Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

There are various things you can do with £500 but choosing to invest it is a wise decision if your finances are in order and you are willing to risk the money.

In ISAs are one of the most common places to start as you can put up to £20,000 a year into the accounts tax-free and your profits are free of capital gains tax.

If you’re starting out you’ll need a brokerage account and a solid plan for where the money is going. There are low and high risk investments so be sure to understand what your money is invested in.

£500 is a good amount to start investing with, and with a solid investment strategy, you could grow your wealth but you might be wondering exactly how to invest £500. Luckily, I am here to help.

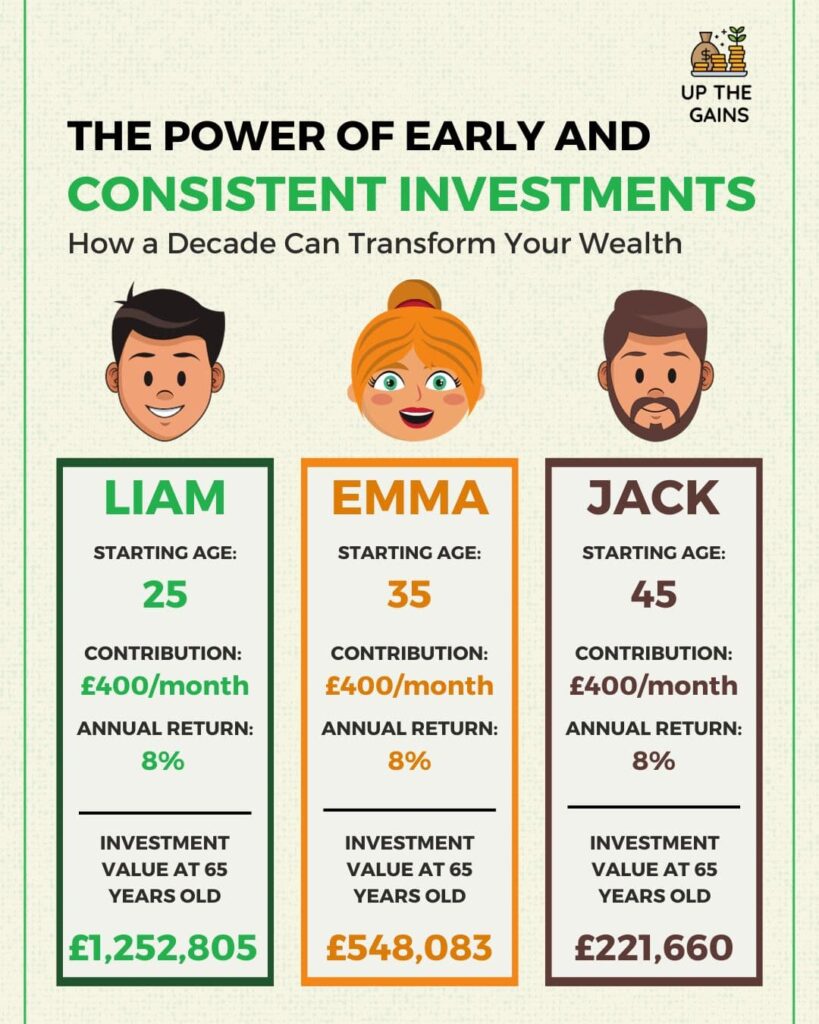

The return on £500 might not be as much as if you were starting with 20k, but the sooner you start investing, the sooner you can build a solid financial future.

In this article, I’ll discuss how to invest £500 and what you should look for once you’ve started investing.

Table of Contents

How to Invest £500

Here are some of the products you can invest £500 in alongside some examples:

Stocks (individual stocks, growth stocks)

Funds (index funds, mutual funds, exchange-traded funds)

Bonds (corporate bonds, high-yield bonds)

One of the easiest options for someone with little money is to open a brokerage account or investment account and start buying stocks in the stock market. Some retail investor accounts can be opened online.

Choosing a broker with commission-free trading can also help you keep costs down when you’re just getting started.

This can sound daunting if you’re a complete beginner but a bank or financial advisor should be able to point you in the right direction.

Robo-advisors can also be useful. They are essentially automated advisors that provide financial and investment advice based on algorithms.

In the past, savings accounts with high interest rates were recommended for people looking to begin investing. But with inflation rising, your money will only depreciate in value with each passing year.

The only way to beat inflation and grow your money is to invest it. This won’t lead to extreme wealth overnight and some investments require years of perseverance but with a little patience, you can get good returns.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

🎙️ Listen To This 🎙️

Join us for an episode with Financial Advisor and Best Selling Author, Shinobu Hindert.

We discuss how to confidently invest your money, what tools you need to invest and the best assets to invest in.

Click her name for access to the full episode or get all our podcast episodes here.

What is the Best Way to Invest Money?

There are several ways to invest money but the best investment for someone else may not necessarily be the best option for you.

Stocks, funds, and bonds are some of the most popular investments. Cryptocurrency investing is also becoming increasingly popular but tends to be reserved for experienced investors due to how high-risk it can be.

For example some of the big blue chip stocks include the likes of:

Holding blue chip stocks is considered a safe play or if you want to own all of them then buy inside of a fund or ETF which are baskets of stocks altogether.

Property is another popular investment because it can produce a regular income but most real estate opportunities require more than a £500 initial investment.

Before you decide how you’re going to invest, you must decide if you’re interested in short-term or long-term investments.

For example, some financial experts would recommend that money should be held in an ISA for a minimum of five years to get a suitable return while bonds can take 30 years to fully mature.

This might sound like a long time but if you’re looking to make a return in less time, it might surprise you to know that you can buy stocks and shares in the stock market in a matter of minutes.

There are also plenty of investment apps for beginners so you can tailor your investment strategies to suit your lifestyle and gain exposure to different stock markets.

Is £500 Enough to Invest?

In short, yes. A lump sum of £500 isn’t a huge amount of money in today’s world – especially with inflation on the rise – but it’s more than enough money to get started as a retail investor.

There’s a common misconception that in order to invest, you must have a good-paying job and a tonne of money stashed away. But this couldn’t be further from the truth and some investment accounts can be opened with as little as £1.

The most important thing when it comes to investing such little money is to have patience. £500 won’t become £5,000 overnight but the longer you leave your money alone, the better the return will be.

Compound interest calculators can give you a rough idea of how much your money can accumulate.

Some investment strategies take as little as a few years to make money but others can take as long as thirty years to produce a good return. So if you’re just looking to make a quick buck, investing might not be the best option for you.

Is Investing Right for You?

Before you invest £500, you must assess your risk tolerance. This is essentially a measure of how much risk you are willing to accept on your investments.

Some low-risk investments will experience little movement over the course of the investment horizon but others can rise and fall within a matter of seconds.

This can mean you lose money from time to time but unless you withdraw or sell your investment, you haven’t actually lost anything yet.

Again, the key to successful investing is being patient and not overreacting to slight changes in the market.

The UK stock market is experiencing high volatility due to rising inflation and with no sign of it slowing down soon, this is something you must keep in mind before investing.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

How Do I Spread Investment Risk?

Understanding how risk works is a crucial part of the investment process. The more money you put in, the more risk is usually involved. Individual shares also tend to be riskier than funds and bonds.

The risks involved with your investment will change based on how the market is performing. For example, market risk, business risk, and interest rate risk are all things you should be aware of.

Here are some of the things you can do to spread investment risk:

Do your research

This might sound simple but that’s because it is! Something as simple as doing your research can lower your risk by a substantial amount.

Rushing into an investment without knowing what it is can be a recipe for disaster and might mean you lose money instead of gaining it.

Diversify your portfolio

Having a diversified portfolio can lower your investment risk because it means you’re not putting all your eggs in one basket.

This can be done by investing in stocks from both small and large companies across different industries and markets.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

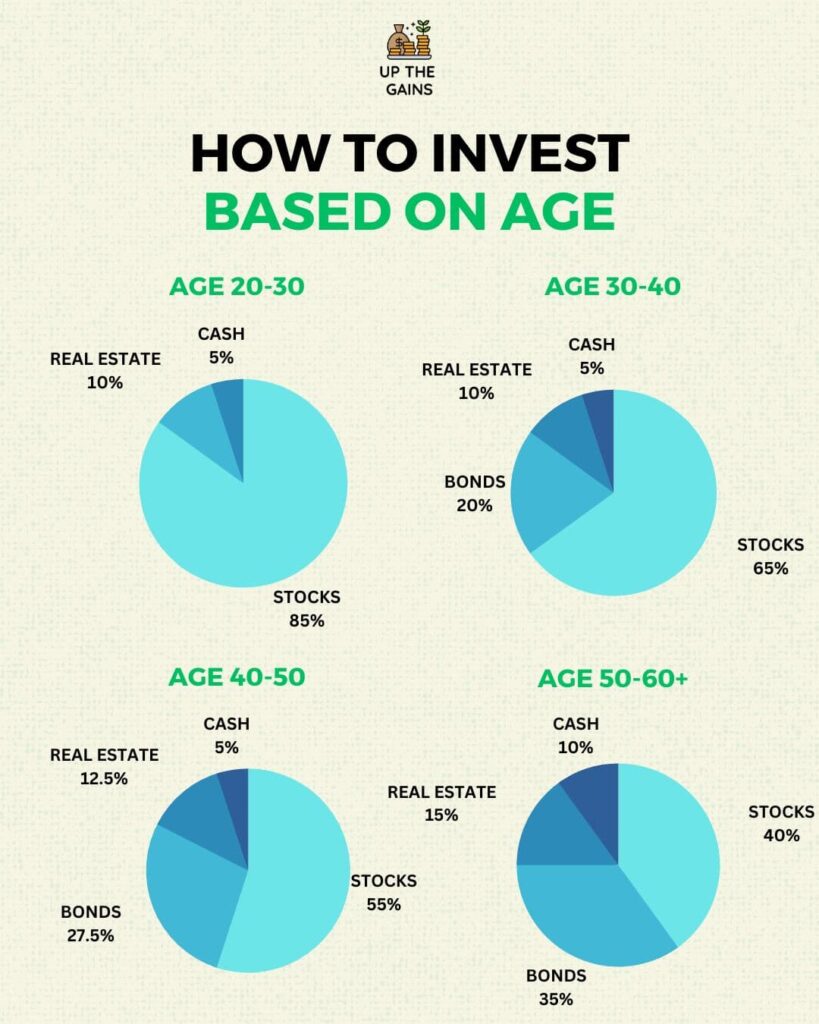

Allocate your assets

Asset allocation is when you invest in a number of asset classes for lower risk and maximum returns.

This could include a combination of stocks, bonds, and real estate. When done right, it can help you balance out your investments and stabilise risk.

Expand into different regions

By investing in international markets, you gain exposure to a wider range of economic cycles, political environments, and industries.

This diversification can help to reduce the impact of any single country’s economic or political events on your overall portfolio.

It also allows you to tap into growth opportunities in emerging markets, which can offer higher potential returns.

However, it’s important to do your research and understand the risks associated with investing in foreign markets, such as currency fluctuations and regulatory differences.

How to Invest £500 in an ISA

ISAs are a good place to start when it comes to investing £500. Not only can they help you build your investment portfolio but they are free of capital gains tax and income tax and have minimal annual management fees!

However, because £500 is such a small starting amount, some ISAs will be better suited to your financial circumstances than others and setting up a stocks and shares ISA is probably the best option for you.

This can be done through your bank or building society or, if you prefer, set up on an online investment platform like Wealthify, Moneyfarm or Vanguard.

Stocks and shares ISAs are a good option for £500 because they could give you a better return on your investment in the long term. Because your income is tax-free, you can keep 100% of the returns made.

Some financial experts also recommend drip-feeding or pound-cost averaging your money.

This is when you invest small amounts of money over time instead of investing a lump sum as part of a long-term investment. It can help smooth returns when the market is volatile.

FAQs

What should I invest £500 in?

With £500, consider investing in a low-cost index fund or exchange-traded fund (ETF) that tracks a broad market index, such as the FTSE 100 or S&P 500. This allows you to diversify your investment across a range of companies and industries, reducing risk.

Alternatively, you could consider investing in a single stock of a company that you believe has strong growth potential and a solid financial track record.

However, it’s important to remember that all investments carry risk, so be sure to do your research and consult a financial advisor if you’re unsure.

How do I get into investing as a beginner?

As a beginner, start by educating yourself on the basics of investing, such as the different types of investments and their risks and rewards.

Consider opening a brokerage account with a reputable online broker that offers educational resources and a user-friendly platform.

Start small with your investments and aim to diversify your portfolio. Remember that investing takes time, patience, and a long-term perspective. Consider consulting with a financial advisor to help you develop an investment plan that aligns with your financial goals and risk tolerance.

Can I invest in funds if I only have £500?

Yes, you can invest in funds with just £500. Many mutual funds and exchange-traded funds (ETFs) have low minimum investment requirements, allowing you to get started with a small amount of money.

Look for funds with low fees and expenses to maximise your returns. Investing in funds allows you to diversify your investment across a range of companies and industries, reducing risk.

In Conclusion

£500 might not seem like a large sum of money but you should still research the risks involved before parting with your hard-earned cash.

Some of the things you should think about before investing are your investment strategy, goals, and timeframe. This should help you choose the right investment product for your financial circumstances.

Finally, you must never invest more than you can afford to lose. Although you might get a big return on your initial investment, this isn’t to say your money won’t lose value along the way.

MORE LIKE THIS

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.