Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Ah, Microsoft! If you’ve ever used a Windows computer, collaborated on a Word document, or competed in an Xbox gaming session, you might be curious about how to buy Microsoft shares in the UK.

Guess what? It’s simpler than ever.

Full disclosure: I’m an enthusiastic Microsoft shareholder, but I promise to keep this guide unbiased.

In this article, we’ll demystify how to invest in Microsoft, identify the top platforms for doing so, pinpoint opportune times to buy, and cover everything else you need to know about Microsoft stock.

Microsoft isn’t just a tech company. From its omnipresent Windows OS, found on 70% of personal computers, to recent investments in OpenAI, to Azure’s cloud capabilities serving businesses globally; it’s a multifaceted powerhouse.

Don’t forget their role in the gaming world with Xbox and even in social networking via LinkedIn.

Stay tuned as we delve deeper into the exciting, diverse world of Microsoft.

- Important Notice

When you invest the value of your shares can go up or down. If you are unsure about your investment decision you should always seek investment advice. Past performance is not a future indicator and always do your own research.

Where To Buy Microsoft Shares

|

|

|

|

|

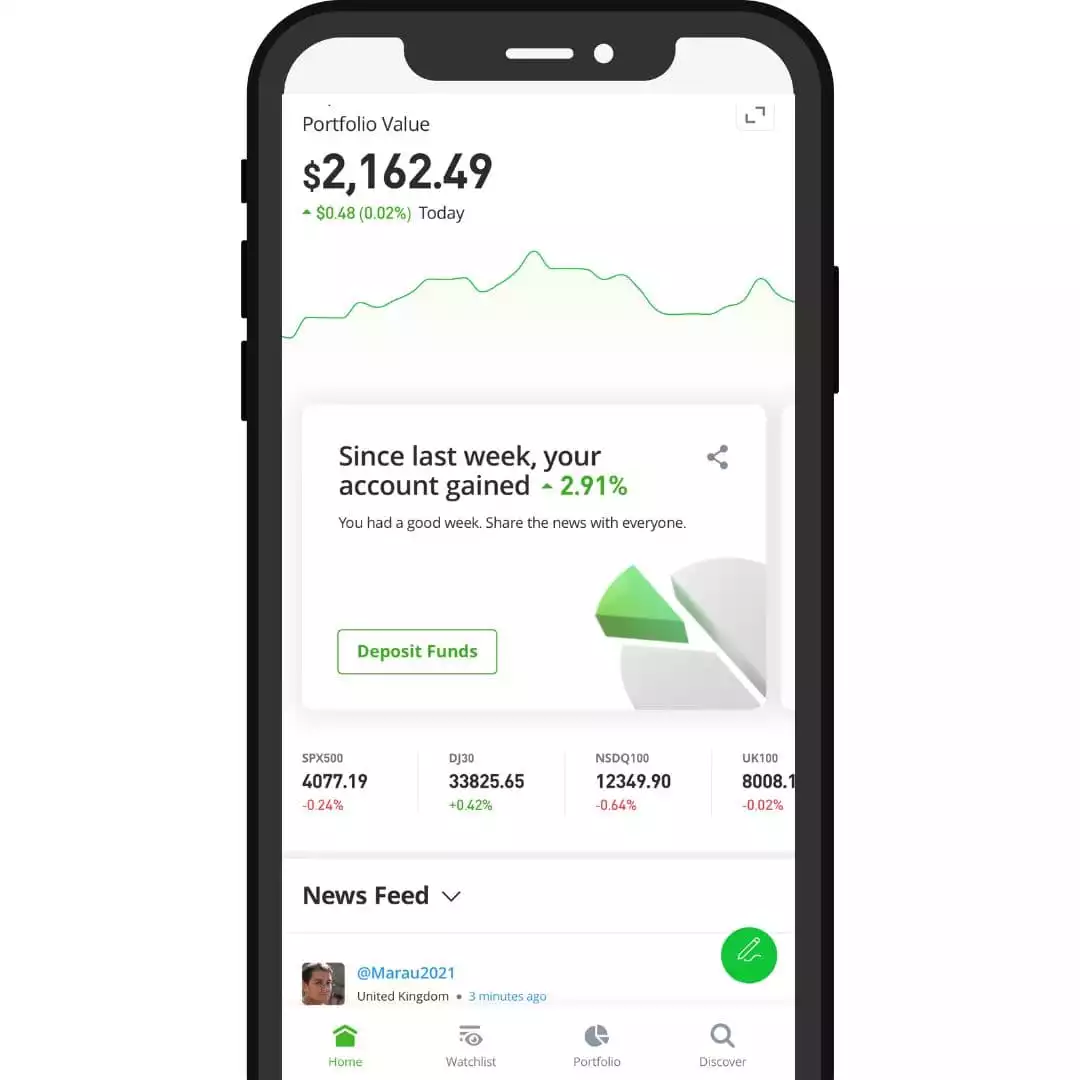

30 million users worldwide enjoy social investing with over 3000 stocks, funds, trusts and cryptocurrencies available. Fantastic mobile app, research and academy.

Award-winning investing service with access to SIPPs, ISAs and more. Expert financial advice and research are also available.

How To Buy Microsoft Shares UK - Quick Guide

Set Up a Trading Account: Have your ID, social security number, and bank details ready.

Fund Your Account: Use a bank transfer or debit card to deposit money.

Complete a W8-BEN Form: This declares you are not part of the US tax system

Find ‘MSFT’ on the Platform: Search for Microsoft’s stock symbol, MSFT.

Know Your Stock: Review the latest data and trends for Microsoft shares.

Buy Shares: Once comfortable, make your purchase.

Microsoft Live share price

The stock price will change at points during the day so be sure to check the Microsoft share price again before you purchase any stocks.

Are Microsoft Shares Overvalued or Undervalued?

The sentiment for Microsoft at this current time in Q4 of 2023 is that Microsoft is a buy.

I personally echo this and believe with Microsoft’s ecosystem and invesments in AI it makes them a great case to form part of any portfolio.

Buying Microsoft Shares: A Step-by-Step Guide

Select an Appropriate Brokerage

Your venture into purchasing shares of Microsoft Corporation begins with the selection of a reputable broker.

Keep in mind that not all brokers facilitate share transactions for all companies listed on various exchanges, and Microsoft Corporation is listed on the NASDAQ (NASDAQ:MSFT).

Digital trading platforms such as eToro*, Hargreaves Lansdown*, and Plum* are popular due to their user-friendly interfaces and a wide array of stocks listed, including those on the NASDAQ.

Style of Account

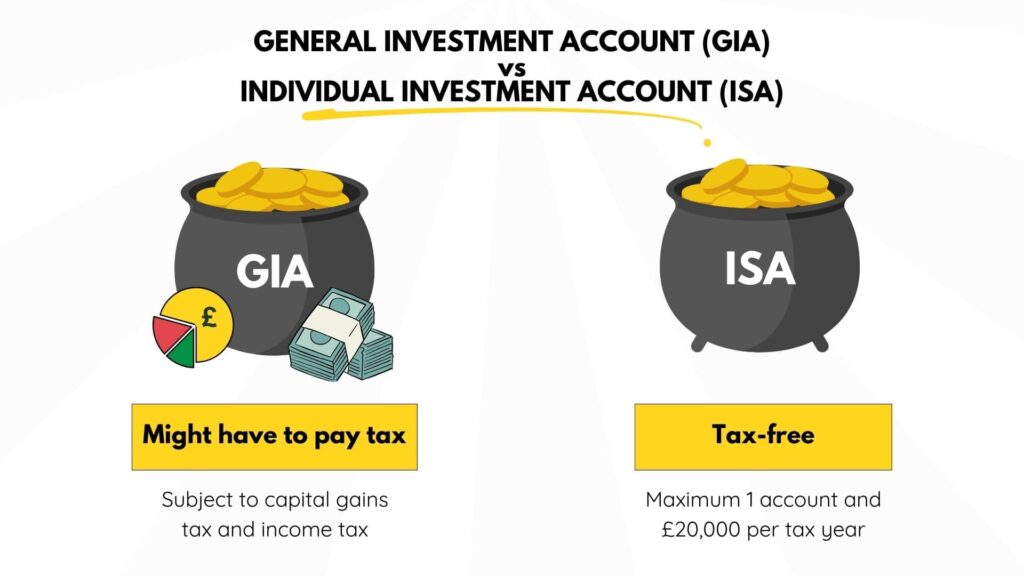

Before you proceed to set up your trading account, it’s pivotal to determine which account style suits your investment needs best: a Stocks and Shares ISA or a General Investment Account (GIA).

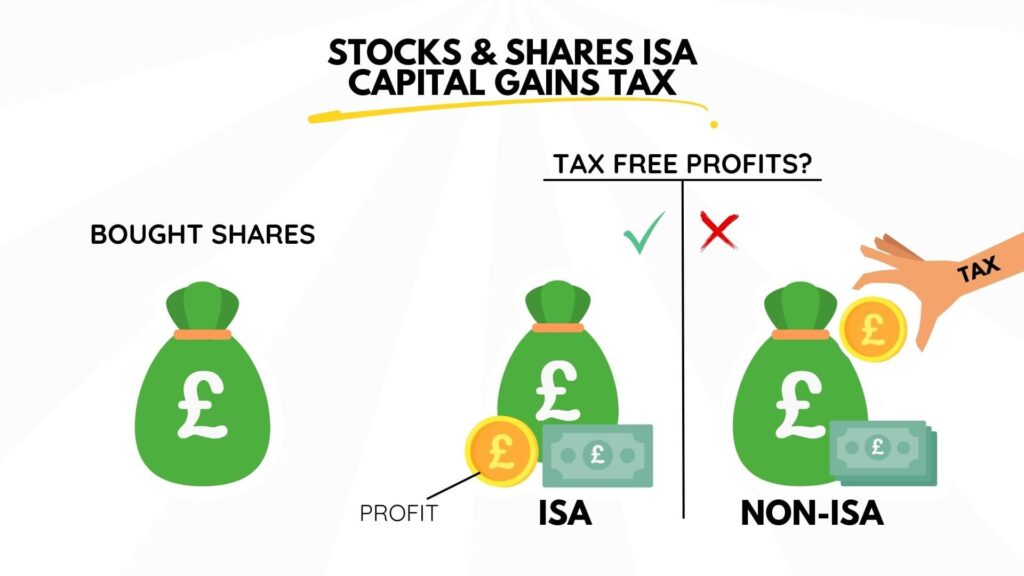

Opting for a Stocks and Shares ISA provides you with considerable tax reliefs, exempting you from capital gains and dividend taxes. This can be a game-changer for those aiming to amplify their investment returns.

Keep in mind, however, that the annual investment ceiling for a Stocks and Shares ISA for the tax year 2022/2023 stands at £20,000.

A General Investment Account (GIA) comes without these tax perks. If your gains or interest surpass £6,000 in a given tax year, be prepared to pay capital gains tax.

Although the GIA doesn’t restrict your annual investment amount, the lack of tax incentives may mean forfeiting a portion of your earnings to the tax authorities.

Create an Account

After deciding on a broker, the subsequent step is to create an account. This typically requires the submission of personal details like your home address, ID, national insurance, and bank details.

The process is straightforward, akin to setting up a typical bank account.

Ensure that you read the terms and conditions meticulously to fully understand the services and charges associated with the account.

Add Funds to Your Account

Once the account is established, the next move is to deposit funds into it. The money deposited into your brokerage account will enable you to purchase shares. This is usually done via a debit card but also can be done via BACS transfer on most.

The time it takes for the funds to appear in your account can vary albeit most instantaneous, so it’s wise to plan ahead if you aim to seize a particular investment opportunity.

Assess the Company

Before buying shares in Microsoft Corporation, or any company for that matter, it’s essential to perform comprehensive research. Assess the company’s financial health, recent performance, and business transactions.

Data regarding Microsoft Corporation’s financials and other investor-centric information can be found on their official website. You may also review market analyses and expert opinions to better understand the potential of the company’s stock.

Decide on Your Investment Amount

Finally, determine the sum you wish to invest. Always remember that stock investments carry inherent risks, and it’s crucial not to invest more than what you can afford to lose.

While deciding on the investment amount, consider your financial goals, risk tolerance, and the current price of Microsoft Corporation shares.

If you’re a new investor, it might be wise to start with a smaller sum and progressively increase your investment as you become more comfortable with the process.

30 million users worldwide enjoy social investing with over 3000 of stocks, funds, trusts and cryptocurrency available.

Use their social features and copy trading to follow and invest with the best investors on the app.

- 0% commission on real stocks and ETFs

- Social Investing

- Copy the top investors in the world

- Regulated by the Financial Conduct Authority (FCA)

- Lack of research

Where else can I buy Microsoft Shares?

If you’re eager to invest in Microsoft but are considering options beyond standard online discount brokers and full-service traditional brokers, you’re in luck. Several other avenues are at your disposal.

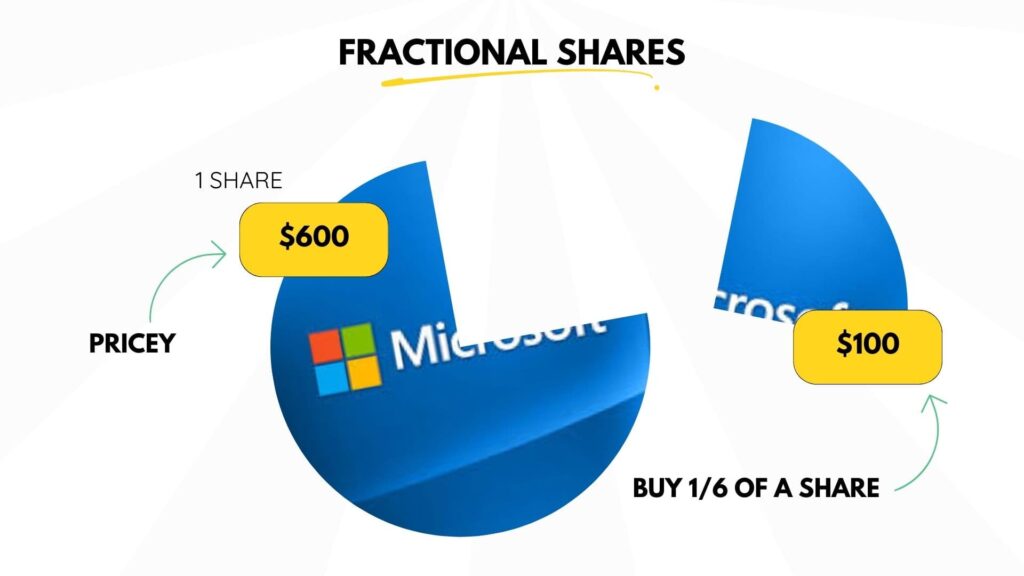

Fractional Share Providers

For novice investors who may lack the funds to buy whole shares of a high-value company like Microsoft, fractional share providers offer an attractive solution. Through these platforms, you can invest a smaller amount of money to own a piece of a Microsoft share.

Well-known platforms like eToro and Trading212 offer the facility of fractional investing, allowing you to become a partial owner of Microsoft without a hefty financial commitment.

This route offers a more affordable way to diversify your investment portfolio and become involved in the equity markets.

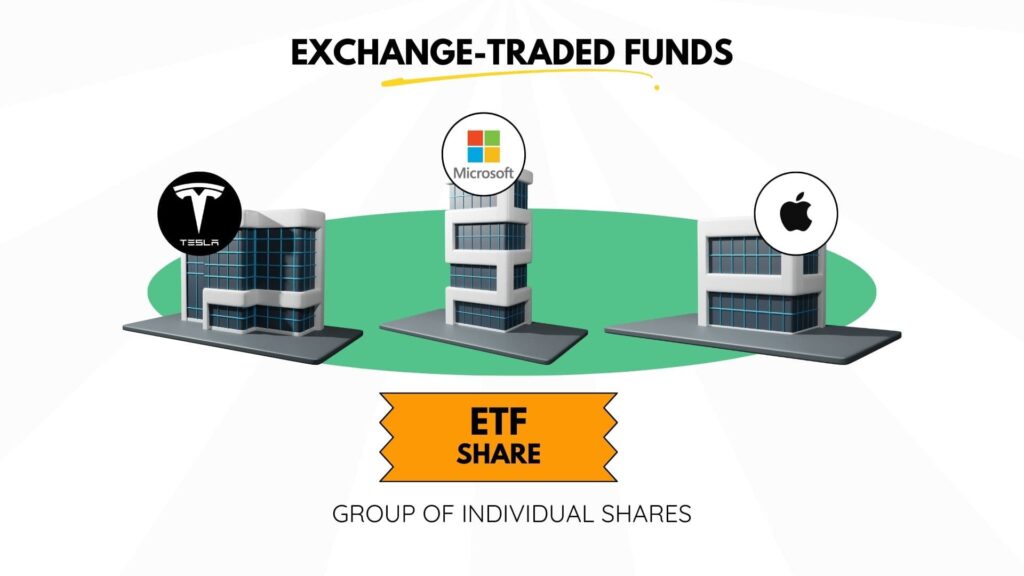

ETFs / Mutual Funds / Index Funds

For broader market exposure with a Microsoft focus, consider investing in ETFs, Mutual Funds, or Index Funds featuring Microsoft.

These diversified funds let you invest in multiple stocks at once and often come managed by experts. It’s a way to tap into overall market trends while keeping a stake in Microsoft.

For instance, an investment in the SPDR S&P 500 ETF would include a percentage allocation to Microsoft stock. Mutual and Index Funds like the Vanguard Total Stock Market Index Fund also offer avenues to indirectly invest in Microsoft.

Check out our best platforms for ETFs here.

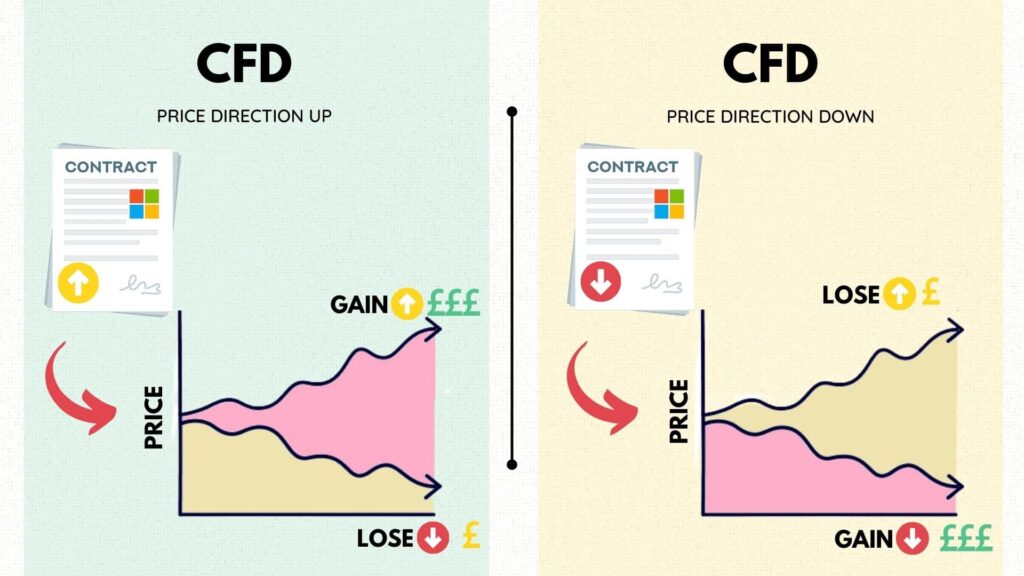

CFDs (Contract for Differences)

For savvy investors comfortable with market risks, CFDs offer a way to bet on Microsoft’s share price without owning the stock. However, CFDs are high-risk and leveraged, magnifying both gains and losses. Exercise caution.

Why invest in Microsoft?

The choice to invest in Microsoft is not a decision to be taken lightly.

It requires a solid understanding of the company’s market position, financial health, and diverse portfolio of products and services.

As of September 2023, Microsoft boasts a formidable market capitalisation exceeding $2.52 trillion, affirming its strong standing in the global tech market.

Below are some compelling reasons to consider adding Microsoft to your investment portfolio:

Ecosystem

Microsoft’s ecosystem is vast and well-integrated, offering a range of services and products that serve both individual consumers and enterprises.

This extensive ecosystem includes everything from its flagship Windows operating system to productivity software like Microsoft Office and cloud services like Azure.

Then they are also a major player in the gaming sector with Xbox and social media with LinkedIn.

For example, 70% of personal computers use the Microsoft Windows software and with products like Windows phones also in the mix it makes Microsoft more than just a technology company, it’s a global player.

Innovation & Cloud

Microsoft is a key player in the cloud computing space, with its Intelligent Cloud segment generating over $75.25 billion in 2022. Microsoft Azure holds a competitive 20% market share, sitting just behind Amazon Web Services.

As businesses continue to embrace digital transformation, Microsoft’s robust cloud offerings place it in an excellent position for future growth.

Equally the company’s consistent investment in R&D ensures that it remains at the forefront of technological innovation.

Microsoft Office Case

Microsoft’s Productivity and Business Processes segment, which includes Office 365 and Microsoft Teams, amassed an impressive $63.36 billion in revenue in 2022.

Microsoft Office’s near-ubiquity in the corporate world illustrates the company’s stronghold on this market.

The high adoption rates and consistent revenue from subscription models make this a compelling aspect for investment.

AI

Microsoft’s ambitious strides in artificial intelligence further its investment allure.

Its strategic partnership with OpenAI, backed by a total investment exceeding $11 billion, aims to harness AI technologies for Azure and potentially artificial general intelligence (AGI).

Microsoft’s exclusive licensing of GPT-3 and its successors like ChatGPT opens up avenues for enhancing existing products and developing new AI-driven solutions, thereby creating additional revenue streams.

Financial Returns

Microsoft’s financial performance is a strong indicator of its investment potential. In 2022, the company reported an 18% increase in revenue, totalling $198.27 billion, and a 19% rise in net income, amounting to $72.74 billion.

Microsoft also has a history of rewarding investors through dividends and share repurchases. Its strong financials make it an attractive investment for both growth-focused and income-oriented investors.

It’s worth noting that while Microsoft presents a compelling investment case, the tech industry is highly competitive and ever-evolving.

Microsoft’s future profitability will significantly depend on its ability to innovate and adapt to technological changes. Therefore, due diligence and a comprehensive understanding of your investment goals are essential before making an investment decision.

How Does Microsoft Pay Dividends?

Microsoft has a quarterly dividend and is currently at a 0.92% annual dividend yield. Microsoft’s share price means you would receive around 0.75 USD per share.

What Should I Consider Before I Buy Microsoft Shares?

Investing in Microsoft shares requires a comprehensive analysis of numerous variables to ensure your investment is in line with your financial objectives and risk profile.

Below is a checklist designed to aid you in evaluating whether Microsoft is the right addition to your portfolio.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Define Your Investment Goals

Begin by crystallising what you expect from your investment. Is your focus on long-term capital appreciation or are you more inclined toward a consistent dividend yield?

Knowing your investment aims will help you assess whether Microsoft’s present standing and future trajectory are compatible with your objectives.

Assess Your Risk Appetite

Although Microsoft is often viewed as a relatively stable tech stock when compared to emerging players, it’s essential to recognise that no investment is entirely devoid of risk.

Take time to identify your own risk tolerance level. Depending on this, you can decide if allocating a significant percentage of your portfolio to Microsoft aligns with your risk management strategy.

Timing the Market

Perfectly timing the market is no small feat; however, a general understanding of market conditions can give you an edge.

If broader market sentiment is bearish, it may be wise to hold off on your Microsoft investment until a more favourable opportunity arises.

This checklist serves as a foundational guide, but it’s always a good idea to consult with financial advisors and conduct detailed research before making any investment decisions.

Risks of investing in Microsoft

While Microsoft’s investment upsides are hard to ignore, taking a balanced view means considering its associated risks. These range from intense industry rivalry to regulatory hoops and economic swings.

Here’s a streamlined rundown:

Regulatory Maze

Navigating a tangled web of global laws, including data privacy and antitrust rules, is a daily challenge for Microsoft. Non-compliance could be costly, both financially and reputationally.

This has also been a subject of news in their attempts to purchase Activation Blizzard. Regulators are considering a monopoly effect with Xbox gaming.

Economic Swings

The state of the global economy influences Microsoft’s financial health. A downturn can dampen tech spending, affecting revenue and profits. Currency fluctuations also come into play given its global operations.

The Innovation Factor

The tech world is a fast-evolving landscape. Microsoft’s ability to stay ahead depends on its investment in R&D and quick adaptation to new technologies.

Competition Heat

Microsoft battles it out with giants like Amazon, Apple, and Google across several domains, including cloud services and software suites. Falling behind in the innovation race could erode market share.

Segment Sensitivity

Key revenue streams like Windows and the Office suite are vital. Disruptions to these, due to competitors or tech shifts, could seriously hit the bottom line.

Cyber Risks

No tech firm is impervious to cyber threats, and Microsoft is no exception. Security breaches can result in significant financial and reputational damage, despite heavy investments in cybersecurity.

When is the best time to buy Microsoft stock?

Deciding when to invest in Microsoft isn’t a one-size-fits-all proposition.

It’s crucial to factor in various elements, from market conditions to company performance, and even events like stock splits and buybacks.

Here’s a more nuanced look:

Economic Climate

Examine the broader market environment. If the economy is on an upswing, Microsoft’s stock is likely to perform well. Conversely, economic downturns may offer more affordable entry points.

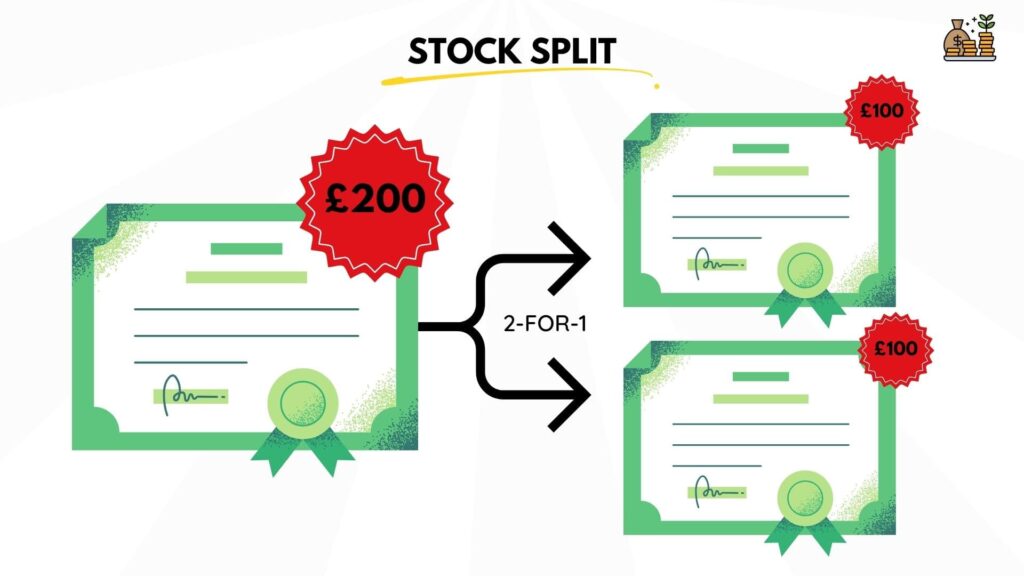

Stock Splits and Buybacks

Watch out for stock splits and share buybacks, as they can affect share price and ownership concentration. A stock split makes the stock more accessible to retail investors, often driving up demand.

Buybacks, on the other hand, usually suggest that the company believes its stock is undervalued, and it can lead to a temporary price boost.

Industry Movements

Keep tabs on tech sector trends. Is there a growing demand for cloud computing or enterprise software solutions? Such industry shifts can serve as cues for Microsoft’s future stock performance.

Company Events

Microsoft’s roadmap, including product launches, earnings reports, and strategic moves like acquisitions or partnerships, often provides key buying opportunities. Each of these can cause stock price fluctuations, presenting potential investment windows.

Portfolio Diversification

With Microsoft’s diversified offerings, from LinkedIn and Xbox to Windows and Azure, consider how this stock complements your existing portfolio.

Microsoft’s new market ventures could open new avenues for growth and diversification in your investments.

In essence, the best time to invest in Microsoft is a combination of these elements.

A thorough investigation of both external and internal factors, aligned with your financial aspirations and risk profile, will help you time your investment more judiciously.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

How To Sell Microsoft Shares?

Selling Microsoft shares just like purchasing them, is a relatively straightforward affair. Here’s an easy-to-follow guide on how to go about it:

Sign in to your trading account: This refers to the account used to buy Microsoft stock. If you don’t already have one, you’ll need to create a brokerage account with a firm that accommodates international stock trading.

Identify your shares: Upon logging in, navigate to your portfolio page where all the shares you currently own are listed. Your Microsoft Corporation shares should appear under the ticker symbol ‘MSFT’.

Opt for ‘Sell’: Next to your Microsoft Corporation shares, a ‘sell’ option should be available. Select this.

Decide on the volume of shares to liquidate: You’ll be asked to specify the number of shares you wish to sell. This could range from a small portion of your shares to your complete holding.

Set a price for your shares: This step is optional. If you choose to determine a specific price, known as a ‘limit order,’ your broker will only liquidate your shares once they reach this price. If you prefer a ‘market order,’ your shares will be sold at the current market rate.

Confirm the sale: Once you’re content with all the details, confirm the sale. Your broker will then execute the order on your behalf.

Remember, the process can vary slightly depending on the brokerage platform you’ve selected. Don’t forget to take into account the transaction fees that your broker might charge when selling shares.

More Like This

FAQs

Do Microsoft Pay Dividends?

Yes, Microsoft offers a quarterly dividend and has been doing so for many years. There’s no indication that this will cease in the foreseeable future.

Can I buy Microsoft Shares with a debit card?

Absolutely, you can acquire Microsoft shares using a debit card. Most online and conventional brokerage platforms support debit card transactions, as well as other methods like bank transfers.

Do you need to complete a W8-BEN form to invest in Microsoft?

Yes, if you’re a UK investor looking to buy Microsoft shares, you’ll need to fill out a W8-BEN form. This applies to all U.S.-based investments and is a requirement to confirm you’re not a U.S. citizen.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.