Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

£100,000 is a top salary and puts you amongst the higher earners in the UK and it’s well above the median wage in the UK by £77,000 a year.

This amount should be more than enough to support yourself or your growing family, and as long as you handle your outgoings correctly, it should allow you to live a comfortable life.

If you live in London, you could expect £100,000 to go quite a long way but compared with places in the North which are often cheaper, £100,000 will go even further.

So, is 100k a good salary in the UK? The quick answer is yes but read on to see how we break it down.

Key Takeaways

- A Six-Figure Success: Bagging a £100,000 salary in the UK puts you in the top 4% of earners.

- Regional Riches: Location matters! In pricey London, £100,000 still goes a long way, while up North, it’s a king’s ransom. Consider where you live when weighing the value.

Master Money Management: Budget smart, clear debts quickly, explore investment avenues, and build an emergency fund.

Table of Contents

Is 100k a good salary UK

A 100k salary is above the nation’s average for a full-time employee.

The average yearly wage for full-time workers in London in 2022, according to Statista, was £41,866, compared with £29,521 for workers in North East England.

This figure has now changed with a recent study by the Office of National Statistics (ONS) showing a 7.8% in salaries in 2023 so far.

A 100k salary will likely be a director’s or senior management position at a larger company.

In most cases, to get to this level, you will need vast experience and proven results at creating value for the businesses you have worked at.

If you’re looking for your first role, reaching this salary level might well be a little way off, but something to work towards if you have ambition.

Podcast Episode - Bad Bosses Beware

Join us for an episode with award winning business owner, Rachel Harris.

We discuss how to get out of toxic workplaces, interview tips, increasing your salary, what makes a good boss and so much more.

Hit the play button just below or click Rachel’s name just above for links to Spotify and Apple.

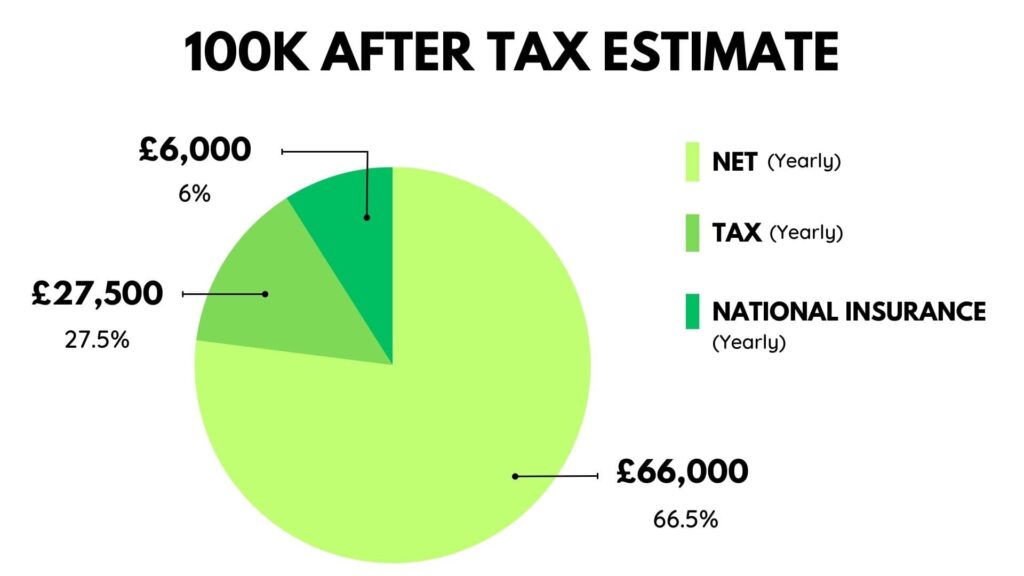

What is 100k after tax?

Right, so you could be landing a 100k salary. But how much do you take home with you?

100k after tax puts you in the higher tax brackets so be prepared for nearly half of your salary to be taxed.

Your 100k salary is subject to income tax and national insurance.

The gross and net wage is calculated based on you being younger than 65 with no student loan, pension deductions or benefits.

Gross income (before tax) of £100k per year equals:

- £48.07 per hour

- £384.62 per day

- £1,923.08 per week

- £3,846.16 bi-weekly

- £8,333.33 per month

Estimated Net Income after income tax and national insurance contributions

- £32.24 per hour

- £257.89 per day

- £1,289.42 per week

- £2,578.84 bi-weekly

- £5,587.47 per month

Tax-wise, you fall into the higher tax bracket of 40% income tax on earnings over £50,271. It’s important to know that tax on any bonuses will be taken similarly.

If you’re moving into a new role, submit your details, including a P45, to HMRC as quickly as possible to avoid any emergency tax.

UK Salary Calculator

Results:

Career progression on 100k salary

Earning £100,000 is an achievement, but what about the road ahead? Career progression is a critical aspect to consider:

Experience and Value Creation: Reaching a £100,000 salary often means you’ve accumulated substantial experience and consistently added value to your employers. To climb higher, keep honing your skills, take on leadership roles, and focus on delivering results.

Networking and Professional Development: Building a strong professional network can open doors to more lucrative opportunities. Attend industry events, seek mentorship, and invest in continuous learning to stay ahead in your field.

Exploring New Roles: If you’re in your first £100k role, don’t rest on your laurels. Set your sights on higher positions, whether within your current company or by exploring opportunities elsewhere. Be proactive in seeking out roles that align with your career goals.

Salary Negotiation: As you progress, don’t shy away from negotiating your salary. Aim to earn what you’re worth, and research industry salary benchmarks to ensure you’re on track.

Remember, career progression doesn’t stop at £100,000; it’s a stepping stone to even greater heights in your professional journey.

Can you live off a 100k salary?

Yes, you should be able to live comfortably off a 100k salary. You are in the UK’s top 5% of wages at this salary level, which you should be proud of.

There are, however, many variables that affect each individual differently when it comes to living expenses. These include:

- Total household income

- Current debt

- How many dependants you have (kids aren’t cheap)

- Current fixed outgoings (Council tax, energy bills)

- Mortgage or rental costs

These costs are completely unique to each individual and so only you will know if you can live off a 100k salary. In most cases, 100k a year would be enough to set up an individual and family for life.

Living Expenses

While a £100,000 salary offers financial comfort, it’s essential to break down your living expenses to ensure you’re making the most of your income:

Housing Costs: Consider whether you rent or own a property. Mortgage or rent payments are typically the most substantial part of your budget. Ensure these expenses are manageable and leave room for savings.

Transportation: Factor in the cost of commuting or running a vehicle. This includes fuel, public transport fares, car maintenance, and insurance. If possible, explore eco-friendly and cost-effective transportation options.

Groceries and Dining Out: Calculate your monthly food expenses, including groceries and dining out. Establishing a grocery budget and limiting restaurant meals can help you save significantly.

Utilities and Bills: Don’t forget about utility bills such as electricity, gas, water, and internet. Track these expenses to avoid surprises and look for ways to reduce consumption.

Entertainment and Leisure: Budget for entertainment, leisure activities, and hobbies. Allocate funds for movies, concerts, sports events, or any other activities you enjoy.

Healthcare Costs: Consider health insurance premiums, medical expenses, and any contributions to a pension scheme or private healthcare plan.

Education and Childcare: If you have children, include the cost of their education, tuition fees, and childcare expenses in your budget.

How much rent can I afford on a 100k salary?

Most financial experts will suggest paying up to 40% of your salary towards rent. However, a suitable bracket is somewhere between 30-40%.

The reason for this imaginary bracket is that you will need to consider other household bills like council tax and energy bills.

It all adds up, so it’s essential to budget for these costs alongside your other fixed outgoings before you work out your available cash for rent.

If you look at a 100k salary monthly, after tax, this bracket is around £1650-£2000.

If you’re in London, or a major UK city, you could afford a luxury one-bedroom flat in a central location or a two-three bed house in more suburban areas.

It’s important to note that the cost of living in London is higher than other major UK cities so factor this in.

For example, in the North of England, this will go a lot further, and most properties would be available to you at this budget level.

Rents rose a lot in 2022, with some places in the UK rising as much as 20%. This means that choice will be slightly spoilt, but this is a very healthy budget for renting a property in the UK.

If you’re creative though you could look at house hacking and try to live rent-free!

Can I buy a house with a 100k salary?

Yes, you could easily buy a house with a 100k salary.

According to our mortgage calculator, you could afford somewhere between £500,000 – £550,000 if you have a 10% house deposit.

In the UK, your mortgage affordability is usually calculated at x5 your yearly income before tax.

Your affordability would increase if you added someone like your partner, friend or sibling to a joint mortgage.

If you’re freelance, this amount could change as lenders are often less favourable to people who work for themselves or own businesses.

You will usually need 24 months’ worth of tax returns but having 3+ years makes it more accessible.

£500,000 in London would get you a comfortable, spacious one-bedroom flat in most areas.

If you’re looking for a larger property, you would need to look around the outskirts to find a house with more bedrooms.

In more rural areas of the country, £500,000 would fetch you a house with multiple bedrooms, a garage and a decent-sized garden. Of course, location is everything, so bare that in mind.

How to maximise your 100k salary

As we touched on briefly, a 100k salary should set you up for life. If you budget correctly and keep your outgoings down, then there should be a substantial amount to start investing money.

So, how can you make your 100k a year go even further? This section looks for tips to help you do just that.

Create a Budget

We know budgeting isn’t the most exciting thing in the world, but even on a 100k salary, you should have one!

Even the richest people in the world will have a comprehensive budget completed, so making one now will set you up for better financial decisions.

Budgeting will allow you to allocate money for things like investing, savings and paying off debt. You can also look to put money towards things like holidays, house deposits and larger purchases that you might be working towards.

Pay off Debt

If you’re earning £100,000 a year, look to clear any debts you may have as soon as possible. Using your new budget, you can allocate funds to pay down your debt faster.

When paying off debt, target high-interest debt first to reduce the amount you’re giving back to the lenders.

Many of us pay off the minimum balance back each month, but at these salary levels, look to clear it down right away.

Start investing your money

At 100k a year, you need to be looking to make your money work for you.

“If you don’t make your money work while you sleep, you’ll be working until you die” – Warren Buffett.

Investing comes in many forms, either via the stock market, which is the most common or by investing in business and property.

If you’re just starting, opening a Stocks and Shares ISA and getting expert advice is a great way to get the ball rolling.

There are risks when investing in the stock market, but if you invest for the long term, many of those risks reduce considerably.

The stock market was built to rise as a whole over time, so if you plan long-term, you should make some decent returns.

If you want to avoid learning about investing but still be an investor, let apps like Moneyfarm and Wealthify do the hard work.

These brands are called robo-advisors and are designed to take care of everything for you. They have built-in algorithms that create portfolios tailored to each individual.

Once you complete a questionnaire, you will have a portfolio ready-made for you and can begin investing what you can afford.

Build an emergency fund

Emergency funds do precisely what they say on the tin. They are funds for you to dip into when an inevitable financial inconvenience occurs.

Experts say most emergency funds should be six months’ worth of pay, but three months is a great place to start.

FAQs

Is 100k a year middle class?

It’s important to note that no official amount makes you into a class, it’s a purely personal judgement, but £100,000 yearly is undoubtedly an excellent wage. If you were to judge by salary, then 100k a year would see you by some as middle class and, in other cases, even upper class.

Is a 100k salary good for a single person?

If you’re single and have low or no debt, 100k is in the UK’s top 5% of salaries, so yes, it is an excellent salary. This level of compensation will allow you to pay your rent/mortgage very comfortably and still have enough left to enjoy time with friends and family, invest and put money away.

Is 100k enough in London?

Yes, 100k is enough in London to live comfortably. Everyone knows things are more expensive in the capital, but if you keep your outgoings down, you will be able to enjoy all the city has to offer.

What percentage of the UK earn over £100k?

Currently, 4% of the UK earns over 100k a year. This puts you in the top 96% of earners and is £77,000 above the national average wage.

Final Thoughts

So, Is 100k a good salary in the UK? We’ve established that it depends on where you live, your financial situation and many other variables.

You can make 100k go a long way, and starting to invest some of your extra money will set you up for later life and even allow you to retire early.

MORE LIKE THIS

- Is 20k a good salary in the UK

- Is 25k a good salary in the UK

- Is 30k a good salary in the UK

- Is 35k a good salary in the UK

- Is 40k a good salary in the UK

- Is 45k a good salary in the UK

- Is 50k a good salary in the UK

- Is 55k a good salary in the UK

- Is 60k a good salary in the UK

- Is 65k a good salary in the UK

- Is 70k a good salary in the UK

- Is 75k a good salary in the UK

- Is 80k a good salary in the UK

- Is 90k a good salary in the UK

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.