Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

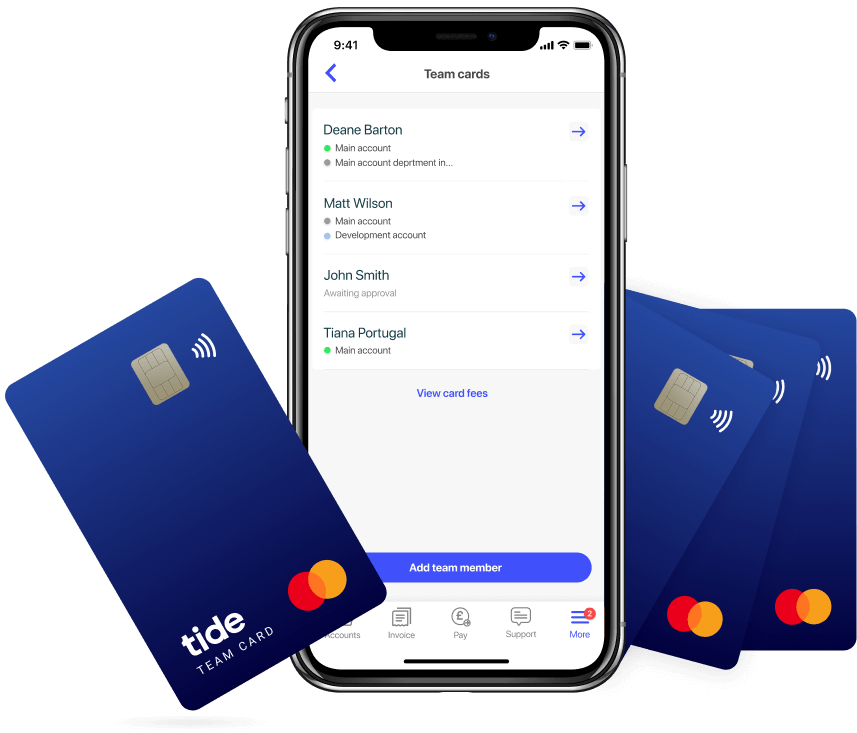

As online banking gains popularity, Tide offers a solution for small and medium-sized businesses to manage their finances through their user-friendly app.

With features like invoicing, payment management, and expense tracking, businesses can handle their money anytime, anywhere.

Tide’s positive reviews speak for themselves and they are fuelling the company’s growth.

As a Tide user myself I have to say the app is great. It seamlessly allows me to transfer payments, generate invoices and I can connect up my Stripe account so all inbound payments go straight in.

I particularly like how you can caterogise your payments so when it comes to filing the tax year accounts to HMRC you just export it in one click and send to your accountant.

Tide also integrates seamlessly with Xero, Sage and QuickBooks for wider accountancy needs.

In this TIDE review, we unpack everything you’ll need to make a decision.

Tide Rating

- Suitable For Beginners

- Useful Features

- User Experience

- Customer Service

- Customer Feedback

- Price / Fees

I’ve rated Tide 4.5 out of 5 stars using our six-pillar method we use to rate financial apps.

So far since becoming a TIDE user I’ve been very impressed and whilst there are some annoying small fees like the 20p transfer fee to UK accounts the integration with QuickBooks has really taken my business to the next level.

The app scored best on suitability for beginner businesses alongside it’s useful features like the business overview and a smooth user experience on the app.

I will also add that the customer service has been excellent for me. There’s a support section of the app and you can speak to a human if you can’t solve your issue, which I think is hugely important.

The Ultimate All-In-One Business Account, Perfect for Startups and Entrepreneurs!

Table of Contents

First up in this TIDE bank review let’s look at the overall pros and cons before we dive into the app in more detail.

Pros & Cons

Pros

- Everything is dealt with via an easy-to-use app

- No monthly/yearly fees on the basic account

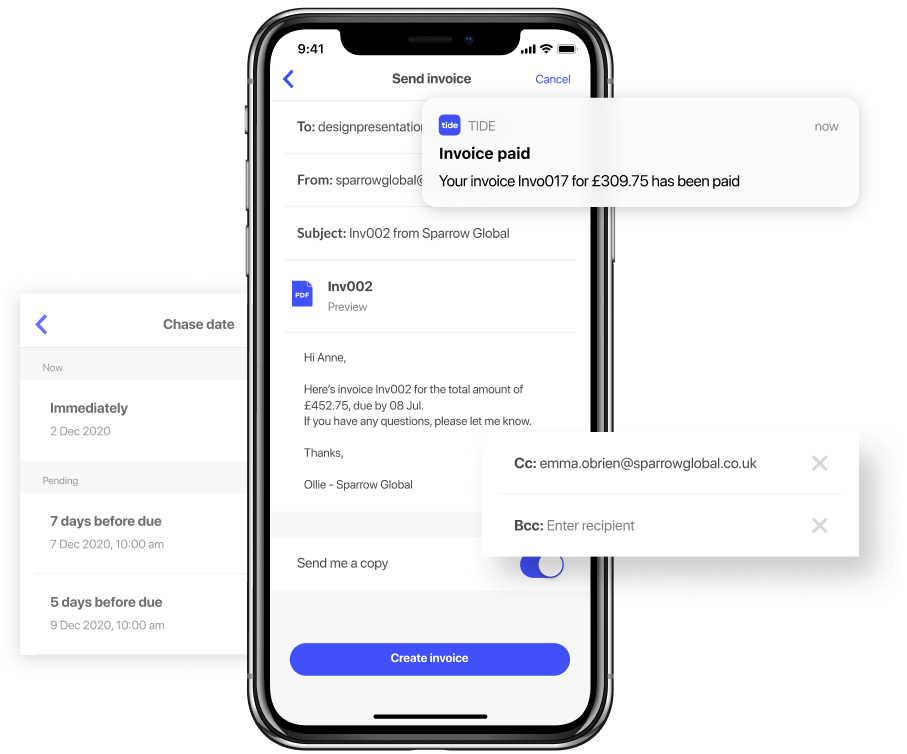

- The app allows you to create and manage invoices

- Organise your finances via categories

- Integrates with a range of software platforms including Sage, Quickbooks and Xero

- Transfer money to other Tide accounts at no cost

- Free replacement cards

- Open a business account direct through the app

Cons

- It costs £1 to withdraw money via an ATM

- It costs money to deposit cash into an account via Post Office or PayPoint

- Transfers between accounts cost £0.20p

- No physical branches

- Not able to accept cheques or set up an overdraft facility

Traditionally business bank accounts have had a monthly or yearly charge attached to them, which for accounts that aren’t used much can be an annoying fee.

Tide works differently if you sign up for their base account in that there are no set monthly or yearly costs – instead, you pay for some transactions, so if you have a bank account where you need to do very few business transactions, then this can work out really cost-effective.

Make the most of the £50 cashback offer when you deposit £50 with TIDE.

Tide Review - Company Overview

It wouldn’t be a Tide review without a little overview so George Bevis, a former banker, founded Tide in 2015, with Eileen Burbidge, a UK government advisor, venture capitalist, and Passion Capital founder, serving as the Chairman of Tide. The company was officially registered on May 18, 2015.

It’s now in the eigth year for the bank but it has gone from strength to strength since it’s early days.

Access to Tides services is provided by a well-designed, easy-to-use app. This approach to easy access technology has helped the bank gain reputation with small and medium enterprises.

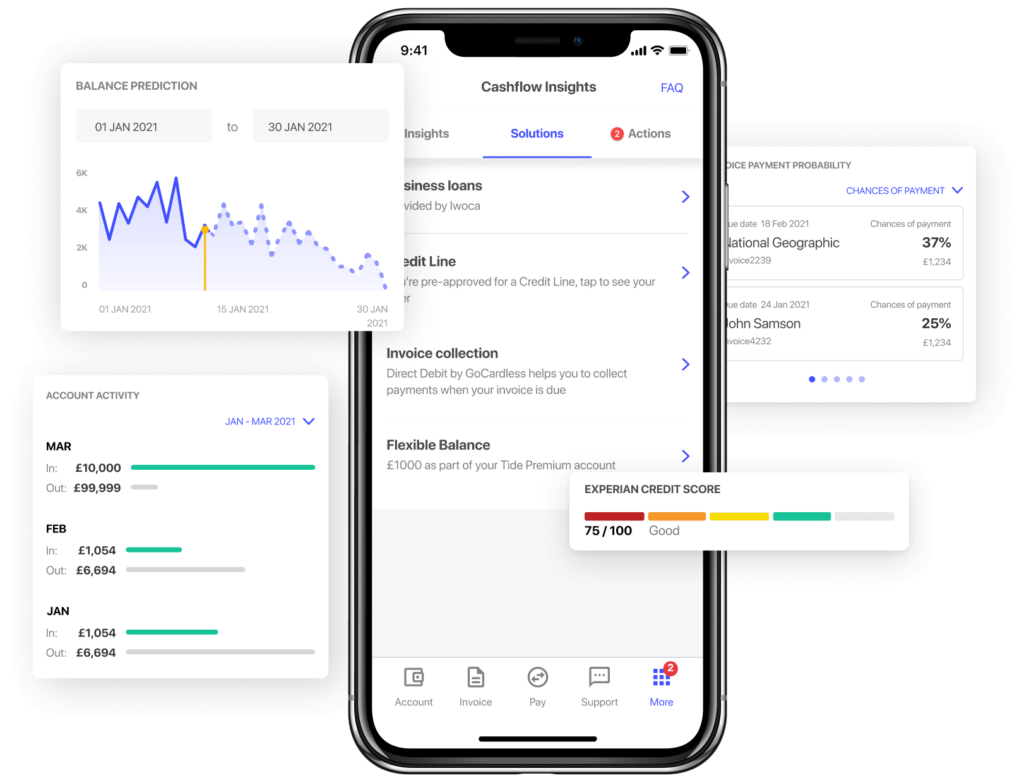

Tides services offer business users convenient information access and integration, which helps them make accurate and timely business decisions.

It’s not all been plain sailing for Tide making waves in a traditional banking stronghold can be a slow process for any financial institution.

Tides customers won’t end up being washed up as they are members of the Financial Services Compensation Scheme (FSCS) with automatic protection for funds of up to £85,000.

The Ultimate All-In-One Business Account, Perfect for Startups and Entrepreneurs!

Tide's main features

- Tide business bank account offers many features ideal for small and medium-sized businesses across industries.

- With a standard sort code, account number, and debit card, you can use the bank account as usual.

- Tide’s intuitive app automatically categorises payments and expenses for easy accounting and quick documentation.

- You can easily adjust and customise categories as needed which is useful for keeping track of expenses

- Signing and setting up with Tide is quick and easy via their app, giving you full access to manage your business finances in one place.

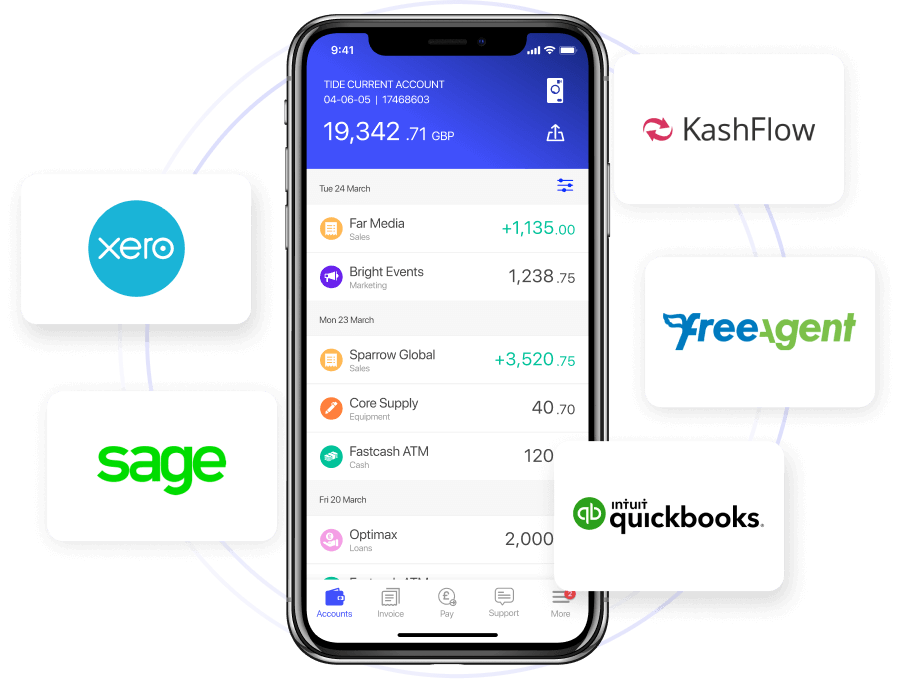

Tide Integrations

When it comes to business banking, one thing that is essential is that it makes life easier when it comes to accounting.

Whether you do your books yearly or on a more regular basis, it stands to reason that you have a bank account that supports you in making business life easier rather than more complex.

Tide does categorise payments for you as a step towards making life easier when it comes to keeping track of your finances and spending.

On top of that, it connects with various accountancy software packages – meaning that you can easily balance the books. With an automatic feed into your accountancy software, things are updated every 24 hours – ideal if you want to stay organised and not leave all of your accounting to the last minute.

The good news is that once you have gone through the setup, logged in and authorised Tide bank to connect to the accountancy software, the rest is done for you – every single time.

Accountancy software that it integrates with includes:

- Xero

- Sage

- FreeAgent

- Coconut

- KashFlow

- QuickBooks

- Crunch

- ClearBooks

Account types

Tide currently offer three business bank account types and says that can you upgrade to any of these at any time if your business grows and your bank account needs to change.

Tide Basic

Free debit card, but you pay extra for your team’s expense cards. You’ll pay £1 for ATM withdrawals and 20p per transfer for money in and out.

Tide Plus

You get a free debit card, and one expense card for your team members included, free of charge. You’ll pay £1 for ATM withdrawals and get 20 transfers in/out included per month – you’ll pay for any over this.

Tide Pro

A new addition to the account types. The pro version is designed to bridge the gap between plus and cashback. It offers unlimited transfers and two expense cards.

Tide Cashback

You get a free debit card and three expense cards for your team members, included free of charge. You’ll pay £1 for ATM withdrawals and get 150 transfers in/out included – you’ll pay for any over this. You earn 0.5% cashback on transactions with your Tide debit card.

Both paid options also come with phone support and a 24/7 legal helpline, which you won’t have access to if you have the basic free account.

If you’re on the cashback account, you also have access to a dedicated team of account managers.

The Ultimate All-In-One Business Account, Perfect for Startups and Entrepreneurs!

Tide fees

Tide offers a variety of fee structures, including a rare free business bank account option. Depending on your business needs, one of their two monthly paid-for accounts may be more cost-effective, as they offer various discounts.

Here’s a breakdown of their fees:

- Tide Free is of course free, Tide Plus £9.99 a month, Tide Pro £18.99 a month, Tide Cashback £49.99 (all monthly prices are ex VAT)

- All Tide accounts charge £1 to withdraw money from an ATM

- Tide Free charges 20p for transactions in/out of the bank but if you are on plus you get 20 free transfers and with pro or above you get unlimited

- Team expense cards are £5 each on Tide Free and you get 1 more free expense card each tier going up.

What are customers saying?

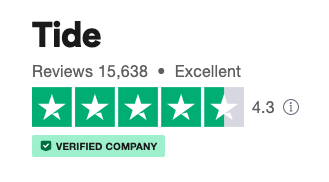

Tide is making waves in the business banking industry, with over 11,000 reviews on their Trustpilot page and an impressive rating of 4.1 out of 5.

With over 75% of reviews being scored average or higher, it’s clear that Tide is a company that’s doing something right.

They’ve been praised for their exceptional aftercare and outstanding customer service. Tide’s referral scheme has also caught the attention of newspapers and websites alike.

The company is looking to expand globally, with plans to offer its services in India by the end of the year. While there are some negative reviews, they are in the minority and mainly come from individuals whose account request was declined or closed.

Tide alternatives

When it comes to business banking, TIDE is just one option among many. There are several alternatives to TIDE that businesses may wish to consider.

Here are a few options to explore:

- Starling Bank

- Revolut Business

- Monzo Business

Each of these banks has its own unique features and benefits, so businesses should carefully evaluate their needs and preferences before choosing a bank.

Tide vs Starling

Starling Bank – a UK-based mobile-only bank that offers business accounts with no monthly fees, 24/7 customer support, and features such as real-time notifications and invoicing. Starlings fees and offerings when measured with Tide’s are slightly better for me.

Tide vs Revolut

Revolut Business – a digital bank that provides multi-currency accounts, corporate cards, and features such as expense management and team management. Revolut are also offering 3 months off their premium service. Click here to find out more about Revolut.

Tide vs Monzo

Monzo Business – a mobile-only bank that offers business accounts with no monthly fees, instant notifications, and integrations with accounting software.

FAQs

Is TIDE any good?

Yes, TIDE is a great option for businesses looking for a simple, mobile-first banking solution. With features such as quick and easy account setup, instant notifications, and expense categorisation, TIDE streamlines many aspects of business banking.

Additionally, TIDE offers competitive pricing and a user-friendly interface, making it an excellent choice for businesses of all sizes.

The only thing that lets TIDE down is the small 20p transfer fees but this disappears once you upgrade from the free version.

Is TIDE FSCS approved?

Yes, TIDE is FSCS (Financial Services Compensation Scheme) approved, which means that deposits of up to £85,000 are protected in the event of the bank’s failure.

This provides peace of mind for businesses that are concerned about the safety of their funds. With FSCS approval, businesses can trust that TIDE is a reliable and secure banking option.

Who is TIDE bank owned by?

TIDE bank is privately owned by a group of investors including Founder George Bevis. This allows the bank to maintain a high degree of flexibility and independence.

This ownership structure enables TIDE to prioritise the needs of its customers and develop innovative solutions that meet the evolving needs of businesses.

As a result, TIDE has been able to establish itself as a leading player in the UK’s digital banking landscape.

Is TIDE a reliable bank?

Yes, TIDE is a reliable and trustworthy bank for businesses. With its FSCS approval, strong financial backing, and commitment to customer service, TIDE has built a reputation as a dependable banking partner.

In fact, I rated TIDE 4.5 out of 5 stars in my review of the bank, citing its easy-to-use mobile app, suitability for start ups, and excellent features as some of its key strengths.

How fast are 'faster payment's?

Faster Payments are a quick and convenient way to transfer money between UK bank accounts. In most cases, payments sent via Faster Payments will arrive within just a few hours, often within minutes.

This makes Faster Payments an ideal solution for businesses that need to make urgent payments or simply want to manage their cash flow more efficiently.

With TIDE, Faster Payments allow businesses to transfer funds quickly and easily without incurring delays.

Is the Tide card a credit or debit card?

The Tide card is a debit card, which means that it is linked directly to a business’s Tide account. As a debit card, the Tide card can be used to make purchases and withdraw cash from ATMs wherever Mastercard is accepted.

Unlike a credit card, the Tide card does not allow businesses to spend beyond their available balance, which can help prevent overspending and keep businesses on track with their finances.

Additionally, the Tide card is free to use and comes with a range of security features, making it a convenient and secure payment solution for businesses.

Does TIDE have an overdraft facility?

No, TIDE does not currently offer an overdraft facility for its business accounts. However, TIDE does provide a range of features that can help businesses manage their cash flow effectively, including the ability to set spending limits, categorise expenses, and receive real-time notifications of account activity.

With these tools, businesses can stay on top of their finances and avoid overdraft fees and other costly charges.

Does TIDE offer business loans?

Yes, TIDE now offers business loans through its partnership with Iwoca and other financial lenders like FundingCircle, YouLend and Uncapped.

Through these partnerships, TIDE customers can apply for loans of up to £250,000 to help grow their businesses. The loan application process is fast and straightforward, with funding typically available within 24 hours depending on your suitability.

The Ultimate All-In-One Business Account, Perfect for Startups and Entrepreneurs!

Conclusion

As a user of Tide myself for two of my businesses, I’ve yet to experience any issues with the service.

If you’re looking for a small paid plan like I am, these prices are similar across most of the business banking industry.

I’m a big fan of the accounting integrations as it saves me hours each month and has really pushed my business forward.

If you’re looking to set up a small business and get started with banking right away Tide is one of the best options available to you.

The Tide Bank is the worst in UK. My business account locked for 9 day already. There are 7 questions about small transactions, something like what is your relationship with the Toolstation?

I cannot pay wages, cannot pay to the suppliers. The chat conversations is like talking to the bot. No one can say how long it is going to last. Don’t touch this crazy bank.

Hi Yury – thanks for this feedback on Tide Bank. This sounds like an issue you’d need to deal with them directly on. I am a TIDE customer and haven’t faced these issues myself but I have always found customer service to be of great help.