Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

The Office for National Statistics reports that at the end of 2022, the average full-time salary in London is just shy of £37,000.

Recent updates from the ONS suggests a 7.8% increase in salaries so far in 2023. This would put the London average salary at £39,886.

The national average salary or median wage as it’s also known is £32,000 meaning the capital is officially 5k even when you factor in the 7.8% as there’s no data on the increase by region yet.

With inflation factored in spending power is now a lot lower and to live comfortably in London with some luxuries, nights out and the occasional holiday for me you need at least a £50,000 salary which is well above average right now.

Are you contemplating a move to the vibrant and cosmopolitan city of London?

Or perhaps you’re already settled into the bustling heart of the UK and are pondering if your salary is sufficient for a comfortable life in the capital?

Whether you’re a local Londoner, a hopeful ex-pat, or simply someone intrigued by the cost of living in London, you’ve come to the right place.

I lived in the capital for over 16 years and so have the inside track on what is a good salary in London.

In this guide, we’ll dissect the median London salary, analyse the cost of living in London, and provide you with a roadmap to evaluate your financial status in relation to London’s living standards.

We aim to equip you with all the necessary information to navigate the financial labyrinth of this fascinating city.

So, sit back, grab a hot drink, and let’s delve into the world of salaries in London.

Table of Contents

What is a good salary in London?

I lived in the city centre and all over the surrounding boroughs for many years starting out on minimum wage and working my way up to close to £80,000 a year at Director level before leaving to start my own businesses.

I can tell you first-hand that my finances were in terrible shape until I was earning a 50k salary.

The Telegraph recently stated that with inflation factored in you need at least £65,000 in 2023 to live comfortably in London which with inflation factored in proves my point.

Whilst this might sound odd to some, London is one of the busiest, socially active and of course, the most expensive cities in the world, so it’s very easy to get yourself into financial hardship.

Before I was earning good money I had to get by and that meant flat sharing, shopping in Lidl, buses rather than tubes and house parties instead of nights out. Essentially keeping a cap on my living expenses and doing my best to get to the end of the month.

It’s simply the truth. Whilst millions get by on the average wage and some struggle with less but there’s no denying that to play in the big city you need a decent salary!

Average London Salary

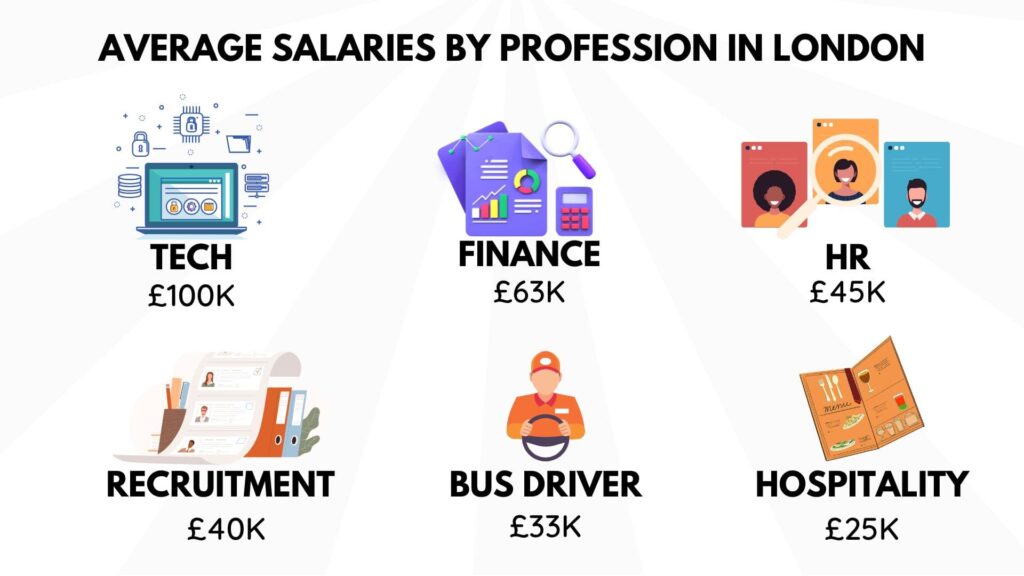

As mentioned briefly according to the ONS the average wage in the capital is just shy of £37,000. However, the average annual salary differs vastly by profession.

So, if you’ve studied to be a lawyer or a doctor then you should be expecting to get paid the bigger bucks!

As you can see London’s average salary varies hugely by profession with a vast disparity between finance, tech and lawyers to hospitality and public services roles.

If you look at the average London salaries vs the average small business turnover of £530,456 per year with 10 employees or less it works out quite similar to having a mid tier level management position.

Understanding the UK Tax System and its Impact on Net Income

It’s not just about gross income, though. You’ve got to consider the UK income tax bands. You’re taxed 20% for earnings up to £50,270, 40% for earnings between £50,271 and £150,000, and 45% for anything above.

Additionally, National Insurance contributions will slightly dent your net salary.

UK Salary Calculator

Results:

The Cost of Living in London

The cost of living in London has risen a lot in some cases with energy by over 54% and with wages not rising as fast as wages people are struggling a lot more than they were last year.

Rent and Accommodation Costs

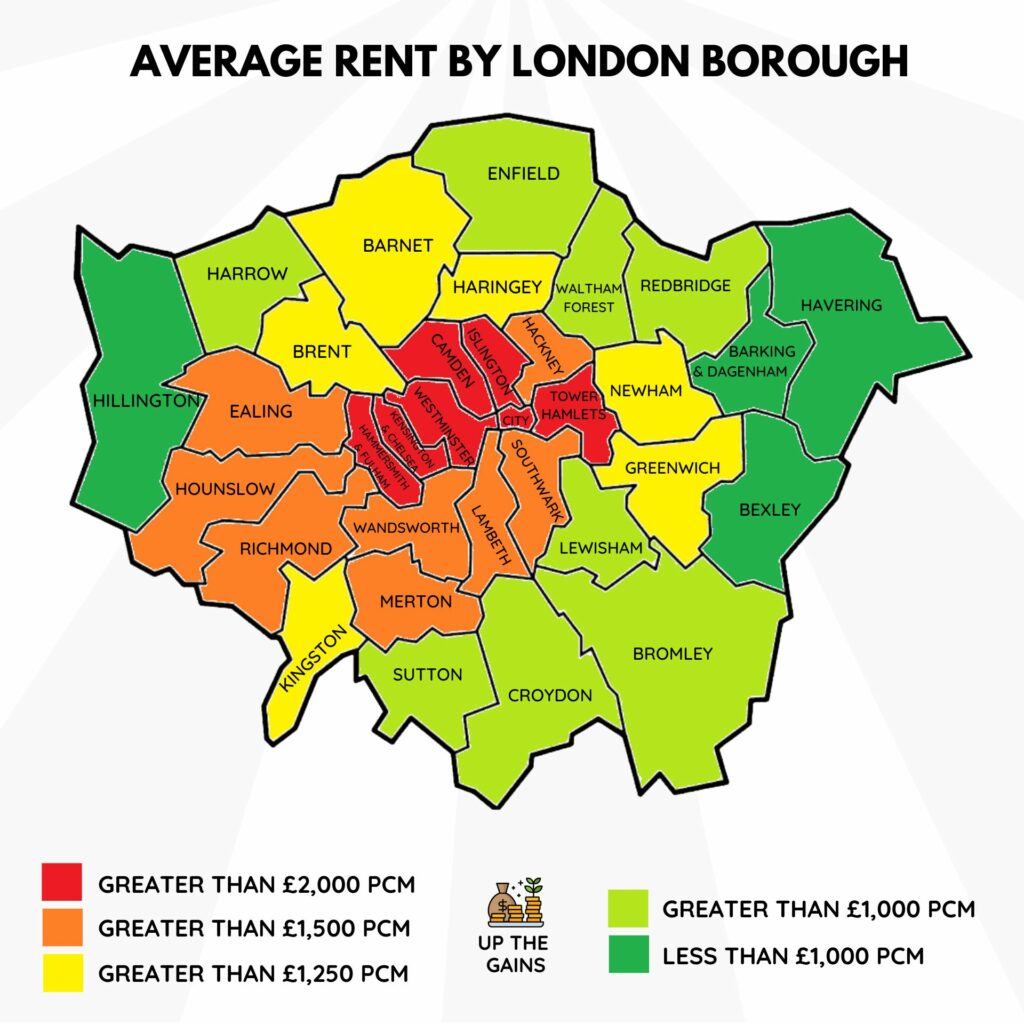

Living in London does come with its costs, with rent taking a large bite out of your budget. The monthly rent for a one-bedroom flat in Central London averages around £1,700 – although this is said by some to have risen to £2,000+.

Greater London is slightly cheaper, but you’ll still have to part with about £1,200. However, opting for shared accommodation can help reduce this figure.

Everyday Expenses

Now, let’s talk about everyday costs. A weekly grocery shop might set you back £30 to £50. A monthly Oyster Card for Zones 1-2 costs around £140.

Dining out, socialising, and other leisure activities also add up.

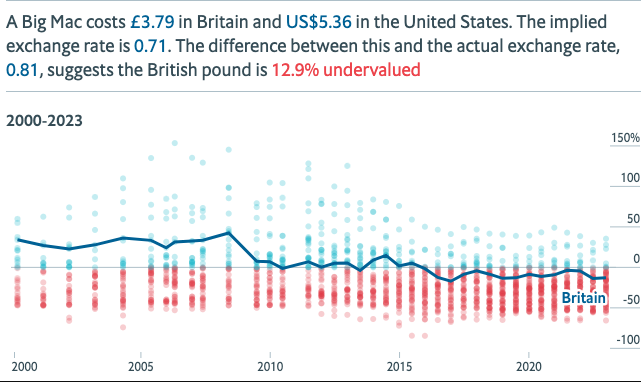

The Big Mac Index, a lighthearted yet insightful tool from The Economist, illustrates how the all important Big Mac costs in the UK.

Hidden Costs of Living in London

However, there’s more to the story than the visible costs. The hidden costs of London living, such as council tax, utility bills, and even the TV licence, can take a significant toll on your monthly budget.

That being said the true hidden costs are your everyday expenses. Those morning coffees in Pret A Manger, lunchtime trips with the team to the local street food market and of course the after-work pints can quickly take a semi-decent monthly wage apart!

Equally the average food shop can add up so be savvy and use things like cashback apps and loyalty schemes to get money back in your pocket.

Could I Live in London with My Salary?

This is depends on so many factors such as location, financial position, any dependents, debts and overall outgoings. If these are high and your earning minimum wage this is going to be challenging.

Let’s look at how you can evaluate this.

Evaluating Your Current Salary

The key question is whether you can live comfortably in London with your salary. If you’re earning £30,000 annually, after tax and National Insurance, you’re left with about £24,000, which is £2,000 per month.

After deducting rent, transport, groceries, and other expenses, you might find yourself slightly stretched. However, with smart budgeting and perhaps opting for a flat share, you can certainly make it work.

As soon you increase this number as long as you don’t have a dose of lifestyle inflation then your spending power will increase with your income.

What an app! I utilise their smart AI to set money aside automatically every payday!

You can earn up to 4.21% AER with their Easy Access Interest Pocket, and begin investing in up to 3000 stocks and funds from as little as £1.

EXCLUSIVE OFFER: Get a free £5 cashback in your Plum account when you open an account through Up the Gains.

- Auto save and invest

- Savings pots with interest

- Low fees in comparison to Chip

- ISAs and free savings accounts available

- Easy to use mobile app

- Tiered fee levels to access all investment options

Budgeting for Life in London

Building a budget is an essential step. Apps like Plum or saving app Chip and websites such as Money Saving Expert can be invaluable resources for financial planning.

These tools can help you track your expenses and savings, ensuring you live within your means.

Improving Your Financial Status in London

Number one should be increasing your income. Secondly reducing your expenses.

If you manage this you’ll be well on your way but let’s unpack it a little more.

Pursuing Higher Paying Job Opportunities

There are many ways to make money in London. Higher-paying sectors like technology, finance, and consulting could be worth exploring.

Personal finance books and business ideas can also help you level up. Also look to invest money so it can start paying you back later down the line.

Side Hustles and Part-Time Opportunities

Consider supplementing your income with part-time work or a high paying side hustle.

Platforms like Upwork, Freelancer, or even LinkedIn offer a plethora of freelance opportunities. But remember, there are tax implications for additional income.

FAQs

What is the top 10% income in London?

In the bustling metropolis of London, income disparities are strikingly evident. The top 10% of households in this vibrant city enjoy an average equivalised disposable income of £70,900 per year.

With this substantial financial standing, they have the means to indulge in the finer things that London has to offer, from luxury accommodations to upscale dining and exclusive experiences.

On the other end of the spectrum, the bottom 10% of households in London face a much more challenging financial reality, with an average equivalised disposable income of £10,600 per year.

These households often encounter greater difficulties in meeting their basic needs and may have to make tough choices when it comes to essential expenses such as housing, transportation, and healthcare.

What is considered a good salary in London?

With the high cost of living, competitive job market, and diverse lifestyles, a good salary in London is typically one that provides financial comfort, enables you to cover your living expenses without strain, and allows you to enjoy the city’s offerings.

From personal experience and opinion, a salary of around £50,000 can be considered a benchmark for living comfortably in London.

This income level often provides the means to afford your own place, cover daily expenses, and even indulge in some luxuries or plan for holidays.

However, it’s important to consider individual circumstances, personal priorities, and the ever-changing nature of London’s economic landscape when determining what salary would be considered “good” for you.

Is 40k enough to live in London?

Yes, a £40,000 salary is certainly enough to live in London. While the city is known for its high cost of living, careful budgeting and smart choices can make it feasible.

A salary of £40,000 should cover your essential expenses, such as rent (especially if you’re open to sharing a flat or living a bit outside of the city centre), groceries, utilities, and transport.

However, your lifestyle, personal preferences, and savings goals will significantly impact how comfortably you can live. It’s essential to remember that while this income level is enough for a decent lifestyle, it might require some compromises on dining out, entertainment, and other discretionary spending.

Nevertheless, with planning and prioritisation, a £40,000 salary can indeed provide a sustainable and enjoyable life in London.

Is 120k a good salary in London?

Absolutely, £120,000 is an excellent salary for living in London. It not only comfortably covers essential costs such as rent, groceries, utilities, and transport, but also leaves room for discretionary spending on dining, entertainment, travel, and other lifestyle choices.

This could include stepping onto the property ladder and buying a flat or house in the city, an achievement that can be challenging with lower income levels.

You might also be in a position to contribute more substantially towards your retirement fund or invest in stocks, bonds or other financial instruments. It could also support your pursuit of hobbies, luxury experiences, or even setting up a Junior ISA for your children.

Can you live off 30k a year London?

Yes, it is possible to live in London on a £30,000 salary, though it does require a level of careful budgeting and some compromise on living conditions and lifestyle.

You may need to consider sharing a flat with others to reduce housing costs significantly, as rental prices in London can be steep, especially in central locations.

Essential expenses such as groceries, utilities, and transport can be managed within this salary by keeping a close eye on spending and making frugal choices.

For instance, cooking at home more frequently rather than eating out, or using public transport instead of taxis, can help manage expenses.

Non-essential expenses such as high-end dining, regular holidays, or frequent shopping trips might not be viable unless you’re saving up in advance.

It’s worth noting that even though there may be constraints, London has many free or low-cost activities that can contribute to a fulfilling lifestyle, from its stunning parks to its many free museums and galleries.

What is the lowest salary in London I can have to live comfortably?

In my personal opinion, it takes a minimum of £40,000 per year as a starting point for a comfortable lifestyle in London.

This will still mean you will need to juggle your finances in order to get through the month but you can certainly get by an enjoy yourself from time to time.

At this income level, you may need to make certain concessions such as flat-sharing, especially in central London, and be mindful of your budget. Frugality or infrequency may be required when it comes to non-essential expenses such as eating out, shopping, and entertainment.

Conclusion

Living in London with a comfortable salary is perfectly achievable with careful planning and financial wisdom.

By understanding salary distributions, accounting for living costs, evaluating your income, and perhaps seeking additional income opportunities, you can navigate your financial journey in the city with confidence.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.