Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

The most recent data concludes that the top 1% of earners in the UK are earning £173,952 a year pre-tax income. This translates into £14,496 a month or £3,345 a week.

Whilst these numbers are enormous these earners fall into the UK’s higher tax brackets meaning they pay 40% of earnings above £50,271 and 45% income tax on earnings above £125,140.

That’s a lot of tax!

Income inequality in the UK is rife. The top 1 percent of income earners are nearing the high six figures.

Discussing these numbers can be difficult for some when the Office for National Statistics reports the average national income in the UK sitting at £32,000.

That being said, to reach these levels you will need to be in a job that requires an enormous level of stress.

When I think of these numbers my mind immediately drifts towards bankers racing about in their Aston Martin, but interestingly that’s not the only sector that pays these kinds of numbers.

Stick around as we unpack the top 1% of earners in the UK.

Table of Contents

What is the distance between the top 10% and the top 1%?

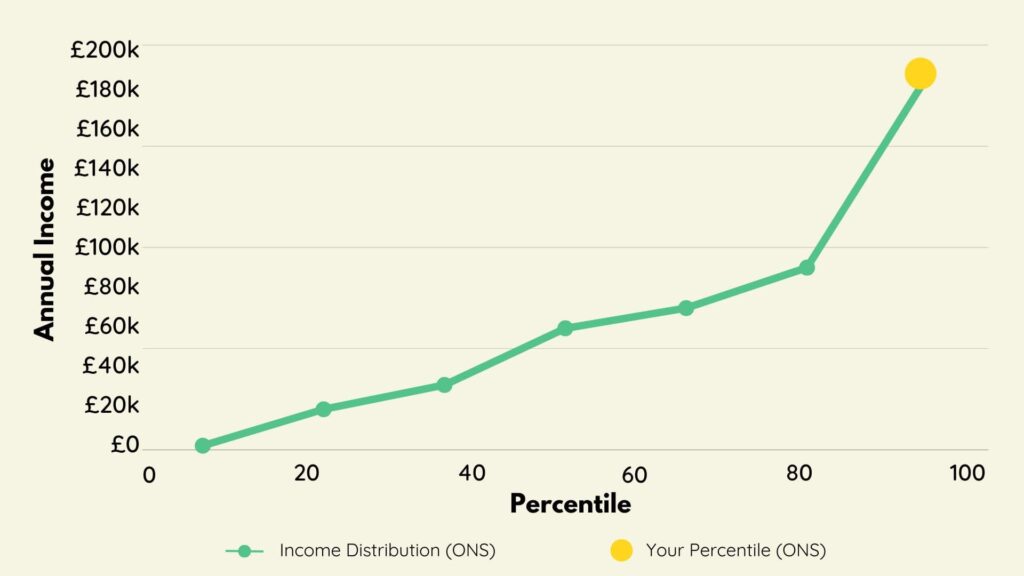

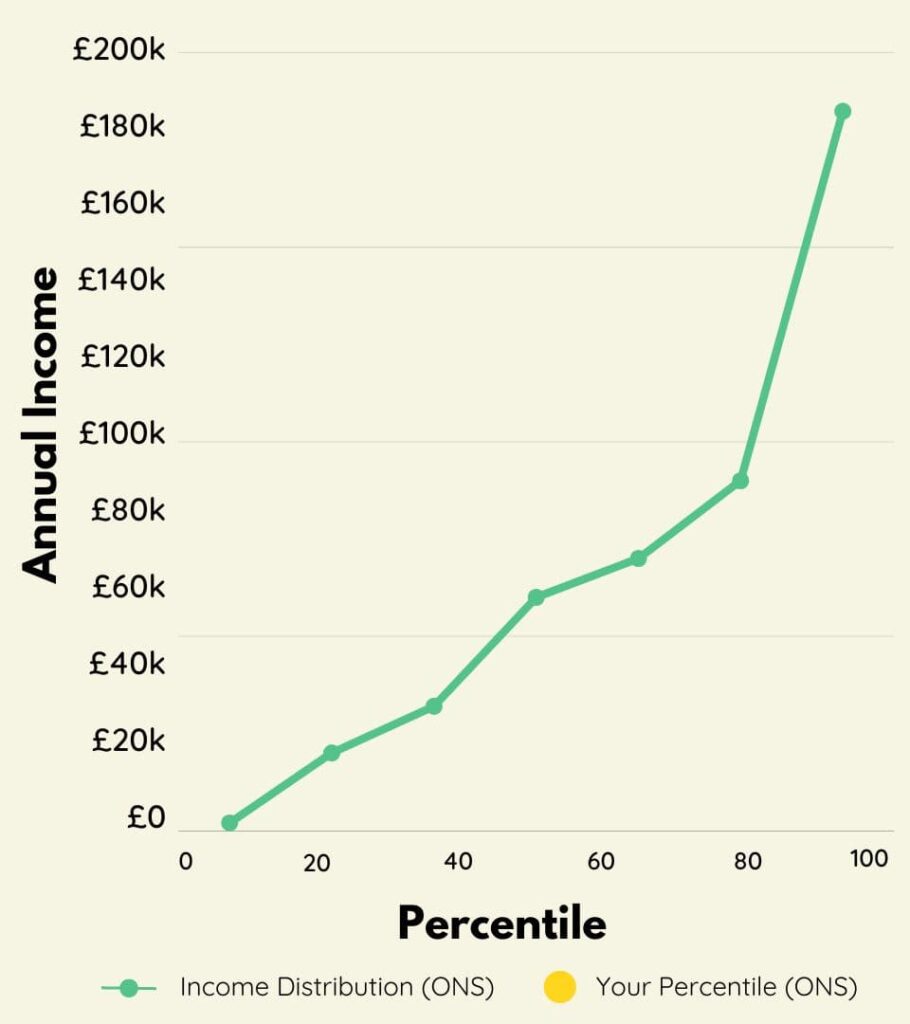

The distance between the top 10% and the top 1% is just wild. To be in the top 10% of earners data shows you need to earn £59,200 according to the HMRC’s latest statistics.

That’s a cool £114,752 difference between the top 10% and the top 1%.

Interestingly once you hit £100k salary a year this bumps you up into the top 5% of earners in the UK.

These numbers show that to reach the top one percent of income in the UK you need to make an enormous jump in salary from the top 10% or even the top 5%.

This data makes for stark reading but if you’re looking at this thinking I want to get into the top 1% these are the levels you need to be hitting.

Below we show the income distribution levels in the UK.

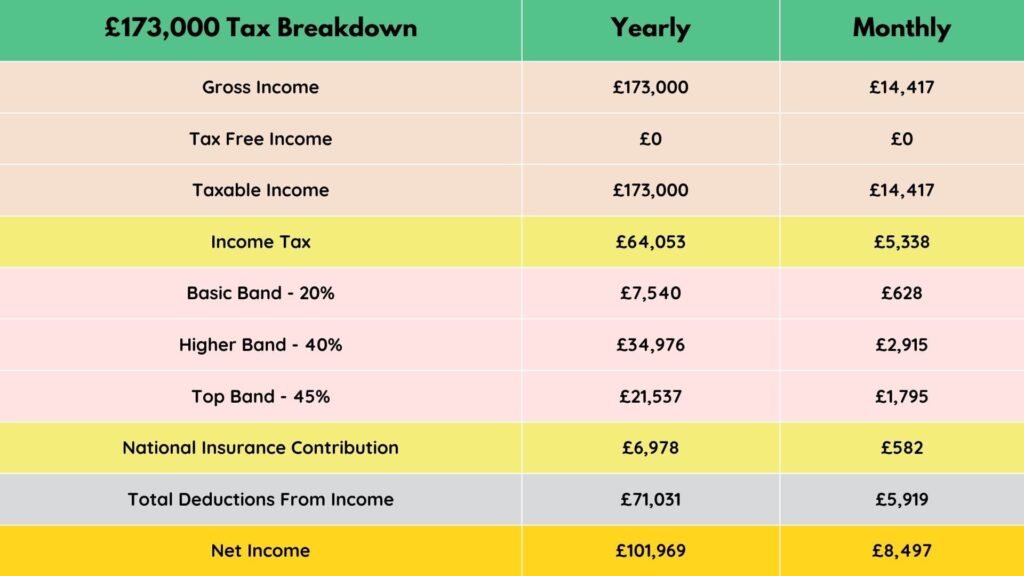

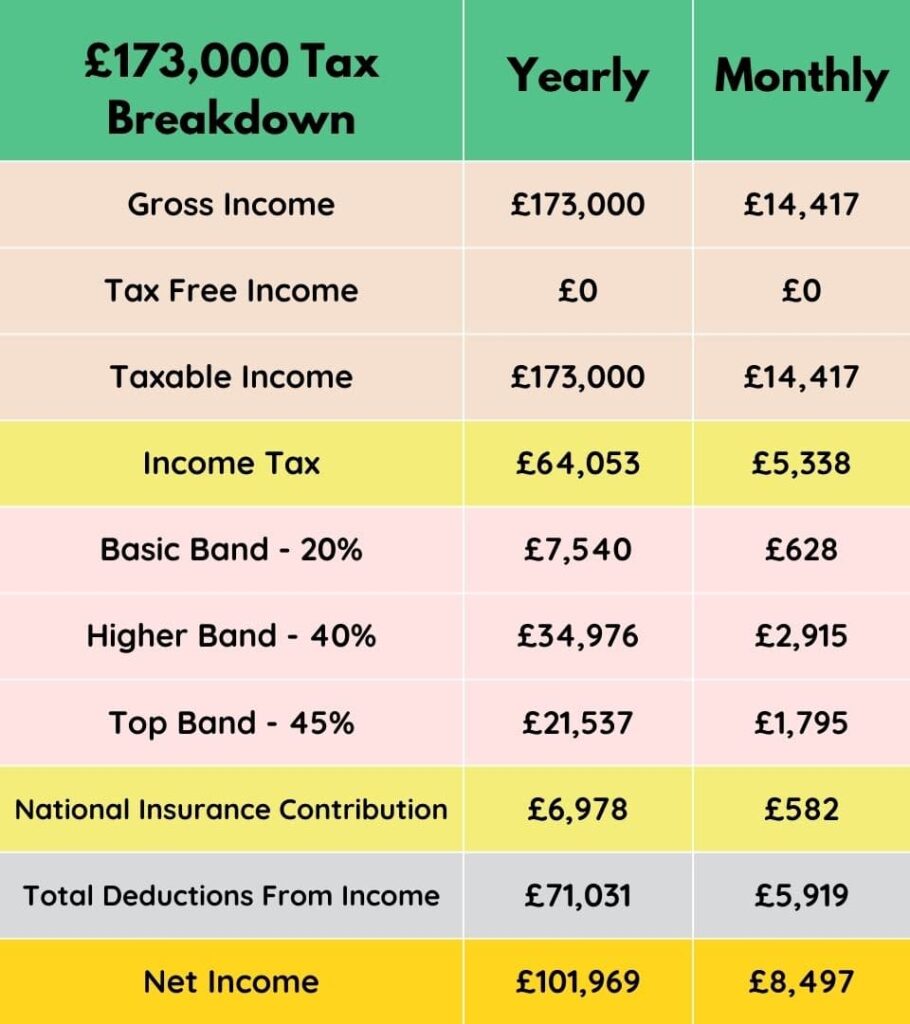

How much is £173k after tax?

£173k after tax leaves you with around £8,497 a month as net income this is after you have paid £5,338 in income tax and £5,919 in total deductions once you have paid national insurance contributions too.

In total, this is 40.9% of your total income when you’re paid these levels which is a hell of a lot of taxable income.

As you can see UK earners pay a lot of tax when you reach the higher levels. Income tax payers are hit with a 20% increase in earnings above £50,270.

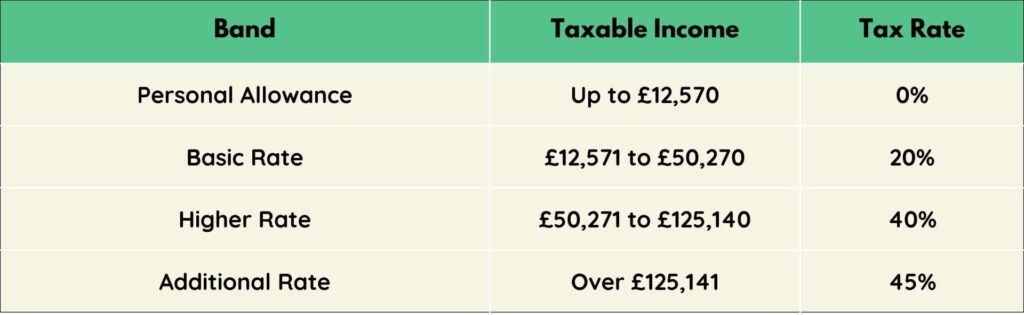

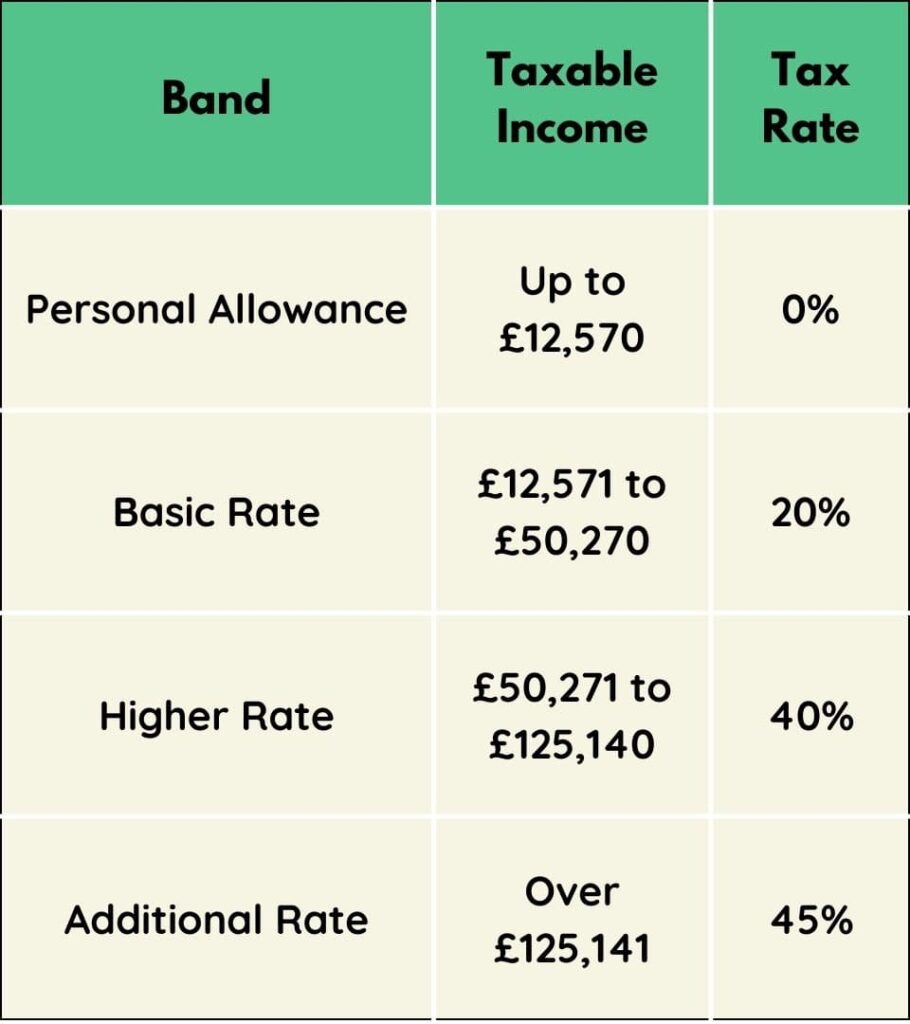

The UK Tax Brackets currently sit like this:

These numbers are reviewed every tax year and so are subject to changes based on the latest budgets set out by the Chancellor and HMRC.

The UK’s highest earners are taxed more simply because they can afford it and the government can rake in more than half of the basic rate taxpayers once you reach the additional rate.

The key to note is your earnings under the £50,270 aren’t taxed at 40% it’s everything you earn over that threshold which you can see from the breakdown of the £173k salary above.

What jobs pay £170k or more?

Jobs that earn 170k aren’t as hard to find as you might think. Going back to my visions of bankers in their 3 piece suits and big cars isn’t wrong but interestingly there are lots of sectors that pay this kind of money.

From our research, though these salary levels aren’t just managers they are specialists in their fields.

Some of the roles we have found are:

- Cardiac Physiologist

- Echocardiographer

- Hair Transplant Doctor / Surgeon

- Quantitative Developer

- Lead App Developer

- Private Dentists

- Associate Attorney

Alongside these roles there are of course your standard Presidents, CEOs, Vice Presidents, CFO, Technology Officers and Sales Directors.

These ranged from companies in tech, recruitment, banking, healthcare, insurance and more.

Interestingly when looking at the average salary in the UK we see a vast amount of these higher-paying roles in London.

A good salary in London differs to the other areas of the UK so if you want to be paid the big bucks then London is certainly the place to be.

Income disparity

The income disparity in the UK is not just a gap; it’s a chasm. While the top 1% rake in nearly £174,000 annually, the national average income hovers around £32,000.

That’s more than a five-fold difference.

This glaring inequality is more than just numbers on a spreadsheet; it’s a socio-economic divide that separates society into different worlds of opportunity, stress, and lifestyle.

Picture this: the top earners could be contemplating which luxury car to add to their collection, while the average guy might be losing sleep over making ends meet.

This income gulf raises critical questions about social mobility, fair taxation, and the kind of society we want to live in.

FAQs

What is the top 3% of income in the UK?

The top 3% of income in the UK currently sits at £80,000 or above. These numbers are a big increase from the national income average of £32,000. These roles are senior management levels or specialists in their fields and require training, degrees and experience to reach.

What is the top 99th percentile in the UK?

The top 99th percentile in the UK is currently £173,000 a year. Anything at this level and above will put you in the top 1%.

What is the top 0.1% of income in the UK?

The top 0.1% of income earners in the UK currently sits at an eyewatering £500,000 per annum pre tax income. These levels are reserved for CEOs, VPs and high-level specialists in their fields.

What Is The Top 1 Percent Of Income - Conclusion

The landscape of income in the UK is a tale of stark contrasts. While the top 1% enjoy incomes nearing £174,000 per year, the national average sits at a modest £32,000.

This disparity isn’t just a statistical curiosity; it’s a reflection of the socio-economic divisions that permeate the UK.

Whether you’re aiming for the top 1% or simply striving to understand the complexities of income inequality, it’s clear that the conversation around earnings, taxation, and social mobility is more relevant than ever.

As we navigate these financial waters, the question remains: what kind of society do we want to build, and how do we make it fair for everyone?

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.