Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

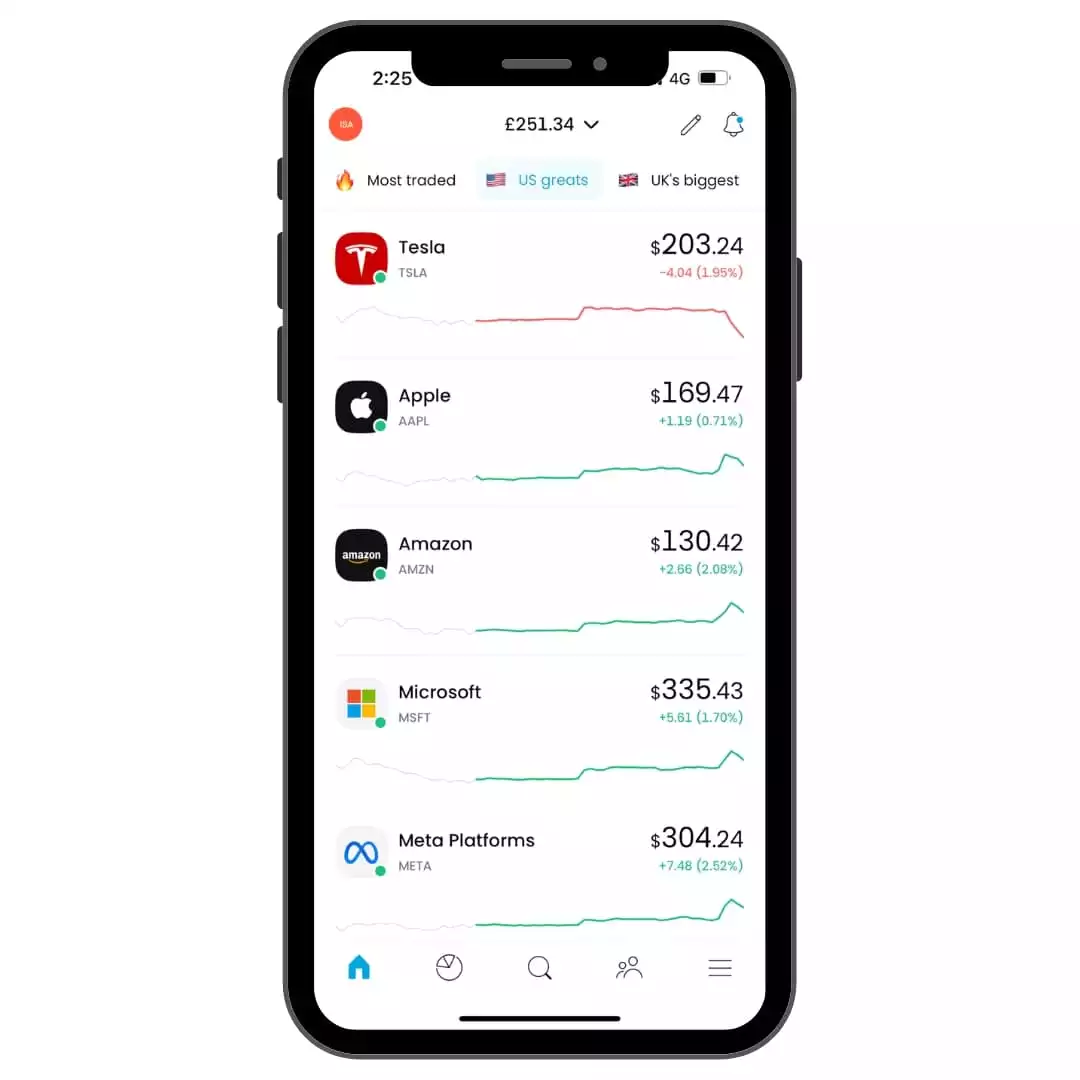

Free shares – they almost sound too good to be true. Yet, major investment apps – from Wombat to Trading 212 – all offer free shares and trading opportunities.

A lot of these three shares are attainable by simply signing up for the platform. However, requirements differ from platform to platform.

Surprisingly, free shares are more ubiquitous than you’d originally think. Like most promotional offers, free shares are mainly used to attract new traders to the platform.

In this article, I’ll explore why a trading app might want to offer prospective traders free stocks, the best platforms that offer free stocks and shares, as well as how to sign up for these bonuses.

Table of Contents

How to get free shares in the UK?

First up you’ll need an investment account and some money invested.

This can range depending on the provider and so below we have included some of the latest offers from the UK’s leading brokers.

9 UK Based Investment Platforms that Offer Free Shares

If you’re wondering which investment app to sign up for for free shares, consider one of the following:

WeBull – Get up to 8 free shares worth up to $2,000 – the minimum amount you’d receive it £23.07! Get this offer here.

Trading212 – You’ll receive up to £100 free shares if you invest a minimum of £1 with the code ‘GAINS’ – Get this offer here.

InvestEngine – This platform offers a sign-up bonus worth £50. Get this offer here.

Freetrade – Gives you £100 worth of free stocks for depositing as little as £1. (Get this offer here)

Wombat – You receive £10 when you make a deposit (however, you have to wait 3 months before making a withdrawal)

Stake – If you make a minimum deposit of £50, you can receive up to £150 worth of stock in GoPro, Nike, or DropBox.

Wealthyhood – Deposit £10 and get a free EFT that’s potentially worth £200 (you need to leave the share for 2 months before you can withdraw).

Degiro – You’ll receive £50 from Degiro as a referral bonus.

How to get Free Shares

This depends entirely on the platform. From Wombat to BestInvest, how you attain these free shares depends entirely on the platform’s criteria.

Normally, you have to follow this kind of process:

Sign up for an account on the platform’s website or via the referral link you’ve been provided. Normally, you’ll need to provide your National Insurance number, ID, and your bank details.

Once your account is set up, you’ll need to make the minimum deposit stated. This could be £10 if you’re investing via WealthyHood or £1 if you’re on Freetrade.

Abide by the terms and conditions stated. This could include waiting a certain amount of time before withdrawing your funds. For example, some platforms won’t provide your free share if you pull out within the first 30 days.

Claim your free share. You may not even have to claim it – the bonus may just appear in your account once conditions have been met.

Send referral links out to your peers to unlock additional free stocks and shares.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

How Do Free Shares Work?

Free stock and shares work in exactly the same way as the stock and shares you buy with your own money.

You can trade them on the stock market, their value can change, and you’re also taxed on them in the same way (more on this later).

Once you’ve gained your free share/stock, you can do whatever you want with it. You can invest your own cash to try and gain a better return, or sell it off and withdraw the cash.

Or you can rebuy into your favourite blue chip stocks like Apple.

Normally, there is a limit to how long you have to wait before you can withdraw the cash.

You could also put your free stock or share into a General Investment Account (GIA) or an Individual Savings Account (ISA).

The free share is enough for you to start investing and even earn compound interest.

Why Companies are Handing Out Free Shares

The reason why companies offer free stock to new customers is to get them to sign up for their platform.

The idea of attaining free stock to play with – and the potential investment reward that could be made from this free stock – entices many beginners to sign up.

Once you’re on the platform and doing whatever you want with your free share, you may be enticed to invest further. Especially when the platform is well laid out and easy to understand.

Are Free Stocks and Shares Taxed?

Both income and profits from shares are subject to taxation. Here is a summary of how each type of income might be taxed:

Dividend Income: Dividends are taxed separately from other forms of income. For the tax year 2021-2022, the dividend tax rates were as follows:

Personal Allowance: If your total income (including dividends) is below the personal allowance threshold (£12,570 for 2023-2024), you don’t have to pay any tax on your dividends.

Dividend Allowance: In addition to the personal allowance, there is a dividend allowance (£1,000 for 2023-2024), which is a tax-free amount on dividend income.

Basic rate taxpayers: 8.75% on dividend income above the dividend allowance

Higher rate taxpayers: 33.75% on dividend income above the dividend allowance

Additional rate taxpayers: 39.35% on dividend income above the dividend allowance

Please note that these rates and thresholds may change, so always check the latest information provided by the UK government or consult with a tax professional.

Capital Gains: Profits from selling shares, known as capital gains, are subject to Capital Gains Tax (CGT). You have an annual tax-free allowance for capital gains, known as the Annual Exempt Amount.

For the tax year 2023-2024, the Annual Exempt Amount was £6,000. If your capital gains exceed this amount, you will need to pay CGT on the difference. The CGT rates for the tax year 2023-2024 are:

Basic rate taxpayers: 10% on capital gains

Higher rate and additional rate taxpayers: 20% on capital gains

ISA account

If you have an ISA, your free share provider may allow you to put your free stock/shares into your ISA. With an ISA account, you are not taxed for the first £20,000 you deposit into it.

£20,000 is the maximum you can save for the 2022/2023 tax year.

This way, you can save up money without losing any to taxation. In this case, you could avoid being taxed for your free stock investment and earnings.

However, not all free share providers will allow you to deposit your bonuses into your ISA account.

FAQs

Can you receive free stocks and shares more than once from an investment app?

Many investment accounts allow you to receive free stocks and shares more than once. Besides the initial sign-up bonus, you can also receive free stocks and shares through a referral bonus.

This is when you successfully refer a friend to sign up for the platform. You may receive a bonus one time for this, or a bonus for every time you successfully refer a new friend.

Is it free to trade on the stock market in the UK?

Most online trading platforms will charge you a fee every time you trade on the market. So, whenever you buy or sell a share, you will be charged something. This includes when you are given free stock to trade.

However, some platforms offer commission-free trading, including the likes of eToro. Other platforms offer free trading if you make a minimum number of trades.

What is the minimum amount you need to start trading in the UK?

If you’re new to trading, start with a small investment amount. If the platform offers some form of free share, use this amount initially.

If the platform requires a minimum deposit, simply put forward however much is required – or, however much you’re prepared to lose. It’s best to start small to get used to how the market works.

Are trading apps safe to use?

If you’ve downloaded the app from the Apple Store or Google Play (and it’s got plenty of positive and authentic reviews) then you can probably trust that it’s safe to use.

Never use a trading app downloaded from a third-party site – i.e., a site not associated with Apple or Google Play.

Is Freetrade legitimate?

Out of all the apps offering free stocks, Freeetrade is one of the most legitimate. Not only is it a member firm of the London Stock Exchange, but it’s also 100% monitored and regulated by the Financial Conduct Authority.

So, despite their low deposit requirement, you can 100% trust Freetrade.

Final Thoughts

You’re able to enjoy free share opportunities on most major trading platforms today. Sometimes, all you have to do is sign up for a UK-based investment platform and follow the terms and conditions to receive your free shares.

You can sometimes also forward a referral code or referral link to receive an additional free bonus.

These bonuses are obviously in place to entice you to use the platform further – which you may or may not want to do. Either way, who could say no to free stock worth much more than you deposit?

Resources

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.