Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

For pure choice and the fact they offer free financial advice, Moneyfarm is the winner here. It’s got a wider selection of portfolios and it’s cheaper to invest in socially responsible products.

That being said, Wealthify has a lot lower barrier to entry and you can start an account for just £1 whereas Moneyfarm requires a £500 first-time deposit.

Both these apps are fantastic robo advisors but stick around while we unpack them so you can make a more informed decision.

Full Disclosure: I own a Moneyfarm Stocks and Shares ISA and have done for over 12 months. I’m very happy with both the product and the performance of the fund.

I do however really like what Wealthify are doing. They are a solid brand and are a great option for beginner investors.

So, let’s get into it as we put Moneyfarm vs Wealthify!

|

4.6

|

4.3

|

|

Minimum Initial Deposit £500

|

Minimum Initial Deposit: £1

|

|

|

|

|

- Free financial advice

- Expert managed portfolios

- Ethical investing option

- High 1st deposit

- Expert managed funds

- Backed by Aviva

- Ethical investing option

- Limited investing options

Table of Contents

Moneyfarm VS Wealthify

Both apps are renowned robo-advisors which if you’re unaware are online brokers that provide both financial advice and investment management options with minimal human intervention.

They’re both built for the modern digital age and are essentially a set-it-and-forget-it type of investment apps. You sign up, set your direct debit up and they’ll take care of your investments for you.

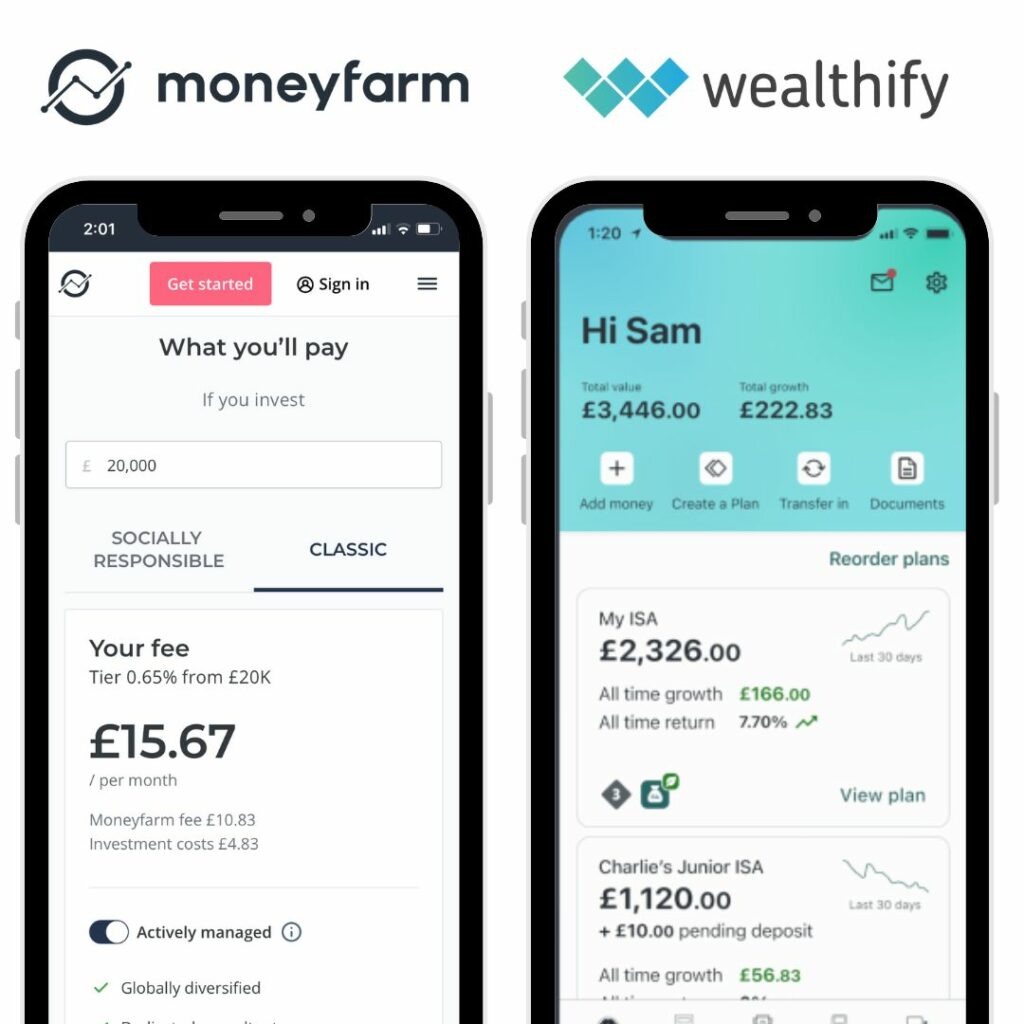

Both investment apps are available on Apple IOS and Android with website options also available to use.

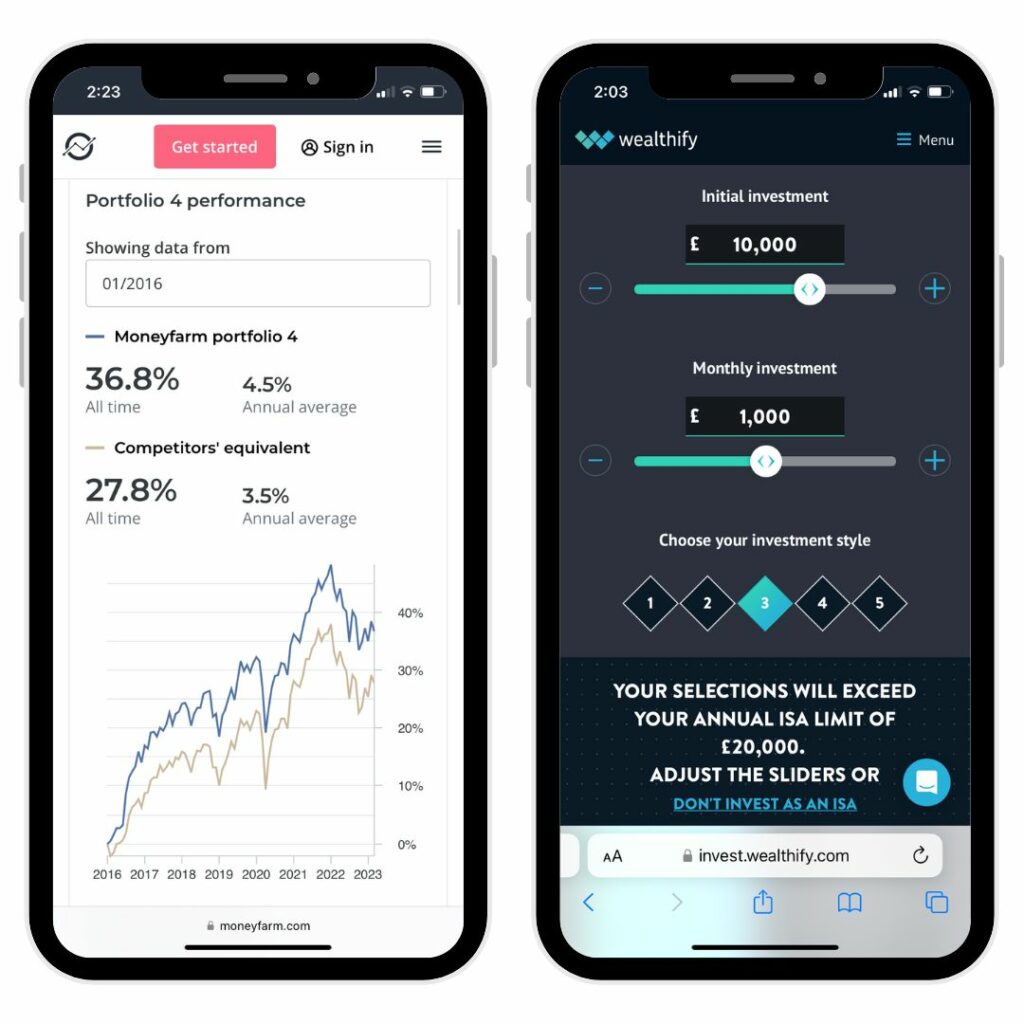

Being digital-first investment products both apps are super slick and easy to use. You can see your portfolio allocation in a super visual way, charting past performance and where your money is going. Essentially a beginner’s dream.

What really sets them apart is Moneyfarms financial advisor service which allows a lot more human touch and intervention to ensure you’re getting the most out of your investment account.

That’s obviously the reason why you have to pay £500 to open an account, for a higher valued service along the way.

Moneyfarm vs Wealthify - Key Features

| Wealthify | Moneyfarm | |

|---|---|---|

| Minimum Investment | £1 (£50for SIPP) | £500 |

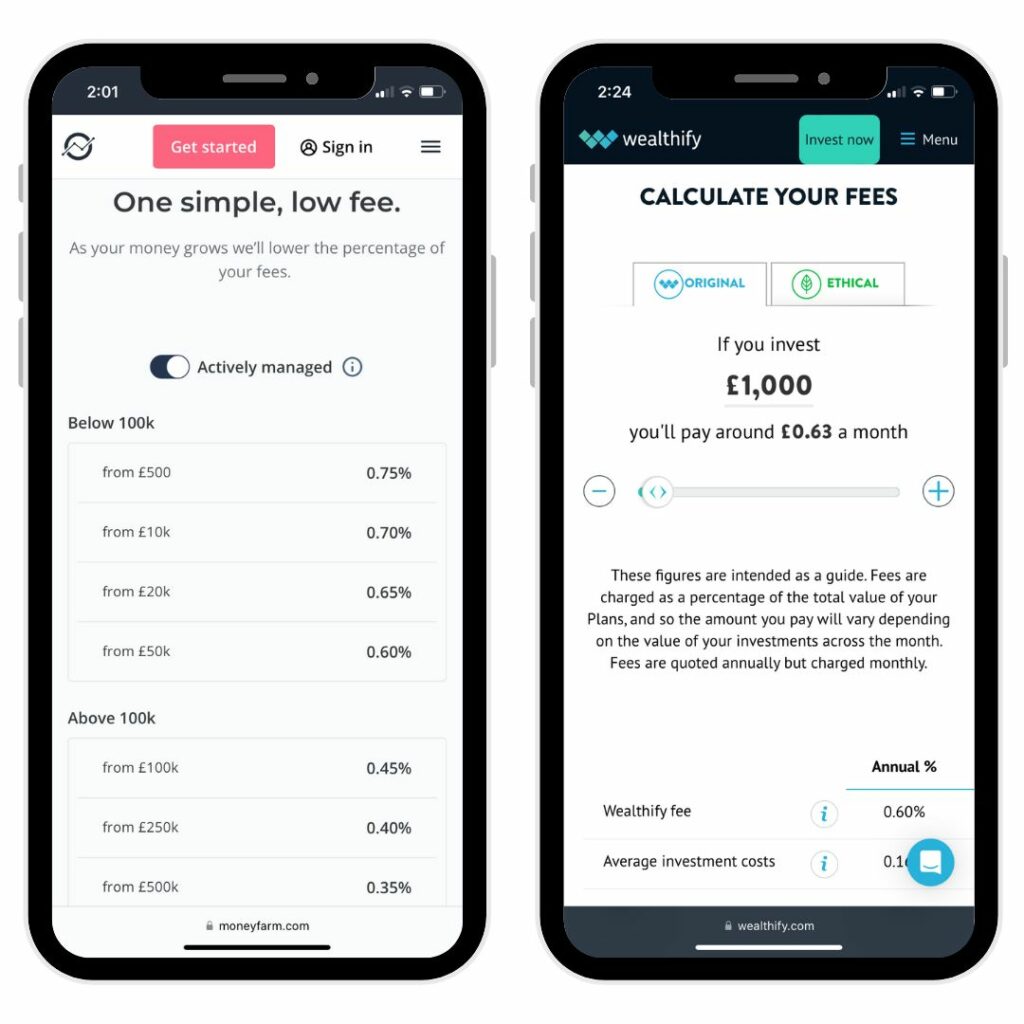

| Management Fees | 0.6% flat free Additional underlying fund charges | Up to £10,000 - 0.75% £10,001 to £20,000 - 0.70% £20,001 to £50,000 - 0.65% £50,001 to £100,000 - 0.60% £100,001 to £250,000 - 0.45% £250,001 to £500,000 - 0.40% Over £500,000 - 0.35% The fee you pay is based on the total value if your portfolio and so if you invest £75,000 you will pay a total fee of 0.60% Additional underlying fund charges |

| Products | ISA, General Investment Account, Junior ISA and SIPP | ISA, General Investment Account, Junior ISA and SIPP |

| Number Of Portfolios | 5 | 7 |

| Ethical Portfolios | 5 | 7 |

When it comes to who’s more expensive the management fees at Moneyfarm are slightly higher.

That being said Moneyfarm fees are more expensive the less you have invested and overtime as you meet certain thresholds these fund fees come down. This is around about £50,000.

Both Moneyfarm and Wealthify have an underlying fund fee and these usually aren’t too expensive but differ slightly.

If you require personal assistance with regard to either brand’s investment process or fees then you can reach out to their customer service teams.

If you’re interested hit up Moneyfarm to sign up here or if you prefer to learn more directly about them read our Moneyfarm Review.

Same goes for visiting Wealthify or you can read our full Wealthify review here.

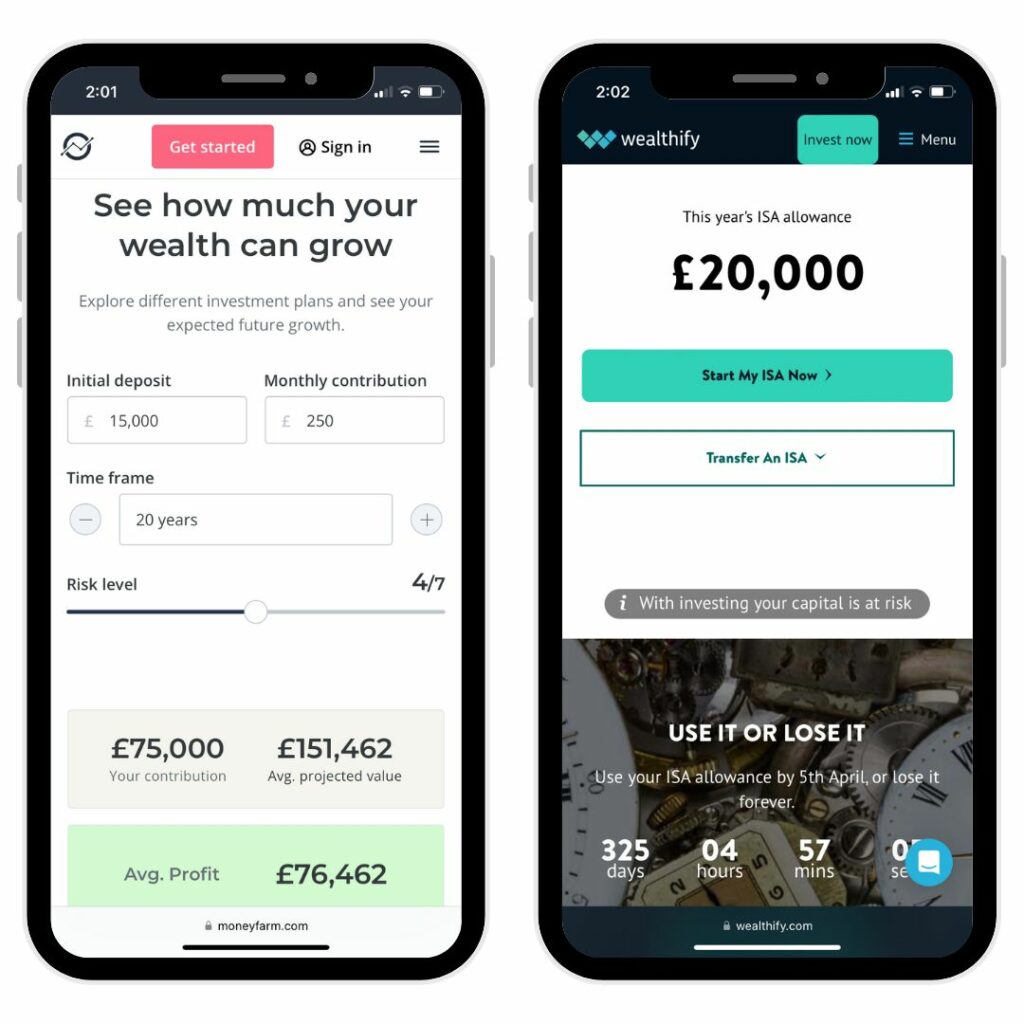

Moneyfarm vs Wealthify - Minimum Investment Amount

As we discussed briefly Moneyfarm is a whopping £500 to open an account. Whilst this deters a lot of people they’ve done it to ensure their users are serious about investing with them.

After the initial outlay though you can put a minimum of £25 as a direct debit each month which is a lot more reasonable.

If you don’t have £500 to get started then Wealthify lets you open a general investment account for £1 and £50 for a SIPP.

Moneyfarm vs Wealthify - Account Options

Moneyfarm and Wealthify both offer the exact same account types which makes them a fantastic selection for both ISAs (individual savings account) SIPPs (self-invested person pension) and JISAs (Junior ISAs).

Stocks and Shares ISA

This means you have access to tax wrappers with the Stocks and Shares ISA providing up to £20,000 per annum tax-free contributions which are free from capital gains tax. So, as your money grows you don’t have to pay tax!

Pensions

With a pension, you can invest tax-free too. You also get 25% tax relief as a bonus on your contributions which is because you’ve already paid income tax on the money.

You can’t withdraw a personal pension until you’re 55 (soon to be 57) so remember any contributions are out of bounds if you need to dip back in.

Also, remember with pensions you will be subject to tax when it comes to withdrawing it. You can take a 25% lump sum tax-free but then anything else is subject to income tax thresholds.

Junior ISAs

If you’ve got kids and want to get them started early you can open a Junior ISA. On top of your £20k ISA allowance, you can invest £9,000 per year on top per child.

They can then access the money when they turn 18. What a way to set them up for life!

GIAs (General Investment Accounts)

Investment options

After you’ve selected an account it’s now time to select your investments. Both Moneyfarm and Wealthify are known for keeping it simple.

Moneyfarm Investment options

There are four options for your investment strategy:

Active management – where the funds are managed by Moneyfarm’s experts

Thematic Investing – where you invest in themes such as technology or clean energy

ESG Socially Responsible – ethical investing for example no tobacco or fossil fuel providers

Fixed allocation – where the investments don’t change a lot and are mainly fixed

Moneyfarm then has 7 different risk levels which you can access. You are asked questions and they suggest a level for you but you can also change this.

It’s essentially low to high risk and the allocations within the actively managed portfolios will change to suit.

Plus you have your own investment consultant to speak with if you need advice on what’s best for you.

Each person is different when it comes to risk and you can see the past performance to help you make investment decisions.

The socially responsible investment options also make Moneyfarm very attractive here and it’s also cheaper here too.

Wealthify Investment Options

There are just two options for Wealthify these are:

Original – your investments are allocated by Wealthify’s experienced investors

Ethical Plan – no investments in things that are not considered ethical

Comparing Wealthify they have just 5 risk levels which is just 2 less than Moneyfarms. Whilst this is slightly more restrictive the models are very similar with regards to the risk level you can choose.

Wealthify offers new investors the opportunity to highlight their risk profile through a series of carefully crafted questions. This is online investing for the future and robo-investing is certainly on the rise!

Portfolio performance

Each investment platform’s performance is harder to navigate as they have different investing options. That being said we have charted 2022’s performance below.

It’s important to note that the stock market vastly underperformed in 2022 therefore the figures are all in minus but this was much the same for all of us.

It’s important when you invest to look longer term and over 5 years Wealthify is up between 2-46% depending on the fund and Moneyfarm is up 1-72% – which shows Moneyfarm is performing a lot better on average.

| Wealthify Perfromace 2022 | Moneyfarm Performance 2022 | |

|---|---|---|

| Cautious | - 11.20% | - 7.80% |

| Tentative | - 11.10% | - 8.00% |

| Confident | - 10.30% | - 9.80% |

| Ambitious | - 9.40% | - 9.70% |

| Adventurous | - 9.10% | - 10.1% |

Customer Reviews

Overall customer satisfaction got both brands is pretty positive. Both pride themselves in offering great customer service and this clearly shows when I looked through all of the reviews.

Wealthify

- Trustpilot score – 4.1 from 2071 reviews

- Apple Store – 4.5 from 2464 reviews

- Google Play – no score but 100k+ downloads

Moneyfarm

- Trustpilot score – 3.7 from 871 reviews

- Apple Store – 4.7 from 1708 reviews

- Google Play – 4.2 from 5642 reviews

Moneyfarm / Wealthify Alternatives

There are some great alternatives to Moneyfarm and Wealthify that you can consider if neither of these two apps are lighting you up.

There is Nutmeg which is very similar we have a Moneyfarm vs Nutmeg review you can check out.

Also one of our favourites is Moneybox and InvestEngine.

Check out our Moneyfarm vs Moneybox review here alongside our full Moneybox review and InvestEngine review.

FAQs

Can I trust Moneyfarm?

Yes, you can trust Moneyfarm. They are a reputable digital wealth management company, regulated by the Financial Conduct Authority (FCA) in the UK and covered by the Financial Services Compensation Scheme (FSCS), which provides a level of protection for your money.

It offers a range of investment portfolios tailored to different risk appetites and goals. However, like any financial investment, investing with Moneyfarm carries risks as your investments can go down as well as up.

Is my money safe with Wealthify?

Yes, your money is safe with Wealthify. They are a reputable digital wealth management company, regulated by the Financial Conduct Authority (FCA) in the UK and covered by the Financial Services Compensation Scheme (FSCS), which provides a level of protection for your money.

What is the average return on Moneyfarm?

The average return over 5 years for their more adventurous portfolio is 14.4% per year. This decreases down when you lower the risk portfolio.

It is important to note that this is not financial advice but simply facts taken from the Moneyfarm website.

Wealthify vs Moneyfarm - Who Wins?

When it comes to comparing the two investment platforms there is a lot to like about both of them. They are both excellent options and are two of the very best robo-advisor platforms there are on the market.

That being said I think because Moneyfarm offer financial advice to levels unseen across the industry as part of their service and have a slightly wider range of investments this swings it for them.

That being said, if you do not have £500 to start then Wealthify is an incredible robo advisor platform that I think you’ll enjoy!

MORE LIKE THIS

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.