If you’re looking for an app-only bank, then this Monese review is for you. Why? Well, Monese can be seen as the grandad of app-only banks and has been going from strength to strength.

In this review, we’re going to delve into all that Monese has to offer.

One major thing that you’ll learn as we go through this Monese review is that Monese is not actually a bank in the true sense of the word. It’s essentially a savings app first that has banking attached to it.

Does it matter that Monese isn’t truly a bank? How easy is it to use the Monese app? How much does Monese cost? Are there any features that really stand out and that customers should be looking to take advantage of?

Well, as you read on through this Monese review, you’ll find the answers to these questions and many more besides.

Table of Contents

Monese Review - Company Overview

Founded back in 2016 by Norris Koppel, Monese was one of the very first app-only banks to launch in the UK.

The idea for this service came on the back of the experience that Koppel had himself: with no utility bills and no UK credit history, he was left unable to open a bank account.

Koppel realised that his issue was far from unique. In fact, there were plenty of people who had moved to the UK who faced being unbanked and so unable to even receive their wages.

Koppel’s answer was the Monese app. An app that allowed virtually anyone to open a current account so that they could receive their wages and pay their bills.

The popularity of what Monese has to offer can be seen by the fact that it now has over 2 million customers, and it was recognised as the best challenger bank at the European fintech Awards.

Monese App Features

One thing that we have found during the course of this Monese review is that this is a service that is rich in features. Two of the features that we’re really big fans of are the credit building features and the insurance product.

The credit building feature allows customers to pay a monthly fee and also make a set payment each month. The payment that is made is locked away for 12 months and then repaid to the customer.

Each time that a payment is made, it’s reported to all three credit reference agencies and boosts the customer’s credit score.

The insurance feature offers cover to Monese customers who may experience a reduction in income. It could be that they lose their job or are off following an injury or an accident. When this is the case, Monese will cover bills ad expenses up to a maximum of £1,800.

As well as these, there are also other great features such as:

- Accounts in multi-currency

- Free worldwide cash withdrawals

- Pre-paid contactless card provided by MasterCard

- Track your spending

- The ability to set budgets and save money

- Able to set up ten saving pots (it would take a whole separate Monese savings review to cover these!)

- Round up your spare change to make saving even easier

- Interest paid on savings

- Earn by referring friends and family

Account Types

As part of our Monese review, we took a look at the various types of accounts that are on offer. What we found was that there are three types: Starter, Classic, and Premium.

All three of these accounts come with a contactless card, the ability to set up direct debits and standing orders, as well as the ability to round up your spending. The differences that creep in are centred around the fees that are charged, but we will be discussing these in more detail soon.

It’s worthy of note that if the insurance feature is of interest to you, this isn’t available with a starter account. You’ll need to upgrade to a Classic or Premium one, and, as you’d expect, the best level of cover comes with the latter. This is how they compare:

Classic

- Bills protection up to £1,200

- Hospital stay insurance of £30 per day for up to 30 days

- Purchase protection insurance up to £1,000 per claim, £2,500 per year

Premium

- Bills protection up to £1,800

- Hospital stay insurance of £50 our day for up to 30 days

- Purchase protection insurance up to £4,000 per claim, £10,000 per year

Another added feature that comes with a premium account is access to priority customer support. Now, we’re not entirely sure how we feel about this.

Yes, it’s always great to have the opportunity to receive VIP treatment, but when it comes to matters involving your money, we believe that everyone should have access to the very best in customer support.

User Experience

An important part of any Monese review involves taking a look at the user experience. After all, the range of features available loses relevance if the whole experience is clunky and difficult.

The big thing here is that Monese does not have any physical branches. That means that everything is done via the Monese app. That being the case, you’d hope that the app was pretty good, and we’re pleased to say that it delivers.

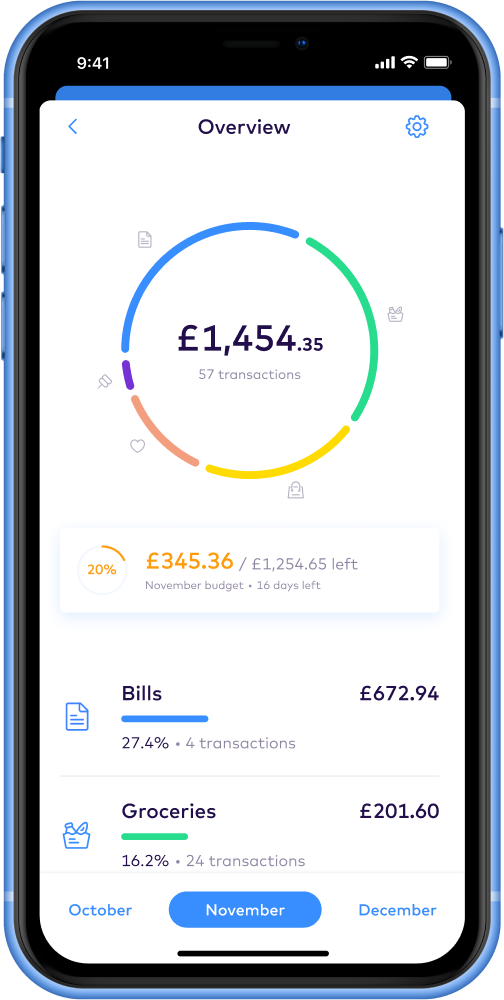

The app is fast, easy to navigate and visually pleasing to use. It’s so difficult when banking apps aren’t easy to move around on, and Monese is certainly not in that category as the design is excellent.

When it comes to opening an account, you’ll find that the app has step-by-step instructions that anyone can follow.

In order to comply with regulations, you’ll need to take a photo of your ID, such as a driving license or passport, and then also record a video of yourself.

As soon as Monese verifies your ID, you’ll be given an account number and sort code so that you can start to send and receive money straight away. There are no credit checks involved, so anyone can open an account with ease.

As you log into the app, you can instantly see your account balance. When it comes to navigating through the Monese app and finding details of savings etc., this is really simple to do.

The menu is clear, and you really shouldn’t experience any difficulties when it comes to finding your way around.

How much does Monese Cost?

Anyone reading a Monese review will be keen to know about any fees that are charged. When it comes to the charges here, it depends upon the account that you have chosen to open.

Let’s take a look at the fees that are involved with each:

Starter account

- Zero monthly fee

- £9.90 for a replacement card

- £1.50 charge for cash withdrawals

- Manual cash top up at Post Office/PayPoint – 3.5%

- 2.5% fee for international transfers (although this falls to 1% at weekends)

- £7.95 per month for the credit builder feature

Classic account

- £5.95 monthly fee

- £4.95 for replacement cards

- Cash withdrawals are free for up to £500 per month and are then subjected to a 2% charge

- Manual cash top-up frees up to £400 per month and then charged at 3.5%

- International transfers charged at 0.5%

- £7.95 per month for the credit builder feature

Premium account

- £14.95 mostly fee

- Zero charges for replacement cards

- Cash withdrawals are free for up to £1,500 and are then subjected to a 2% charge

- Manual cash top-up frees up to £1,000 per month and then charged at 3.5%

- Free international transfers

- £7.95 for the credit builder feature

What we like?

As we come towards the end of this Monese review, we wanted to give you a summary of the things that we really like. These include:

- The ability to take out insurance to cover purchases as well as a reduction in income

- The Monese app is fast and easy to use

- Setting up an account is extremely quick and simple

- You’re able to categorise your spending to help you budget

- The credit builder feature is a great touch

- You can use more than one currency

What we don't like?

While we’re big fans of what Monese has to offer, the reality is that nothing is perfect. Here are some of the things that we’re not so keen on:

- There is no access to an overdraft or loan

- Some of the fees, such as that for a replacement card, are on the high side

- The Starter account is fairly limited and lacks many of the features that make Monese worthwhile

- There aren’t any ISA options

What are Monese customers saying?

A true reflection of how a company performs and treats its customers can be found by looking at exactly what current customers have to say. We all know how easy it is these days to be vocal and voice our displeasure!

The good news for Monese is that the vast majority of its customers seem more than satisfied with what’s on offer.

Over at Trustpilot, Monese is rated 4 out of 5, and this comes from a whopping 27,000 reviews. From these 27,000 reviews, 68% of people rate Monese as excellent and are full of praise for the customer service and the ease of use.

That being said there are 17% rating the company as bad and most of them have been quite recently where users have complained about being locked out of their accounts.

I’m hoping that this is a glitch and that Monese are dealing with this. Something to keep an eye on as before this the company had very good reviews.

UTG Rating 8/10

Overall, Monese is a good option for those looking for a smart banking app with all the bells and whistles. What we would say is the fees are slightly on the higher side when comparing it to competitors.

I’d like to see more features added and would be interested to see lending and investing partners brought in to really make it a full suite.

I’d also be happy to increase this rating up to a 9 but recent reviews are something to keep an eye on.

That being said you’ll be very happy with Monese and their offering if you do choose them so I would certainly check out their website and see if it’s for you.

If you’re interested in seeing our best money saving apps then click here.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.