Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

In your 30s and keen on building wealth? It all starts with setting clear, SMART financial goals, coupled with a keen eye on your expenditure.

Make your money work for you by exploring diverse investment vehicles like stocks, bonds, ETFs, and real estate.

Manage any existing debt strategically using methods like the snowball or avalanche approach, and ensure you’re maximising pension contributions.

It’s a steady journey of making informed decisions, balancing risk and reward, and staying committed to your financial objectives. Time to embark on your wealth-building journey!

When I hit my 30s I realised quickly that I needed to level up my finances if I was going to hit my goal of being financially free by 50.

I had already built a sizeable stock portfolio but to increase my income even further I knew I needed to add new income streams.

I didn’t want to rely on my 9-5 so I started a business which I’ve built from the ground up. It’s now earning 3 times what my 9-5 paid me.

Alongside that, I’ve launched 3 more businesses that are growing and already profitable. I invest every penny I have back into my businesses, the stock market and property.

In this guide, I’ll show you how to build wealth in your 30s, harness the power of compound interest, set clear financial goals, and get a head start on securing a robust financial future.

So, without further ado (I’m not Steven Bartlett), let’s dive in.

Table of Contents

How To Build Wealth In Your 30s - The Basics

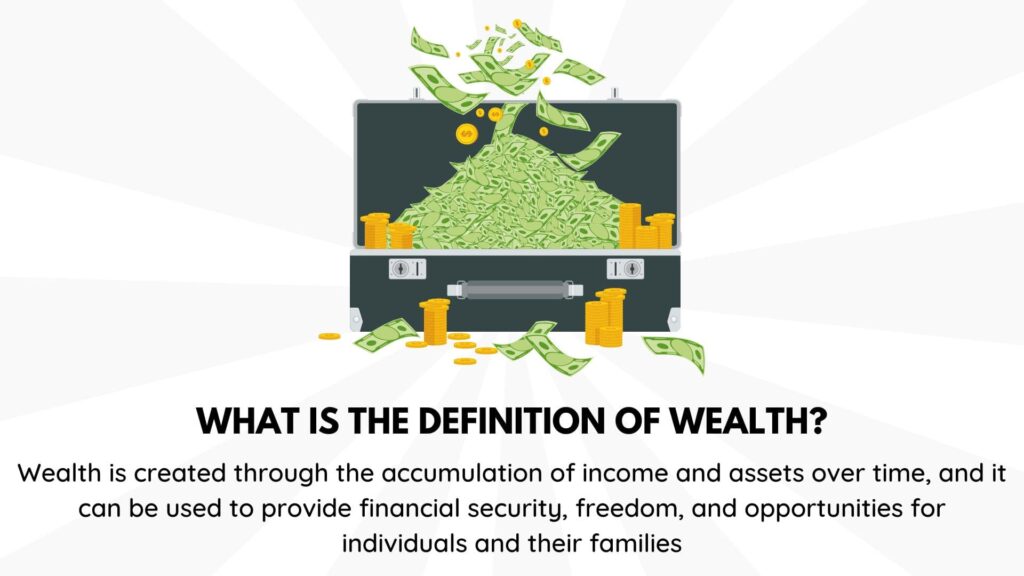

First things first: what exactly do we mean by “wealth”? Well, it’s not just about having a massive salary or winning the lottery (although those certainly wouldn’t hurt).

Definition of Wealth

True wealth consists of assets, investments, and cash reserves that generate income and grow over time. In other words, it’s not just about how much money you make, but how you put that money to work for you.

Others will say it’s the freedom to do what you want as money is no longer an object. Personally, I’m more in this camp than the first but I do everything listed above to generate time freedom!

Listen to this 🎙️

Join us with Ola from All Things Money to discuss the foundations you need to have financial success.

Ola is an absolute class act and we dive into some of the key ways to build wealth, invest and grow businesses.

Hit play just below or if you want access to the episode with links to your favourite podcast platforms hit Ola’s name just above.

The Power of Compound Interest

If you haven’t yet discovered the magical world of compound interest, prepare to be amazed.

Compound interest is like a financial snowball: as it rolls down the hill, it grows larger and larger, gathering momentum with each turn. Thanks to this powerful force, even modest investments can grow exponentially over time.

For example, let’s say you invest £10,000 with a 7% annual return. In 10 years, without any additional contributions, your investment would grow to around £19,672.

In 20 years, it would jump to nearly £38,697. And in 30 years? A whopping £76,123! That’s the power of compound interest in action.

Play around with our compound interest calculator to see the affects for yourself.

To invest you will need a brokerage account and we’ve included a link to our favourites just below.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Setting Financial Goals

As the old saying goes, “A goal without a plan is just a wish.” And we’re not in the business of wishing here – we’re in the business of making things happen.

To give substance to your financial goals, it’s crucial to make them SMART. The SMART framework stands for:

- Specific: Your goal should be clear and well-defined. Instead of saying “I want to save more”, try something like “I want to save £10,000 for a house deposit”.

- Measurable: You need to be able to track your progress. If your goal is to save £10,000, you could measure your progress by setting up a savings account and monitoring the balance.

- Achievable: Your goal should be realistic and attainable. It’s better to aim for a goal that stretches you but is within reach, rather than something unattainable that sets you up for failure.

- Relevant: Your goal should align with your broader financial objectives. For instance, if your long-term goal is to retire early, a relevant short-term goal might be to max out your pension contributions.

- Time-bound: Your goal should have a deadline. Having a specific timeframe creates a sense of urgency, which can motivate you to stay on track. For example, you might aim to save £10,000 for a house deposit within 2 years.

By setting SMART financial goals, you can create a roadmap to wealth that’s both realistic and achievable.

Types of Financial Goals

Financial goals come in all shapes and sizes. Some people dream of buying a house or starting a business, while others simply want to build a comfortable nest egg for retirement.

Whatever your ambitions, it’s important to break them down into short-term, medium-term, and long-term goals.

For example, a short-term goal might be saving for a holiday or paying off a credit card. A medium-term goal could be saving for a house deposit or building an emergency fund.

And a long-term goal might involve investing for retirement or setting up a trust fund for your children. By breaking your goals down into manageable chunks, you can make steady progress towards your ultimate financial dreams.

Managing Debts and Savings

Managing debt is a critical part of building wealth. It’s like untangling a knotty string of Christmas lights – it might be a headache at first, but oh, the satisfaction when you’re done!

Strategies for Debt Management

Here are a few strategies that can help you go from debt-riddled to debt-free:

- Snowball Method: Named not for any connection to frosty weather, but for the momentum you’ll build as you pay off debts. You start by tackling the smallest debts first, regardless of the interest rate, then move onto the next smallest, and so on. It’s like a victory dance for every debt you conquer!

- Avalanche Method: If the snowball method is about emotional satisfaction, the avalanche method is about cold, hard maths. You pay off debts with the highest interest rates first, which can save you a pretty penny in the long run. Like an avalanche, it can start slow but becomes unstoppable once it picks up speed.

- Consolidation Loans: Think of this as a financial group hug. You lump all your debts into a single loan, usually with a lower interest rate. It’s like turning your unruly gang of debts into a well-behaved choir, singing in unison.

- Balance Transfers: This strategy involves some nifty financial footwork. You juggle debt from a high-interest credit card to another card with a lower interest rate. It’s a bit like stealing from Peter to pay Paul, except Peter and Paul are both your credit cards.

- Debt Management Plans: It’s like calling a truce with your creditors. You agree to repay your debts over a longer period, often with lower interest rates. It might not be as glamorous as the other strategies, but it could be just the ticket if you’re in a tight spot.

Remember, each method has its strengths and weaknesses, like superheroes with their individual superpowers and kryptonite. So, choose your financial superhero wisely based on your unique debt situation!

Building an Emergency Fund

I like to think of an emergency fund as a financial safety net. You hope you’ll never need it, but it’s there to catch you if you fall. As a rule of thumb, your emergency fund should cover around 3-6 months’ worth of living expenses.

This can help you weather unexpected events like job loss, medical emergencies, or major car repairs without going into debt.

Investing for Wealth Accumulation

Stepping into the world of investing can feel like you’ve been thrown into a dense forest with only a compass, but don’t worry!

Once you familiarise yourself with the terrain, you’ll be navigating like Bear Grylls in no time. Here’s your guide to some common investment vehicles:

- Stocks: Investing in stocks is like buying a slice of a company’s future profits (or losses!). You’re essentially becoming a part-owner. Stocks can be a roller-coaster ride with their volatility, so buckle up for highs and lows!

- Bonds: Bonds are the ‘steady Eddies’ of the investment world. They’re essentially IOUs from companies or governments that promise to pay you regular interest and return your initial investment at the end of the term. They’re like your reliable friend who always pays you back, albeit with modest interest.

- Mutual Funds: Imagine a smorgasbord of stocks, bonds, and other securities, all managed by a seasoned chef – I mean, a fund manager. You get a taste of everything without having to pick each item yourself, which can help spread your risk.

- Exchange-Traded Funds (ETFs): These are the chameleons of the investment world. They’re similar to mutual funds but are traded like stocks on an exchange. They can mimic the performance of a particular index, sector, or commodity, making them a great ‘set it and forget it’ option. – Check out the Best ETF Brokers In The UK here.

- Real Estate: Buying a property can be a bit like Monopoly but with real money. It can provide rental income (Ka-ching!) and potential capital growth if property values increase. Just remember, ‘location, location, location!’

Each of these investment vehicles carries its own adventure and peril. The key is to diversify your portfolio, so you’re not putting all your eggs in one basket.

Think of it as your investment survival kit, helping you navigate the wilds of the financial world.

The Role of Pensions in Wealth Building

If you’re based in the UK, pensions are a vital part of your wealth-building strategy. Through the UK pension scheme, your employer makes contributions to your pension pot, which are then invested on your behalf.

If your employer offers to match your contributions, it’s definitely worth maxing out – after all, it’s essentially free money!

Additionally, you might consider setting up a private pension, like a Self Invested Personal Pension (SIPP).

These offer greater flexibility and control over your investments, making them a popular choice for many savvy savers. The average pension in your 30s is said to be around £15,000 – £25,000.

Tax-efficient Investing

As a UK investor, you have several options for tax-efficient investing. Individual Savings Accounts (ISAs) allow you to invest up to £20,000 per year tax-free.

Plus, any income or gains from investments held within an ISA are completely tax-free. Not too shabby, right?

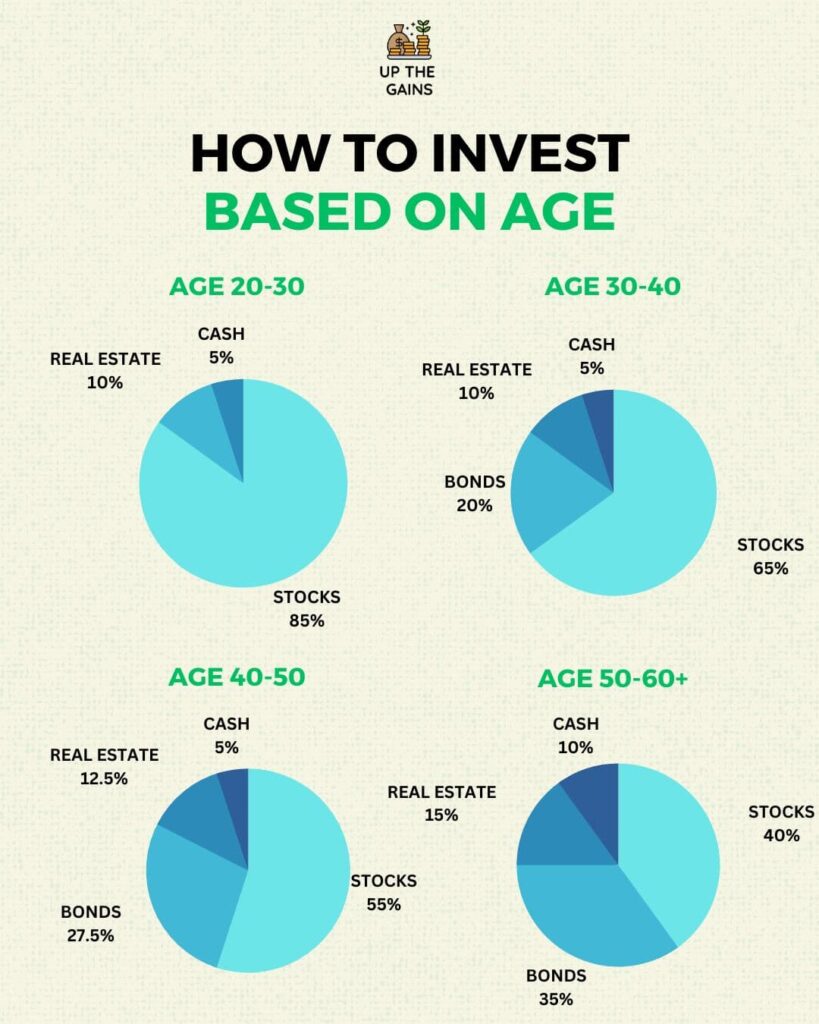

Investing in Your 30s: Why It's Different

Investing in your 30s is a bit like being in the Goldilocks zone. Building wealth in your 20s, you might not have much disposable income to invest.

It’s also not like building wealth in your 40s and beyond, you might be playing catch-up or shifting your focus towards lower-risk investments.

But in your 30s, you’re ideally placed to take on a bit of risk and reap the rewards of long-term investing. It’s the ‘just right’ of investing decades.

Tailoring Investment Strategies for Your 30s

In your 30s, it’s time to get serious about your investment strategy.

That might involve shifting from high-risk, high-reward investments towards a more balanced portfolio. It might also involve investing more heavily in tax-advantaged accounts, like your pension or an ISA.

The key is to align your investment strategy with your personal financial goals and risk tolerance.

You might also consider seeking advice from a financial advisor to help tailor your investment strategy to your individual needs.

Real Estate and Wealth Building

For many people, buying a home is a major financial goal. Aside from the obvious benefits (like not having to deal with pesky landlords), homeownership allows you to build equity over time.

Equity, in this case, refers to the portion of your property that you actually own outright.

As you pay down your mortgage and as the value of your home increases, your equity grows. It’s a bit like a forced savings plan, with the added bonus of giving you a place to live.

However, buying a home also comes with costs, such as stamp duty, solicitor’s fees, and survey costs. So, before you rush out to view your dream home, make sure you’ve got a handle on all the potential costs involved.

That being said, there’s a reason why we all want to get onto the property market. Saving for a house deposit and applying for a mortgage are goals most of us aspire to!

Investing in Rental Properties

If you’re feeling a bit more adventurous, you might consider investing in rental properties. The UK rental market can offer consistent income and potential for capital growth.

Plus, being a landlord gives you an excellent excuse to use phrases like “the rent is due NOW” and “no pets allowed here EVER”.

However, being a landlord also comes with responsibilities, like property maintenance and dealing with tenants. So, before you dive in, make sure you understand what you’re getting into.

Take advice from other landlords by joining communities and Facebook groups.

Building a Passive Income Stream

Imagine waking up to find that you’ve made money while you were sleeping. Sounds great, right? That’s the allure of passive income.

Unlike active income (which requires you to trade time for money), passive income sources can generate earnings around the clock, with minimal effort on your part.

Examples of passive income sources include royalties from a book or song, dividends from investments, or rental income from property.

They might take some time and effort to set up, but once they’re up and running, they can provide a steady stream of income.

Strategies for Building Passive Income

Building a passive income stream takes time and patience, but the rewards can be well worth it. You could invest in dividend-paying stocks, write a best-selling novel, or even start a dropshipping business.

The key is to find something that aligns with your skills and interests and to be patient. Building a passive income stream is a marathon, not a sprint.

Protecting Your Wealth

It’s all good making all of the money in the world but if you can’t keep it then what’s the point! Protect your neck as Wu-Tang would say and you do this in a number of ways which we’ll discuss here.

Importance of Insurance

Insurance isn’t the most exciting topic, I’ll admit. But it plays a crucial role in protecting your wealth.

Different types of insurance (like life insurance, health, and property insurance) can protect you and your assets from unforeseen events.

Think of insurance as a financial umbrella: it might not be much fun to carry around, but you’ll be glad you have it when the storm hits.

Estate Planning

It’s never too early to start planning for the inevitable. Having a clear estate plan in place can ensure that your wealth is distributed according to your wishes and can help avoid potential disputes among your heirs.

This might involve setting up a will, establishing trusts, or appointing a power of attorney.

Although it might feel a bit morbid to plan for your own demise, think of it as the ultimate act of care for your loved ones.

FAQs

How to get rich in 30s?

Getting rich in your 30s involves setting clear financial goals, living below your means, and diligently saving a portion of your income.

You should consider investing wisely in diverse assets like stocks, bonds, real estate, and mutual funds for long-term growth.

Pay off debts quickly, maximise your pension contributions, and explore opportunities for generating passive income. It’s about smart financial planning, disciplined saving, and strategic investing.

Is 35 too late to start investing?

Absolutely not. Starting to invest at 35 is not too late at all. While earlier is generally better when it comes to investing, beginning in your mid-thirties still gives you a substantial time horizon to take advantage of compounding returns.

It’s essential to start as soon as you can, make regular contributions, diversify your investments, and maintain a long-term perspective.

Where should I be financially at 35 UK?

By age 35 in the UK, you should ideally have cleared any high-interest unsecured debts, have a solid emergency fund covering 3-6 months of living expenses, and be regularly contributing towards your retirement, aiming to have at least twice your annual salary saved in your pension.

You might also be investing in additional assets, like stocks, bonds or property, and possibly have begun planning for other significant financial goals, like children’s education or owning a home, depending on your personal circumstances.

Conclusion

Building wealth in your 30s is all about taking control of your financial future. With clear goals, smart investing, and a bit of patience, you can lay the groundwork for a prosperous and secure life.

So, what are you waiting for? Your future self will thank you for the steps you take today.

And remember, it’s not about getting rich quick. It’s about steadily growing your wealth over time, making smart decisions, and enjoying the journey. After all, as the old saying goes, “Rome wasn’t built in a day”, and neither is financial wealth.

So, whether you’re just starting out or looking to level up your financial game, I hope this guide has given you some inspiration and practical tips.

And remember, everyone’s financial journey is unique. What matters is that you’re taking steps towards building wealth in a way that aligns with your values and goals.

And finally, don’t forget to have some fun along the way! Money is just a tool to help you live the life you want. So, use it wisely, but remember to enjoy the fruits of your labour too. After all, what’s the point of building wealth if you don’t get to enjoy it?

Now, go forth and prosper! Your journey to financial success starts now. And who knows, maybe one day you’ll be the one giving advice on how to build wealth in your 30s!

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.