t be a problem so things like good credit scores and larger deposits help.

Final thoughts

When looking at how to get a mortgage on a low income, the big takeaway here is that it can be done. The mortgage market caters for a whole range of circumstances and you have the best chance of securing the lending that you need by consulting with a mortgage broker.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.