Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

I really like the way Wealthify operate.

Their whole ethos is to keep things simple for new investors, providing a suite of investing products, including the Wealthify Stocks and Shares ISA, alongside Junior ISAs, general investment accounts and personal pensions.

Wealthify classify as a robo-advisor and ask you a series of questions when you join to help tailor the right portfolio for you. For beginners it’s hard to find a better platform.

Their model is not for those interested in individual stock picking. This is for those who just want a reliable platform that takes care of things for them.

Popular robo-advisor with 5 expert-managed portfolios tailored to your investing style.

- No minimum investment - portfolios start at £1

- Engaging app and user experience

- Charge a flat rate - keeping fees simple

- Not for those who want to pick individual stocks

Wealthify applies a standard fee of 0.60%, and considering the fund charges, the total typically comes to approximately 0.76% of the fund value for traditional plans and about 1.3% for socially responsible plans.

This pricing places them in line with the majority of other automated investment service providers.

In this Wealthify review, I’ll unpack whether or not it’s the right option for your money alongside the pros and cons, main features, fees and everything else you need to to know!

Wealthify Ratings

- Suitable For Beginners

- Useful Features

- Price / Fees

- Customer Service

- Customer Feedback

- User Experience

I’ve rated Wealthify 4.54 out of 5, which is an excellent score for an investing app and is the highest score we have on Up the Gains.

Wealthify scored best on its suitability for beginners with 5 stars and scored lowest on it’s user experience which scored 4.2.

If you’ve heard enough then head over to the Wealthify website to open an account just below or if you want to read on. Let’s unpack the app!

Popular robo-advisor with 5 expert-managed portfolios tailored to your investing style.

- No minimum investment - portfolios start at £1

- Engaging app and user experience

- Charge a flat rate - keeping fees simple

- Not for those who want to pick individual stocks

Table of Contents

Pros & Cons

Pros

- Backed by Aviva, a trusted household name

- Regulated by the FCA and covered by the FSCS

- Up to £85,000 of investments are covered by FSCS in case of company closure

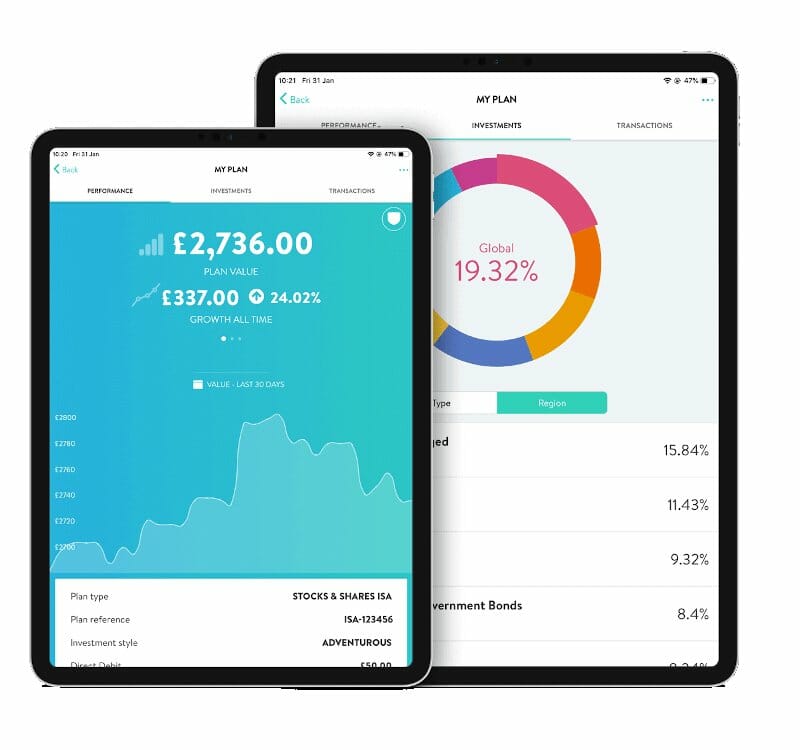

- User-friendly app for checking and tracking portfolio performance

- Desktop version available for a larger screen display

- Wealthify takes a straightforward approach to fees with a flat rate charge

Cons

- Not ideal for experienced investors who want more control and individual stock picking

- Lack of choice in investment plans

- Wealthify offers ethical investment plans, but with higher fees

- Higher fees may discourage investors from pursuing ethical investment options

- It's not going to be the right fit for everyone

Wealthify Review - Company Overview

Wealthify first launched back in 2016 and has since gone on to win numerous awards.

In 2018, the insurance giant Aviva acquired a stake in Wealthify. By June 2020, Wealthify was fully owned by Aviva.

While keeping its independent status, it’s reassuring to know that such a well-known brand is in the background.

Wealthify are owned by

Investing with Wealthify can be done confidently, knowing that it is regulated by the Financial Conduct Authority (FCA). It is also covered by the Financial Services Compensation Scheme (FSCS). So, yes Wealthify is safe.

Is Wealthify good for beginners?

Wealthify makes things simple which means it’s perfect for beginners.

Wealthify has been acknowledged with a “Highly Commended” distinction at the 2019 Moneyfacts Consumer Awards, earned a “Best Buy” accolade from Boring Money in 2022, and bagged the titles for “Best Junior ISA” and “Best Investment ISA” at the Personal Finance Awards.

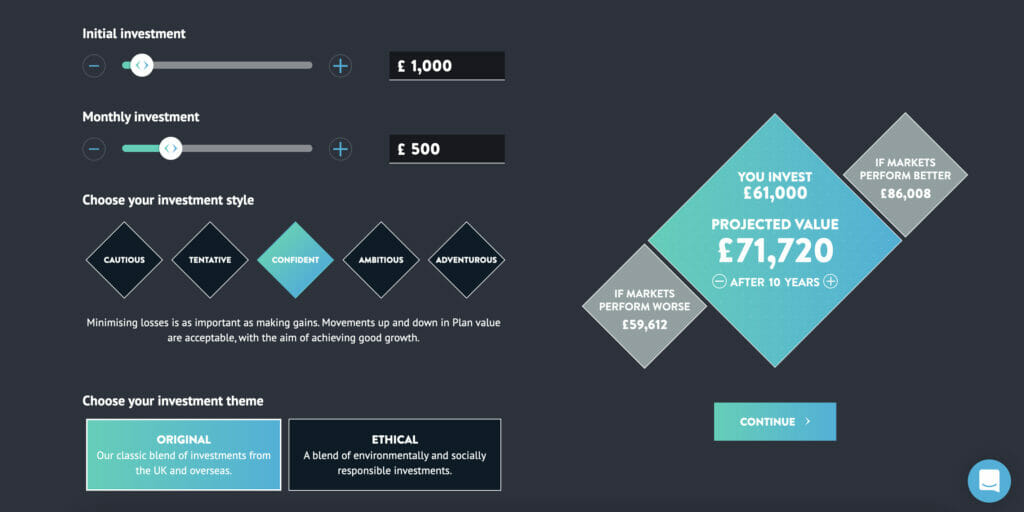

An investment plan is created based on your answers to a suitability questionnaire when you open your account, and these answers allow Wealthify to establish your attitude toward risk.

Their AI smart algorithms then assess your answers advising on the best strategy for you.

You as the customer then have the pick of an original or ethical plan. There’s two options to choose from and that’s it. Super simple, and effective providing a managed experience for its customers.

Your portfolio is managed by complex algorithms which monitor how it’s performing.

What’s interesting here, though, is that there is always the possibility of human intervention if needed.

That’s because, alongside the automated process, Wealthify also has a team of experts monitoring portfolios. These experts are able to use their experience to tweak portfolios and therefore your investment strategy as and when required.

Having this human element, alongside the technology, certainly brings increased levels of confidence when it comes to investing with Wealthify.

Types of Accounts - Wealthify ISA Review

It’s important to know what types of accounts are on offer.

Wealthify offers four options for you to choose from, and regardless of your choice, you’ll find that your funds are primarily invested in things such as Exchange Traded Funds (ETFs) and Mutual Funds.

The exact make-up of your portfolio and investment style will be tailored depending on your appetite for risk.

So, with that being said, let’s take a look at the ways that investing with Wealthify is possible:

Wealthify Stocks and Shares ISA Review

Another way of investing with Wealthify is to explore its stocks and shares ISA.

Being able to offer these types of accounts means that Wealthify is an attractive proposition to a wide range of investors looking to make the most of their tax-free allowance.

I like that there’s a low barrier to getting started as the minimum investment is set at just £1. It’s important to get as many people as possible investing.

However, unlike with a General Investment Account, there is a cap on how much you can invest each year.

The current ISA Allowance is set at £20,000 per year. So, if you plan on investing lower than this in oen year, you have nothing to worry about.

While the investing experience is the same as the one you’d have with a General Investment Account, with an ISA you pay no capital gains tax or any tax on dividends.

That is exactly why a stocks and shares ISA is essential to own.

Popular robo-advisor with 5 expert-managed portfolios tailored to your investing style.

- No minimum investment - portfolios start at £1

- Engaging app and user experience

- Charge a flat rate - keeping fees simple

- Not for those who want to pick individual stocks

Junior stocks and shares ISA

If you have children, stopping and thinking about their financial future can often be worrying.

Being able to give them a slight boost and a helping hand is something that all parents would like to do but they have perhaps always thought that it was unachievable. That’s where Junior ISAs come in.

With a Junior ISA, you can invest up to £9,000 annually. You’re able to open separate accounts for each of your children, but each child can only have a single account.

Again, you can get started by investing just £1, and every penny that gets paid into the account belongs to your child. They just can’t access the money until they turn 18.

As recently as 2020, it won the Best Junior ISA at the Personal Finance Awards.

General Investment Account

GIA accounts are simple to set up and are a great way to start investing with Wealthify. They are not the same as ISA accounts though.

You get started with as little as £1, and you can invest as much as you like: there is no limit here like there is with the Wealthify ISAs.

The downside with a General Investment Account with Wealthify is that, just as with these types of accounts anywhere else, you’re going to have to deal with the possibility of being taxed.

If you’re earning more than £12,300 from your investments, then capital gains tax comes into play. These numbers are staying the same for 2022/23 as they have for the past financial year.

If you’re benefiting from more than £2,000 worth of dividends a year, you’ll also find that you’ll be taxed on this.

When you look at the potential taxation, it could make sense to opt for the an ISA.

A General Investment Account is an excellent option if you’ve already exceeded your tax-free ISA allowance for the year, but if you haven’t, depending on your situation, it could make sense to go down this route.

Please consult Wealthify before deciding which investment account is suitable for you.

Ethical investing at it's best

While investing with Wealthify, you can opt to choose to do so in a way that is better for the world as a whole.

By opting for an ethical plan, you can be sure that your funds aren’t going into companies that are involved with the likes of tobacco, deforestation, or gambling. Instead, funds are invested into ESG (environmental, social, and governance) companies.

I think this is something that sets Wealthify apart against many of the other competitors in the industry.

It helps attract new investors that have an ethical or ESG mindset and installs trust in the brand as a whole.

Popular robo-advisor with 5 expert-managed portfolios tailored to your investing style.

- No minimum investment - portfolios start at £1

- Engaging app and user experience

- Charge a flat rate - keeping fees simple

- Not for those who want to pick individual stocks

Wealthify Pension Review

While the thought of retirement may seem a lifetime away, the reality is that it’s never too early to start planning. The Wealthify pension option is easy to set up, and you then get to have a say in how your money will be invested.

You can choose from the same options as you can with investment products which is original and ethical.

You can see a pie chart like graphic to show you where your money is going.

I personally really like the Wealthify pension calculator. You can populate your expected retirement date, investment amount and the type of investor you want to be.

You can also transfer your old workplace pensions into your Wealthify personal pension.

Opening an account?

Investing with Wealthify is easy to get started and you can open a Wealthify account with as little as £1 (or £50 if you’re opening a pension).

This entry-level is much lower than that offered by the likes of Nutmeg and Moneyfarm.

Once you’re signed up, it’s time to start building your portfolio. As soon as you’ve chosen the type of account that you want, you’re taken to a ‘Create Your Plan’ page.

This is an extremely easy process and it’s here where Wealthify asks questions to consider your attitude toward risk.

Something that really sets Wealthify apart from other robo-advisers is the fact that it will actually decline some people if it believes that investing just isn’t suitable for a person.

Wealthify Fees

Wealthify offer a flat fee of 0.6%, no matter how much or how little you invest. This makes it very simple for beginners investors to understand.

This approach means that Wealthify is one of the cheapest, in terms of fees, robo-adviser for anyone investing £20,000 or less.

The 0.6% isn’t overly competitive when you start to invest more than £100,000 as other providers like Moneyfarm offer reductions the bigger your account is.

Just as you’d find with any other provider, there are other fees alongside the portfolio management one.

With Wealthify, these tend to be no higher than 0.16%. However, if you choose an ethical plan, the fees increase to around 0.76%.

This means all in you’re looking at 0.76% for standard plans and around 1.3% for ethical plans.

I think anything over 50k in your account and you should be shopping around for lower fees or moving your money into a self managed platform.

Popular robo-advisor with 5 expert-managed portfolios tailored to your investing style.

- No minimum investment - portfolios start at £1

- Engaging app and user experience

- Charge a flat rate - keeping fees simple

- Not for those who want to pick individual stocks

Wealthify alternatives

Wealthify vs Nutmeg

Based on portfolio performance Wealthify performed better than Nutmeg on 4 out of 5 of the risk brackets with only the cautious portfolio underperforming over the past five years.

Wealthify and Nutmeg are similar in that they are both UK-based investment management companies that offer online investment platforms, managed portfolios, and ethical investment options.

However, they differ in their fee structures, investment strategies, and user interfaces, so investors should compare and evaluate each company based on their individual needs and preferences.

Wealthify vs Moneyfarm

Wealthify customer reviews

Wealthify Trustpilot reviews are currently 4.2 out of 5 from a total of 1912 reviews. This is a respectable score and ranks them higher than competitors Nutmeg and Moneyfarm.

When I looked at the 5 star reviews Wealthify has a number of comments about it’s ease of use and customer service.

To keep things fair I looked at the 2 and 1 star reviews for comparison and the main comments were around performance but when you compare this to overall stock market performance in the last two years Wealthify has done pretty well.

Sarah Kingdom – Excellent Service

User friendly – so simple and well presented, also live chat assistance was prompt and efficient.

Kelly – I joined Wealthify around 7 months ago

I joined Wealthify around 7 months ago and the service has been brilliant and their incentives are great. I spoke with Liam in their customer service team today regarding a query I had and he assured me everything I needed to know. Would recommend this company highly and have so to friends already!

FAQs

Is Wealthify any good?

Whether or not Wealthify is a good investment company depends on individual circumstances and preferences. Wealthify has several advantages, including being backed by a big name brand, regulated by the FCA, and offering a straightforward approach to fees.

However, it may not be the best option for experienced investors who want more control over their investments, or for those who are looking for low-cost ethical investment options.

Overall, Wealthify is a good choice for beginner investors who want a hands-off approach to investing and a user-friendly app for tracking their portfolio performance.

Can Wealthify be trusted?

Yes, Wealthify can be trusted it is FCA regulated and your money is FSCS protected up to the value of £85,000.

The award winning app is owned by Aviva and offers quality investment accounts for it’s users.

How many people use Wealthify?

Wealthify has over 31,000 users at this current time. It’s still one of the smaller investment brokers in the UK but has a good reputation and solid customer reviews.

Can I buy shares on Wealthify?

You cannot buy individual shares via Wealthify. They offer two investment options which include standard and ethical. These funds are then adapted to suit the risk tolerance of the individual.

So, technically yes you can buy shares but they are part of a fund.

Does Wealthify invest for you?

Yes, Wealthify invests for its clients by managing their portfolios and making investment decisions on their behalf based on their chosen investment plan and risk tolerance.

Should you wish to change your risk tolerance you can do so in the app or by speaking to one of the Wealthify team.

How to close a Wealthify account?

To close a Wealthify account, investors need to log in to their account, navigate to the settings page, and select the “Close my account” option.

They may be required to sell any remaining investments and withdraw any funds before closing the account. It’s also recommended to contact Wealthify’s customer service team to ensure that the account closure process is completed properly.

Conclusion

I’ve given Wealthify a 4.54/5 and is every bit an award-winning robo-advisor product.

If you’re a beginner looking to enjoy hands-off investing with a trustworthy partner, then I think you could do a lot worse than investing with Wealthify.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.