Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

The average monthly savings for a single person in the UK is around £180-200 and the current average household savings are £450 per month.

This means that saving £500 a month is a good amount, in fact, it’s well above the average if you’re doing it alone and also above average for a UK household.

At this level, it can have a significant impact on your financial future if you practice consistent saving.

But where does £500 a month actually get you? Let’s dive in.

Is saving £500 a month good enough? Well, the answer to that is absolutely it is.

However, it will differ per person. For example, if you’re in the top 1% of earners £500 a month would be less than a 10th of your income so I’d say it wouldn’t be.

But, for the majority of us, £500 a month is a fantastic amount. Of course, you need to factor in your living expenses, current financial situation and long-term financial goals here but it’s a lot more than the average person will ever be able to save.

So, let’s make it count!

Table of Contents

Is Saving £500 A Month Good?

Saving £500 a month is £6,000 a year. That’s not chump change by any means and will have a huge impact on your cash savings.

If you stick at it with monthly contributions you’ll soon create a substantial savings pot.

Shopping around for good interest rates or indeed speak to a financial advisor or money coach if you’re unsure of what to do with it.

Personally, once you’ve built an emergency fund up I would be looking to invest the majority of this money so getting some solid personal finance knowledge under your belt will serve you well.

Let the latest technology help get you there with the best money savings apps.

How Fast Will £500 Grow With Interest Rate Scenarios

Let’s have a look at some interest rates and how they impact your returns over the long term.

| Years | 1% Annual Rate | 2% Annual Rate | 3% Annual Rate | 4% Annual Rate | 5% Annual Rate |

|---|---|---|---|---|---|

| 1 | £6,060 | £6,121 | £6,183 | £6,245 | £6,308 |

| 2 | £12,243 | £12,486 | £12,731 | £12,979 | £13,230 |

| 5 | £31,031 | £31,644 | £32,270 | £32,909 | £33,561 |

| 10 | £64,051 | £66,242 | £68,508 | £70,853 | £73,280 |

| 20 | £137,012 | £147,036 | £157,797 | £169,335 | £181,753 |

| 30 | £226,802 | £250,888 | £276,814 | £305,076 | £335,840 |

As you can see from this table that even a 1% increase in interest rates can massively impact what you get back over the long term.

Why, well compound interest means you earn interest on interest as your pot grows and this snowballs over time.

Why £500 a month?

So why does the figure of 12500 a month come up so often in personal finance discussions?

This sum serves as a useful benchmark for several reasons, striking a balance between being achievable and impactful.

Whether your focus is on short-term financial security or long-term financial independence, £500 a month can make a significant difference.

Let’s delve into some of the key areas where this amount can be particularly effective.

Financial Security

A steady savings habit of £500 a month can quickly add up to create a robust financial cushion.

With £6,000 saved in a year, you’ll have a considerable safety net that can help you navigate unexpected events such as job loss, car repairs, or health emergencies.

For many, this sum offers peace of mind, knowing that a sudden financial hit won’t derail their overall financial health.

Financial Goals

Setting and reaching financial goals becomes more manageable with a £500 monthly savings commitment.

Whether you’re trying to budget for a holiday, a wedding, or even starting your own business, having a concrete figure to aim for each month brings structure to your financial planning.

A consistent savings strategy can turn even the loftiest financial dreams into achievable realities.

Financial Independence

If you’re interested in the Financial Independence, Retire Early (FIRE) movement, then our FIRE calculators can demonstrate just how impactful saving £500 a month can be.

This kind of regular, substantial saving accelerates your journey towards financial independence, allowing you more freedom to live life on your terms.

Or if you want to find out more about FIRE then read our full FIRE guide.

Investing Opportunities

A monthly saving of £500 can also open doors in the investment world. With this amount, you can diversify your portfolio and explore different investment avenues.

If you’re unsure where to start, our “How To Invest £500” guide provides practical tips and strategies to maximise returns on this sum.

Get On The Property Ladder

In the UK, getting on the property ladder is often seen as a significant financial milestone.

With the average UK deposit at around £53,935, it can seem like an overwhelming target. However, saving £500 a month can dramatically ease this burden.

In just nine years, you would have enough for the average deposit, not even considering the benefit of potential interest or investment gains during that period.

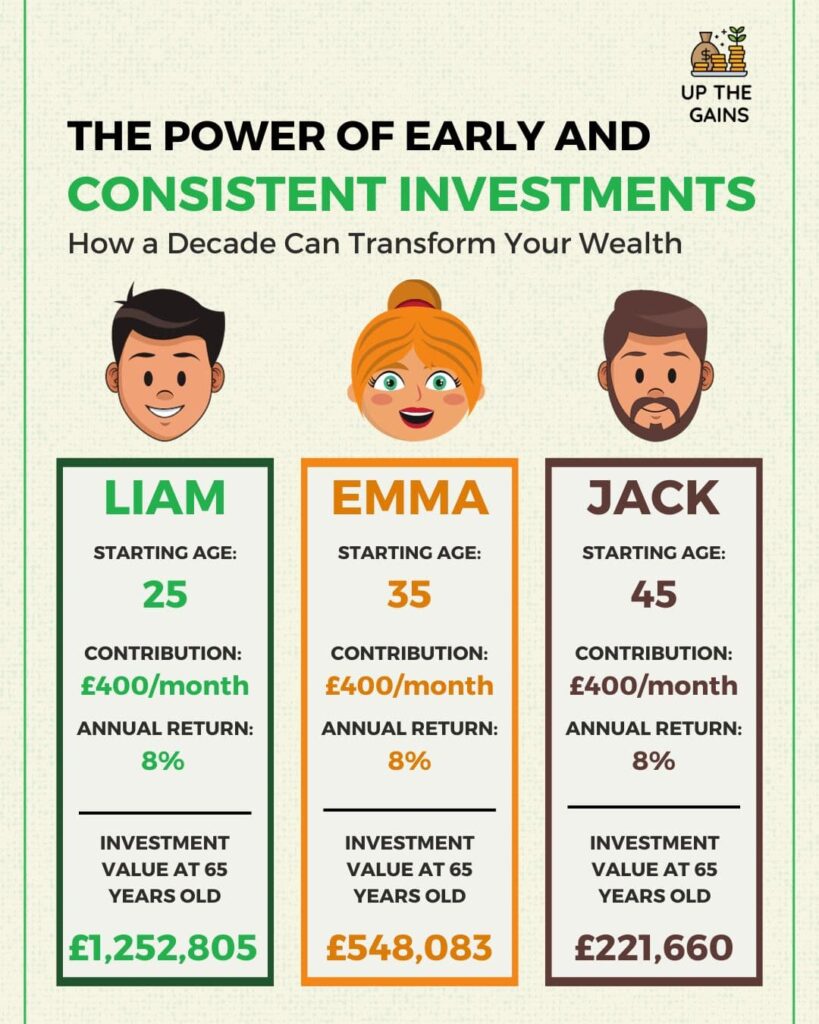

Retirement Savings

Last but not least, £500 a month can make a massive difference in your retirement savings.

Thanks to compound interest, this monthly contribution can grow into a substantial nest egg over the years.

By the time retirement rolls around, you’ll be thankful you made the monthly commitment.

Let the latest technology help get you there with the best money savings apps.

How Much Should I Save Each Month?

Determining the right amount to save each month can feel like a balancing act. Too little, and you won’t meet your financial goals; too much, and you might struggle with daily living expenses.

This crucial question doesn’t have a one-size-fits-all answer, but considering several key factors can guide you toward a saving strategy tailored to your circumstances.

In this section, we’ll explore these factors: creating a budget, establishing an emergency fund, investing, and planning for retirement.

Create a Budget to Maximise Savings

Understanding your income and expenses is the first step to determining how much you should be saving each month. A detailed household budget can act as a financial compass.

It shows you where your money is going and identifies opportunities to cut back on spending. This isn’t just about reducing your morning Starbucks, but also about making smarter choices with larger financial commitments like mortgages or car payments.

With a clearer picture of your monthly spending, you can work out a reasonable savings goal. If £500 seems too high or too low after budgeting, adjust accordingly.

You can also use our monthly budget calculator which is completely free.

Have You Got an Emergency Fund?

An emergency fund is crucial for everyone, no matter your financial situation. This fund acts as a financial safety net for unforeseen circumstances, like a sudden job loss or unexpected medical expenses.

Financial experts often recommend having at least three to six months’ worth of living expenses saved. If you don’t have an emergency fund yet, consider making this your primary focus before pursuing other financial goals.

Once you have a comfortable cushion, you can divert more funds into other saving or investment vehicles.

Are You Investing?

Investing is another significant aspect of your financial strategy and should be viewed differently than traditional savings.

While saving is about preservation and immediate availability, investing is about growing your money over time.

Thanks to the magic of compound interest, even small, regular investments can grow into a substantial sum over the years. If you’re new to investing, start small.

Soon you’ll learn how to turn that £500 into £5,000 and beyond.

You don’t have to dive into the stock market right away; many people start with low-risk options like bonds or index funds. Once you’re more comfortable and informed, you can start diversifying your investment portfolio.

What About Retirement Savings?

Retirement may seem far off, but it’s never too early to start planning. Pension schemes, particularly those that offer employer contributions, are an excellent way to prepare for your future.

If your employer matches your contributions, try to contribute enough to get the maximum employer match; it’s essentially free money.

Keep in mind that pensions are a long-term commitment and early withdrawals often come with significant penalties.

If you’re self-employed or don’t have access to an employer-sponsored pension scheme, look into setting up a personal pension.

Check out the best UK personal pensions on the market right now.

The State Of Savings In The UK

The average amount of savings in the UK differs vastly based on age group. According to savings statistics from the ONS, this is how each age group fairs:

- 18 to 24-year-olds – £2,481

- 25 to 34-year-olds – £3,544

- 35 to 44-year-olds – £5,995

- 45 to 54-year-olds – £11, 013

- 55 to 64-year-olds – £20,028

- 65 to 74-year-olds – £113, 600

So in just one year, savings £500 a month you’d have more in savings than most 18-44-year-olds!

Contextualising £500 in Various Scenarios

Let’s have a look at some scenarios that £500 a month might work by income level or job role.

High-Income Earners

If you’re earning a six-figure salary, £500 may seem like pocket change. In this bracket, it’s easy to overlook the potential of such a sum.

High-income earners often have significant financial commitments such as mortgages on larger properties, school fees, and possibly even higher levels of debt due to lifestyle inflation.

A consistent £500 saving each month offers a financial cushion and an opportunity to diversify investment portfolios.

Financial planners usually advise saving a larger portion of your income when you earn more, which could mean saving upwards of £1,500 to £2,000 per month.

Middle-Income Earners

For those bringing in an average income, £500 a month hits a sort of sweet spot. It’s an amount that’s generally achievable and can yield significant long-term results.

Life changes such as marriages, births, and career moves can all affect your financial outlook. You should regularly review your saving strategy to ensure that £500 is still the best amount for your circumstances.

Inflation and rising living costs may even prompt you to increase your monthly savings.

Low-Income Earners

If you’re on the lower end of the earning scale, £500 might seem like a lofty goal. Smaller, consistent contributions are far better than none at all.

Using a sliding scale based on a percentage rather than a fixed sum can be more achievable. Government schemes and benefits aimed at helping low-income earners can also come in handy.

The Self-Employed and Freelancers

The gig economy is booming, and if you’re part of it, savings are doubly important. £500 per month might be easy in a good month but challenging during leaner times.

A flexible saving strategy is vital. Save more than £500 in profitable months to create a buffer for the less lucrative periods.

The Over 50s

If you’re over 50 and haven’t been an avid saver, the £500 figure could serve as a wake-up call. With retirement looming, now’s the time to bolster your nest egg.

Financial tools like catch-up contributions in pension schemes can be particularly beneficial in this scenario.

Young Professionals and Millennials

Young professionals and millennials stand to benefit the most from compound interest.

While £500 might seem like a lot when you’re just starting, consider it as a long-term goal. Factor in career growth and salary increases, and it becomes a feasible target.

Conclusion

Navigating the labyrinth of personal finance can often seem daunting, but a solid savings account acts as an invaluable cornerstone.

By setting aside £500 a month, or another figure tailored to your monthly income, you’re not just saving money; you’re investing in a more secure and stable future.

From establishing a robust emergency fund to taking advantage of diverse investment opportunities, regular savings contribute significantly to long-term financial stability.

So, whether you’re just starting your savings journey or looking to fine-tune your strategy, never underestimate the transformative power of consistently saving a portion of your monthly income.

Financial stability may seem like a distant goal, but with a thoughtful approach and a disciplined saving habit, it’s well within your reach.

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.