Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Oh, Apple. If you’re like me and have every Apple gadget under the sun you’ve probably wondered how to buy Apple shares in the UK.

Well, the good news is these days it’s very easy! Full disclosure, I’m a proud Apple shareholder but am not biased in this guide.

In this article, I’m going to walk you through how to buy Apple stock, the best places to invest in Apple, the best time to buy and everything else you should know about Apple stock.

- Important Notice

When you invest the value of your shares can go up or down. If you are unsure about your investment decision you should always seek investment advice. Past performance is not a future indicator and always do your own research.

Where can I buy Apple Shares?

|

|

|

|

|

30 million users worldwide enjoy social investing with over 3000 stocks, funds, trusts and cryptocurrencies available. Fantastic mobile app, research and academy.

Award-winning investing service with access to SIPPs, ISAs and more. Expert financial advice and research are also available.

How To Buy Apple Shares UK - Quick Guide

Embarking on your journey to acquire shares in Apple requires you to initiate the process of setting up a trading account. Ensure you have your personal identification, national insurance number, banking particulars, and proof of residence at the ready for this stage.

Subsequently, you’ll need to define your payment methods. Typically, this involves using a direct bank transfer or a debit card to infuse your newly established trading account with funds.

Your next task is to locate Apple shares on your trading platform. You can achieve this using the Apple stock symbol, which is “AAPL”.

It’s imperative that you thoroughly investigate the specifics of Apple Inc shares. Your trading platform will equip you with all the up-to-date information concerning these shares.

Finally, when you feel satisfied and at ease with all the details, you can go ahead and buy your Apple shares. And just like that, you’re an Apple shareholder!

Apple Live share price

The stock price will change at points during the day so be sure to check the Apple share price again before you purchase any stocks.

Are Apple Shares Overvalued or Undervalued?

Apple has had an incredible year so far but astonishingly still has room to grow.

The company remains a buy for most analysts and especially when planning to hold for the long term Apple represents a compelling option to be a part of any investor’s portfolio.

Buying Apple shares with a broker

The most common way to buy Apple stock is through a broker. In the UK we have both online discount brokers many of whom offer commission-free trading and traditional full-service brokers.

Use this guide to help you select the right broker to buy Apple shares.

Select a Reliable Broker

Now you know how to buy Apple shares next up you need to first choose a credible broker.

Keep in mind, that not all brokers offer share purchases for all companies listed on various exchanges, and Apple is listed on the NASDAQ (NASDAQ:AAPL).

Online trading platforms such as eToro*, Hargreaves Lansdown*, and Trading212 are popular choices owing to their user-friendly interfaces and a wide array of listed stocks, including those on the NASDAQ.

Style of Account

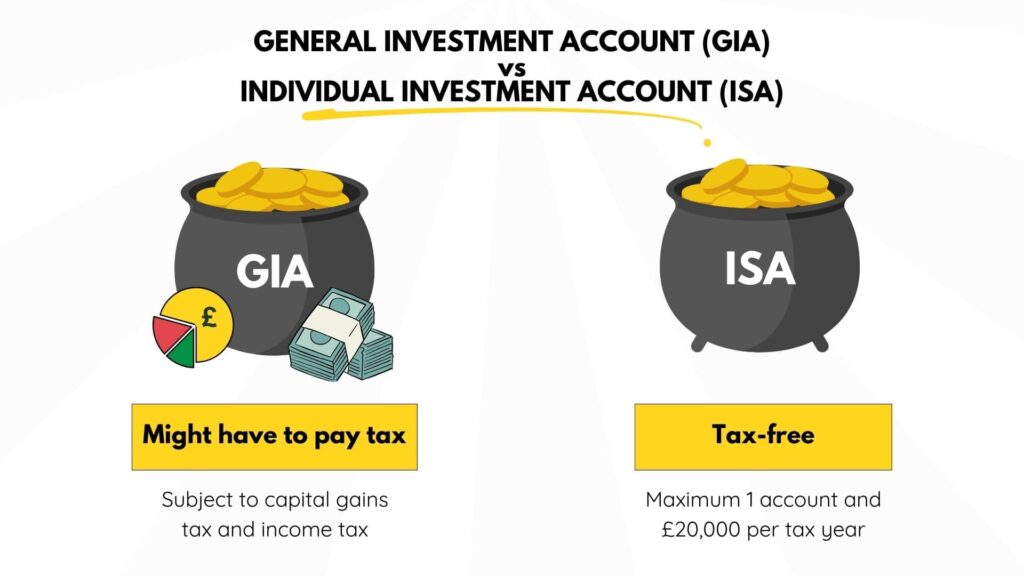

Before moving on to the account creation step, it’s crucial to decide the type of account you wish to open—specifically, whether to go for a Stocks and Shares Individual Savings Account (ISA) or a General Investment Account (GIA).

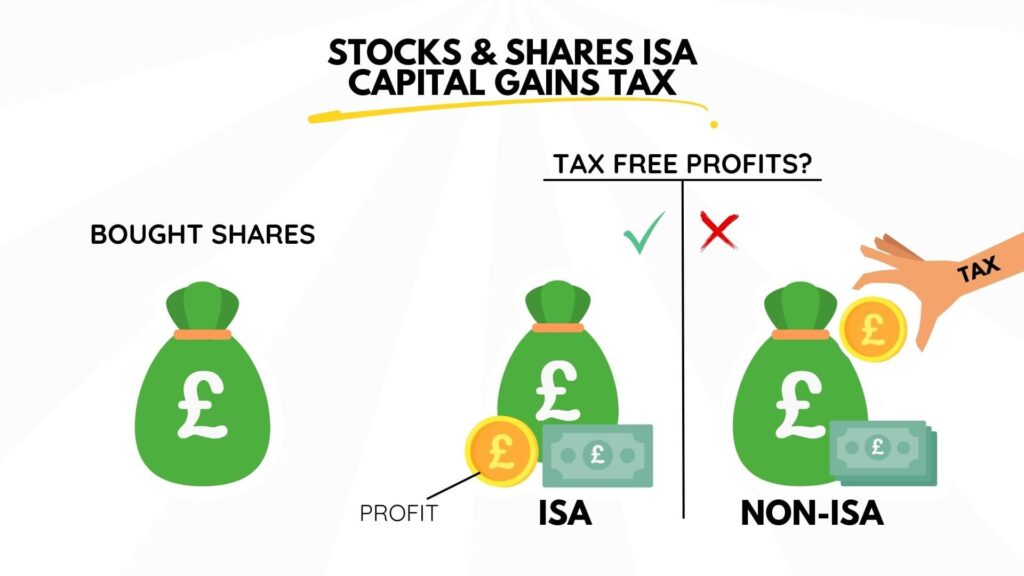

A Stocks and Shares ISA offers significant tax benefits, as it allows you to invest without paying tax on dividends or capital gains. This can be a major advantage for investors looking to maximise their returns.

However, there is a limit to how much you can invest in an ISA each tax year, which for the 2022/2023 tax year is £20,000.

On the other hand, a General Investment Account (GIA) doesn’t offer these tax advantages.

If you choose to go this route, you’ll be liable to pay capital gains tax on any profits or interest earned above £6,000 in a tax year.

While this account type doesn’t have an annual investment limit, the absence of tax benefits means you might end up sharing a slice of your profits with the taxman.

Your choice between these two account types will depend on your investment goals and how you prefer to manage your tax liabilities.

Lastly, there is also the option in the UK to invest in Apple inside your SIPP (self-invested personal pension) if you so wish.

Create an Account

Once you’ve selected a broker, your subsequent step is to create an account.

This process usually involves providing some personal details, such as your address, ID, national insurance, and employment details.

It’s a straightforward process, akin to setting up a conventional bank account.

Ensure you carefully read through the terms and conditions to understand the services and fees associated with the account.

You will also be required to submit a W8-BEN form to state you are not a US citizen and therefore not subject to their tax rules. Your chosen broker will help you do this through the platform and it takes less than a minute.

Add Funds to Your Account

After setting up your account, your next task is to deposit funds into it. Placing money into your brokerage account allows you to purchase shares.

This is commonly done through a bank transfer, though some brokerages might also accept cheques or wire transfers.

The time taken for the money to appear in your account can vary, so it’s wise to plan ahead if you’re aiming to seize a particular investment opportunity.

Assess the Company

Prior to buying shares in Apple, or any company for that matter, it’s vital to undertake thorough research. Assess the company’s financial health, recent performance, and its business transactions.

Information about Apple’s financial records and other investor-related data can be located on their official website.

You might also want to read market analyses and expert opinions to glean insights into the potential of the company’s stock.

Decide Your Investment Amount

Finally, determine how much you wish to invest. Remember that investing in stocks invariably involves risk, and it’s imperative not to invest more than you can afford to lose.

When deciding on your investment amount, consider your financial goals, risk tolerance, and the current price of Apple shares.

If you’re a beginner investor, it may be wise to start with a smaller amount and gradually increase your investment as you become more comfortable with the process.

30 million users worldwide enjoy social investing with over 3000 of stocks, funds, trusts and cryptocurrency available.

Use their social features and copy trading to follow and invest with the best investors on the app.

- 0% commission on real stocks and ETFs

- Social Investing

- Copy the top investors in the world

- Regulated by the Financial Conduct Authority (FCA)

- Lack of research

Where Else Can I Buy Apple Shares?

So, you’re keen on investing in Apple but want to explore alternative avenues beyond online discount brokers and full-service traditional brokers?

The good news is that you have several other options to consider.

Each of these methods comes with its unique set of advantages and drawbacks, making it crucial to weigh them carefully before taking the plunge.

Let’s delve into three notable alternatives: Fractional Share Providers, ETFs/Mutual Funds/Index Funds, and CFDs.

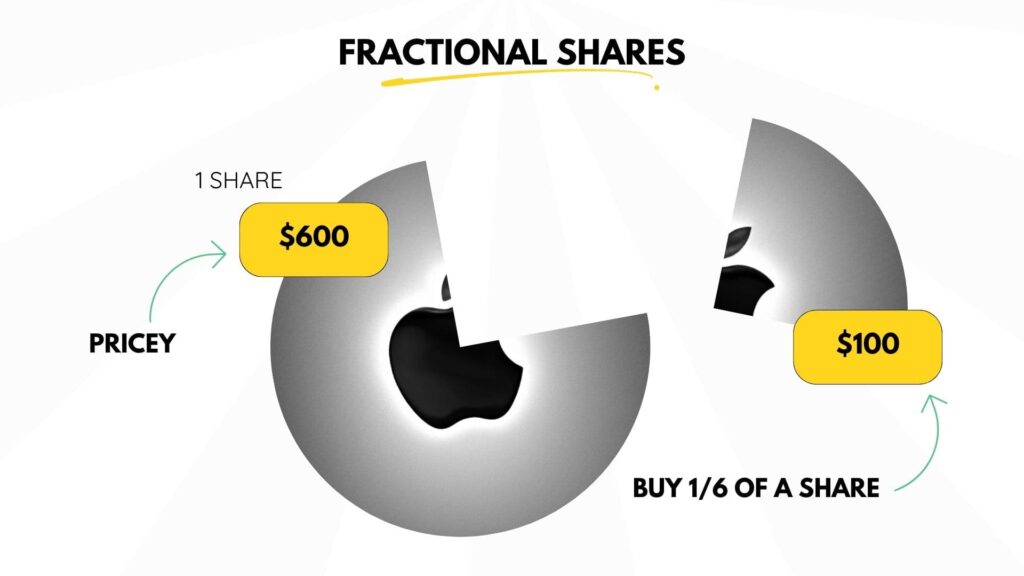

Fractional Share Providers

Fractional share providers are an excellent entry point for budding investors who may not have the financial wherewithal to purchase entire shares of high-value companies like Apple.

With this option, you can invest in just a portion of a single share for a fraction of the price.

Popular platforms such as eToro and Trading212 allow you to engage in fractional investing, enabling you to own a slice of Apple without breaking the bank.

It’s an accessible way to diversify your portfolio and participate in the stock market with lower capital.

Check out our eToro vs Trading212 review here.

ETFs / Mutual Funds / Index Funds

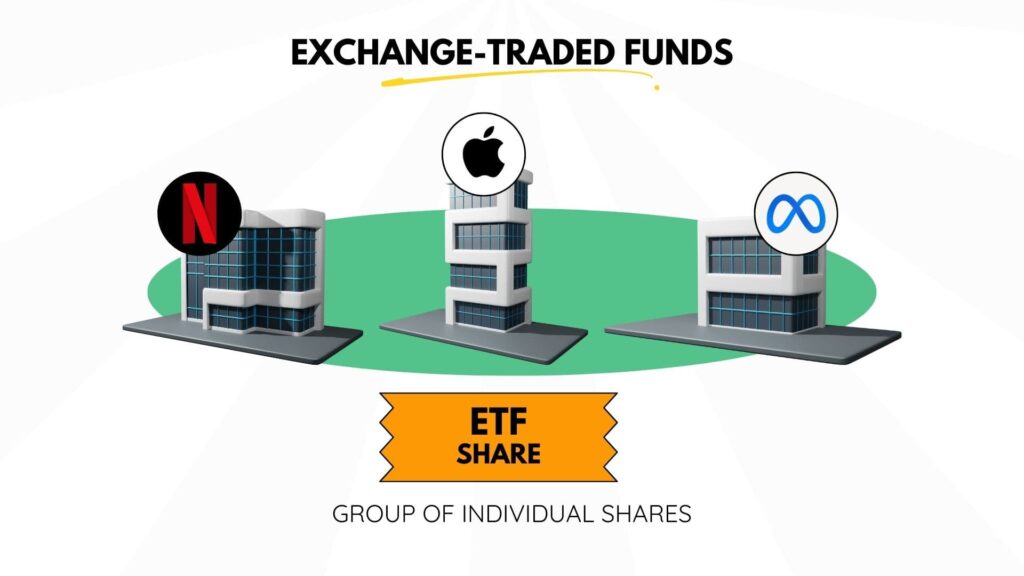

Another route to indirectly owning Apple shares is through Exchange-Traded Funds (ETFs), Mutual Funds, or Index Funds that include Apple in their portfolio.

These funds are collections of multiple stocks, often managed by professionals, which you can invest in as a single unit.

For example, the SPDR S&P 500 ETF includes a percentage of Apple stock.

Mutual Funds and Index Funds like the Vanguard Total Stock Market Index Fund also provide exposure to Apple.

By opting for these investment vehicles, you can benefit from broader market trends while still having a stake in Apple’s performance.

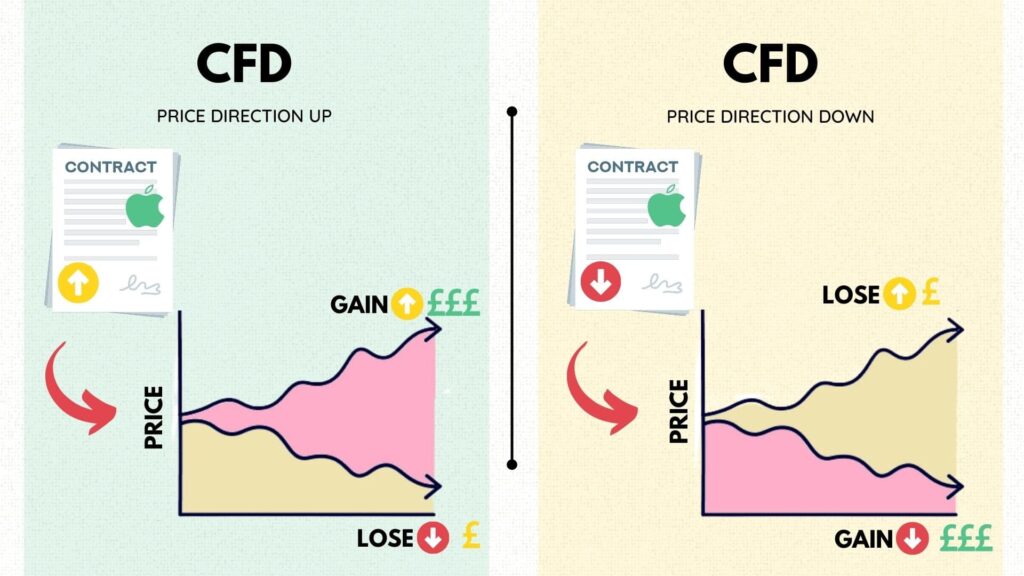

CFDs (Contract for Differences)

If you’re more inclined toward speculative investments and have a solid grasp of the market dynamics, CFDs could be an intriguing choice.

Contract for Differences allow you to speculate on the price movement of Apple shares without actually owning the shares. Essentially, you’re betting on whether the price will rise or fall, making it a riskier but potentially lucrative option.

Keep in mind, however, that CFD trading often involves leverage, which can amplify both gains and losses. Due to the speculative nature of CFDs, they may not be suitable for everyone and should be approached with caution.

Why Invest In Apple?

As both an Apple shareholder and a consumer who regularly indulges in their latest upgrades and gadgets, I have a personal affinity for the company’s design and innovation.

It’s not just my personal taste that attracts me to Apple, though. The company has concrete financial and strategic strengths that make it a compelling investment opportunity.

A Robust Product Ecosystem

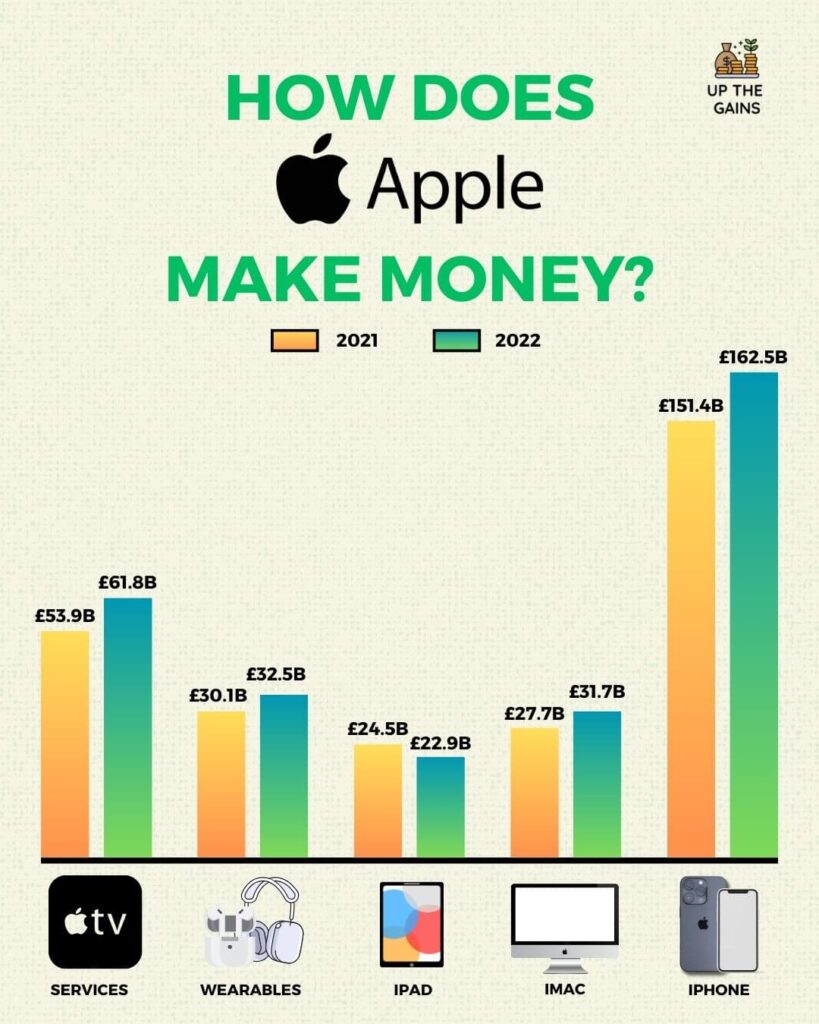

Apple’s impressive product lineup includes not just their flagship iPhone, but also iPads, MacBooks, Apple Watches, and Apple TVs.

What truly sets Apple apart is how these devices interact seamlessly with their software and service offerings. iCloud, Apple Music, and the App Store, among others, create an ecosystem that engenders customer loyalty and facilitates recurring revenue.

Innovational Prowess

In the sphere of technology, the term ‘innovative’ is almost synonymous with Apple. The company has a history of being a trailblazer, from the iMac to the iPod, to the first iPhone, to AirPods and beyond.

Apple doesn’t just rest on its laurels; it continuously enhances its product range and forays into new markets. This has helped Apple solidify its standing as a leading player in the industry.

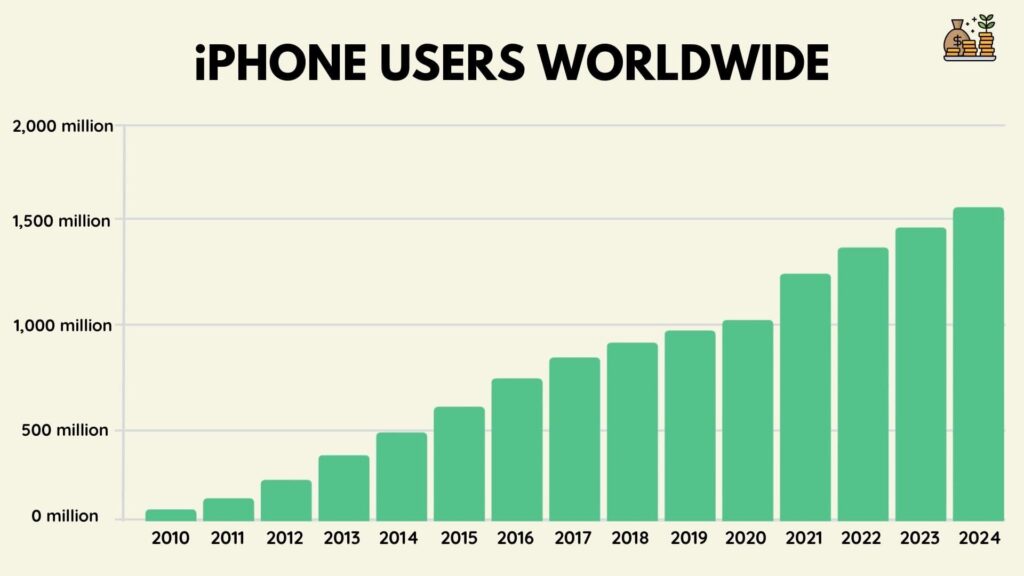

The iPhone Phenomenon

Although faced with formidable competition, Apple’s iPhone still accounts for more than half of the company’s total sales.

The premium smartphone market continues to be dominated by the iPhone, whose sales figures show a reassuring upward trend year over year.

The recent launch of the iPhone15 was actually not as positive for investors because Apple decided not to raise prices and also offered a trade-in phone exchange.

I personally think this is a stroke of genius, Apple has raised prices on every launch so far but with only 20% of the entire phone market they want to solidify that position with current customers.

The iPhone 15 has enough upgrades to attract new customers and once you’re a customer they catch you with the ongoing services such as iCloud and wearables like the Apple Watch and AirPods.

Expanding Service Offerings

One of the notable growth areas for Apple has been its services segment, encompassing everything from Apple Music to iCloud and Apple TV+.

The revenue from this segment has seen considerable growth, lending the company a more diversified income stream and reducing its reliance on hardware sales.

In the US, Apple has also launched a high-yielding savings account to accompany Apple Pay. This is a master stroke in my eyes as they are now entering the financial payments realm which I believe they could compete in.

Financial Returns: Dividends and Stock Splits

As an investor, it’s reassuring to know that Apple has a track record of paying dividends and undertaking stock splits.

These financial manoeuvres are enticing for shareholders and could be a crucial part of your investment strategy.

Financial Stability

Apple’s balance sheet is a fortress, bolstered by large cash reserves and minimal debt.

Both revenue and operating income have seen consistent growth over the years, making Apple’s financial stability an attractive proposition for any investor seeking long-term gains.

With its potent blend of innovation, robust product ecosystem, solid financials, and expanding service offerings, Apple presents an enticing investment opportunity for those eyeing long-term growth and stability.

Like all investments, however, it’s vital to assess the associated risks comprehensively before taking the plunge.

How do Apple Pay Dividends?

Apple has made quarterly dividend payments since 2012. Its current annual dividend yield is 0.54%.

With a current share price of $177, their quarterly dividend amount is $0.24 a share. Please note this will fluctuate based on Apple’s share price.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

What Should I Consider Before I Buy Apple Shares?

Investing in Apple shares, like any other investment, necessitates a thorough assessment of various factors to ensure that the investment aligns with your financial goals and risk tolerance.

Here’s a checklist to help you evaluate your decision to invest in Apple.

Evaluate Your Investment Objectives

Start by clarifying your investment goals. Are you looking for long-term capital growth, or are you more interested in a reliable dividend income?

Understanding your investment objectives will help you determine if Apple’s current performance and future outlook align with your aims.

Risk Tolerance

While Apple is generally considered a less volatile stock compared to smaller tech companies, no investment is entirely without risk.

Determine your own level of risk tolerance and decide if investing a large portion of your portfolio in Apple aligns with that.

Market Timing

Though it’s challenging to time the market perfectly, understanding the broader market trends can offer some insight into your investment timing.

If the stock market is in a bearish phase, it might be worth waiting for a more opportune time to buy Apple shares.

Financial Analysis

Dive deep into Apple’s financials to get a comprehensive view of the company’s health. Look at their income statement, balance sheet, and cash flow statements. Focus on key ratios like P/E, P/B, and debt-to-equity to understand its valuation and leverage.

Product Pipeline

Keep an eye on Apple’s product development and upcoming releases. New product launches or updates can significantly impact the stock price, either positively or negatively.

Regulatory Environment

Given that Apple operates globally, it’s also susceptible to various regulatory challenges in different jurisdictions. Trade policies, antitrust laws, and intellectual property disputes are all worth keeping an eye on as they can affect Apple’s stock price.

Dividends and Stock Splits

If you are interested in dividends or potential stock splits, consider Apple’s history and likelihood of continuing these practices. Although past actions are no guarantee of future performance, they can offer some clues.

Competitive Landscape

While Apple has been a dominant player in its markets, the tech industry is notoriously fast-moving. Keep an eye on competitive forces, market saturation for Apple products, and how well the company is positioned against its competitors.

Diversification

Don’t forget the cardinal rule of investing: never put all your eggs in one basket. Make sure that buying Apple shares fits into your broader investment strategy and contributes to a diversified portfolio.

Tax Implications

Understand the tax implications of your investment, especially if you are not using a tax-efficient account like a Stocks and Shares ISA. Profits or interest above £6,000 in a tax year currently attract capital gains tax in the UK.

By taking these factors into consideration, you’ll be better prepared to make a well-informed decision about investing in Apple shares.

What Does It Cost to Buy Apple Stocks?

The cost to buy Apple stock will vary from broker to broker. In addition to the share price, it’s essential to take into account several types of fees that can impact the total cost of your investment.

Platform Fees

Some brokers charge a platform fee, which is a monthly or annual fee for using their trading platform. This fee can add up over time, reducing your overall return on investment.

Dealing Fees

Dealing fees, also known as trading fees or commission fees, are the charges incurred for each transaction.

Some brokers charge a flat fee per trade, while others may charge a percentage of the total trade value. Be mindful that these fees apply both when you buy and when you sell your shares.

Currency Conversion Fees

If you’re investing from the UK, you’ll also need to consider currency conversion fees as Apple’s shares are priced in U.S. dollars.

Many platforms charge a foreign exchange fee, which is typically a percentage of the converted amount. This fee can sometimes be hidden in the exchange rate, so it’s worth checking the rates carefully.

What's the Cheapest Way to Buy Apple Stock?

If you’re looking for the most cost-effective way to invest in Apple, consider using commission-free brokers like eToro and Trading 212. These platforms allow you to buy and sell shares without incurring trading or commission fees.

However, it’s important to note that while they don’t charge traditional fees, there may still be costs associated with currency conversion. Always read the fine print to ensure you’re fully aware of any hidden fees or charges.

Should I buy Apple Shares today?

The decision to buy Apple stock is ultimately a personal one that hinges on various factors such as your investment objectives, financial standing, and risk appetite. Below are some considerations to help guide your decision.

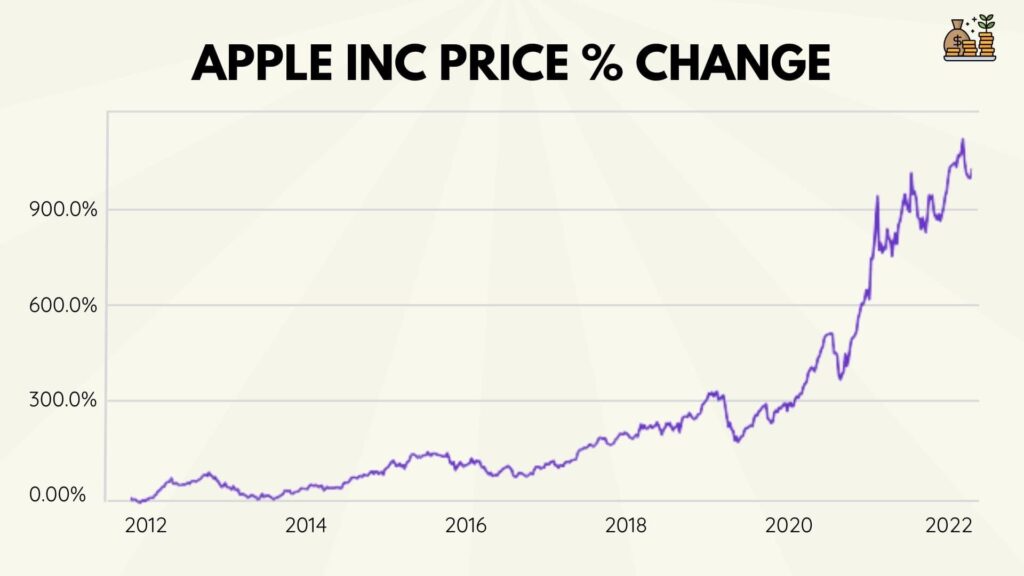

Historical Performance

Apple’s stock has an impressive track record, delivering a total return of approximately 66,054% over the past 20 years, compared to the S&P 500’s 349% total return in the same period.

That’s a 38.4% compound annual growth rate (CAGR) for Apple versus a 7.8% CAGR for the S&P 500. Although past performance isn’t a guarantee of future returns, such a consistent record of outperforming the market is undoubtedly a point to consider.

Market Trends and Strategic Choices

Apple underperformed slightly relative to the S&P 500 in 2022, but it’s important to note the company’s strategic moves. Notably, Apple’s decision to develop its own semiconductor chips has set it apart from competitors, influencing even giants like Tesla, Amazon, and Meta.

Innovations and Diversifications

Apple’s innovation isn’t just limited to its core products. The company has been diversifying its offerings, entering new sectors such as virtual and augmented reality, evidenced by its RealityOS trademark filing. Apple’s move into the ‘Buy Now, Pay Later’ space with Apple Pay Later shows further diversification.

Product Roadmap

Apple’s product launches in September were robust, including new iPhones, Apple Watches, and AirPods, featuring groundbreaking technology like crash detection.

Apple’s release calendar for 2024 is equally exciting, promising AirVisionPro, the new M3 chip and a new iPad Pro on the card.

Risks and Market Volatility

Investing in any stock carries inherent risks and the stock market can be volatile. Apple’s shares did see a dip of 28% last year but have bounced back with a 42.7% gain so far in 2023 which is something potential investors should keep in mind.

So, should you buy Apple stock today? Ultimately, that’s a decision only you can make.

Factors like your investment objectives, financial situation, and risk tolerance should all be considered carefully. If you’re still unsure, it might be beneficial to consult a financial advisor for personalised advice.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

When Is The Best Time To Buy Apple Shares?

It’s very difficult to know the best time to buy Apple shares. It depends on a multitude of different factors such as current market value, performance and product releases.

Then is it’s also important to factor in wider contributing factors such as macroeconomic trends too!

That being said, I think that Apple is close to having 3 trillion dollars in market capitalisation and with room still to grow it makes the company a compelling case for investment at any point.

For me, I would look at not just the growth but equally current performance and perhaps start by dollar cost averaging into the holding each month if you’re worried about a lump sum investment.

How To Sell Apple Stock?

For those looking to sell Apple shares, much like buying them, is a pretty uncomplicated process. Here’s a straightforward guide on how to go about it:

Access Your Trading Account: This would be the account you utilised to buy your shares in Apple If you don’t have one already, you’d need to set up a brokerage account with a company that facilitates the trading of international stocks.

Find Your Shares: Once logged in, navigate to your portfolio page where you should find all the shares you currently possess. Your Apple shares should be listed under the ticker symbol ‘AAPL’.

Select ‘Sell’: Next to your Apple Inc shares, there should be a ‘sell’ option. Click on this.

Decide the Number of Shares to Sell: You will then need to specify the quantity of shares you plan to sell. This could vary from offloading a portion of your shares to liquidating your entire position.

Set Your Share Price: This step is optional. If you choose to set a specific price, known as a ‘limit order,’ your broker will only sell your shares once they hit this price. If you opt for a ‘market order,’ your shares will be sold at the current market price.

Confirm the Sale: Once you’re happy with all the details, confirm the sale. Your broker will then execute the order on your behalf.

Remember, the process might vary slightly depending on the brokerage platform you’ve chosen. Always consider the transaction fees that your broker might levy when selling shares.

FAQs - How To Buy Apple Shares

Do Apple Pay Dividends?

Yes, Apple pays a quarterly dividend and has done so since 2012. There is no news that this will change in the near future.

Can I buy Apple Shares with a debit card?

Yes, you can buy Apple shares with a debit card. Most online and traditional brokers will accept debit cards as a form of money transfer into your account. Other ways include BACs and in some cases cash.

Do you need to complete a W8-BEN form to invest in Apple?

Yes, as a UK investor, you will need to complete a W8-BEN form in order to purchase Apple shares. This is the same for all US investments to ensure you state you are not a US citizen.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.