Quickfire Roundup:

Nutmeg is an online investment platform based in the UK that helps people grow their money by investing it in a mix of assets like stocks and bonds.

It’s designed to be super user-friendly, so even if you’re new to investing, you can set up an account, choose how much risk you’re comfortable with, and

Nutmeg will handle the rest – investing your money in a way that aims to get you the best returns for your chosen level of risk. They offer different types of accounts, including ISAs and pensions, to fit various financial goals.

Nutmeg is a safe and regulated financial services company in the U.K. and has one of the best reputations in the business. Those looking to simplify their investment portfolio and reduce fees will generally find Nutmeg to be one of the best options available.

In this Nutmeg review we’re going to dive into the company, their offering, products, customer sentiment and most importantly is Nutmeg worth it?

Nutmeg Rating

- Useful Features

- User Experience

- Suitable For Beginners

- Customer Service

- Price / Fees

- Customer Feedback

I’ve rated Nutmeg 4 out of 5 which is on par with it’s main competitors in Moneyfarm and Wealthify.

Nutmeg scored best on its useful features and user experience 4.5 stars and scored lowest on it’s customer feedback at 3 stars.

That being said, Nutmeg has a lot of great features which I believe will be useful for some people so with this in mind we’re happy to review the app in more detail.

Nutmeg Pros & Cons

Pros

- Leading robo-advisor owned by JP Morgan

- Excellent set up options for beginners

- Smooth and easy-to-use mobile app and desktop version

- 10 portfolio options to choose from

- ISAs, pension and general investment account options

Cons

- £500 first deposit required to open an account

- Fees are slightly higher than its direct competitors

- No relief on fees for increasing investment account size

Table of Contents

Nutmeg Review - Company Overview

Nutmeg was originally founded in 2011 by Nick Hungerford and William Todd. Although the firm was initially labelled a hit fintech startup, it has yet to turn a profit.

It has been considered an overall success, though, boasting over 80,000 customers and generally receiving rave reviews. In 2021 Nutmeg was purchased by New York-based investment bank JP Morgan for an undisclosed amount.

Nutmeg’s Clear and Straightforward Approach

Perhaps Nutmeg’s biggest strength is its clear and straightforward approach to investing. The user experience is very easy to understand and navigate.

It is not designed for the savvy investors who want to day trade stocks or options but geared towards the long-term investor who just wants to pick some stocks or EFTs / funds and let them grow for the long term.

There are a lot of funds to choose from, but the tools Nutmeg has makes it easy for users to educate themselves and pick the best funds for their own goals.

Nutmeg Investment Accounts

When you set up your Nutmeg investment account, you will have five different account options.

These include:

General Investment Account (GIA): A basic account with no special tax advantages. Offers flexibility in investment amounts and withdrawals, but subject to taxes on gains and income.

Stocks and Shares ISA: A tax-efficient account for UK residents, allowing investments in stocks, bonds, and funds without paying income or capital gains tax. Annual contribution limit of £20,000.

Lifetime Stocks and Shares ISA: Aimed at first-time homebuyers or retirement savers. Includes a 25% government bonus on contributions, but has restrictions on withdrawals and penalties for non-qualified withdrawals.

Junior Stocks and Shares ISA: A tax-advantaged savings account for children under 18, with money locked until the child turns 18. Parents or guardians can contribute up to an annual limit.

Pension (SIPP): A pension account allowing individuals more control over investments. Contributions are eligible for income tax relief, but there are annual limits and restrictions on accessing funds before a certain age (currently 55, subject to change).

This comprehensive range of options makes Nutmeg a versatile investment platform, appealing for its flexibility and the simplicity in setting up these accounts.

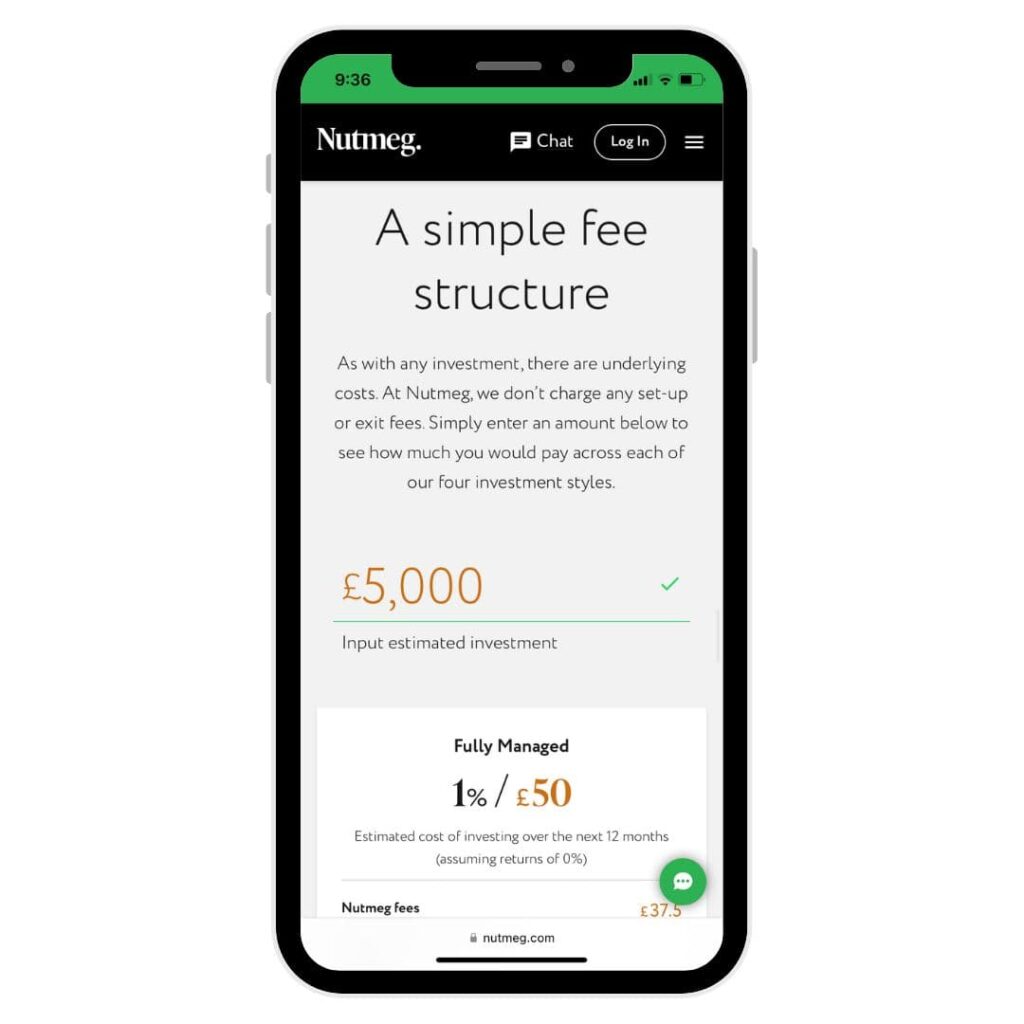

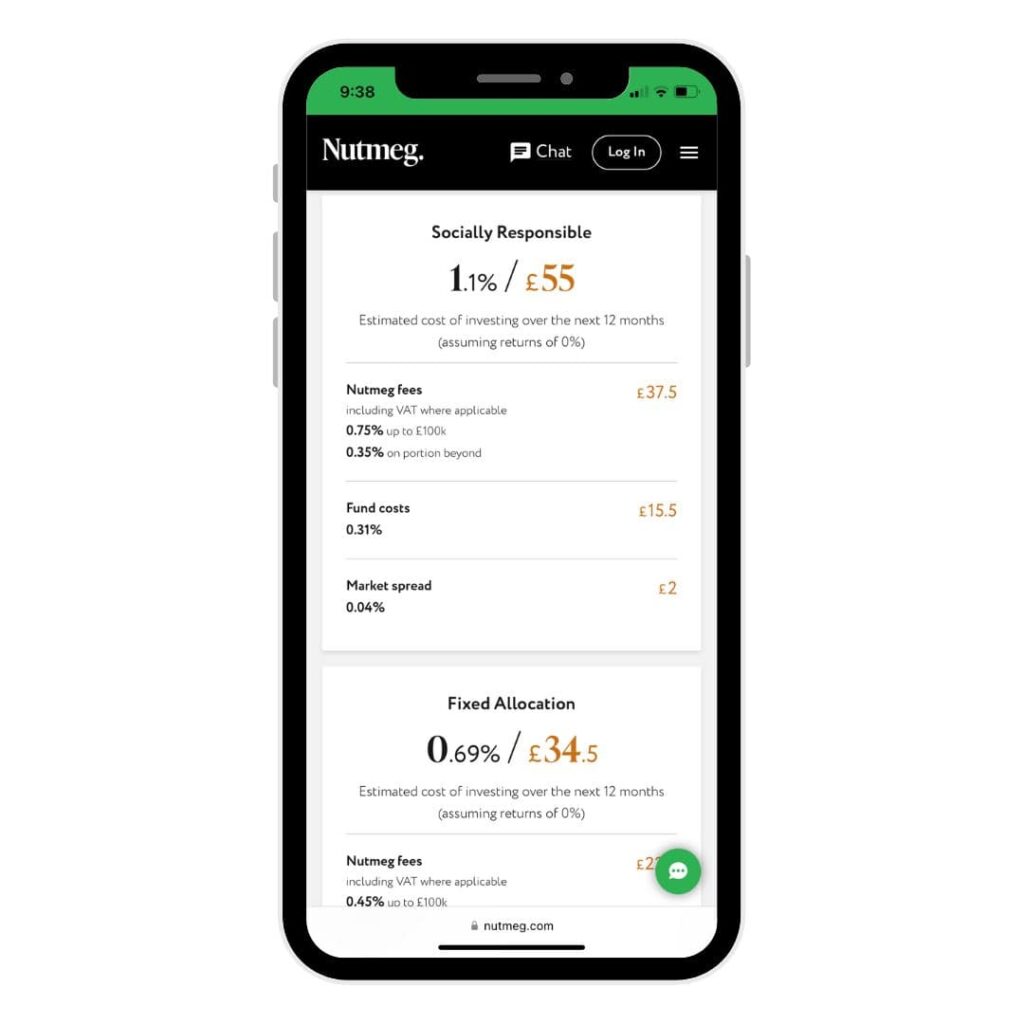

Nutmeg Fees

Nutmeg hangs its hat on offering low fees, and we must say that they do not disappoint there.

- The fees vary with portfolio type and start off with the Fixed Allocation charging .45% on the first 100k and .35% above that with an additional fund cost of .17%

- The Fully Managed and Smart Alpha charge .75% on the first 100k and .35 above that with a .19% fund fee.

- The Socially Responsible portfolio does get a little pricy at .75% on the first 100k, .35% after that and a .31% fund fee. But compared to the industry as a whole, that is still very reasonable.

All of the funds get charged a .07 market spread, which is essentially the commission on any trades, and for all but the Smart Alpha portfolio, will probably happen quite infrequently.

Nutmeg portfolio types

Nutmeg offers four distinct investment styles, catering to different investment preferences and goals:

Nutmegs Fully Managed Portfolio:

- Nutmeg’s experts actively manage your investments.

- Portfolio is regularly reviewed and adjusted based on news, data, and market analysis.

- Suitable for investors who prefer human expertise in managing their investments.

Nutmegs Smart Alpha Portfolio:

- Aimed at outperforming the market, Smart Alpha seeks ‘alpha’ or excess returns over the market.

- Managed using strategies developed by J.P. Morgan’s global research team.

- Investments are frequently adjusted based on market conditions.

- Higher fees compared to other options due to active management.

Nutmegs Fixed Allocation Portfolio:

- Similar to Fully Managed, but investment decisions and rebalancing are made by algorithms.

- Human experts select ETFs, while technology decides when to make changes.

- Cost-effective option due to reliance on automation.

- Ideal for those who prefer a hands-off investment approach and lower fees.

Nutmegs Socially Responsible Portfolio:

- Investments are made exclusively in environmentally and socially responsible businesses.

- Avoids industries such as fossil fuels and tobacco which have negative environmental or societal impacts.

- Managed by human experts and periodically rebalanced to optimize performance.

- Note: While Nutmeg offers this option, it is part of J.P. Morgan Chase, which is known to invest in fossil fuels.

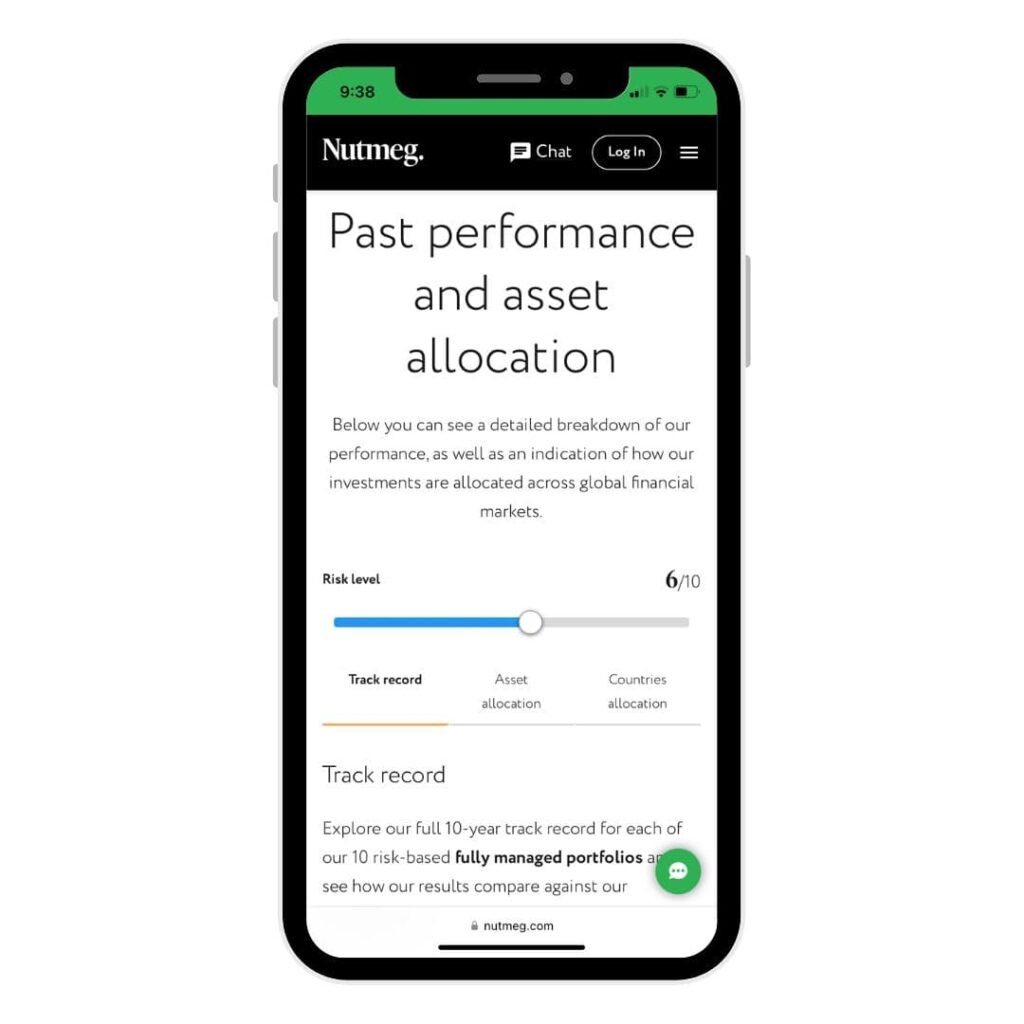

Each investment style comes with different levels of risk, ranging from 1-10, with 10 being the most risky.

Typically, higher risk is associated with potentially higher rewards but also more volatility, while lower risk options tend to have steadier, but often lower returns. All dividends are automatically reinvested, and Nutmeg employs Modern Portfolio Theory to optimise asset selection.

In addition to the investment styles, Nutmeg provides a robo-advisor service for investors who value simplicity and low fees. This service is suitable for those looking for a set-and-forget investment approach.

When selecting an investment style, it’s essential to consider your financial goals, risk tolerance, and preference for active or passive management.

Nutmeg Risk Assessment

Once you choose your portfolio and account type, Nutmeg asks a series of questions that, along with data such as your age, attempts to assess your personal risk level.

Based on a score of 1 to 10, you are then assigned a personal risk level and ETFs are chosen based on your assessment and choice of portfolio type.

Everything seems very cookie cutter, but in this case, we do not see that as a negative.

Nutmeg is clearly geared towards the beginner investor who values simplicity and does not want to spend the time to learn all there is to know about finance or investments.

What is the Nutmeg minimum investment?

Nutmeg has a minimum investment of £500 for GIAs, ISAs and SIPPs (pensions). You can, however start a Lifetime ISA for as little as £100.

When you compare this with similar brands like Wealthify they are a lot more expensive but I think they want to make sure you are serious about your account before getting started.

How safe is Nutmeg?

Investing with Nutmeg is perfectly safe. Nutmeg is authorised to operate in the U.K. by the Financial Conduct Authority, which means the company must follow all U.K. regulations.

When you invest in Nutmeg, your assets are protected by the Financial Services Compensation Scheme (FSCS). FSCS protection means your account balance is protected in the event that Nutmeg, or now JP Morgan goes bankrupt.

Goal Setting

Nutmeg has a very well laid out, yet simple, goal planning section in the app that will help users stay on track while making the best investment decisions for their goals and personal situation.

The goal-setting feature shows how different asset allocation models will change the hypothetical returns over longer periods of time.

We like how simple it is to use, how it very clearly shows the power of long-term investing and how even small increases in monthly contributions add up to an enormous difference in net worth later in life.

Nutmeg Review - Customer Service

Every page on the website has a customer service option at the top, signalling to customers that a human representative is always available, at least during regular business hours.

Customers can contact representatives via phone, email or an in-app chat feature.

The industry as a whole has faced some scrutiny for a lack of customer service offered to investors, especially novice investors.

The issue came to a head in 2021 with the Robinhood debacle, and it appears Nutmeg has successfully separated itself and is making sure its customers have reasonable access to customer service representatives.

One last feature we noticed on their website that shows Nutmeg’s commitment to customer service is that investors even have the option to meet with an advisor in person at Nutmeg’s London office.

We are not sure how easy it is to actually schedule but were impressed with this feature and have not seen anything like it on any of the other online investing platforms.

Nutmeg Alternatives

The key competitors to Nutmeg are the other two major robo-advisors in the UK. These are Wealthify and Moneyfarm which we have reviews on.

Moneyfarm vs Nutmeg or check out our Wealthify Advisor Review.

What are the customers saying?

This wouldn’t be a Nutmeg review if we didn’t check out what customers and press are saying about the company. This normally gives the best insight into a company and its practices.

Nutmeg’s Trustpilot reviews are what you would expect for a company of this size and nature with a 3.9 out of 5.

When we looked down the 1-star reviews that it has received they’re mostly from customers who have lost money since the end of 2021 into early 2022 where as we know the entire stock market has entered a bear market.

With that in mind I’d be discounting those and just reading some of the more positive reviews you get a sense that they’re doing a pretty damn good job.

There has been some negative press lately about them not posting a profit but for me that is understandable after how the market has performed in 2022.

Educational Resources

Nutmeg offers a huge selection of educational resources for its users. They have a suite of simple yet powerful predictive tools that will show how users can increase their future net worth by making even small adjustments now.

The real gem of their educational resources is their blog, titled Nutmegonomics.

They have dozens of articles on a variety of topics from investing, the economy, news, and even sections on the engineering behind Nutmeg, Brexit and the psychology behind investment gains and losses.

Novice retail investors who do wish to become expert investors will find an abundance or resources to get started, from simple to some fairly advanced topics.

Another educational feature we especially love is they have an entire section on their website titled the Investment Jargon Buster. Again, very on brand for Nutmeg and it is essentially a glossary of several hundred investment terms.

As Up the Gains is all about breaking down finance in a way that is easy to understand we love the fact Nutmeg is embracing education alongside their investment products.

The more people are on the site the more they invest and believe in the product so increasing our knowledge increases the money we may potentially hold with them.

Third Party Links

Nutmeg also has a section on their website titled Wills, Life Insurance and Mortgages. There is fairly limited information on the section, and mainly offers affiliate links to an online mortgage broker, life insurance provider and estate planner.

Nutmeg users get a discount from all three and overall like the feature since Nutmeg users are clearly interested in getting their financial houses in order, and it’s a good way for Nutmeg to earn a little extra revenue in order to keep their promise of keeping fees low.

FAQs

Can I trust Nutmeg?

Yes, Nutmeg can be trusted and is regulated by FCA. It is also protected by FSCS (financial services compensations scheme) up to the value of £85,000.

This means your money is protected should Nutmeg ever go bust.

The Nutmeg platform also has high level banking style security to login.

Is Nutmeg any good?

Yes, Nutmeg is good option to consider and the awards that it has won means that it is trusted by the industry too.

What I would say is that their fees are higher but their products are fantastic and brilliant for beginner investors who are serious about investing for the long term.

Is Nutmeg better than Wealthify?

Nutmeg has a superior offering with more choice and account options.

Wealthify works out cheaper than Nutmeg and allows you to open an account for £1.

It is a close one to call as different providers will suit certain individuals.

How to contact Nutmeg?

You can get in touch with Nutmeg’s customer support team, which is located in London, through various channels. If you prefer to talk on the phone, dial 020 3598 1515 from Monday to Thursday between 09:00-17:30, or on Friday between 09:00-16:30.

Nutmeg also offers a live chat feature during the same hours. For those already using Nutmeg, there’s an in-app messaging option called Nutmail you can use once you’re logged into your account.

Alternatively, if you have any questions or need assistance, you can send an email to [email protected].

How to close a Nutmeg account?

To close your Nutmeg account, follow these steps:

-

Login to your Account: Log in to your Nutmeg account through their website or app.

-

Withdraw Funds: Before closing your account, you’ll need to withdraw any funds you have invested. Go to the account you want to close, and submit a request to withdraw all of your funds.

-

Contact Customer Support: Once you have withdrawn your funds, contact Nutmeg’s customer support to inform them that you would like to close your account. You can do this by:

- Phone: Call them on 020 3598 1515 (Monday to Thursday 09:00-17:30, Friday 09:00-16:30 UK time).

- Email: Send an email stating your desire to close the account.

- Live Chat: Use the live chat feature on their website during customer service hours.

- Nutmail: If you are logged in, you can use the Nutmail function to send a message requesting account closure.

-

Follow Instructions: Customer support may provide you with further instructions or ask you for additional information to verify your identity. Follow their instructions to complete the account closure process.

Please note that closing an investment account can have tax implications or penalties, especially if it is an ISA or pension account.

How do I withdraw money from Nutmeg?

Withdrawing money from Nutmeg is relatively straightforward. Here’s how you can do it:

Log In: Start by logging into your Nutmeg account via the website or their mobile app.

Select Account: Once you’re logged in, go to the dashboard and select the account you want to withdraw money from.

Withdraw Funds: Look for an option that says “Withdraw” or “Withdraw Funds.” This could be under a menu titled ‘Payments & Transfers’ or similar. Click on it.

Enter Amount: Enter the amount you wish to withdraw. Be sure to check if there are any minimum withdrawal amounts or fees associated with withdrawing funds.

Confirm Bank Details: You’ll likely be asked to confirm the bank account to which the funds should be sent. If you haven’t already linked a bank account, you may need to do this first.

Submit Request: After confirming the amount and bank details, submit your withdrawal request.

Wait for Processing: Withdrawals might not be instant and could take several days to process. This is partly because Nutmeg might need to sell assets to free up cash for your withdrawal.

Final Thoughts

Overall throughout this Nutmeg review it’s been clear we were impressed with Nutmeg’s business model, website and execution.

They promise simple, easy and effective tools and resources and they definitely deliver. Their market is the opposite of the typical Robinhood user and is not really suitable for the short term investor.

They are geared towards investors who want to set up their accounts and let time work its magic. Their fees are reasonable, they offer an adequate selection of funds and without a doubt keep things simple and easy.

I wouldn’t worry too deeply about them not posting a profit.

Majority owners JP Morgan have deep pockets and want to expand their retail investing capabilities so I would be confident of them making a profit in the not so distant future once the markets return to its former glory days.

We hope you enjoyed our Nutmeg review and do let us know your thoughts in the comments below.

More like this

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.