Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Snoop is a budgeting app that combines your spending across all your banks and cards into one easy-to-manage app.

You can see where all your money is going, and the app even suggests new products when it feels you’re overspending. Big bonus – it’s totally free!

I spent 6 months using the app to provide this unbiased Snoop app review.

I have to say I found the app a lot of fun. It’s got some great features that we’ll unpack shortly.

If you’re looking for a budgeting app that’s both visual, easy to use and saves you money I think you’ll be hard pressed to find a better app than Snoop right now.

Snoop is a proper budgeting app allowing you to track your spending, bills and savings across multiple banks and credit cards.

It doesn't offer interest, investments or banking products like some other providers on the list but if you just need help budgeting then Snoops tools are 1st class.

- Bill switching suggestions

- Spending categories

- Credit card trackers and suggestions

- Rewards and offers

- Weekly and monthly spending summaries

- Daily alerts

- No interest offered or investing products

The app is available on IOS and Android and combines your bank accounts to give you a 360 degree for of your finances.

It then predicts how much you can spend and save using their smart AI algothirm.

If you’re already sold, head to the Snoop app website to get started.

Snoop Rating

- Suitable For Beginners

- User Experience

- Price / Fees

- Useful Features

- Customer Service

- Customer Feedback

I’ve rated Snoop a 4.4 out of 5 using our six pillar method which I use to assess financial apps.

Snoop scored best on it’s suitability for beginners and user experience.

The app scored worst on customer feedback which we’ll unpack a bit more later in the article.

Snoop App - Main Features

Open banking technology and intelligent AI are the drivers that can make your finances look simple.

The app displays in super easy to access tabs at a tap of your fingers. It’s a slick experience and very straightforward to navigate around.

Main features:

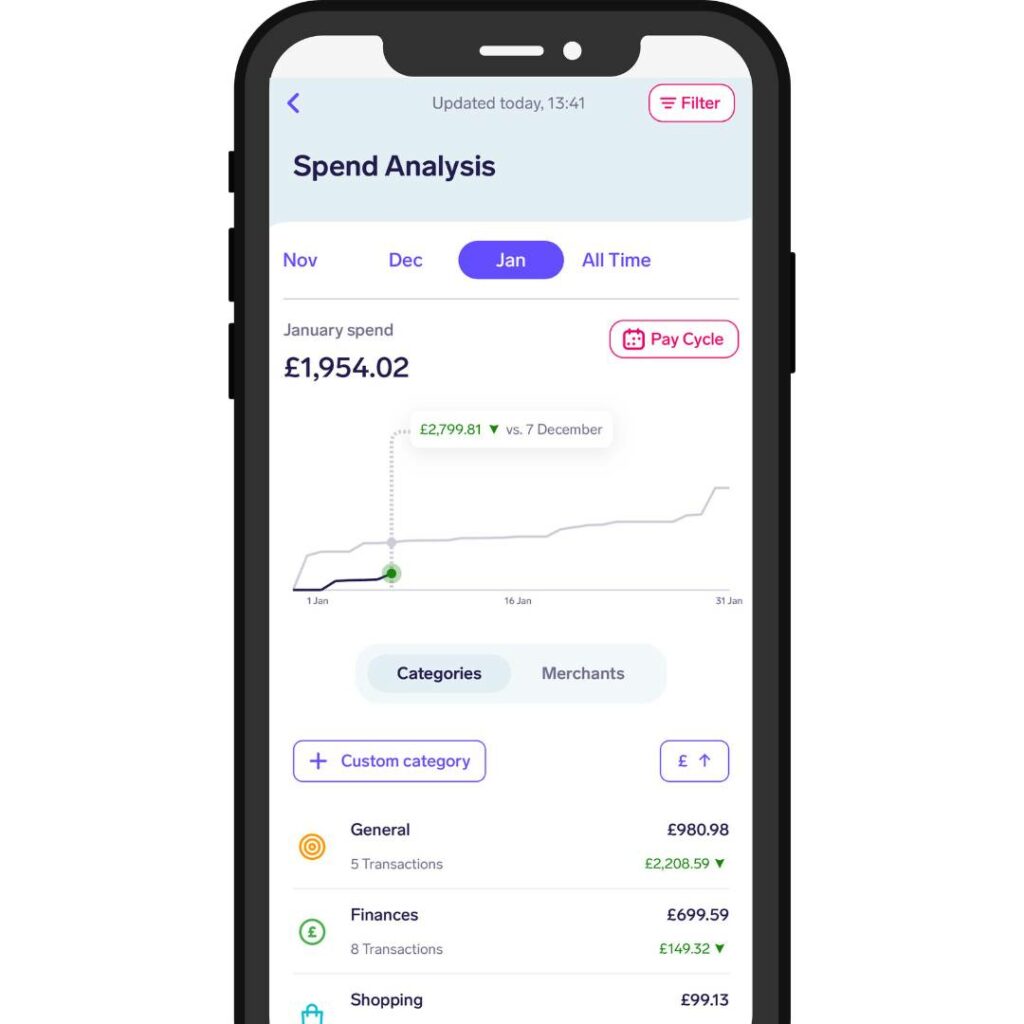

- Spending Analysis –An intelligent overview tracking your spending. Split into a graph view comparing the current month vs the previous month alongside clickable categories that are effectively sorted for you.

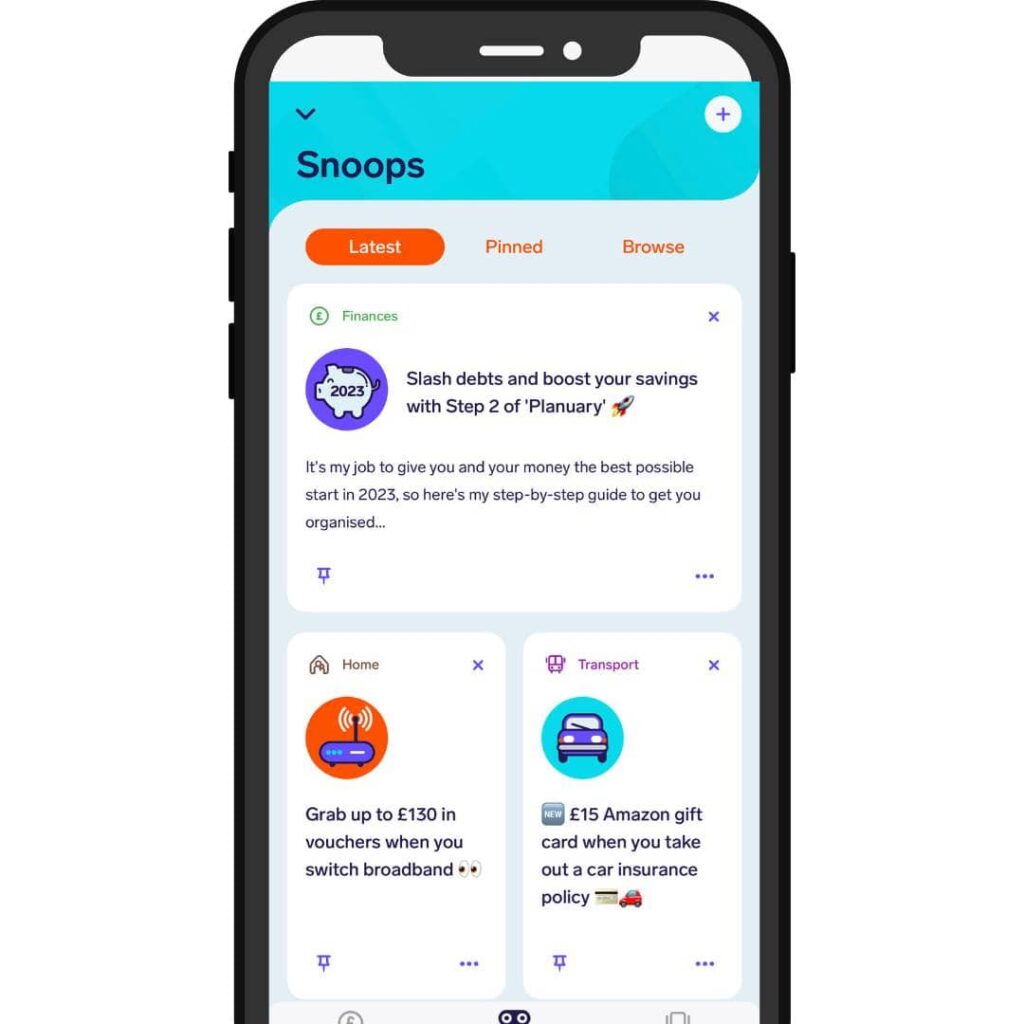

- Snoop of the day –Daily personal finance tips and tricks to help save money, boost your credit score, pension tips and more.

- Spending alerts – Set yourself alerts to limit spending and track refunds.

- This week’s bills –This shows you records of all the bills you have paid this week so you can keep track of expenses as they come in.

- Discount Codes – You can browse offers and kickbacks on the app. I had a free pint in a Greene King pub and 5p a litre off petrol at Morrisons. Honestly, there are 100s of great deals.

- Switch and Save – This gives you a list of immediate rewards for saving on things like broadband, insurance and more.

- Switch and Win – If you use the Switch app to switch your bills, you’re entered into a monthly competition to get your monthly bills paid up to £2000

- Referral Scheme – Invite a friend; you get a £5 Amazon Voucher if they connect a bank account.

- Snoop Space Forum – A safe space for you to ask questions about your money to the Snoop team and others in the community

Pros and Cons

Pros

- It's totally free to use

- Save money on your bills

- Budget for the entire household

- Overview of your spending

- Access to 100s of offers

- Connects with over 60 banking and credit card partners

Cons

- No direct savings accounts

- Lacking spending suggestions

- That's all, folks!

Snoop is a free money management and budgeting app, helping you track your spending, cut your bills and control your finances.

Is Snoop good for beginners?

Yes, Snoop is good for beginners. Especially those that struggle to budget and find visual aids useful.

The fact that it connects with your banks within minutes and has a really easy to use interface makes it a very attractive option.

However, if you’re looking for a wider suite of features such as saving and investing then apps like Plum and Chip could be better solutions.

You can also check out our full list of UK budgeting apps here.

Is the Snoop app any good?

Yes, the app is impressive. It’s super intelligent and user-friendly and has made a massive difference to my finances. The household bills feature will help everyone who uses it, and if an app can save money, then we’re all for it.

Since I’ve been on it, I’ve renegotiated my SKY TV bill and internet bill, plus saved over £300 towards Christmas presents.

What I like about it most is that it’s free to use. There’s also a paid plan called Snoop Plus, which unlocks many cool features that we’ll touch on in a moment.

Snoop app review - Who are they?

The company was founded in 2019 by former Virgin Money Execs, CEO Jane-Anne Gadhia and Managing Director John Natalizia.

They raised over 15 million over the next 2 years to fund development and expansion, which would explain why they’ve only just started popping up on the scene over the past 18 months.

The app uses Open Banking Technology and artificial intelligence (AI) to connect all your finances into one place. The robot inside the app can then detect overspending and help you budget or negotiate new deals accordingly.

Snoop is a free money management and budgeting app, helping you track your spending, cut your bills and control your finances.

How to open a Snoop account?

The app is available to download for free on IOS and Android. It took me 2 minutes to sign up and connect my Halifax and Monzo accounts, and I also added my MBNA credit card.

Once signed up, you get a net worth calculation and you can go back quite a way to look at your spending habits.

The only issue is that it counts me sending money between my personal accounts or to my joint account as payments, so you’d need to discount those or set them up in other categories.

What banks does the Snoop app connect with?

Snoop connects with over 60 major high street and digital banks. There are all the familiar faces on there, such as Barclays, Natwest, Lloyds, HSBC, Santander and credit card providers like American Express, M&S and practically all New Day accounts.

Connecting all your banks and cards is helpful to make full use of the Snoop app. This way, Snoop can start to look at your spending and allow you to get a complete financial picture.

Snoop Free vs Snoop Plus

| Snoop | Snoop Plus | |

|---|---|---|

| Monthly cost | Free | £4.99 or £31.99 a year |

| See all your bank accounts in one app | ||

| Automatic spending categorisation | ||

| Monthly and all time spend analysis | ||

| Daily account balance updates | ||

| Weekly spending report | ||

| Regular payment and subscription tracking | ||

| View spending by merchant or category | ||

| Weekly spending report | ||

| Contract renewal reminders | ||

| Weekly reminder of upcoming bills | ||

| Exclusive product switching deals | ||

| Money guidance and insights | ||

| Daily personalised money-saving suggestions | ||

| Unlimited custom spending categories | ||

| Track your total net worth | ||

| Track payday-to-payday spending | ||

| Manually add accounts | ||

| Create unlimited spending alerts | ||

| Create unlimited custom spending alerts | ||

| Create unlimited refund alerts | ||

| Track bills by pay cycle |

Snoop is a free money management and budgeting app, helping you track your spending, cut your bills and control your finances.

What is Snoop plus?

Snoop plus is the upgraded version of the free account. The plus version allows you to set up unlimited custom categories and alerts, which are helpful if you’re trying to keep a closer eye on your spending habits.

It also allows you to track your spending and bills by pay cycle, as the free version goes month to month. This is helpful if you’re paid on different days each month or bi-weekly / weekly.

I think the free option has more than enough features for someone to get started, and I’m not sure the £4.99 a month payment is worth the unlimited categories and alerts.

Household Bills Feature

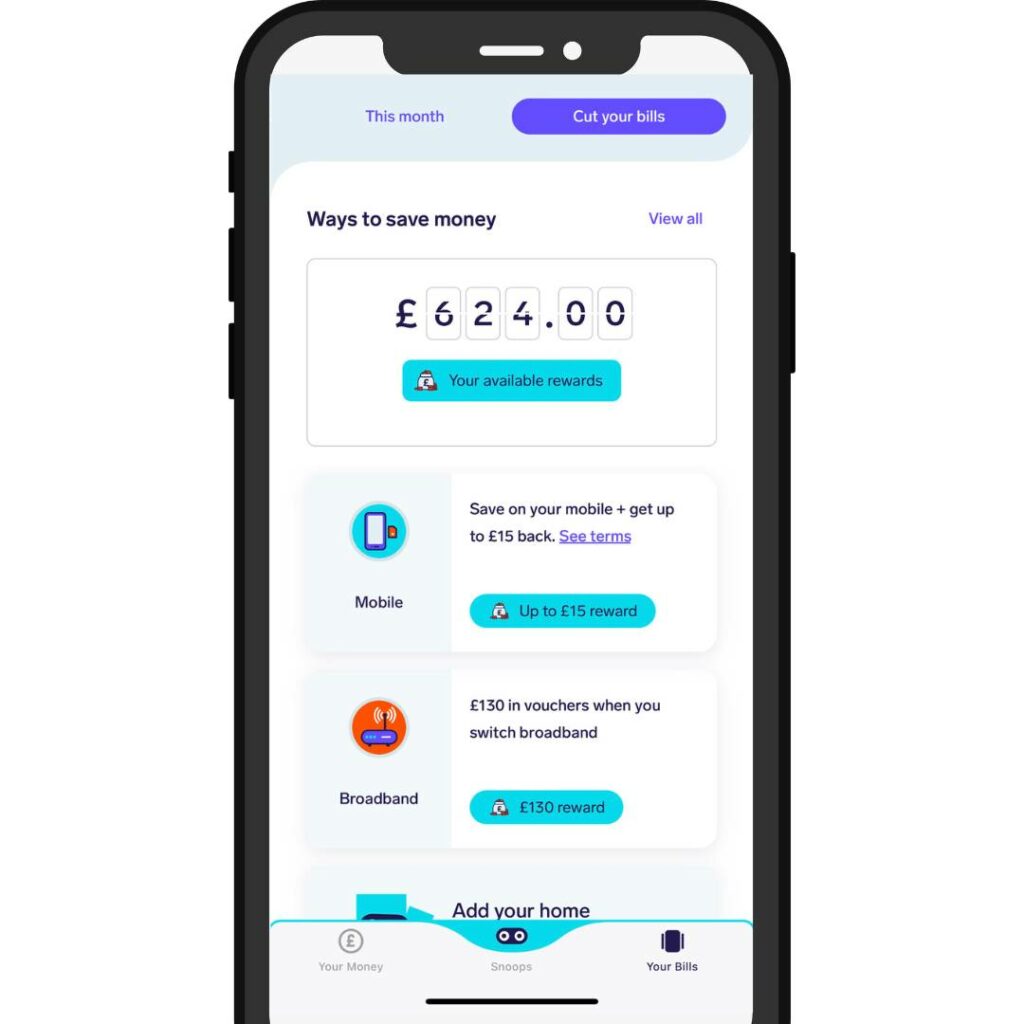

Now, this was something super unique that is excellent. After analysing my accounts for around 10 minutes, Snoop suggested up to £624 worth of savings that could be made by switching to various accounts.

The most enticing for me was the current account switch with First Direct, where I got £175 for switching and a £30 Amazon voucher. Not bad!

Below is a list of the other offers I was presented with:

- Energy Bills

- Mobile phone

- Broadband

- Car insurance

- Life insurance

- Pet insurance

- Current account

- Mortgage deals

- Credit cards

- Travel insurance

- Bike insurance

- Investment accounts

When looking at all of these, 10% were valuable to me at the time. But that’s 10% more than I would have had without using the app, so overall a brilliant feature.

I have my pet insurance and mortgage for renewal later this year, so I will dig into the offers again to see if I can save anything.

Customer Reviews

Doing some ‘snooping’ around online and you can quickly see that customers of Snoop really like the app.

I could only find four bad reviews, and when you’re talking about a money app, that’s very good going compared to some of its competitors like Money Dashboard.

Trustpilot is displaying a 4.3 out of 5 from 35 reviews which is very strong, and comments include:

“I’m an accountant, but even so, my home finances send me to sleep. However, this app has helped me revolutionise my finances.”

“This great app links your bank accounts and keeps a lookout on your monthly spending and direct debits.”

Not bad for an app that’s only really started breaking through in the past 12-18 months.

Snoop App Alternatives

Snoop vs Plum

Snoop vs Chip

Chip is more of a savings app than a budgeting app so if you’re looking for a budgeting solution then I would opt for Snoop over Chip.

Snoop vs Money Dashboard

Money Dashboard is probably Snoops biggest rival.

In terms of a budgeting app it’s a lot more detailed than Snoop so I think you’d opt for Snoop as a beginner and upgrade to Money Dashboard when you’re more experienced.

Snoop vs Emma

FAQs

Is the Snoop app safe?

Yes, the Snoop app is safe as it does not hold funds directly. They use two-factor authentication alongside face ID for logging in, and they are also authorised and regulated by the Financial Conduct Authority (FCA).

Snoop has been commended for its attitude to keeping your data safe and having the same level of security as a high street banking app.

Who is Snoop app suitable for?

Snoop app is perfect for beginners looking to get a handle on their spending and more experienced budgeters who have used spreadsheets or printables in the past and are looking to utilise their innovative technology.

There really is a wide market for Snoop as their household bills feature, which can save you money on your more considerable expenses, is a big draw for anyone.

Snoop is a free money management and budgeting app, helping you track your spending, cut your bills and control your finances.

Final Thoughts

As you can tell from this Snoop app review, we’re big fans!

They have made an app that not only allows you to track your spending all in one place, but they have gone a step further to help save you money on your everyday bills.

In my few months of using the app, it saved me money and even made me money when I switched my current account. All in all, totalling about £500 back in my pocket.

I find it very difficult to say that about any other budgeting apps I’ve encountered. It’s a straight 5 stars from me!

If I could add anything, it would be directly using the app to save or invest with Snoop, which competitors like Chip and Plum allow you to do.

If you’d like to check out all of our favourite budgeting apps, you can do so here.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.