Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Considering a remortgage after your fixed-term mortgage ends? You’re not alone.

I have just been through this exact process. Our fixed term mortgage was finishing in September 2023 and we’d been waiting for some clarity around the rates.

The good news for you is the process is relatively simple but there are some things you need to watch out for.

Remortgaging can be a savvy financial strategy, offering you the chance to snag lower interest rates, switch mortgage types, or even tap into your home’s equity.

In this guide, we’ll delve into all the ins and outs of how to remortgage before the end of a fixed term, covering the benefits, key considerations, and essential steps to take.

KEY TAKEAWAYS

- Time it Right: Start exploring 6 months before your fixed term ends for the best deals.

- Choose Wisely: Understand the pros and cons of fixed vs. variable mortgages.

- Watch the Fees: Be aware of arrangement, valuation, and early repayment fees.

Table of Contents

Understanding Remortgaging Your After Fixed Term

When a fixed-term mortgage comes to an end, homeowners have the option to remortgage.

Remortgaging involves replacing your existing mortgage with a new one, usually with a different lender or a different mortgage product from the same lender.

I can hear you saying, how long does a remortgage take? Well, good question. Its roughly 4-8 weeks with a new lender and 1-3 with your current one.

Many homeowners choose to remortgage after the fixed term ends in order to find a better mortgage deal, lower their interest rate, or take advantage of new opportunities available in the market.

What happens if I don’t remortgage after my fixed term?

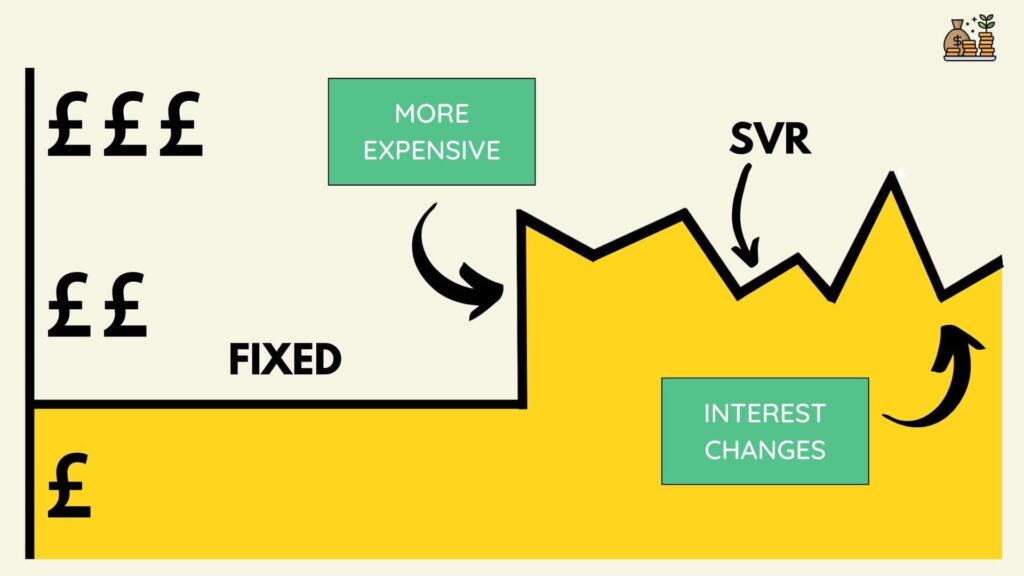

If you decide not to remortgage after fixed-term mortgages end, you’ll typically be moved onto your lender’s Standard Variable Rate (SVR).

This is a default mortgage interest rate that your lender sets and can change at their discretion.

Here’s what you need to know about staying on an SVR:

Financial Implications:

- Rate Fluctuations: Unlike a fixed-rate mortgage, an SVR is variable and can change over time. This means your monthly payments could increase or decrease based on market conditions and your lender’s decisions.

- Higher Costs: SVRs are generally higher than the initial rates offered in fixed or tracker mortgage deals. This could mean you end up paying more in the long run if you stay on an SVR.

Flexibility and Risks:

- Flexibility: One advantage of being on an SVR is that it’s usually more flexible. You can often make overpayments or switch to another mortgage deal without facing early repayment charges.

- Budgeting Challenges: The variable nature of an SVR can make budgeting more difficult, as your mortgage payments can fluctuate.

- Missed Opportunities: By staying on an SVR, you might miss out on more competitive rates or deals that better suit your financial situation.

Strategic Considerations:

- Market Watch: If you’re financially savvy and keep a close eye on interest rates, staying on an SVR could allow you to jump onto a better deal when one becomes available. However, this strategy comes with the risk of rates rising before you make your move.

- Financial Review: It’s advisable to regularly review your financial situation and the mortgage market to ensure that staying on an SVR still aligns with your financial goals and circumstances.

If you’re considering staying on an SVR, it’s crucial to weigh these factors carefully.

Consult with a mortgage adviser to explore whether this option makes sense for you, given your financial goals and current market conditions.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Benefits of Remortgaging After Your Fixed Term Ends

There are several benefits to remortgaging after the fixed term but each situation is different so be sure to read into this and make your own decisions.

Stable Interest Rates

One of the primary reasons homeowners choose to remortgage in a rising interest rate environment is to secure a stable, fixed interest rate for a set period.

This can offer predictability in your monthly repayments, shielding you from further rate hikes that could increase your mortgage costs.

While the new rate may be higher than your initial rate, fixing it could protect you from even steeper increases in the future.

Access to More Suitable Deals

Even in a climate of rising interest rates, the mortgage market remains competitive. Lenders are continuously adapting, offering new mortgage products that may better suit your current needs.

For instance, if you’re concerned about further rate hikes, remortgaging onto a new fixed-rate deal could offer you the stability and predictability you desire.

While the new fixed rate might be higher than your initial one, it could protect you from even steeper increases down the line.

Switching to a Different Mortgage Type

The end of your fixed-term mortgage presents an opportunity to reassess your financial goals and needs.

While fixed-rate mortgages offer the benefit of predictable monthly payments, they’re not the only option available.

You might consider other mortgage types that offer different benefits, such as more flexible repayment terms. However, it’s crucial to weigh the risks and benefits carefully, especially in a rising interest rate environment.

Opting for a variable rate mortgage at this time could expose you to the risk of further rate increases.

Accessing Home Equity

If your property’s value has increased since you first took out your mortgage, remortgaging can be an effective way to release some of this built-up equity.

This could be particularly advantageous in a rising interest rate environment, where other forms of borrowing may become more expensive.

You can use the released equity for various purposes, such as home improvements or extensions, which could further increase your property’s value, or for consolidating debts at a potentially lower interest rate than other forms of credit.

Factors To Consider When Remortgaging

Before you decide to remortgage after the fixed term, it’s essential to consider the following factors:

- Remaining Mortgage Term: Evaluate how much time remains on your existing mortgage and how this aligns with your financial goals. If there’s only a short period remaining, it might not be financially viable to remortgage due to associated costs.

- Early Repayment Charges: Check your current mortgage agreement for any early repayment charges (ERCs). ERCs are fees that may be charged if you choose to repay your mortgage early or remortgage before the fixed term ends.

- Overall Costs: Assess the overall costs of remortgaging. Consider fees such as arrangement fees, valuation fees, legal fees, and any potential exit fees from your current mortgage provider. It’s important to ensure that the potential savings from remortgaging outweigh these costs.

- Financial Circumstances: Evaluate your current financial situation, including your income, expenses, and credit score. Lenders will assess these factors when considering your application for a remortgage.

- Sammie's Hot Tip 🌶️

Patience is key when remortgaging, especially in a high interest rate environment. I personally shopped around and spoke to multiple experts before signing a new deal. Trust me, even shaving off just 0.1% on your interest rate can translate to significant savings over time!

How soon can you remortgage before fixed rate ends?

The best time to start considering your remortgage options is about six months before your fixed-term mortgage ends.

This time frame allows you to shop around and lock in deals without feeling rushed.

It’s also advantageous because most lenders in the UK will allow you to secure a new mortgage rate up to six months before your current deal ends, giving you peace of mind and the ability to budget for the future.

However, the timing isn’t solely dictated by the end date of your fixed term. Other factors can influence when it’s best to remortgage.

For instance, keeping an eye on the Bank of England’s base rate can provide clues about future interest rate movements.

If rates are expected to rise, it might be beneficial to lock in a lower rate sooner rather than later.

Your personal financial circumstances also play a role.

A significant positive change, such as a salary increase or an improved credit score, could mean you qualify for better mortgage deals, making it an opportune time to remortgage.

Similarly, if the value of your property has increased, you may find yourself in a lower loan-to-value (LTV) bracket, which could also make you eligible for more favourable rates.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

Steps to Remortgage After the Fixed Term

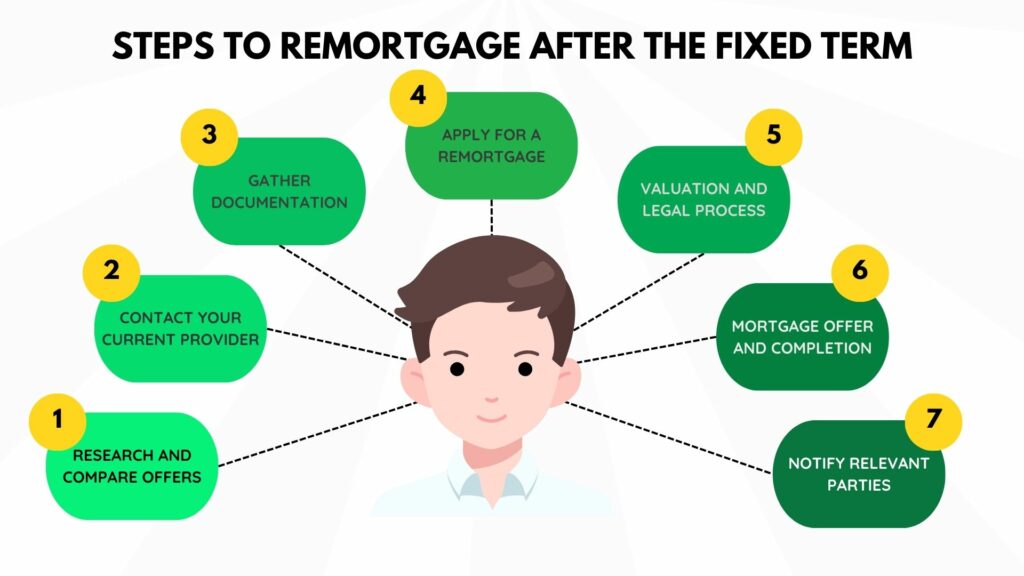

Remortgaging after the fixed term typically involves the following steps:

- Research and Compare Offers: Start by researching and comparing different mortgage products and offers available in the market. Consider factors such as interest rates, fees, and repayment terms.

- Contact Your Current Provider: It’s worth contacting your current mortgage provider to determine if they have any competitive offers available for existing customers. They might be willing to negotiate a better deal to retain your business.

- Gather Documentation: Prepare the necessary documentation required for your remortgage application. This typically includes proof of income, bank statements, identification documents, and details of your existing mortgage.

- Apply for a Remortgage: Submit your remortgage application to your chosen lender. Provide all the required information and documentation accurately and promptly. Your lender will assess your application and review your financial circumstances, credit history, and property value.

- Valuation and Legal Process: Your new lender will likely conduct a valuation of your property to determine its current market value. Additionally, a solicitor or conveyancer will handle the legal process involved in remortgaging, ensuring that all necessary checks and searches are completed.

- Mortgage Offer and Completion: If your application is successful, your new lender will issue a mortgage offer detailing the terms and conditions of your remortgage. Once you have reviewed and accepted the offer, you can proceed with the completion process. Your solicitor or conveyancer will handle the legal transfer of funds, and your new mortgage will replace your existing one.

- Notify Relevant Parties: Inform your insurance provider, as well as any other relevant parties, about the change in mortgage lender and details. Update your direct debit or standing order instructions to ensure smooth repayments.

Are there fees involved in remortgaging?

Yes, remortgaging comes with a range of fees that you’ll need to consider as part of the overall cost.

Here’s a closer look at the types of fees you may encounter:

Types of Fees:

- Arrangement Fees: These are fees charged by the new lender for setting up the mortgage. They can vary widely and may be a flat fee or a percentage of the loan.

- Valuation Fees: Your new lender will likely require a property valuation to assess its current market value. The cost of this valuation can vary.

- Legal Fees: You’ll need a solicitor or conveyancer to handle the legal aspects of the remortgage. These fees can also vary and may include costs for searches and land registry fees.

- Exit Fees: Also known as redemption fees or early repayment charges, these are fees you may have to pay to your current lender when you leave them for a new deal.

- Broker Fees: If you’re using a mortgage broker to find the best deal, they may charge a fee for their service, although some brokers are paid via commission by the lender.

Additional Considerations:

- Waived or Reduced Fees: Some lenders offer deals with no arrangement fees or offer to cover the cost of valuation as an incentive. However, these deals may come with higher interest rates, so it’s essential to calculate the overall cost.

- Adding Fees to the Loan: Some lenders allow you to add arrangement and valuation fees to your mortgage amount instead of paying them upfront. While this can ease immediate financial strain, it will increase the amount you owe and the interest you pay over time.

- Cost-Benefit Analysis: It’s crucial to weigh the total cost of these fees against the potential savings from a lower interest rate or better mortgage terms. Sometimes, the fees can outweigh the benefits, making the remortgage less financially advantageous.

Can you remortgage during a fixed term or before it ends?

While it’s possible to remortgage before the fixed term ends, it’s essential to check your current mortgage agreement for any early repayment charges that may apply.

These charges can sometimes outweigh the potential savings from remortgaging, so it’s important to evaluate the cost-effectiveness before making a decision.

Do you have to remortgage after fixed term?

No, you don’t have to remortgage at all. There are no rules saying you can or can’t.

What happens is you simply are put onto an SVR (standard variable rate which can be more or less favourable for your monthly payments depending on the current rates.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

FAQs

What are the potential benefits of remortgaging after the fixed term?

Remortgaging after the fixed term can offer several benefits, including the opportunity to secure a lower interest rate, access better mortgage deals, switch to a different mortgage type, and release equity in your home.

What factors should I consider before remortgaging?

Before remortgaging, it’s important to consider factors such as the remaining mortgage term, early repayment charges, overall costs, and your current financial circumstances.

How do I remortgage after the fixed term?

To remortgage after the fixed term, you’ll need to conduct research and compare offers, contact your current provider, gather the necessary documentation, apply for a remortgage, go through the valuation and legal process, receive a mortgage offer, and complete the remortgage process.

What documents do I need for a remortgage application?

You’ll typically need to provide proof of income, bank statements, identification documents, and details of your existing mortgage for a remortgage application.

Can I negotiate a better deal with my current mortgage provider?

Yes, it’s worth contacting your current mortgage provider to inquire about any competitive offers available for existing customers.

They may be willing to negotiate a better deal to retain your business. However, it’s important to compare their offer with others in the market before making a decision.

How long does the remortgage process take?

The duration of the remortgage process can vary depending on various factors, including the complexity of your application and the efficiency of the lender and solicitor involved.

On average, it can take between four to eight weeks to complete the remortgage process.

Will remortgaging affect my credit score?

During the remortgage application process, the lender will conduct a credit check, which can temporarily impact your credit score.

However, as long as you continue to make your repayments on time, remortgaging itself should not have a significant negative impact on your credit score in the long run.

Can I remortgage if I have bad credit?

Having bad credit can make it more challenging to remortgage, as lenders may be more cautious.

However, it’s still possible to remortgage with bad credit, especially if you have been proactive in improving your credit score since your initial mortgage.

Conclusion

Remortgaging after the fixed term can be a strategic move to secure a better mortgage deal, lower your interest rate, or access equity in your home.

By carefully considering the benefits, factors, and steps involved, you can make an informed decision about whether remortgaging after the fixed term is the right choice for you.

Remember to conduct thorough research, compare offers, and consult with professionals to guide you through the process.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.