Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Turning £10,000 into £100,000 is a journey that blends astute investments with entrepreneurial grit.

By spreading your funds across a mix of investment vehicles such as stocks, REITs, and index funds, and channelling your passions into launching ventures like online businesses or podcasts, you can steadily build wealth.

A keen eye on market trends, dedicated effort in nurturing your ventures, and the patience to allow your investments to compound are vital.

It’s crucial to approach this goal with a long-term mindset and be prepared to adapt and learn along the way. Remember, diversification is key to managing risks, and consistency can be a powerful ally in wealth creation.

Are you sitting on £10,000 and dreaming of turning it into £100,000?

Well, this journey requires patience, skill, and a knack for smart investing.

I remember turning £100 into a £1,000 and I said to myself now it’s time to get to the 100k. I applied many of the same principles and combined some of the things on this list to get there.

Let’s explore the strategies that could potentially guide you to that elusive six-figure sum.

Table of Contents

How to Turn £10k Into 100k?

Once I had learnt to turn £100 into a £1000 I quickly applied the same principles to turn 10k into 100k.

This allowed me to start to flourish and my money was working for me in different areas and spaces.

Learning how to make 10k a month is like breaking some sort of psychological barrier but then once you get there you start looking towards 100k.

Here are 18 ways to turn 10k into 100k – not all of them will be for you but you’ll find some in there that you can work with.

Let’s get into it!

Invest in Yourself

- Expected Earnings: Varies significantly.

- Difficulty: Medium to High.

- Length of Time: 2-10 years.

Reasoning:

Investing in yourself means empowering yourself with knowledge and skills that can lead to enhanced earning potential. It could be through formal education, attending workshops, online courses, or even reading books.

What makes this investment fruitful is that it not only enhances your skill set but also increases your value in the job market. The more skilled you are, the more opportunities you have in terms of career choices and negotiation power.

Moreover, investing in yourself can have a profound impact on your personal growth and self-confidence. It can help you discover new interests or hobbies that can eventually turn into income sources.

For example, learning a new language could lead to opportunities in translation or international business. It’s an investment that continues to pay dividends throughout your life.

To Put It Into Practice:

- Assess your current skills and identify areas you want to improve or learn.

- Allocate a portion of your £10,000 to enroll in courses, attend conferences, or buy books and resources.

- Apply the new skills in your career, or explore new career paths or entrepreneurial ventures that align with your new skills.

Start a Business

- Expected Earnings: Highly variable; can exceed £100,000.

- Difficulty: High.

- Length of Time: 5-10 years.

Reasoning:

Starting a small business is one of the most dynamic ways to multiply your investment. It gives you control over your financial future. However, it’s also one of the riskiest.

The success of your business can depend on various factors including the market demand, your dedication, and sometimes the sheer timing and luck.

Businesses can provide exponential growth in earnings compared to a salaried job. For instance, if you create a product or service that becomes popular, your earnings can surpass any traditional investment in terms of ROI (Return on Investment).

However, it’s important to understand that with higher rewards come higher risks. Many businesses fail within the first few years. A strong business plan, market research, and financial planning are essential.

Sometimes it also requires you to wear different hats, from being a salesperson to handling customer support, especially at the beginning.

Having your own business is still a fantastic way to build wealth on your initial investment just be ready for what it it’ll take to get it right!

To Put It Into Practice:

- Research to find a lucrative niche or industry; validate the market demand.

- Create a detailed business plan and budget; allocate your £10,000 strategically.

- Consider legal requirements, such as licenses and permits. Start marketing and offering your product/service to the public.

Invest in Small Businesses

- Expected Earnings: Varies, could exceed £100,000.

- Difficulty: Medium.

- Length of Time: 3-10 years.

Reasoning:

Investing in small businesses or startups can be an effective way to grow your money. When you invest in a small business, you’re putting your funds into a venture in exchange for equity or a percentage of the business’s profits.

This can be highly lucrative, especially if the business scales and becomes successful. Being a part of a successful growth story can exponentially multiply your investment.

However, this is also fraught with risk. Many small businesses fail, and when they do, investors can lose all or part of their investment so don’t put all your eggs in one basket.

Therefore, it’s critical to conduct thorough due diligence. Understanding the business model, the market, the founders, and the financials are key.

Check out some of the best books for small businesses here.

To Put It Into Practice:

- Explore platforms like SeedInvest, Kickstarter, or Angel List for potential investment opportunities.

- Thoroughly vet the businesses and founders. Look for a solid business plan, a scalable model, and a defined target market.

- Diversify your investment across multiple businesses to spread the risk.

Start an Online Business

- Expected Earnings: Varies greatly; some can earn thousands to millions per year.

- Difficulty: Medium to High.

- Length of Time: 1-5 years.

Reasoning:

Starting an online business offers endless possibilities, from e-commerce to online consulting. With a starting capital of £10,000, you have the flexibility to invest in inventory, marketing, or software tools that can help scale your business.

Running an online business requires commitment, effort, and skill in various areas including marketing, customer service, and possibly supply chain management. It’s essential to research your chosen industry and market thoroughly.

That being said, having your own business that runs from your laptop is pretty cool and should you get it right it gives you options to travel and work at the same time.

To Put It Into Practice:

- Identify a product or service that meets a specific demand.

- Set up your online platform using website builders like Shopify, WordPress, or Wix.

- Develop a marketing strategy to acquire customers and focus on providing excellent customer service.

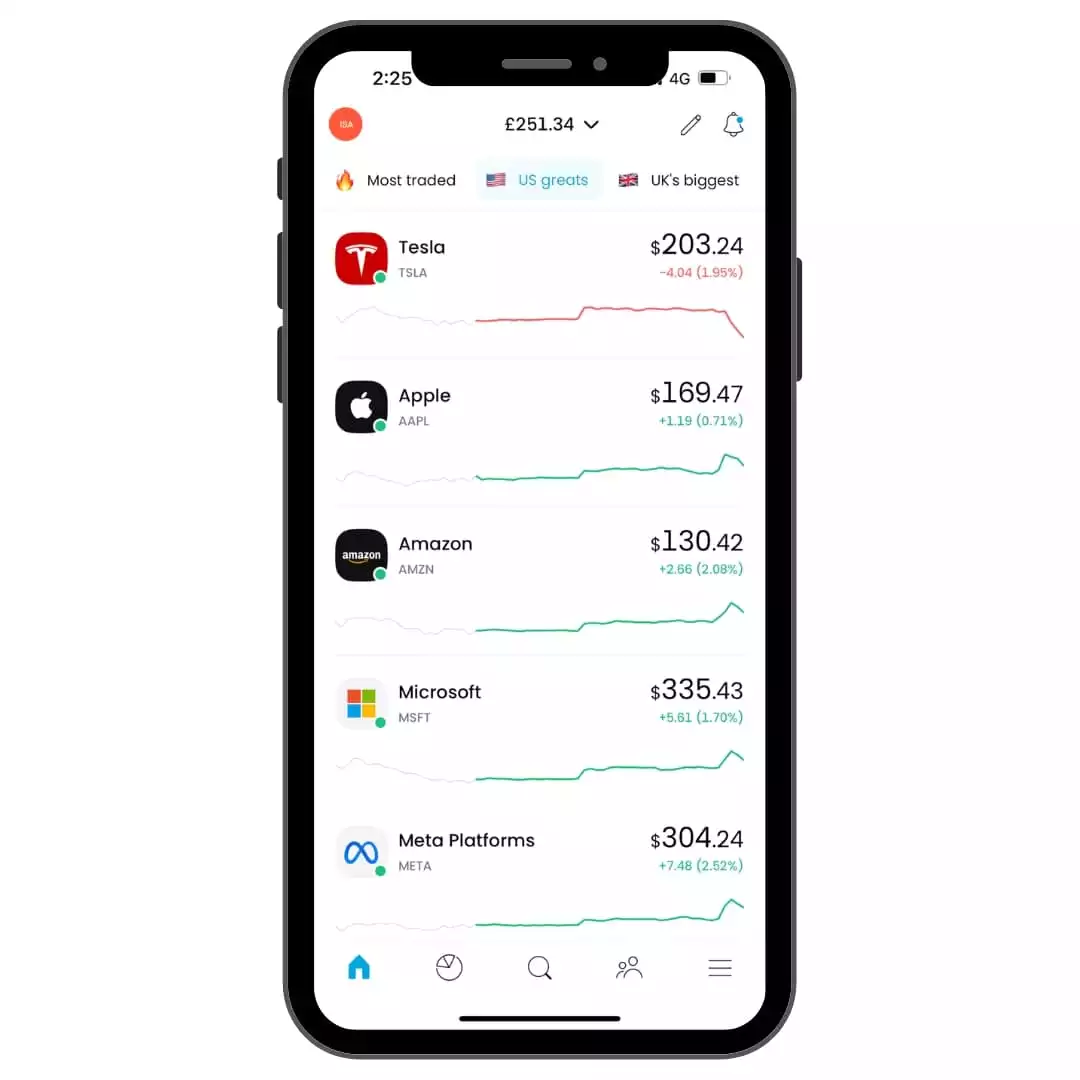

Invest in Stocks

- Expected Earnings: Varies widely; average is around 7% – 10% annually.

- Difficulty: Medium to High.

- Length of Time: 5-10 years.

Reasoning:

Investing in stocks can be a lucrative way to build wealth. With £10,000, you have enough capital to diversify across several promising stocks. It’s essential to research companies thoroughly and understand the risks involved in stock investing.

Be aware that the stock market can be volatile, and it’s important not to invest money that you cannot afford to lose. Diversification, a long-term perspective, and avoiding impulsive decisions are key to successful stock investing.

You can go for blue-chip investment options, dividend stocks or risky investments in upcoming companies.

Most dividend-paying stocks provide stable income potential alongside their performance so coupled with a smart long-term investment strategy you can really make use of them!

There is also the opportunity to invest in IPOs (initial public offering) which is where you invest in a business that’s just about to go live on the stock market but really you just want to follow the basics.

As you can see there are lots of different strategies but stock investing is one of the best ways to turn 10k into 100k. Just remember the risks involved.

To Put It Into Practice:

- Open a brokerage account.

- Research and choose stocks of companies with solid fundamentals, or consider low-cost index funds for diversification.

- Invest your £10,000 and avoid making impulsive trades based on market fluctuations.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Invest in Index Funds

- Expected Earnings: Average annual return of 7-9%.

- Difficulty: Low.

- Length of Time: 15-25 years.

Reasoning:

Index funds are mutual funds that replicate the performance of a major market index, such as the S&P 500. They’re considered a low-cost and lower-risk way to invest in the stock market.

Unlike actively managed funds, index funds are passive investments, which generally come with lower fees.

Since you’re essentially investing in a small portion of an entire index, it’s inherently diversified, reducing the risk significantly compared to investing in individual stocks.

It’s important to note that while index funds are lower risk compared to individual stocks, they are not risk-free. Market fluctuations can affect returns.

However, historically, the stock market has trended upwards, and index funds allow you to harness this long-term trend.

To Put It Into Practice:

- Open an account with a brokerage that offers a wide selection of index funds. – Check out the Best Fund Platforms here.

- Research different index funds, taking into account their tracking index, fees, and historical performance.

- Invest your £10,000 in one or more index funds and consider setting up regular contributions to take advantage of dollar-cost averaging.

Buy and Hold Real Estate

- Expected Earnings: £30,000 – £100,000+.

- Difficulty: Medium to High.

- Length of Time: 5-20 years.

Reasoning:

Property is a classic investment avenue for wealth creation. The buy-and-hold strategy involves purchasing a property and holding onto it for an extended period until its value appreciates.

Besides appreciation, if you rent out the property, it can also generate a steady stream of income and cash flow. This dual benefit of appreciation and rental income makes it a powerful investment tool.

However, a rental property requires substantial management and understanding. Factors like location, property type, market trends, and tenant management are critical.

There’s also the aspect of handling maintenance, taxes, and possibly dealing with periods when the property isn’t rented. Also, unlike stocks or bonds, real estate is not liquid, and selling a property can take time.

Real estate investing isn’t for the faint-hearted but I believe that combined with stock market investing is one of the best ways to generate income.

Obviously, there are upfront costs but you can look to a financial advisor or property investing professional to help find good deals!

To Put It Into Practice:

- Research different markets to find an area with good growth potential.

- Use your £10,000 as a down payment to secure a mortgage for the property.

- If renting out, price it competitively and vet tenants thoroughly. Keep a reserve fund for maintenance and other expenses.

Invest in REITs

- Expected Earnings: 4% – 12% annually.

- Difficulty: Low to Medium.

- Length of Time: 5-10 years.

Reasoning:

Real Estate Investment Trusts (REITs) are companies that own or finance income-producing real estate in various property sectors.

They are known for paying high dividends, and they offer the opportunity to invest in real estate without having to buy property. With £10,000, you can diversify your investment across different REITs.

While REITs can be a solid investment, they are not without risks. They can be affected by the overall health of the economy, interest rates, and the real estate market. Diversification within your REIT investment and a long-term perspective are key.

To Put It Into Practice:

- Research various REITs that focus on different sectors, such as retail, residential, or healthcare properties.

- Diversify your £10,000 investment across multiple REITs to spread risk.

- Reinvest dividends to compound your investment over time.

Engage in Affiliate Marketing

- Expected Earnings: Varies; can range from a few hundred to thousands of pounds per month.

- Difficulty: Medium.

- Length of Time: 2-5 years.

Reasoning:

Affiliate marketing involves partnering with companies to promote their products or services online and earning a commission for sales or leads generated through your referral.

It’s an attractive way to generate passive income, especially if you have a knack for marketing and a good online presence.

With £10,000, you can invest in building a high-quality website, advertising, and content creation, which can significantly speed up the process of establishing your affiliate marketing presence.

However, affiliate marketing can be competitive. It requires consistent effort in content creation, SEO, and understanding your audience.

Choosing the right niche and products to promote is essential, as is building trust with your audience.

You can get started with some of the best affiliate companies in the UK that have multiple partners to chose from in 100s of different niches.

To Put It Into Practice:

- Choose a niche you are knowledgeable and passionate about.

- Sign up for affiliate programs related to your niche.

- Promote the products/services through a blog, social media, or other platforms. Use part of your £10,000 for high-quality content and advertising.

Start a Blog

- Expected Earnings: £0 to £10,000+ per month.

- Difficulty: Medium.

- Length of Time: 1-5 years.

Reasoning:

Starting a blog can be a fulfilling and potentially lucrative endeavour. By sharing your knowledge and insights on a particular topic, you can attract an audience and monetise through ads, sponsored content, or affiliate marketing.

Your £10,000 can be allocated toward premium hosting, a unique domain, marketing, and possibly content creation.

However, blogging is a marathon, not a sprint. It takes time to build an audience and start earning significant income. The niche you choose, the quality of your content, and your marketing efforts play a critical role in your blogging success.

You will need skills in SEO, graphic design, web design and marketing but fear not – I learnt everything I needed from YouTube.

One of my websites which is 18 months old is making a monthly blog profit of £5k!

It’s more than possible to make 10k a month though in 24-36 months you just need to keep building content and building your traffic.

To Put It Into Practice:

- Choose a niche you are passionate about.

- Set up your blog with a reputable hosting service, and invest in a unique domain and professional design.

- Consistently create high-quality content and promote your blog through social media and SEO strategies.

Start Dropshipping

- Expected Earnings: £10,000 – £50,000 in the first year.

- Difficulty: Medium.

- Length of Time: 2-5 years.

Reasoning:

Dropshipping is a retail business model where the store doesn’t keep the products it sells in stock. Instead, when a product is sold, it purchases the item from a third party and has it shipped directly to the customer.

This model significantly reduces the capital requirements for inventory, making it accessible for someone with £10,000 to start a reasonably scaled operation.

However, dropshipping can be challenging due to slim margins, shipping complexities, and competition.

Choosing a niche with the right balance of demand and competition is essential. Customer service also plays a vital role, as shipping times and product quality are out of your direct control.

To Put It Into Practice:

- Research to find a profitable product niche with low competition.

- Find reliable suppliers through platforms like AliExpress or Oberlo.

- Create an online store using platforms like Shopify, and use your funds for branding, website optimisation, and advertising.

Use Peer to Peer Lending

- Expected Earnings: 3% – 8% annually.

- Difficulty: Low to Medium.

- Length of Time: 2-5 years.

Reasoning:

Peer-to-peer lending involves lending your money to individuals or small businesses online. Platforms like Funding Circle or LendingClub act as intermediaries that match lenders with borrowers.

This can be an attractive way to earn higher interest than what’s typically offered by savings accounts.

However, there are risks associated with peer-to-peer lending, including the risk of default by borrowers. It’s essential to understand the platform’s criteria for creditworthiness and diversify across different risk levels.

This isn’t as passive as putting money in a savings account; active management and understanding are required but a lot of people consider P2P lending to be a form of passive income.

To Put It Into Practice:

- Choose a reputable peer-to-peer lending platform.

- Diversify your £10,000 across multiple loans with varying degrees of risk.

- Monitor your investments regularly and reinvest the returns.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

Start a YouTube Channel

- Expected Earnings: Varies greatly; some channels earn thousands or even millions per year.

- Difficulty: Medium to High.

- Length of Time: 1-5 years.

Reasoning:

YouTube is a platform where creativity can translate into earnings. Starting a YouTube channel about a topic you’re passionate about can eventually lead to substantial income through ads, sponsorships, and merchandise.

Your initial £10,000 can be used for high-quality equipment, editing software, and perhaps marketing to gain initial traction.

However, building a successful YouTube channel requires consistent effort, creativity, and patience. It’s a crowded platform, and standing out takes time and dedication. Monetising a YouTube channel also requires meeting certain criteria including a minimum number of subscribers and view hours.

To Put It Into Practice:

- Choose a niche that you are passionate about and that has an audience.

- Invest in good equipment and create high-quality content consistently.

- Engage with your audience, and once eligible, monetise through ads, sponsorships, and merchandise.

Sell Digital Products

- Expected Earnings: £100 to £10,000+ per month.

- Difficulty: Medium.

- Length of Time: 6 months to 3 years.

Reasoning:

Selling digital products, like e-books, courses, or software, can be a great way to make money with relatively low overhead costs. With £10,000, you can invest in creating high-quality content, marketing, and an efficient sales funnel.

Keep in mind that the digital product space can be competitive. Therefore, it’s essential to find a niche where you can offer unique value. Also, customer feedback is vital; be prepared to continually improve your products based on feedback.

To Put It Into Practice:

- Identify a niche where you have expertise or can offer unique value.

- Create high-quality digital products and set up an online store or use platforms like Udemy for courses.

- Market your products through social media, email marketing, and other channels.

Start an Etsy Store

- Expected Earnings: £100 to £10,000+ per month.

- Difficulty: Medium.

- Length of Time: 1-3 years.

Reasoning:

If you’re creative and enjoy crafting, opening an Etsy store could be a perfect way to turn your passion into profits. Etsy is known for unique and handmade items. With £10,000, you can invest in materials, equipment, and marketing to set your store apart.

However, success on Etsy requires more than just crafting skills. You must also be adept at pricing, customer service, and marketing. Standing out on Etsy can be challenging due to the large number of sellers, so having a unique product or niche is crucial.

To Put It Into Practice:

- Identify a unique product or niche that you are passionate about.

- Set up your Etsy store and create high-quality product listings with detailed descriptions and images.

- Invest in marketing, especially social media, and consider running promotions to attract initial customers.

Invest in Wine

- Expected Earnings: 6% – 15% annually.

- Difficulty: Medium to High.

- Length of Time: 5-10 years.

Reasoning:

Investing in fine wine can be a unique and potentially lucrative way to diversify your investment portfolio.

The value of fine wine can appreciate over time, especially as it becomes rarer and matures. With £10,000, you can invest in several high-quality wines or even a wine fund.

However, wine investing is not without its complexities. It requires a deep understanding of wine varieties, vintages, and market trends.

Proper storage is crucial to maintain the wine’s quality, which can entail additional costs but there are companies out there that do this for you.

To Put It Into Practice:

- Educate yourself about the wine market, including different regions, varieties, and what makes a wine valuable.

- Consider starting by investing in a wine fund or buying bottles of fine wine with a track record of appreciating in value.

- Ensure you have access to proper storage facilities or consider using professional wine storage services.

Launch a Podcast

- Expected Earnings: £0 to £5,000+ per episode.

- Difficulty: Medium.

- Length of Time: 1-4 years.

Reasoning:

Podcasting can be a powerful way to build an audience and earn income through sponsorships, ads, and merchandise.

If you have expertise or passion in a particular field, you can create content that resonates with a specific audience. Your initial £10,000 can be invested in high-quality recording equipment, editing software, and marketing.

However, like many content-based endeavours, podcasting is not a get-rich-quick scheme.

Building an audience takes time, and learning how to monetise a podcast can be challenging initially. Consistency, quality, and networking are vital for success.

If you’re interested check out ‘The Money Gains Podcast’ which is our weekly podcast all about investing, side hustling, entrepreneurship and more.

To Put It Into Practice:

- Choose a niche or topic you are passionate about and plan your podcast episodes.

- Invest in quality recording equipment and software.

- Publish consistently and promote your podcast through social media and networking with other podcasters.

Use a High Yield Savings Account

- Expected Earnings: Around 3-5% annually.

- Difficulty: Very Low.

- Length of Time: This is more for preservation than growth; expect many years.

Reasoning:

For those who are very risk-averse, using a high-yield savings account like a fixed Cash ISA can be an option.

While the returns are very low compared to other investment avenues, your capital is safe and typically insured up to a certain limit. This can be a place to park your emergency fund or money you can’t afford to put at risk.

Remember, with current interest rates, you won’t likely reach your goal of turning £10,000 into £100,000 through a savings account alone in any reasonable timeframe.

To Put It Into Practice:

- Research different banks and financial institutions for the best high-yield savings account rates.

- Open an account and deposit your £10,000.

- Regularly check if better interest rates are available elsewhere.

More like this

FAQs

How Can I Get Rich Off 10K?

To turn £10,000 into substantial wealth, unleash the power of compound interest by investing in a mix of assets like stocks and real estate, and amplify your earnings by launching a side hustle or online business, all while keeping a disciplined approach and a long-term perspective on wealth creation.

Is 10k good for investing?

£10,000 is an excellent starting point for investing. This amount allows for meaningful diversification across asset classes including stocks, bonds, real estate, or even alternative investments like cryptocurrencies.

The ability to spread investments helps in mitigating risks. Additionally, with £10,000, one can consider launching small-scale entrepreneurial ventures, or invest in specialised investment vehicles like REITs.

Utilising a mix of traditional and alternative investment approaches, and maintaining a disciplined and well-researched strategy, can pave the way for sustained growth and wealth accumulation.

How can I turn 10k into more money?

To turn £10,000 into a larger sum, consider investing in a well-diversified portfolio, which might include stocks, ETFs, or real estate. Additionally, thinking entrepreneurially can pay dividends; explore creating an online business or side hustle to generate extra income.

As your investments and income streams develop, reinvest the profits to capitalise on the power of compounding. Throughout this process, maintain a long-term perspective, regularly educate yourself, and make data-driven decisions.

How Can I Turn £10k Into £100k Passively?

Turning £10k into £100k passively primarily involves making investments that don’t require constant attention or effort. Placing the funds into index funds or ETFs that track the overall market or specific sectors can be an effective way to capitalise on market growth over time.

Another option is investing in real estate through REITs, which allows for exposure to the property market without the hassle of managing properties.

It’s important to have a long-term perspective, as passive investments typically take time to grow significantly and to diversify to lower your risk.

How to Turn 10k into 100k in 1 year?

To turn 10k into 100k in just one year is a highly ambitious goal that involves taking significant risks. Engaging in speculative trading in stocks or cryptocurrencies could yield high returns, but it’s essential to be well-informed and prepared for potential losses.

Launching a high-demand business, product, or service, and scaling it rapidly through effective marketing and sales strategies can also be a route to such growth.

Leveraging skills in high-paying freelance or consulting gigs can accumulate capital which can then be aggressively invested.

It’s crucial to approach this with caution, as high returns in a short time frame generally come with high risks, and there is no guaranteed success.

What is the best way to turn £10k into £100k?

The best way to turn £10,000 into £100,000 involves a combination of smart investments and entrepreneurial efforts. First, allocate a portion of the funds into a diversified investment portfolio that includes stocks, ETFs, and potentially alternative assets like cryptocurrencies.

Parallelly, utilise a part of the capital to start a business or side hustle, focusing on areas where you have the expertise or identifying high-demand niches.

Continuously reinvest the profits back into the business and your investment portfolio. This approach, coupled with dedication, continuous learning, and a long-term perspective, can significantly increase the chances of multiplying your initial capital.

Conclusion

To turn 10k into 100k it’ll require a combination of strategic investments, entrepreneurial ventures, and a long-term perspective.

By diversifying your portfolio across stocks, real estate, index funds, and alternative investments, you can maximise your earning potential.

Simultaneously, pursuing entrepreneurial endeavours such as starting an online business, selling digital products, or investing in rental property can provide additional income streams.

It’s essential to conduct thorough research, stay informed, and be patient as wealth accumulation takes time. Remember to adapt to changing market conditions, manage risks through diversification, and seek professional advice when necessary.

With dedication, calculated risks, and a proactive mindset, transforming £10,000 into £100,000 is an attainable financial goal.

Further Reading

For further reading on wealth creation and investment strategies, consider the following resources:

“The Intelligent Investor” by Benjamin Graham – This timeless classic offers valuable insights into value investing and building a successful investment portfolio.

“Rich Dad Poor Dad” by Robert Kiyosaki – A popular personal finance book that challenges traditional beliefs about wealth and provides practical advice on building financial independence.

“The Millionaire Next Door” by Thomas J. Stanley and William D. Danko – This book delves into the habits and characteristics of self-made millionaires, providing valuable lessons on wealth accumulation and financial success.

Financial websites and blogs – Explore reputable financial websites such as Investopedia, The Motley Fool, and Forbes for up-to-date articles, expert advice, and market insights.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.