Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Ah, SoFi! I had the pleasure of visiting the SoFi stadium last year for a Rams game and it was absolutely incredible. But the financial technology company is way more than that!

It’s really changing the way you handle your personal finances!

- Full Disclosure

I’m a SoFI shareholder, but this guide is completely unbiased and takes into account a wide range of research, analyst views and performance.

In this article, we’ll simplify the process of how to buy SoFi shares in the UK, highlight the top platforms for investment, and give you all the key information you need to know about SoFi stock.

This American online personal finance company is more than just a lender. Based in San Francisco, SoFi is on a mission to help people achieve financial independence and realise their ambitions.

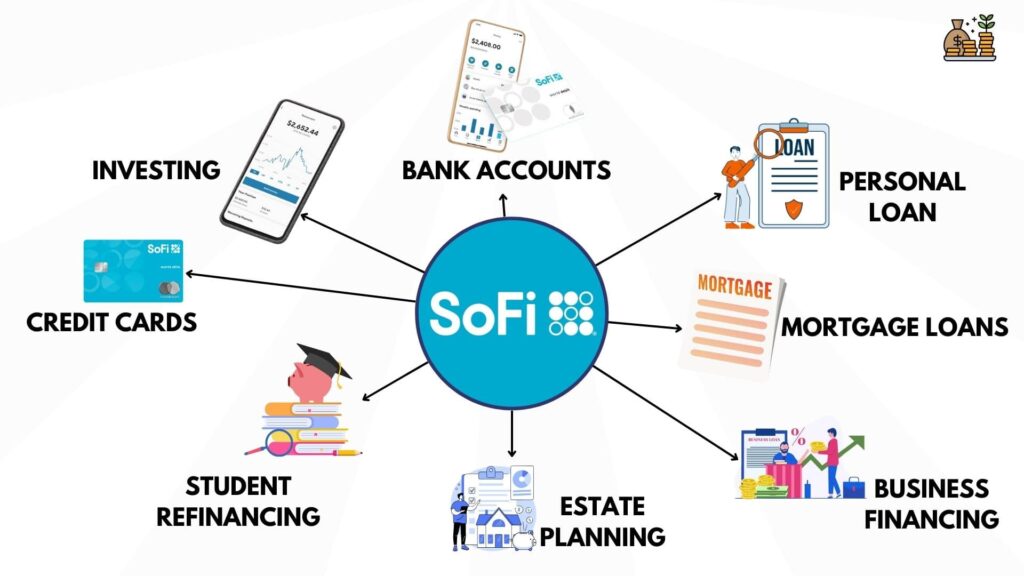

SoFi isn’t your average finance company. With a range of products accessible via mobile app and desktop, they aim to give you the tools to control your financial future.

Whether it’s student loans, personal loans, mortgages, or investing, SoFi is all about getting your money right.

Stay tuned as we explore the various investment options available for UK investors interested in investing in SoFI.

- Important Notice

When you invest the value of your shares can go up or down. If you are unsure about your investment decision you should always seek investment advice. Past performance is not a future indicator and always do your own research.

Where To Buy SoFi Technologies Stock?

|

|

|

|

|

30 million users worldwide enjoy social investing with over 3000 stocks, funds, trusts and cryptocurrencies available. Fantastic mobile app, research and academy.

Award-winning investing service with access to SIPPs, ISAs and more. Expert financial advice and research are also available.

How To Buy SoFi Shares - Quick Guide

Set Up a Broker Account: Have your ID, social security number, and bank details ready.

Fund Your Account: Use a bank transfer or debit card to deposit money.

Complete a W8-BEN Form: This declares you are not part of the US tax system

Find ‘SOFI’ on the Platform: Search for the SoFi stock symbol, SOFI.

Know Your Stock: Review the latest data and trends for SoFi shares.

Buy Shares: Once comfortable, make your purchase.

SoFi Live share price

The stock price will change at points during the day so be sure to check the SoFi share price again before you purchase any stocks.

Are SoFi Shares Overvalued or Undervalued?

Buying SoFi Shares: A Step-by-Step Guide

Select an Appropriate Brokerage

Embarking on your voyage to buy shares in SoFi Technologies Inc. requires choosing a reliable broker initially.

It’s essential to remember that not all brokers facilitate share purchases for every company listed on different exchanges, and SoFi Technologies Inc. is listed on the NASDAQ (NASDAQ:SOFI).

Online trading platforms like eToro*, and Hargreaves Lansdown* are preferred options due to their user-friendly interfaces and a wide range of listed stocks, including those on the NASDAQ.

Style of Account

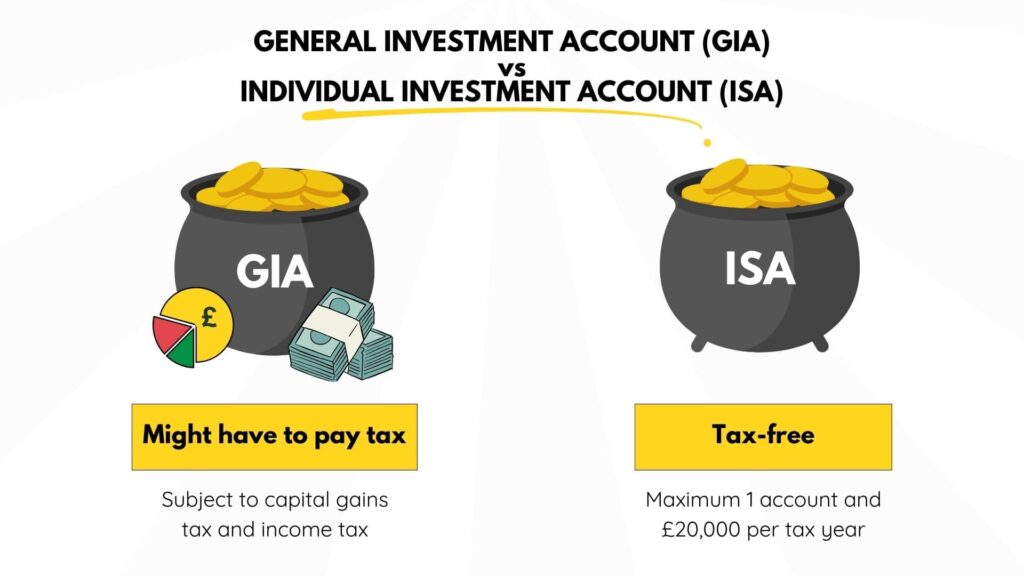

Before you proceed to set up your trading account, it’s pivotal to determine which account style suits your investment needs best: a Stocks and Shares ISA or a General Investment Account (GIA).

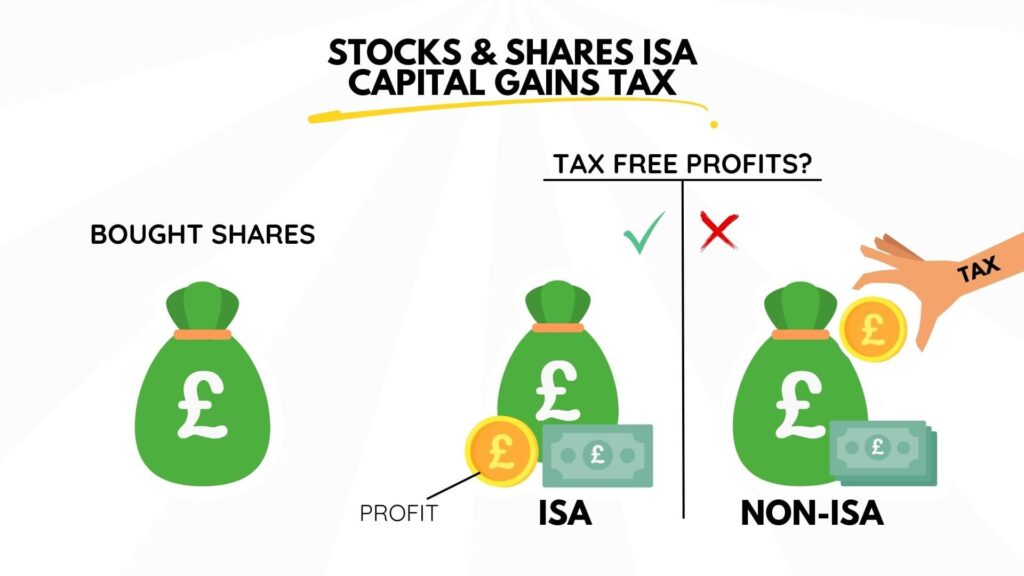

Opting for a Stocks and Shares ISA provides you with considerable tax reliefs, exempting you from capital gains and dividend taxes. This can be a game-changer for those aiming to amplify their investment returns.

Keep in mind, however, that the annual investment ceiling for a Stocks and Shares ISA for the tax year 2022/2023 stands at £20,000.

Check out the Top Stocks & Shares ISAs in the UK right now.

A General Investment Account (GIA) comes without these tax perks. If your gains or interest surpass £6,000 in a given tax year, be prepared to pay capital gains tax.

Although the GIA doesn’t restrict your annual investment amount, the lack of tax incentives may mean forfeiting a portion of your earnings to the tax authorities.

Establish an Account

After selecting a broker, the subsequent step involves setting up an account.

This typically includes providing some personal details such as your address, identification or social security number, and employment details. This process is pretty straightforward and akin to creating a standard bank account.

Ensure that you thoroughly review the terms and conditions to fully understand the services and fees associated with the account.

Infuse Funds Into Your Account

After the account is established, your next move is to deposit funds into your account. Injecting money into your brokerage account permits you to purchase shares.

This is usually executed through a bank transfer, though some brokerages might also accept cheques or wire transfers.

The duration for the funds to appear in your account can vary, so it’s advisable to plan ahead if you intend to seize a particular investment opportunity.

Scrutinise the Business

Before investing in shares of SoFi Technologies Inc., or any company, a detailed analysis is crucial. Evaluate the company’s financial health, recent performance, and its business transactions.

Information related to SoFi Technologies Inc.’s financial history and other investor-centric data can be located on their official website.

To gain insight into the potential of the company’s stock, you can also explore market analysis and expert opinions.

Decide Your Investment Quantity

Finally, determine the sum you’re willing to invest. It’s critical to remember that stock investments always carry a level of risk, and it’s paramount not to invest more than you can afford to lose.

When determining your investment size, consider your financial goals, risk tolerance, and the current price of SoFi Technologies Inc. shares.

If you’re a rookie investor, it might be prudent to start with a smaller sum and incrementally increase your investment as you become more accustomed to the process.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Where Else Can I Buy SoFI Stock?

If you’re eager to invest in SoFI but are considering options beyond standard online discount brokers and full-service traditional brokers, you’re in luck.

Fractional Share Providers

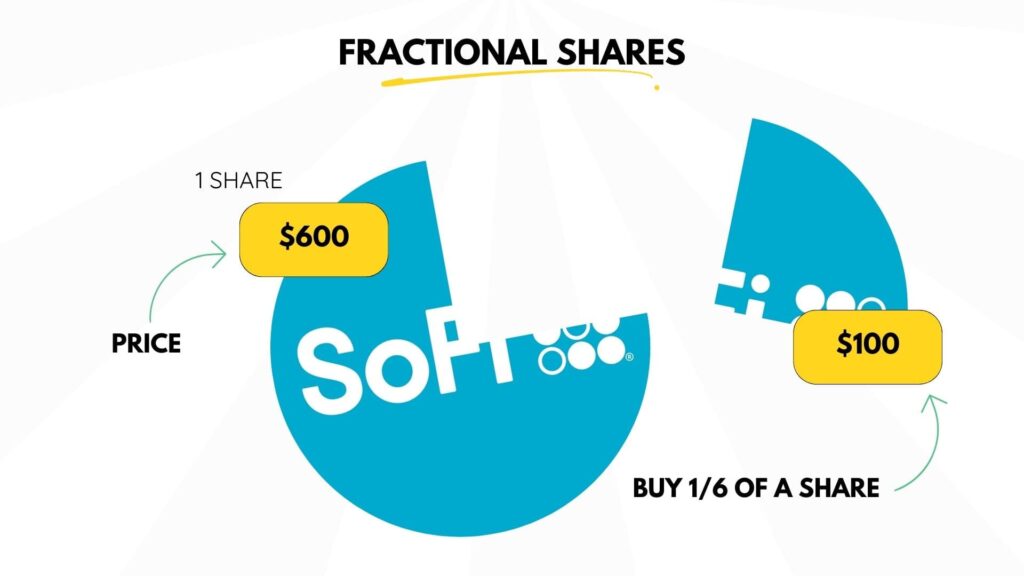

For novice investors who may lack the funds to buy whole shares of a high-value company like SoFi, fractional share providers offer an attractive solution.

Through these platforms, you can invest a smaller amount of money to own a piece of a Sofi share.

Well-known platforms like eToro and Trading212 offer the facility of fractional investing, allowing you to become a partial owner of SoFi without a hefty financial commitment.

Buying fractional shares offers a more affordable way to diversify your investment portfolio and become involved in the equity markets.

ETFs / Mutual Funds / Index Funds

If you’re looking for a more diversified investment strategy that still includes a focus on SoFi, you might want to consider ETFs, Mutual Funds, or Index Funds that feature SoFi.

These investment vehicles allow you to invest in a range of stocks simultaneously and are often managed by professionals. This strategy provides a way to capitalise on broader market movements while maintaining a position in SoFi.

For example, an investment in the SPDR S&P 500 ETF could include a percentage allocation to SoFi shares.

Mutual and Index Funds like the Vanguard Total Stock Market Index Fund also provide opportunities to invest indirectly in SoFi.

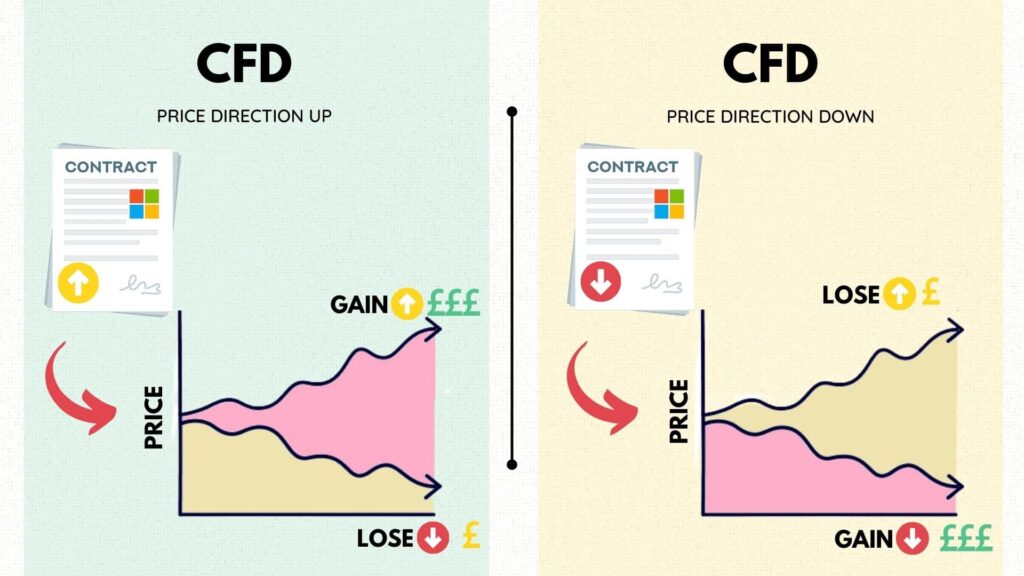

CFDs (Contracts for Differences)

For seasoned investors who are at ease with market volatility, CFDs offer an avenue to speculate on SoFi’s share price without actually owning the shares.

However, it’s worth noting that CFDs are high-risk and leveraged instruments that can amplify both profits and losses. Proceed with caution.

SoFi Shares Information

For those looking to invest in SoFi, it’s important to to get the full picture of the financial technology company and their finances.

Why invest in SoFi?

SoFi Technologies, Inc. is an innovative company that’s shaking up the personal finance space.

Here are some compelling reasons to consider investing in SoFi:

Strong Performance

Impressive Growth: As of July 31, 2023, SoFi’s stock was up a staggering 148% for the year.

Revenue Surge: The company maintained consistent double-digit quarterly revenue growth, with a 37% increase compared to the same period last year.

Diverse Product Range

Wide Array of Services: From student loan refinancing to mortgages and investing, SoFi offers a comprehensive range of financial products.

Crypto Offerings: SoFi provides trading options for 22 cryptocurrencies, more than many other brokers.

Market Position

Appeal to Young Investors: SoFi has successfully targeted a younger, tech-savvy audience, providing a modern alternative to traditional banking.

Banking Charter: The acquisition of Golden Pacific Bancorp granted SoFi a regular banking charter, allowing it to diversify its revenue streams.

Financial Health

Customer Growth: SoFi added 400,000 new customers in the final quarter of 2022.

Rising Deposits: A 46% increase in deposits indicates growing customer confidence.

Risks and Considerations

Annual Losses: Despite its growth, SoFi reported a net annual loss of $72 million in 2022.

Market Risks: The gain-on-sale loan model exposes SoFi to financial contagions, which could impact its profitability.

Future Outlook

Transition to Traditional Banking: While this move could cap its valuation, it might also lead to more sustainable growth.

In my opinion, SoFi is a groundbreaking company with a lot to offer. Its performance and diverse product range make it a compelling option for investors looking for something fresh in the personal finance sector.

However, like any investment, it comes with its own set of risks and should be approached with caution.

Does SoFi Pay Dividends?

SoFi do not currently pay dividends as the company has yet to turn a profit on it’s shares.

30 million users worldwide enjoy social investing with over 3000 of stocks, funds, trusts and cryptocurrency available.

Use their social features and copy trading to follow and invest with the best investors on the app.

- 0% commission on real stocks and ETFs

- Social Investing

- Copy the top investors in the world

- Regulated by the Financial Conduct Authority (FCA)

- Lack of research

What Should I Consider Before I Buy SoFi Shares?

Investing in SoFi shares necessitates a thorough examination of various factors to ensure the investment aligns with your financial goals and risk tolerance.

Define Your Investment Objectives

Start by clarifying your investment expectations. Are you looking for long-term growth or perhaps a diversified addition to your portfolio?

Understanding your goals will help you evaluate whether SoFi’s current position and future prospects align with your investment strategy.

Gauge Your Risk Tolerance

While SoFi has shown impressive growth, it’s crucial to remember that all investments come with risks. Assess your own comfort level with risk to determine if a substantial allocation to SoFi shares fits within your risk management plan.

Market Timing

Timing the market is challenging, but having a general sense of market conditions can offer an advantage. Given SoFi’s volatility and its performance in the IPO boom, consider the broader market sentiment before taking the plunge.

Risks of Investing in SoFi

Investing in SoFi is not without its challenges, and it’s essential to consider the associated risks:

Regulatory Challenges: SoFi’s transition to a more traditional banking model could bring additional regulatory scrutiny.

Economic Factors: Market downturns or financial crises could impact SoFi’s gain-on-sale loan model, affecting its profitability.

Innovation and Competition: SoFi operates in a competitive fintech landscape. Its ability to innovate and adapt is crucial for maintaining market share.

Financial Health: Despite customer and revenue growth, SoFi reported a net annual loss of $72 million in 2022, indicating that the company is still in a growth phase with associated risks.

By considering these factors, you’ll be better equipped to make an informed decision about investing in SoFi shares.

How To Sell SoFi Shares?

- Log into your trading account.

- Locate SoFi shares in your portfolio.

- Click ‘Sell’ next to the SoFi ticker.

- Specify the number of shares to sell.

- Choose ‘limit’ or ‘market’ order.

- Confirm and execute the sale.

Note: Process and fees may vary by broker.

FAQs

Is SoFi available in UK?

SoFi is not available in the UK right now. There are no signs from the brand that international expansion is on the cards but it is something to keep an eye on in the future.

Can I invest in SoFi outside the US?

Yes, SoFi is available on most major investment platforms. If you have an online brokerage account that invests in US stocks then it’s highly likely they will offer shares in SoFi, however each broker will vary.

Can you buy SoFi with a credit card?

Absolutely, you can acquire SoFi shares using a debit card. Most online and conventional brokerage platforms support debit card transactions, as well as other methods like bank transfers.

Do you need to complete a W8-BEN form to invest in SoFi?

Yes, if you’re a UK investor looking to buy SoFi shares, you’ll need to fill out a W8-BEN form. This applies to all U.S.-based investments and is a requirement to confirm you’re not a U.S. citizen

More Like This

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.