Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Are you wondering how to turn £500 into £5000? Start by investing in low-cost index funds or ETFs for long-term growth potential.

Invest in yourself through education or starting a small business. Engage in retail arbitrage or side hustles to leverage market opportunities. Additionally, consider odd jobs or selling online courses to boost your income.

While it requires effort and smart decision-making, the potential to multiply your initial investment makes it worth exploring further. Read on to discover detailed insights and practical steps to turn your £500 into £5000.

Turning £500 into £5000 may seem like a daunting task, but with the right strategies and a determined mindset, it’s entirely possible.

In this article, we will explore 13 profitable ways in which I leverage myself to achieve this financial milestone. Each strategy will include expected earnings, difficulty level, time to create, reasoning, and three practical steps for you to put into practice.

Table of Contents

How To Turn £500 into £5000?

My own financial freedom journey started when I was googling terms like this. Unfortunately back then the information that was out there was limited.

I believe it’s vital to make your money work for you and so start investing in ways to increase your income so you can have choices later in life.

Starting businesses allows me to grow my income and if I’m not in profits within six months then I know that business either needs to be binned or needed more than £500 to get going.

Escaping the rat race is something that was hugely important to me and turning £500 into £5000 is actually a big step on that journey.

Start a Business

- Expected Earnings: Varies based on the business model and industry; potential for substantial profits.

- Difficulty: Medium to high, requires thorough planning, execution, and dedication.

- Time to Create: Several months to a year, depending on the business type and market entry.

Starting your own business allows you to leverage your skills, passions, and entrepreneurial spirit to generate income.

By identifying a profitable niche, developing a solid business plan, and executing effective marketing strategies, you can achieve significant earnings.

Whether it’s a service-based business, e-commerce venture, or innovative startup, the potential for growth and financial success is within reach. Remember you may need the £500 as an initial investment for start-up costs and initial marketing.

I personally believe this is the big one. If you can get your own business right you have the opportunity to 10x your earnings a year.

That being said, small side hustle businesses have been incredible for me too. You don’t need to be the next Elon Musk to make money from a small business.

Resources: Top 10 Books For Small Business Owners.

To Put It Into Practice:

Identify a viable business idea by conducting market research, analysing customer needs, and evaluating the competition.

Create a comprehensive business plan that outlines your target market, marketing strategies, financial projections, and operations.

Secure necessary funding through self-financing, loans, or investors. Launch your business, continuously adapt to market dynamics, and provide exceptional products or services to customers.

Affiliate Marketing

- Expected Earnings: £100 to £5000 or more per month, depending on the niche, product selection, and marketing efforts.

- Difficulty: Low to medium, requires an understanding of online marketing, content creation, and affiliate networks.

- Time to Create: A few weeks to a few months, depending on your learning curve and the growth of your affiliate network.

Affiliate marketing allows you to earn commissions by promoting other companies products or services. By joining affiliate programs, creating valuable content, and driving traffic to your affiliate links, you can generate passive income.

The key is to focus on a niche that aligns with your interests and has a strong demand, ensuring higher conversion rates and earnings.

Essentially you can return 100-fold on your original investment if you get it right making and for me, affiliate marketing is one of the best ways to invest your time.

To Put It Into Practice:

Choose a profitable niche and research affiliate programs in that area.

Build an online platform such as a website, blog, or social media presence to attract an audience interested in your niche.

Create valuable content that includes affiliate links and drive targeted traffic to your platform. Monitor your campaigns, optimise your strategies, and continuously seek new opportunities to increase your earnings.

Selling Digital Products

- Expected Earnings: Varies widely based on the type of product, pricing strategy, and marketing efforts; potential for significant profits.

- Difficulty: Medium, requires creating high-quality digital products and implementing effective marketing strategies.

- Time to Create: Several weeks to a few months until you earn money

Selling digital products allows you to leverage your expertise, creativity, and knowledge to generate income.

Whether it’s e-books, online courses, templates, graphics, or software, digital products have a low production cost and can be sold repeatedly.

With effective marketing, you can reach a global audience and establish yourself as an authority in your niche.

I have two main digital products on Up the Gains an ebook and a budgeting spreadsheet. They were made once, updated every now and then but sold 100s of times.

To Put It Into Practice:

Identify a profitable niche and research the demand for digital products in that area.

Create high-quality digital products that provide value and solve a problem for your target audience.

Set up an online platform to sell your products, such as a website or dedicated marketplace. Implement marketing strategies to drive traffic, attract customers, and maximize sales. Continuously update and improve your digital products based on customer feedback and market trends.

Start a Blog

- Expected Earnings: Varies widely based on monetization methods and audience size; potential for earning £500 to £5000 or more per month.

- Difficulty: Medium, requires consistent content creation, audience building, and effective monetization strategies.

- Time to Create: Several weeks to several months, depending on content creation and audience growth.

Starting a blog provides an opportunity to share your knowledge, passions, and expertise while generating income.

By creating valuable and engaging content, attracting a loyal readership, and implementing monetiSation methods such as ads, sponsored content, and affiliate marketing, you can earn a steady stream of income from your blog.

The beauty of blogging is you can work from anywhere in the world. Fancy a bit of that digital nomad life then blogging is for you!

My blogging career started around 24 months ago, since then I own a blog earning over £5,000 a month and 2 others are earning a few hundred that I started in late 2022. It’s more than possible for you to do the same but word of warning before you start.

You need to understand SEO marketing, copywriting and audience growth.

To Put It Into Practice:

Choose a niche that aligns with your interests, expertise, and target audience’s needs.

Set up a blog using a user-friendly platform, and invest in a professional design and reliable hosting.

Create high-quality and valuable content on a regular basis, promote your blog through social media and other marketing channels, and implement monetization strategies to generate income.

Start a YouTube Channel

- Expected Earnings: Varies widely based on channel size, niche, and monetisation methods; potential for earning £500 to £5000 or more per month.

- Difficulty: Medium, requires video production skills, content creation, audience building, and effective monetisation strategies.

- Time to Create: Several weeks to several months, depending on content creation and audience growth.

Starting a YouTube channel allows you to showcase your creativity, expertise, and personality while building a loyal audience.

By consistently creating high-quality videos, optimising them for search visibility, attracting subscribers, and making money on YouTube comes through ads, sponsorships, and merchandise, you can earn a substantial income from your YouTube channel.

I have a very small YouTube channel but I make around £20 per video each month through the affiliate links. I firmly believe it’s all about the content because the audience growth will come with consistency.

To Put It Into Practice:

Determine your niche or area of expertise and identify your target audience.

Plan and create high-quality videos that provide value, entertainment, or information to your audience. Optimize your video titles, descriptions, and tags for search visibility.

Build your subscriber base, engage with your audience through comments and community features, and implement monetization strategies such as YouTube Partner Program, brand collaborations, and merchandise sales.

Invest in Stocks

- Expected Earnings: Varies widely based on market performance, individual stock selection, and investment duration; potential for significant returns over time.

- Difficulty: Medium to high, requires research, analysis, and understanding of stock market dynamics.

- Time to Create: Long-term investment; best results achieved over several years or decades.

Investing in stocks offers the potential for long-term capital appreciation and wealth creation.

By carefully selecting individual stocks or investing in low-cost index funds or mutual funds, you can participate in the growth of successful companies and benefit from their increasing stock prices over time.

While the stock market carries risks, with proper research and a long-term perspective, it can be a lucrative investment avenue.

I have a 5 figure stock portfolio which I have built up over a decade. With compound interest you’re pushing a snowball off a mountain that’ll grow exponentially over time.

To Put It Into Practice:

Educate yourself about the stock market, including fundamental and technical analysis techniques.

Research and analyze individual stocks or consider investing in low-cost index funds that align with your investment goals and risk tolerance.

Open an investment account, set a budget for your investments, and regularly monitor your portfolio. Consider diversification and consult with a financial advisor for guidance if needed.

Discover your financial independence with our hand-picked investing apps designed specifically for beginners - it's wealth-building simplified.

Invest in ETFs and Index Funds

- Expected Earnings: Varies based on the performance of the underlying index or market sector; historically, average returns have ranged from 7% to 10% annually.

- Difficulty: Low, as ETFs and index funds offer diversified exposure to the market without the need for active management.

- Time to Create: Long-term investment; best results achieved over several years or decades.

Investing in ETFs (Exchange-Traded Funds) and index funds provides a simple and cost-effective way to gain exposure to a broad market or specific sector.

These funds pool money from multiple investors and aim to replicate the performance of a particular index.

By investing in ETFs or index funds, you can benefit from the overall market’s growth and diversification, reducing the risk associated with investing in individual stocks.

As part of my own stock portfolio I have 80% of my entire wealth in index funds and ETFs. Learning how to invest in index funds and having long term thinking can help you grow your wealth.

To Put It Into Practice:

Research and select ETFs or index funds that align with your investment objectives and risk tolerance. Look for funds with low expense ratios and a track record of consistent performance.

Open an investment account with a reputable brokerage platform that offers access to a wide range of ETFs and index funds – Check out the Best ETF Trading Platforms.

Allocate a portion of your investment capital to these funds and hold them for the long term. Regularly monitor their performance and make adjustments to your portfolio if necessary.

No buying and selling fees on their DIY portfolios for 500+ exchange-traded funds from iShares, Vanguard and Blackrock.

EXCLUSIVE OFFER - Get up to £50 BONUS when you invest your first £100 (T&C's Apply)

- One of the lowest fees on the market

- Brilliant for beginners and seasoned investors

- Fantastic customer service / 4.6/5 TrustPilot Score

- ISAs available

- Not for individual stock pickers

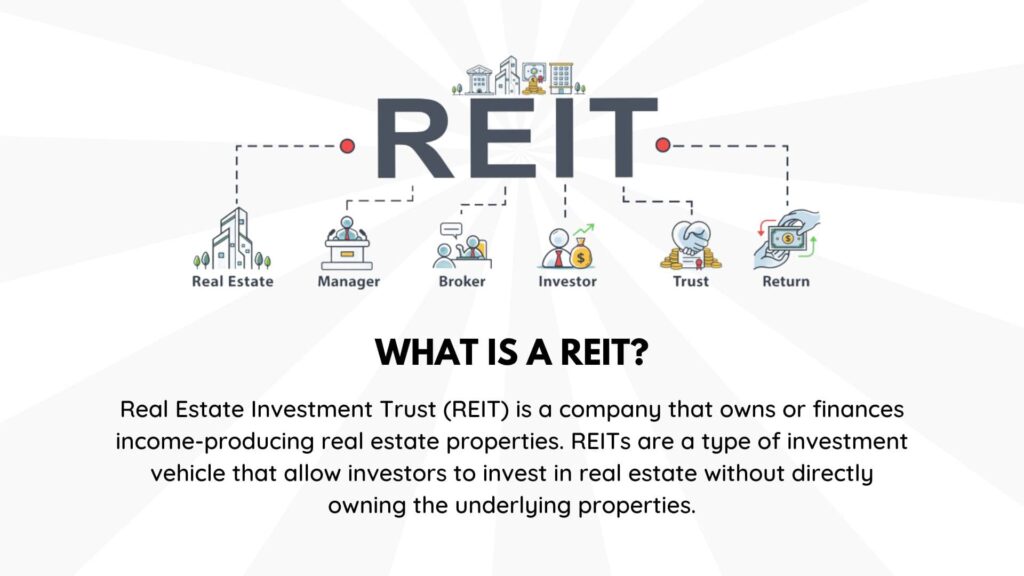

Invest in REITs or Real Estate Funds

- Expected Earnings: Varies based on the performance of the real estate market and the specific REIT or real estate fund; potential for earning regular dividends and long-term capital appreciation.

- Difficulty: Low to medium, as investing in REITs and real estate funds allows you to gain exposure to the real estate market without the need for direct property ownership.

- Time to Create: Long-term investment; best results achieved over several years.

Reasoning: Investing in REITs (Real Estate Investment Trusts) or real estate funds provides an opportunity to participate in the income and appreciation potential of real estate without the complexities of property management.

REITs and real estate funds typically invest in a diversified portfolio of properties, including residential, commercial, or industrial assets, generating rental income and potential capital gains.

To Put It Into Practice:

Research and select REITs or real estate funds that align with your investment goals and risk tolerance. Consider factors such as property types, geographical locations, and historical performance.

Open an investment account with a platform that offers access to REITs or real estate funds.

Allocate a portion of your investment capital to these funds, and monitor their performance. Reinvest dividends or consider periodic contributions to maximize long-term returns.

Start a Dropshipping Store

- Expected Earnings: Varies based on product selection, marketing efforts, and customer demand; potential for earning £500 to £5000 or more per month.

- Difficulty: HARD!

- Time to Create: Several weeks to several months, depending on product selection and store setup.

Dropshipping is an e-commerce model that allows you to sell products without the need for inventory management or shipping.

By partnering with suppliers, you can list their products on your online store and earn a profit from the difference between the wholesale and retail prices. Dropshipping offers flexibility, low startup costs, and the ability to reach a global customer base.

I personally think dropshipping is very difficult to crack. There are 100s of success stories but it’s something that everyone thinks they can do until they realise the amount of work that goes into it.

That being said successful dropshippers I know are earning millions a month. Yes, millions! But, they are pro’s at it so beware of jumping headfirst into this without researching it deeply!

Resources: Shopify’s ultimate dropshipping guide

To Put It Into Practice:

Identify a profitable niche and conduct product research to find in-demand items with reliable suppliers.

Set up an online store using an e-commerce platform, and optimize it for a smooth customer experience.

Connect with suppliers, list their products on your store, and implement effective marketing strategies to drive traffic and generate sales. Continuously monitor and improve your product offerings, customer service, and marketing efforts.

Investing in yourself

- Expected Earnings: Indirect but potentially significant impact on income potential and personal growth.

- Difficulty: Low to medium, depending on the areas of self-improvement and personal development you choose to focus on.

- Time to Create: Ongoing commitment to personal growth and skill enhancement.

Investing in yourself is a powerful and rewarding way to transform your life and unlock new opportunities. By dedicating time and resources to your personal development, you can acquire new skills, expand your knowledge, and enhance your capabilities.

This, in turn, can lead to career advancement, increased earning potential, and personal fulfilment.

I have bought multiple courses and watched countless hours on YouTube learning everything I could in order to be successful in business and the stock market.

There isn’t a day we stop learning and in fact, every failure is a lesson learnt.

To Put It Into Practice:

Set Clear Goals: Identify areas of self-improvement that align with your personal and professional aspirations.

Whether it’s improving your communication skills, learning a new language, or acquiring industry-specific certifications, define clear goals that will guide your investment in yourself.Continuous Learning: Take advantage of various learning resources available to you, such as online courses, workshops, books, podcasts, or mentorship programs.

Develop a habit of continuous learning to stay updated with the latest trends and industry developments.Seek Personal Growth Opportunities: Embrace challenges and step out of your comfort zone to grow personally and professionally.

Attend networking events, join professional associations, and engage in activities that broaden your horizons and expand your network.

Invest in Cryptocurrencies

- Expected Earnings: Highly volatile and speculative; potential for significant gains but also substantial losses.

- Difficulty: High, requires knowledge of cryptocurrency markets, technical analysis, and risk management.

- Time to Create: Ongoing investment and monitoring.

Investing in cryptocurrencies can provide substantial returns, but it comes with high risks due to the market’s volatility and unpredictability.

Cryptocurrencies like Bitcoin and Ethereum have experienced significant price increases over the years but also drop in price every now and then very quickly indeed!

It’s important to note that investing in cryptocurrencies should not be the sole strategy to turn £500 into £5000. It’s essential to diversify your investments and only allocate a small portion of your capital to cryptocurrencies.

I have a very small positions in some of the more popular cryptocurrencies but I won’t ever let this get higher than 1-2% of my entire net wealth. The risk is simply too high for me personally.

To Put It Into Practice:

Educate yourself about cryptocurrencies, blockchain technology, and the risks associated with investing in this asset class.

Select reputable cryptocurrency exchanges and create an account to buy and trade cryptocurrencies.

Develop a risk management strategy, set realistic profit targets and stop-loss levels, and regularly monitor the market. Consider consulting with a financial advisor or cryptocurrency expert for guidance.

Discover your financial independence with our hand-picked investing apps designed specifically for beginners - it's wealth-building simplified.

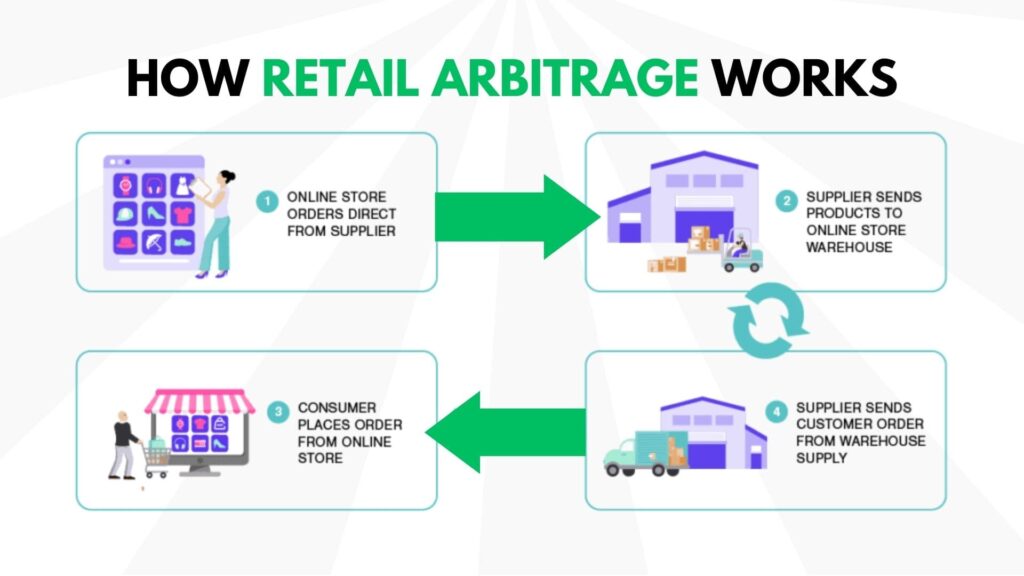

Retail Arbitrage

- Expected Earnings: Varies based on product selection, pricing strategy, and market demand; potential for earning a profitable margin.

- Difficulty: Medium, requires research, product sourcing, and effective pricing strategies.

- Time to Create: Ongoing, as you continue to identify profitable opportunities.

Retail arbitrage involves buying products at a lower price and reselling them at a higher price, taking advantage of price discrepancies between different marketplaces or retailers.

By identifying in-demand products, conducting thorough research, and leveraging online platforms, you can earn a profit by capitalising on market inefficiencies.

For example, I buy trainers like Nike air Jordans at retail prices and then resell them on Stock X once they are sold out. It’s a side hustle that’s earned me over £10,000.

Resources: Motley Fool’s Guide to Retail Arbitrage

To Put It Into Practice:

Research popular products and identify price discrepancies across different online marketplaces or retail stores.

Source products at a lower price from sources such as clearance sales, liquidation auctions, or wholesale suppliers.

Create listings on online marketplaces or set up your e-commerce store to sell the products at a higher price. Implement effective marketing strategies to attract customers and maximize sales.

FAQs

How to flip 500 fast?

Take advantage of the power of buying low and selling high. Look for undervalued items, discounted products, or limited-time deals that you can acquire for a lower price and sell for a profit.

Utilise online marketplaces, local classifieds, or social media platforms to reach potential buyers. Maximise your earnings by focusing on high-demand items or niche products.

Be proactive, do thorough research, and stay informed about market trends to identify profitable opportunities. With strategic buying and selling, you can quickly turn £500 into a higher amount by leveraging your keen eye for value and maximising your profit margins.

How Can I Invest £500?

Make the most of your £500 by diversifying your investment portfolio. Consider options such as investing in low-cost index funds or exchange-traded funds (ETFs) for broad market exposure and long-term growth potential. Explore peer-to-peer lending platforms for higher-yield opportunities.

Invest in yourself by acquiring new skills or knowledge through courses or books. Start a small business or side hustle with low start-up costs. Lastly, consider micro-investing platforms that allow you to invest small amounts regularly.

By spreading your £500 across different investment avenues, you can minimise risk, maximize potential returns, and set the foundation for long-term financial growth.

Conclusion - How to turn 500 into 5000?

Turning £500 into £5000 requires a combination of smart strategies, diligent effort, and a willingness to take calculated risks.

The ten strategies outlined in this article offer a diverse range of opportunities to achieve your financial goal. However, it’s important to remember that there are inherent risks and challenges associated with each approach.

Diversifying your investments, leveraging your skills and knowledge, and being adaptable to market dynamics will increase your chances of success.

By implementing the recommended steps and remaining committed to your goals, you can turn £500 into £5000 and take a significant step towards financial independence.

RESOURCES:

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.