Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Experts advise that 30% of your salary should contribute towards your rent with an overall 40% maximum, including household expenses.

Essentially, you should keep within a budget and never spend more on rent than you can afford. Once you pay your rent, you should have enough left over to live comfortably.

Each person is different and budget for rent will be affected by location, age, dependants and salary.

Before taking the plunge and steaming into the new rental that has an extra bedroom or island kitchen, you should always ask yourself how much rent can I afford.

Each person is unique, and some people are okay with paying for a shorter commute or a garden for the kids to play in. For some, there is more value in a higher rent.

For others, keeping costs lower so there’s money for holidays, Christmas, savings or investments is more important.

This article looks at guidelines around how much rent you can afford, likely house deposits, moving costs and some tips for keeping rent as low as possible.

Table of Contents

How much rent can I afford in the UK?

When you’re standing at the estate agent’s window or perusing Rightmove, it’s easy to dream big.

But keeping your feet on the ground is essential, especially in today’s market. Rents have increased across the UK in some places by up to 24% in just 12 months.

If your rent is already above £1000, that is a £240+ increase in just one year.

When you factor in the cost of living crisis and stagnating wages that we are all facing in the UK, living comfortably is more challenging than it once was.

So, what can you do about it? Well, luckily for you, there are lots of options which we’re going to unpack.

If you’re saving up for something check out the latest money saving apps.

Let the latest technology help get you there with the best money savings apps.

How much of my salary can I contribute to rent?

Below we’ve listed out the average monthly rent you can afford in the UK based on your salary after tax.

The amounts listed in the afford section are worked out as between 30% (lowest) and 40% (highest) of your salary. This is based on over 8 years of data from the ONS.

For example the cost of living in London might mean your paying the higher end for somewhere closer to the tube.

| Average Monthly Rent You Can Afford (Estimate) | Monthly Salary (After Tax) |

|---|---|

| £300 - £400 | £1,000 |

| £375 - £500 | £1,250 |

| £450 - £600 | £1,500 |

| £525 - £700 | £1,750 |

| £600 - £800 | £2,000 |

| £675 - £900 | £2,250 |

| £750 - £1,000 | £2,500 |

| £825 - £1,100 | £2,750 |

| £900 - £1,200 | £3,000 |

Just to give you some context £3,000 a month after tax is about a 50k salary, give or take and a 30k salary is just under £2,000 a month.

To live comfortably in the UK you will need to make sure your rental amount fits to your paycheck.

Recent studies by The Telegraph say that you need at least £65,000 to live comfortably in London. Essentially though a good salary in London is currently anything above the average of £37,000.

How to budget for rent?

Creating a budget that you can keep on top of your money and ensure you have enough to cover potential rental payments, bills and essentials.

- Income vs outgoings – this is the vital 1st step. Nail this, and you’ll get a clear picture of your finances. Don’t leave anything out, right down to the last penny

- Identify savings – once you’ve completed your income vs outgoings, you’ll be able to see spending patterns that you can cut down. For example, overspending at local supermarkets rather than heading to an Aldi or buying 2-3 coffees a day when you could make your own.

- Stay flexible – The critical thing is to stay flexible. Your budget will naturally change monthly as new costs come in and old ones reduce or increase. Keep yourself flexible and create a little emergency fund that you can use if you need it.

- Keep it up to date – my partner and I keep our finance Sunday’s in the diary every month. This is usually the first Sunday after payday Friday. We plan out the month so we know what we can and can’t spend on.

There are many different ways to make a budget suit each person. We prefer using technology to help us with some of the best money savings apps.

There is a technique called the 50/30/20 technique which attributes 50% to your needs like rent and household bills.

30% goes on your wants, such as Netflix and nights out, and the final 20% goes to your savings and investments.

This technique has been very successful, but it’s important to note that it is just a guide, and when times are tough, taking money out of the 20 or 30% section and putting it towards your needs should be considered.

Other ways to create a budget include using printables, budgeting spreadsheets and old-fashioned handwritten budgets.

Sale!

Sale! Ultimate Financial Planner

£25.00 Original price was: £25.00.£17.00Current price is: £17.00.

Ways to reduce your renting costs

- Live rent free

- House Share

- Rent a room out

- Move to the country or suburbs

- Negotiate with your landlord to reduce your rent

- Put in a lower offer when you want to move there

- Pay more in advance to lower monthly payments

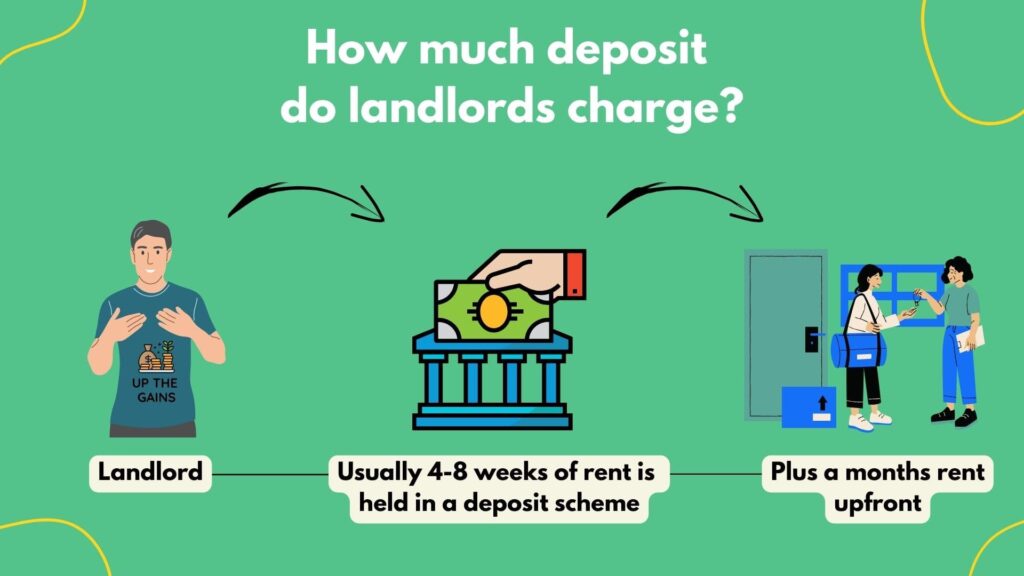

How much deposit do landlords charge?

Typically landlords will ask for 4-8 weeks of rent for a holding deposit, and in my personal experience in London, it’s usually 6 weeks.

Depending on the cost of the house or flat, this can run into the thousands, so it’s essential to budget for this before putting in an offer.

The government keeps your initial deposit in a deposit scheme keeping it safe for you until you leave the property. Your landlord must legally retain it in the tenancy deposit protection scheme.

Equally, whilst living in the property, fix anything you damage so there are minimal deductions.

How much are estate agency fees for renting?

Estate agency fees vary, but you usually will be charged an admin fee for the paperwork alongside referencing and credit checks.

I’ve been charged upwards of £300 before but also as low as £150. It depends on the agent; unfortunately, negotiating with estate agents is difficult.

The best way around these costs is to go private and deal directly with a landlord, so you may only have to pay for a credit check and reference.

Make sure you check if your landlord is legit. Renting out a house without the correct mortgage is illegal without a buy-to-let mortgage so if you’re going direct be aware of this.

Let the latest technology help get you there with the best money savings apps.

How much are moving costs?

According to Compare My Move, the average cost of removal ranges from £265 for a man in a van to £1,500 for a family home.

These costs can quickly spiral if you’re moving long-distance or cross-country, so budget this in too.

Tips to save on moving costs

- Use family and friends where you can

- Negotiate a fixed price with your removal company

- Rent a van and do the heavy lifting yourself

- Pack and unpack yourself to save on the time required for the removal company

What other costs do I need to consider when renting?

When creating a moving budget, it’s important to factor in your other essential costs. Once you know what your rent is look into your other items to ensure you can afford your new property.

Items to consider for your budget are:

- Council Tax – check out your new property’s tax band on the local councils’ website

- Gas & Electricity – Be sure to look into some options for providers in advance and get a gauge from the landlord on average monthly costs

- Water – You will have a set provider and can keep the cost down by utilising less

- Contents Insurance – This is not essential to have, but if you get broken into, you will want to have some insurance so you can claim back some money for your valuables

- TV License – You will need one if you’re planning on watching any TV, and if you live with friends, then consider splitting the bill

- Broadband – use price comparison websites and get the best deal possible for your broadband. Our favourites are Broadband.co.uk and Broadband Genie.

- Mobile Phone – if you’re in the 21st century, then a mobile phone is pretty much a necessity; look into rentals like Raylo and sim-only deals to keep the costs down

- Commuting Costs – if you’re travelling to work you will likely have costs for petrol, trains or the bus

- Food – look to save where you can by shopping at Aldi or Lidl and take packed lunches in to keep this down

Why should you consider having an emergency fund?

Putting aside an emergency fund is like having a financial safety net should a significant financial inconvenience occur.

An emergency fund is advised to be 3-6 months’ worth of pay. For example, if you lost your job, it may take some time before you get a new one, and having an emergency fund makes that situation much less stressful.

Boon Brokers are one of the UKs leading online mortgage brokers. They have a 5-star excellent Trustpilot rating with over 543 reviews.

- No mortgage fees

- Whole of market access

- Free online consultations

- Directly authorised by the FCA

- No in person meet ups

FAQs

What is the average rent in the UK?

The average rent in the UK is now £1,172 PCM (per calendar month). Homeowners and estate agents expect rents to rise throughout 2023 as the cost of living crisis causes landlords to raise rents.

The average rent in London is currently £1,832, which is much higher than the nation’s average. These are for 2 bedrooms properties.

Is 50% of income too much for rent?

In most cases, yes, it is. However, if you value something in your property, like a large garden or a short commute, paying a bit more each month can be worth it.

For example, if you’re on a higher than average salary like 70k and want to pay more so your family have space then this is a decision you could look to make

How can I save money if my rent is too high?

Start with a budget and look for things in your monthly spending patterns that you can cut back on initially. Then with that money, look to reduce debt payments and start to put money aside.

If all else fails, you can attempt to negotiate with your landlord, or if forced, you may need to move altogether.

Final Thoughts

We hope you have the answer to how much rent can I afford.

Simply put, it’s usually somewhere close to 30%. This is because there are so many other costs you will need to consider that will likely push you up to half of your income.

If you’re struggling financially and aren’t budgeting correctly, start there. It can be a quick fix to help you find some extra cash with money you already have coming in.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.