Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

It’s estimated that living in London is 27% more expensive than in the rest of the UK. Yes, you are paid more, but the cost of living in London is equally high.

The average cost of living in London for a couple is currently £1,750 – £2,500 depending on where you live.So, if you’re planning on moving to the big city, make sure you budget accordingly and be prepared for things to cost more!

Having lived in the capital for most of my adult life, mainly in East London, I still work in the city centre even though I have moved to the home counties.

I’ve got personal experience and unique data on the cost of living in London and the average living expenses you’ll face if you aim to live there.

For this study (which was great fun, by the way), I took cabs, got my haircut, visited over 50 estate agents, shopped in multiple stores, travelled all over the city, drank about 1000 coffees and ate out once a week for over two months.

I also spoke to friends in the city about their estimated average monthly costs and living expenses to get a more comprehensive picture for you.

It was an expensive study for me, but hopefully, it provides you with the most comprehensive guide to the cost of living in London.

Table of Contents

Cost of living in London

The cost of living in London varies so much by area, salary, dependants, current living situations and so much more.

London has been known as the centre of the world for centuries and is one of the oldest cities on the planet.

Starting in the City of London and expanding beyond the walls, it now has 32 boroughs and spreads nearly 50 miles wide.

Being such an attractive place to visit and work has meant that the city’s centre has become a sprawling metropolis of offices, bars, shops, tourist traps, and hi-rise living.

What is the current population of London?

The population of London is currently standing at 9.5 million, which, compared to the overall population for the entire UK of 67 million, is pretty massive!

With this colossal influx of people comes a higher cost of living, and London is one of the most expensive cities to live in the world.

What is the average cost of living in London?

From personal experience, the average cost of living in London as a single person is high compared to living where I live now in the home counties (the surrounding counties around London).

When I first moved to London as a single person, I lived in a shared house, and it was only after I met my partner did we lower our monthly costs by moving in together.

If you’re looking to move to London, it will be hard to afford your own rental property, and you will likely need to share it with someone else the first time.

Things like monthly rent will be your biggest monthly expense.

- The average cost for a single person to live in London – £1750-£2500 a month, including housing costs

- The average cost for a couple to live in London – £3000-4000 a month, including housing costs

- The average cost for a family of four to live in London – £5000-£6000

What is the average living cost in the UK?

To live comfortably in the UK with some financial freedom and luxuries, you need £33,600 as an individual, £49,670 as a couple and £67,554 per year for a family of four with two young children.

This is a stark contrast to just scraping by, which the pensions association is stating just £10,900 a year as an individual and £16,700 as a couple.

So when comparing all of these numbers. On average, London is 27% more expensive than the rest of the UK.

What are the most expensive areas in London?

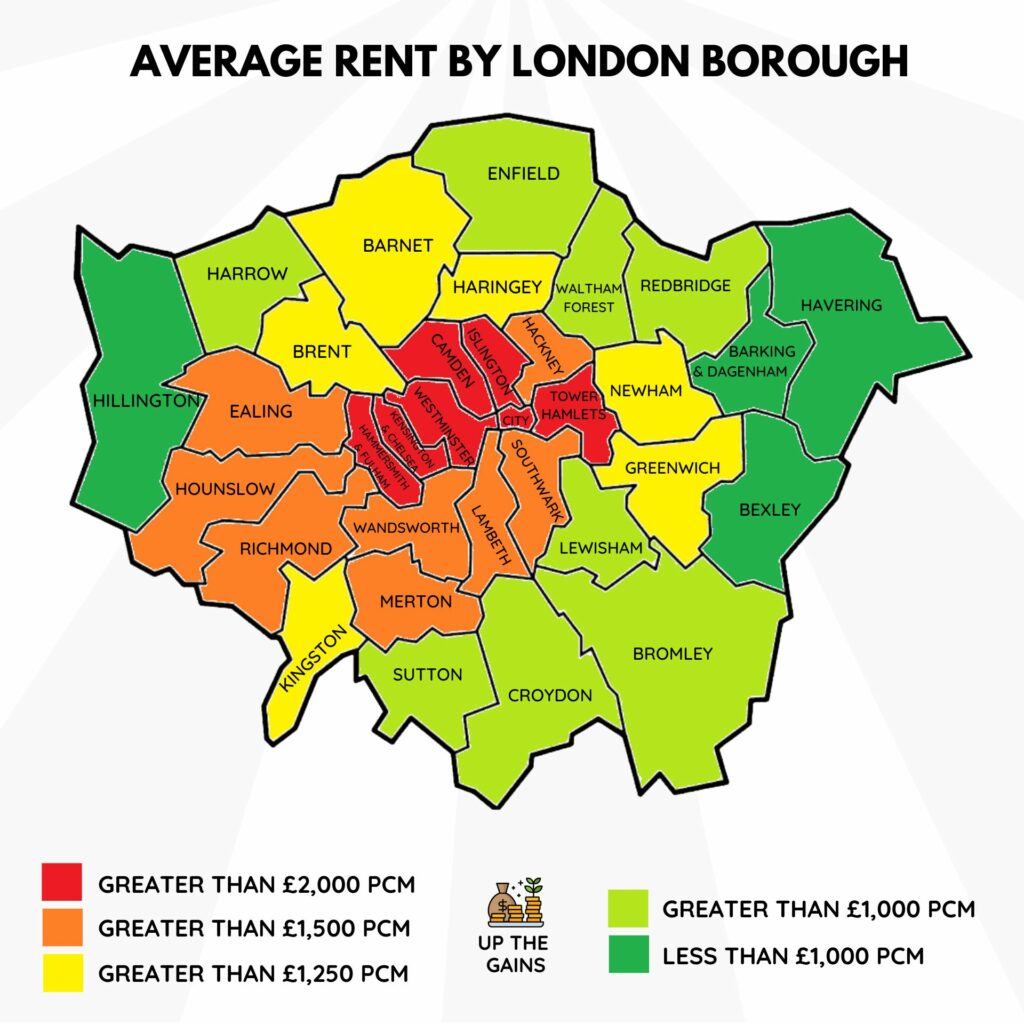

The most expensive areas in London is in the city centre as highlighted by this average rent by area graphic just below.

The most expensive borough in London is Kensington and Chelsea, and this is followed closely by the City of Westminster and then, surprisingly, Camden.

The cheapest area in London is currently Bexley, Barking & Dagenham, Havering and Hillingdon. They are however the furthest away from the city centre so you need to juggle this with your commute.

My most recent flat in London was in Blackhorse Road, Waltham Forest which was situated at the end of the Victoria Line plus had relatively cheap rent.

What salary do I need to live comfortably in London?

Having lived in the capital for over 12 years, where I started as a waiter and ended up as a Director, I can tell you that you need at least £1750 a month to survive.

But, that’s just to survive to live comfortably, you really do need a lot more when living in London to have some luxuries.

Making money in London though is down to you. It’s a city with tonnes of opportunity it just depends on what you make of it.

A study by Londoners from TimeOut in 2019 revealed that £53,000 was the optimum salary to live comfortably in London; however, that number has undoubtedly increased with inflation.

If we were to add around 20% to this, a salary to live comfortably in London would be around £63,600.

This is £21,734 above the average salary in London, which is currently £41,866, according to Statista.

Alongside your rent costs, there are plenty of other monthly expenses, which include:

- Council tax

- Utility bills

- Grocery bill

- Tv License

- Renter’s insurance

- Other living costs

So to live comfortably in London, you need to earn way above average…sounds pretty expensive to me! Hence why I moved to the countryside!

What are the public transportation costs like in London?

The transportation costs in London are excellent because there is so many options for you to take.

The London Underground links are phenomenal, backed up by an extensive overground network that can get you both across the city and the entire country.

Driving in central London can be expensive, with the congestion charge around the city centre being quite pricey, especially if you travel through it daily.

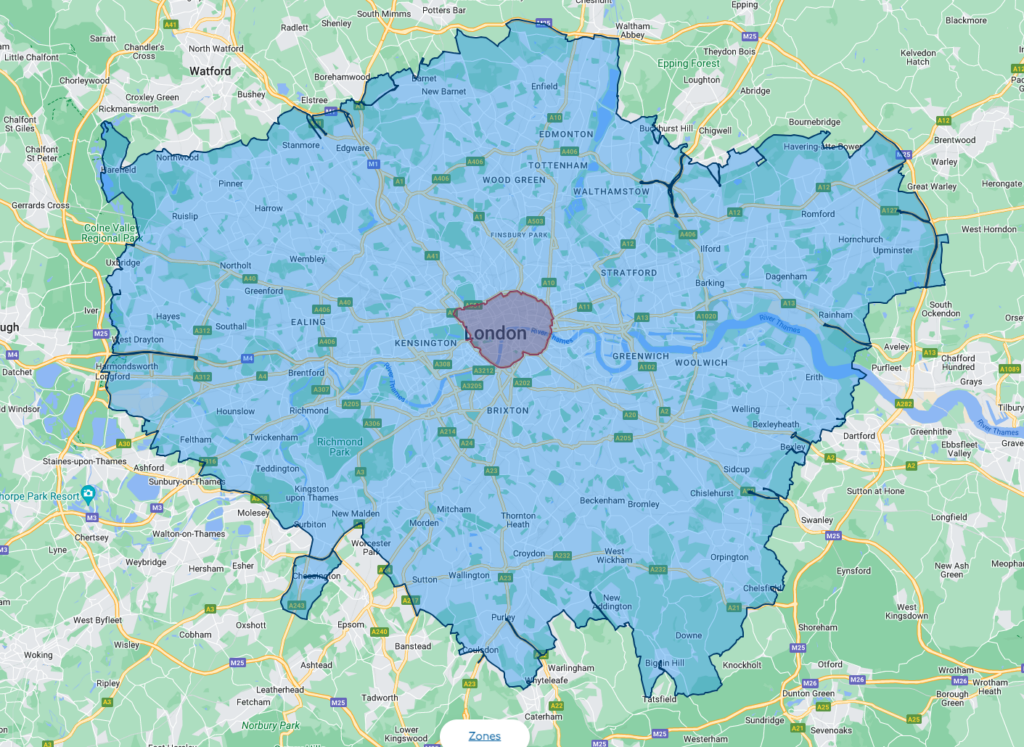

Plus, on the 29th August the ULEZ low emission zone extending to the wider boroughs of London meaning you could be charged if you’re vehicle doesn’t meet requirement.

You can check if your car meets requirements on the TFL website.

Most Londoners rely on the public transport network to get them from A to B, usually via tube, DLR, bus or overground.

Buying things like a monthly travelcard keeps the average monthly cost of travel lower. Also, look to avoid travelling at the busier times of the day so you can get the off-peak fares.

London Underground & Overground Fares

- Single journeys range from £2.50 – £5.50 again, depending on which zone you travel through

- Weekly spend on travel cards ranges from £40 for just Zone 1 to £75 for zones 1-6

- Monthly spend on travel cards ranges from £140 for Zone 1 to £270 for zones 1-6

Bus Fares

- 11+ – £0.80p for single journey / £2.40 Daily Cap / £11.60 Weekly Pass

- 18+ (adult) – £1.65p for single journey / £4.95 Daily Cap / £16.30 Weekly Pass

Latest figures provided by TFL

Taxi Fares

London is famous for its black cabs and whilst they are a lot of fun, they can be expensive if you’re going far. They run on the meter and change in price depending if peak or off-peak.

You can also access Uber and Bolt, the city’s largest digital taxi apps and often cheaper than black cabs.

How much do everyday items cost in London?

Everyday item costs in London vary depending on where you are and how swanky you’re feeling.

You can easily go out and spend £100s but equally can grab a deal somewhere with a burger and a pint for £10 (more like £15 these days).

On my two-month tour of central London, I wrote down every cost I spent and made a list of the items for you with averages.

Here are some average living expenses in London from my study:

- Average dinner at a pub for 2 (without wine or beer) – £36

- Average restaurant prices for 2 (with a glass of wine each) – £58

- A pint of lager – £6.10

- A pint of IPA – £6.50

- A pint of Guinness – £6.80 (this makes me sad)

- A glass of house wine – £5.80

- Cinema tickets – £13.80

- Haircuts – Men £25 / Women £110+

- Theatre tickets for 2 – £40-£250 average amount depending on the seats

- Gym membership – £30-75 a month

Average bills in London

The average bills in London are also something you will need to keep in consideration.

From keeping the lights on to keeping your tummy full, London has its own unique price tag.

Here’s how those unavoidable expenses break down.

The Average Cost of Groceries

The average cost of groceries for a couple is around £74 a week.

For a family of 4 with dependants this increases to £102 a week which is just over £400 a month!

When it comes to daily living, food can eat into your budget more quickly than you might expect.

It’s wise to skip high-end stores and instead make a beeline for places like Aldi or Lidl.

Life Online: TV Licences and Broadband Charges

In today’s world, fast internet isn’t a luxury; it’s a necessity, especially if you’re studying or working from home.

And don’t forget: if you stream anything or have a TV set, a UK TV license is compulsory.

My BT bill was £32 but I paid for high-speed internet as I often worked from home with my partner. Our TV license bill was £13 a month.

So, before you even unpack, make sure to compare broadband deals and packages that suit your needs. There’s usually a good deal to be had if you dig a little.

Energy Bills: Keeping the Home Fires Burning

You’ve paid the rent—now it’s time to keep the lights on. Many Londoners pay separate gas and electricity bills, but combining these can be both easier and cheaper.

Believe me, dual fuel tariffs are worth considering.

A monthly commitment of about £240 for both gas and electricity is a good ballpark figure to keep in mind.

This does depend on the energy rating of your house so be sure to check into this before you buy that beautiful old house that costs a fortune to heat.

How to reduce the cost of living in London?

Living in London on a budget can be done. I’ve been there and done it, starting on a 25k salary right through to a 60k salary.

Unfortunately, living costs are on the rise and there are always fixed bills that you can’t get out of.

For example, you always have to pay council tax and your energy bills, but there are other ways to keep costs down.

Here are 10 ways I used to help me spread the cost of living:

- Use budgeting apps or money-saving apps

- Look for discounts

- Sign up for Cashback apps

- Home or outdoor workouts

- Walk more and reduce public transport

- Batch cook meals

- Savvy shopping in Lidl and Aldi

- Buy unbranded goods and clothes

- Flat sharing in furnished accommodation

- Ride a bike

Student accomodation costs in London

Student accomodation costs vary from £150-300 a week depending on the area, quality of the student halls and space required.

This is somewhat lower than the average London flat share which is currently sitting at around £800-1000 for a single room.

Should you opt out and go for a one bedroom flat this increases again depending on which borough you go for.

Is London expensive?

Yes, London is one of the most expensive cities in the world, and when compared to the rest of the UK the only city that comes close to the cost of living in London is Edinburgh or Manchester.

House prices and everyday items are much higher, but salaries also match this, with the average wage in London being 25% higher than in the rest of the UK average, according to City AM.

If you add up your monthly cost of living in London, then it can price a lot of people out, but it is more than possible to live in London and enjoy it. It’ll just hurt your wallet along the way.

FAQs

What is a good salary in London?

If you’re single, then a decent salary to live in London is between £35,000-£45,000. This salary will allow you to have a comfortable property and enjoy the occasional luxury or night out.

You will likely need to avoid trying to live in central London, where the annual average cost of living is much higher, but if you are smart and live in the suburbs, your daily expenses can be pretty affordable.

How much rent do Londoners pay?

The average rental price sits at £1,863 for a two bedroom house in London.

Renting rates are higher in the capital as higher property prices make it harder for Londoners to get onto the property ladder.

Londoners are spending more on rent than in other cities, with up to 40% of their monthly wage going towards rent

Can I live in London on 30k a year?

Yes, you can live in London on a 30k salary but you will most likely need to live in a property share and conduct a monthly budget to ensure you cover costs.

At this salary level, your income tax will be lower as you’re not in the higher tax bracket.

Living in the suburbs of London makes it slightly cheaper and being a savvy shopper will help lower your outgoing but it is more than possible to live in London on this salary.

Is London cheaper than New York?

Yes, London is cheaper than New York but not by much.

It’s said that London is just 2% cheaper than new york when you put the cost of living vs. average salary.

Although in general the UK is paid less than their American cousins but we don’t have to pay large premiums on health insurance.

What is a middle class salary in London?

A middle-class salary in London is anything over 50k.

This is simply the number it takes to live relatively comfortably in a decent area and still be able to afford a few luxuries each month.

Final Thoughts - Average Cost Of Living In London

So, we’ve established that the cost of living in London is higher than in all other places in the UK. However, if you manage your money, it’s more than possible to get by.

Overall your monthly rent will be your most significant cost, followed closely by council tax, so if you’re wise about where you live, you can keep to a monthly budget!

That being said, if you want to save and invest your money but are on an average wage, then London isn’t the best place to live.

My London budget and monthly expenses changed a lot over the years as energy prices rose and average rents increased, but luckily so did my salary, so I could offset this by increasing my income.

The UK capital is beautiful, but boy, is it an expensive city!

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.