Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Lightyear Quick Overview

Lightyear is an investing app that offers low-cost investing alongside over 3500 stocks and ETFs.

I downloaded Lightyear earlier this year and used the app extensively for a month in order to write this review.

I have to say I really enjoyed it. The mobile app is fast and easy to navigate around with a slick design that sets it apart from a lot of the investing apps on the market right now.

One of the best features is the interest on uninvested cash which makes it an attractive option for investors who often leave cash in their accounts ready to invest.

On top of that, they have low fees, access to international stocks and the ability to buy fractional US shares which is great for those who invest smaller amounts.

Lightyear has over 3,500 trading instruments available for investors with a smart mobile app and web version.

You can earn interest on your uninvested cash which is highly attractive for larger investors.

Richard Branson is one of the key investors.

- Fantastic mobile app

- Commission free trading on ETFs (other fees may apply)

- Interest on uninvested cash

- Easy account opening

- Customer support is email only

- Minimal educational tools

- Important Notice

When you invest the value of your shares can go up or down. If you are unsure about your investment decision you should always seek investment advice. Past performance is not a future indicator and always do your own research. Capital at risk when you invest.

Lightyear Rating

- User Experience

- Useful Features

- Price / Fees

- Suitable For Beginners

- Customer Feedback

- Customer Service

I’ve rated Lightyear 4.4 out of 5 using our six pillar rating system which we use to assess all investing apps.

Lightyear scores best on it’s user experience which I found to be one of the best I have used. It has plenty of useful features which makes it suitable for beginners and experienced investors alike.

Lightyear scored worst on it’s customer service due to the fact that you can only email in. For me this needs to be upgraded to live chat or telephone asap.

If you’ve heard enough you can download Lightyear here.

(Capital is at risk when you invest)

Pros & Cons

Pros

- Low Commission on Stock Trades

- Commission free on ETFs (other fees may apply)

- Interest on uninvested cash

- Fantastic mobile investing app

- Available Apple app store and Android

- Web version also available

Cons

- Missing extensive training resources

- No ISA

- Need to add live customer service

Who is Lightyear best for?

For me, Lightyear is for those who are looking for a GIA to add to their stocks and shares ISA or for those who trade low amounts to keep under the capital gains tax thresholds.

The lack of an ISA can be quite restrictive for some but if that doesn’t bother you then honestly the platform is excellent.

This app also isn’t for frequent traders who are looking for CFDs, Forex trading or spread betting. They’ve designed it for real stock and ETF investors so if that’s you then Lightyear is perfect for this.

Is Lightyear good for beginners?

Yes, Lightyear is a fantastic option for beginners. It’s designed for simplicity and finding your way around the app is super easy.

Something to note is the app is for new investors who are happy making their own investment decisions.

If you’re looking for a broker to handle your investments for you then Lightyear is not for you.

If that is the case then Moneyfarm or Wealthify are great options for you. Check out our Moneyfarm vs Wealthify Review.

Lightyear Invest Review - Main App Features

As I said I had a lot of fun using Lightyear and wanted to cover some of the important features of the app from my personal experience.

I’ve included screenshots of my journey around the app so you can see 1st hand from my experience.

Stock Overview Pages

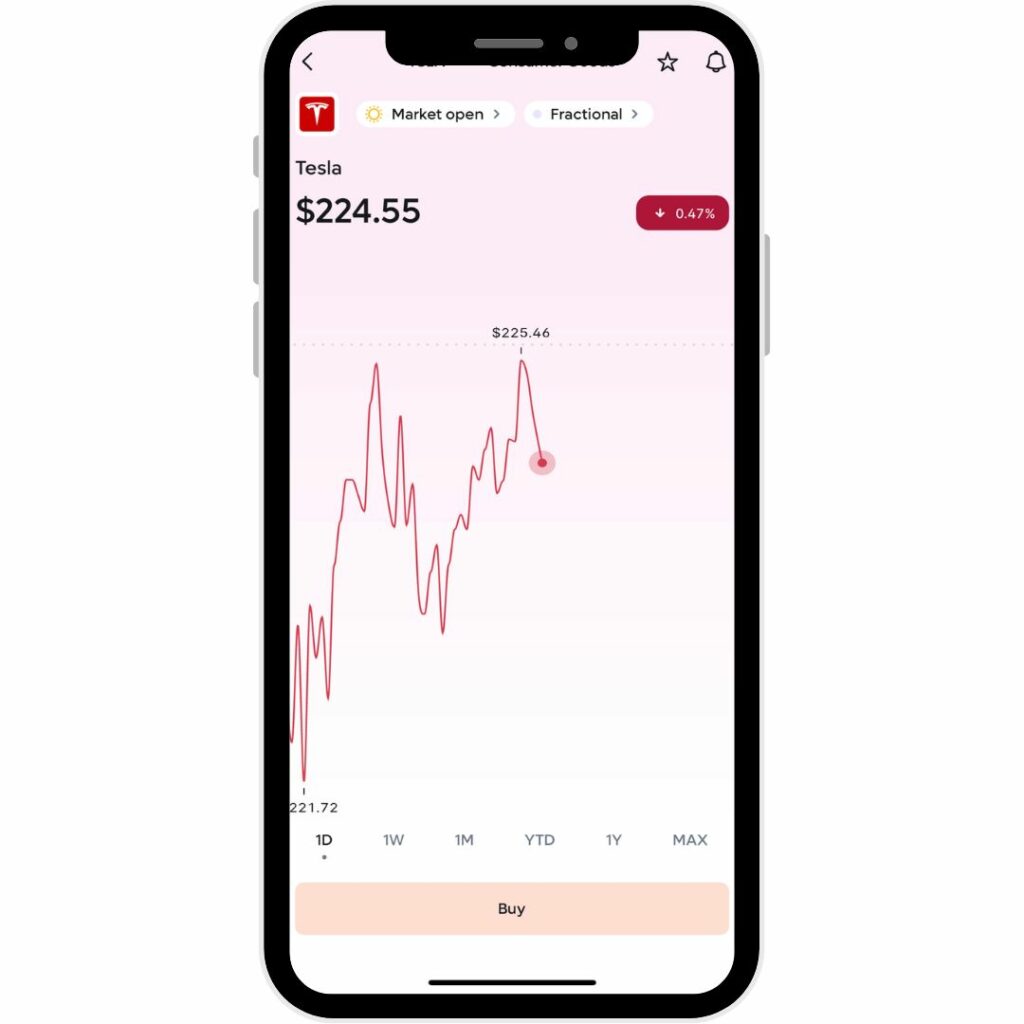

One of the best things about Lightyear is the stock information. When you click into a stock as you’ll see in the examples below you land on a chart on which you can change the timeframe very quickly.

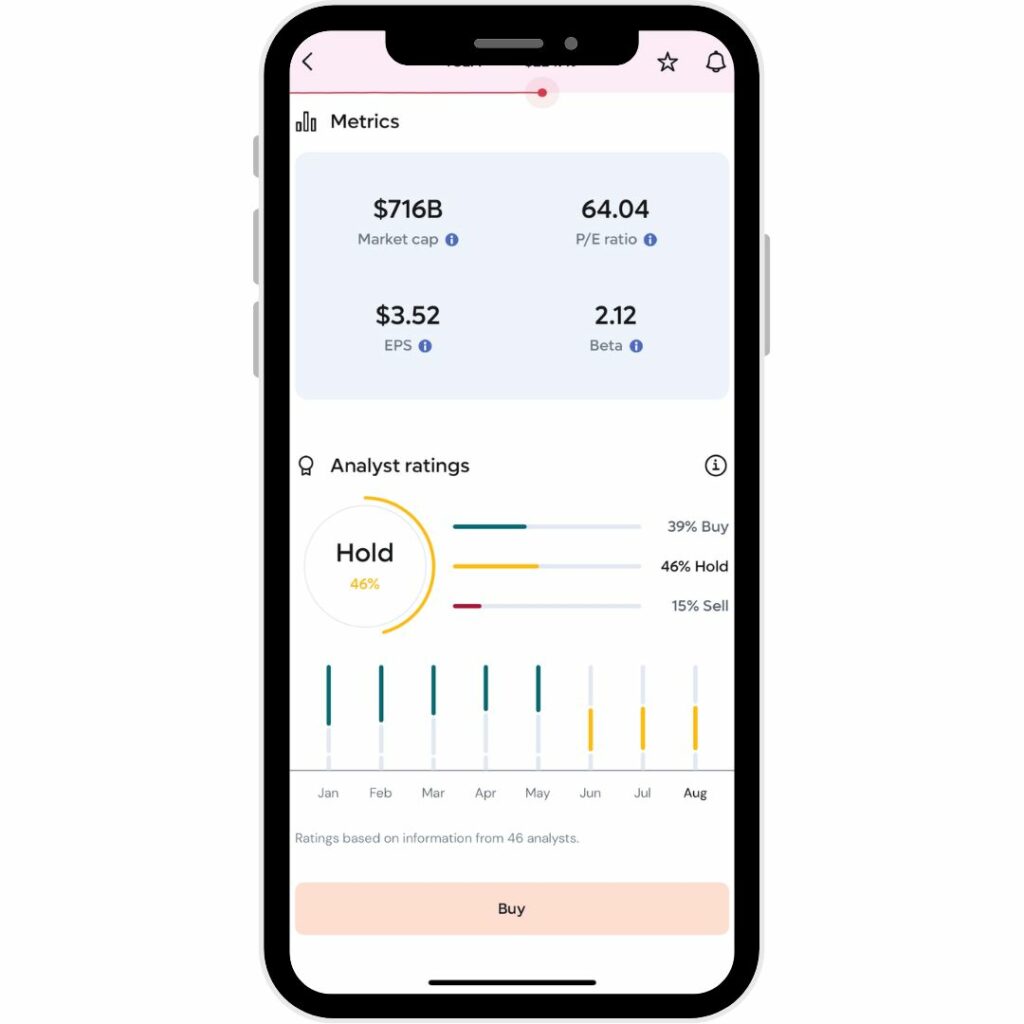

I love the layout as you scroll down and it’s very easy to see company metrics like market cap (size of the business), PE ratio, and EPS (earnings per share).

There are highly visual analysts ratings which you can see just below alongside analyst price targets and company financials.

There is also a live news section which connects to major stock publications like Reuters, Barrons, Seeking Alpha, Business Wire and more, meaning you don’t need to leave the app to find out what’s going on.

All of these features allow investors to get a very comprehensive overview of a stock before making an investment decision. I love the way Lightyear has laid this out and can see it’s appeal to new investors.

Navigation

The navigation on the app is one of the best I’ve seen. It’s so simple and user friendly.

At the bottom there are 3 options to choose from

- The explore page where you can find the latest stocks and ETFs.

- Your portfolio page where you can see your overall performance plus your individual holdings and their performance

- Lastly the wallet section where you can track your activity, add money, convert into a foreign currency and withdraw money.

As you can see from the wallet page I am currently earning 4.50% interest on uninvested cash (this is subject to change).

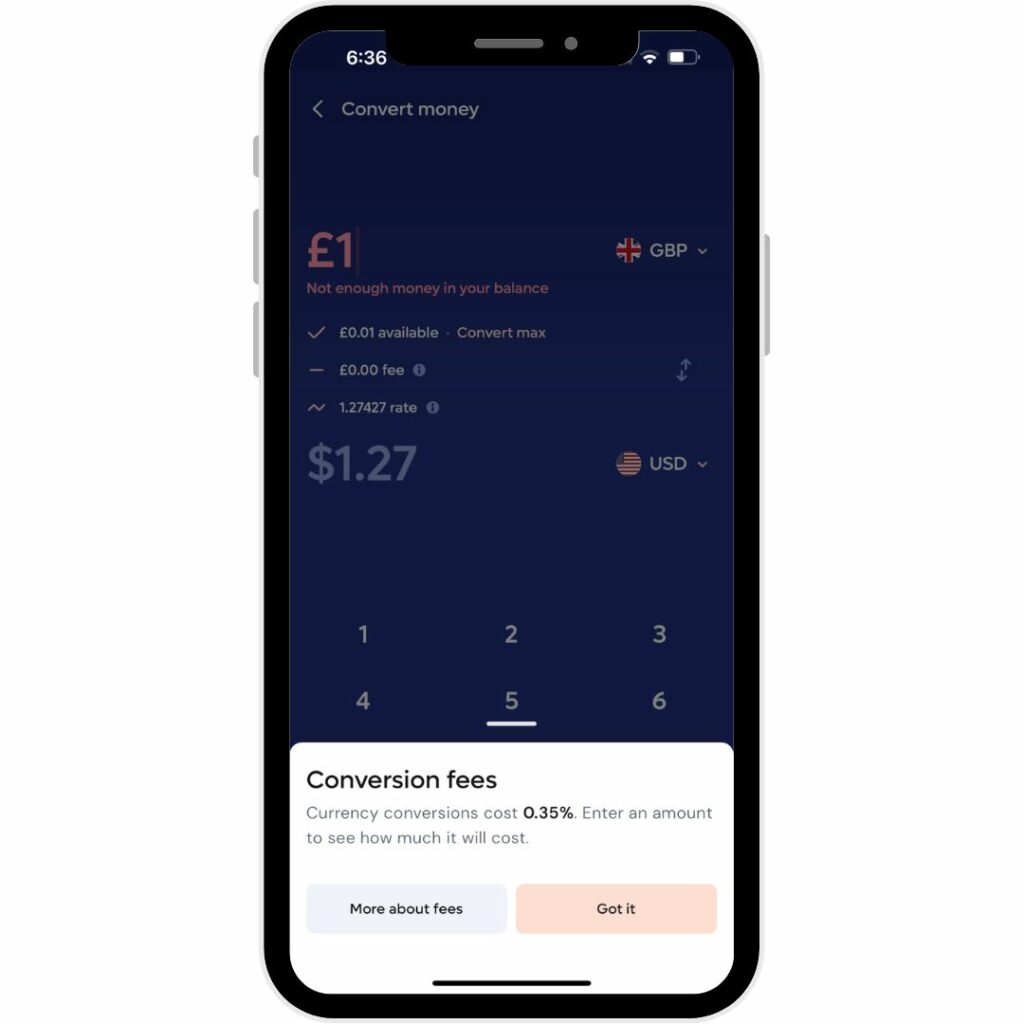

Multi Currency Account

Lightyear offers free multi currency accounts as part of their service.

You have the capability to deal in various currencies and purchase equities globally, allowing you to maintain multiple currencies in your account.

At the moment, you can hold: British Pounds (GBP), American Dollars (USD), and Euros (EUR). Plus you can move your money into these currencies at any time.

Additionally, there’s an option for HUF (Hungarian Forint), but this is restricted to Hungarian clients.

You have the option to deposit and keep foreign funds in your account, potentially allowing you to bypass higher currency conversion charges that you may find with other providers.

We go into more detail about the currency conversion fee below.

News & Watchlists

Via the explore page you have a list of the top stories of everything happening in the financial world. There are also videos integrated but when you click on them it takes you to YouTube so you need to navigate back to the app to stay on it.

Just below the top stories there is your watchlist where you can add stocks and ETFs into so you can keep track of the ones you’re most interested in.

Lightyear has over 3,500 trading instruments available for investors with a smart mobile app and web version.

You can earn interest on your uninvested cash which is highly attractive for larger investors.

Richard Branson is one of the key investors.

- Fantastic mobile app

- Commission free trading on ETFs (other fees may apply)

- Interest on uninvested cash

- Easy account opening

- Customer support is email only

- Minimal educational tools

Lightyear Investing App Review - Company Overview

The team behind Lightyear have been instrumental in creating some of the most popular financial apps of the day including Revolut, Robinhood and TransferWise.

The vision for the app is to create a borderless mindset to the European investing world. Simply put allowing investors to invest using multi-currency accounts with low conversion fees. Nice idea!

Lightyear Financial Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.

Who owns Lightyear?

Lightyear was founded by ex-Wise duo Martin Sokk and Mihkel Aamer. The investors in the business are industry heavyweights with the likes of Richard Branson (Virgin), Taavet Hinrikus (Co-Founder Wise) and Eileen Burbidge (early Monzo investor).

Richard Branson, an investor in Lightyear and founder of Virgin Group says:

“For too long, financial markets have been overly complex with high barriers to entry and confusing jargon. Martin, Mihkel and the Lightyear team are lifting the lid on the world of investing – making it more transparent whilst empowering people through education – to choose the products which are right for them.”

Range of investments available

This wouldn’t be an investing app review if we didn’t cover what you can invest in!

Stocks and Shares

There is a fantastic range of international shares available on Lightyear with over 2000 US stocks alone.

You can invest in companies like Tesla, Apple, Netflix, Alphabet as well as UK companies like Manchester United, Barclays, BT Group and even Chinese stocks like Baidu and Alibaba.

Lightyear is constantly adding new stocks into the explore page but if you like investing in successful businesses it’s more than likely Lightyear has you covered.

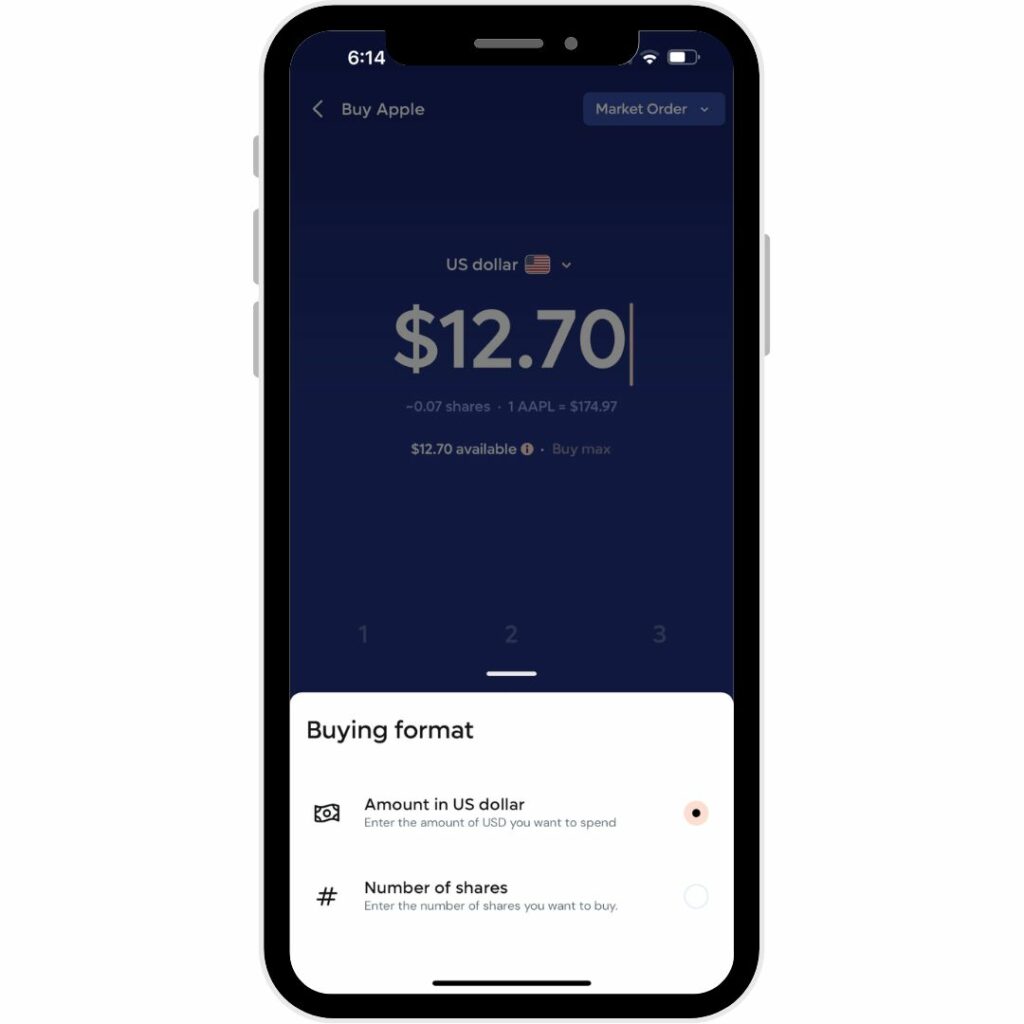

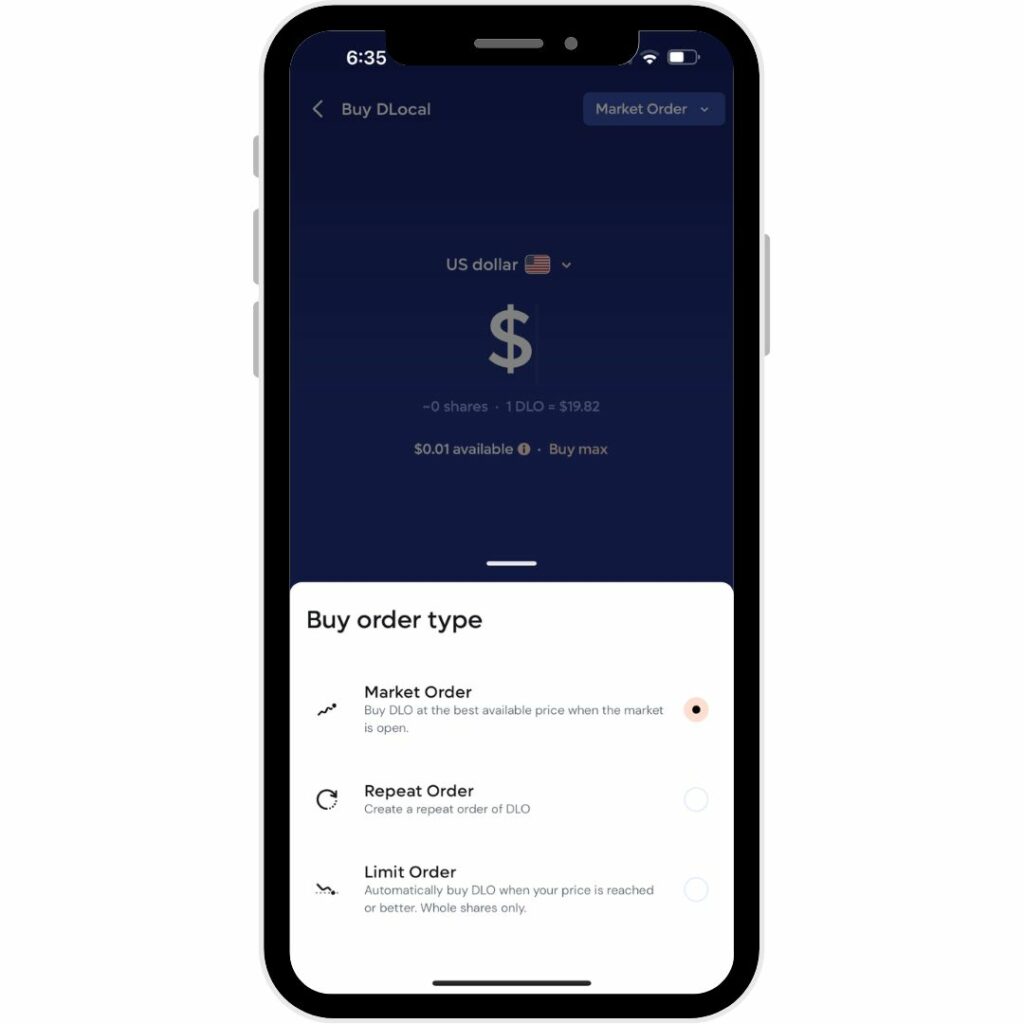

I tested out buying a share in Apple and the process was very easy. As you can see from the image below you buy in US dollars and your money is converted from pounds to make the trade.

You can even place options to repeat an order which you can set to daily, weekly or monthly for a price that you set.

There’s also options to place a market order which you can use to buy stocks at the best available price when the market reopens (should the market be closed).

And lastly, you add a limit but only if you are buying a whole share and not fractional shares.

- Note

When dealing with fractional shares, you can only purchase them at the existing market price, as opposed to placing an order at a desired future price (known as a limit order). This rule is consistent across almost all investment platforms that offer fractional shares.

Fractional shares

You can also trade fractional shares with Lightyear (if they’re US stocks). This allows you to purchase a small piece of a single share (a fraction), which is ideal if you don’t have a significant balance in your account and wish to invest in a variety of shares (as some can be quite expensive).

For example, consider if one Nike share is valued at $200 (this is not a live price). For many investors, that’s a substantial amount to invest in just one company.

Lightyear fractional shares: With fractional shares, you have the flexibility to invest any amount in Nike, and in return, you receive the corresponding fraction of a share. So, if you invest $50, you’ll obtain ¼ of a Nike share. Clear enough?

ETFs

Yes, there are exchange trade funds (ETFs) available on Lightyear. In fact, at the time of writing there are 153 of them.

What I like is that there are the major ETF providers on the app including Vanguard, Blackrock, SPDR and Van Eck.

Investing in ETFs gives you instant diversification across either a sector, country, continent or indeed globally. There are many benefits to ETF investing and if that’s something you love investing in then you should check out my best ETF platform providers.

Lightyear Account Fees

Lightyear is a very low cost investing app. It’s completely free to deposit by bank transfer or withdraw money which I really liked.

The only fees you’re liable for are trading fees which are for stocks per trade 1 GBP/EUR or up to 1 USD depending on the currency of issuance so be careful as this can add up.

ETFs are commission free which I thought was a nice touch to encourage investors to diversify (other fees may apply).

| Fee Type | Cost |

|---|---|

| Minimum deposit | £1 |

| Standard platform charge (monthly) | 0% |

| Best platform charge (monthly) | 0% |

| Standard fee per trade | £1 |

| Best fee per trade | £0 |

| Forex conversion fee | 0.35% |

| Deposit fee | £0 (0.5% fast deposit) |

| Withdrawal fee | £0 |

| Inactivity fee | £0 |

Currency conversion fees

Put simply if you were to use the currency exchange fees listed below you would be paying 0.35% – so if you converted £60 you would pay 0.21p in fees.

Lightyear does provide a multi-currency account and you are not required to convert money every time you invest like some of their competitors.

Currency fees vs competitors

| Investment Platform | Currency Conversion Fee |

|---|---|

| Trading 212 | 0.15% |

| Lightyear | 0.35% |

| Freetrade | 0.45% |

| eToro | 0.50% |

| AJ Bell | 0.75% |

| Hargreaves Lansdown | 1% |

| Interactive Investor | 1.5% |

How to sign up for Lightyear?

What I liked about setting up a Lightyear account was that it was fast. I was up and running in a matter of minutes.

Please ensure you have your name, address and national insurance number ready to input.

It also takes you through some security sections asking you to set up a pin code and if you like you can activate face ID which I did to save some time when logging in.

Other than that it was so quick and simple. All was left to do was verify my email, deposit some cash and start using their investment services.

Lightyear has over 3,500 trading instruments available for investors with a smart mobile app and web version.

You can earn interest on your uninvested cash which is highly attractive for larger investors.

Richard Branson is one of the key investors.

- Fantastic mobile app

- Commission free trading on ETFs (other fees may apply)

- Interest on uninvested cash

- Easy account opening

- Customer support is email only

- Minimal educational tools

What are customers saying?

Looking online at forums and most importantly the Lightyear Trustpilot reviews people absolutely love Lightyear.

Their rating on Trustpilot is 4.7 out of 5 which gives them an excellent rating and at the time of writing there were 484 reviews.

Review from Jose on Trustpilot

“Very good experience, especially for beginners”

The app is fast and easy to use. For me it was very positive that you can transfer funds via Wise and that you can hold balances in different currencies while earning interest on uninvested cash. The process of buying stock is smooth and transparent.

Source: Trustpilot

Alternatives to Lightyear

The main alternatives to Lightyear for me are eToro, Trading 212 and Freetrade.

You can also throw into the ring other apps such as Plum and Chip although these are more rounded apps offering savings accounts alongside investing.

FAQs

Is Lightyear safe?

Yes, Lightyear is a secure investment platform. The inclusion of a pin entry and face ID gives you banking level security on your app.

Does Lightyear have UK stocks?

Yes, Lightyear has 257 UK stocks to invest in. This covers off most companies inside the FTSE100 & FTSE 250 including companies like HSBC, AstraZeneca, Unilever, Tesco, BT group and Aviva.

Is Lightyear protected by FSCS?

Lightyear is not protected by FSCS at this time.

Our final thoughts

My final thoughts are that I really enjoyed using Lightyear and personally think it’s a lot better than competitors in the space such as Freetrade, Shares.io and StakeUK.

I do however still think eToro and Trading 212 trump them slightly, but if they continue to innovate and add new features I can see this gap being closed.

One thing I do think they need to add is an ISA but understand the complexities this has for financial companies.

If you’ve made it this far you can sign up to Lightyear still here.

(Capital at risk when you invest)

Legals

Lightyear Financial Ltd is an appointed representative of RiskSave Technologies Ltd, which is authorised and regulated by the Financial Conduct Authority.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.