Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

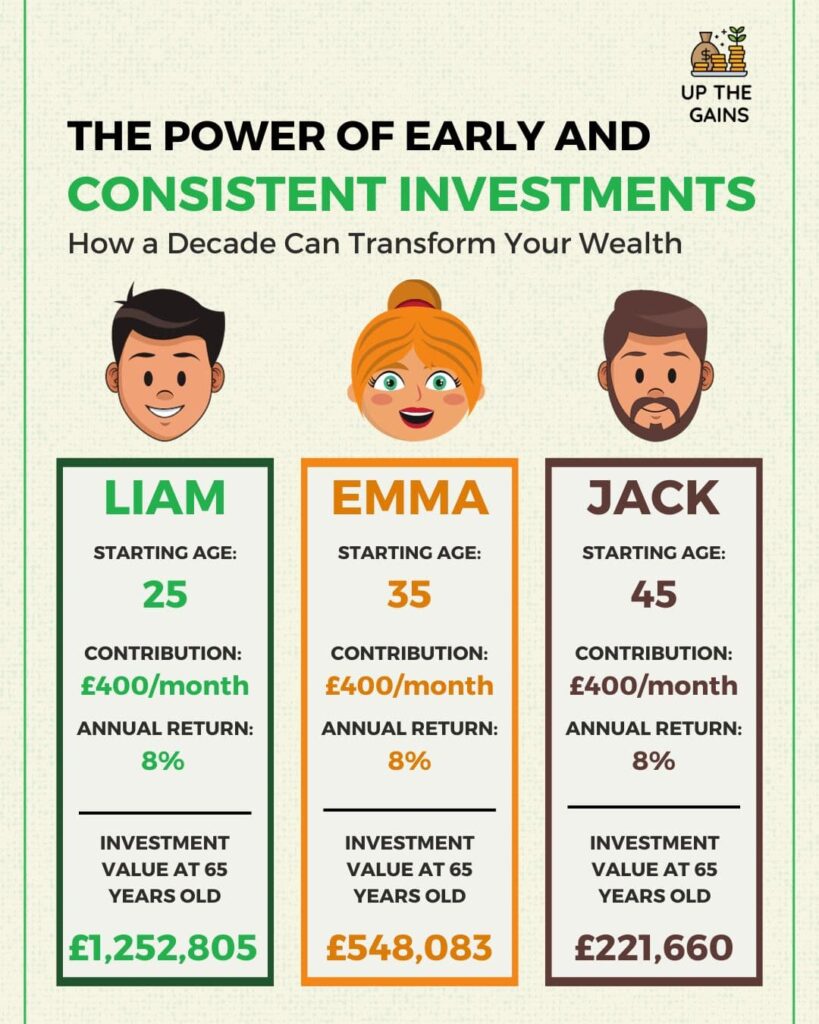

The great thing about investing is that you don’t need to be starting out with thousands of pounds to invest.

Learning how to invest £1,000 is a great starting point and because it’s a round number can be transferred over to any amount very easily.

I’m a big believer of start small, think big so I’m going to show you some of the best ways to invest £1,000 for maximum results.

Key Takeaways

-

Diversify for Resilience: Spread your £1,000 across assets like index funds and stocks to manage risk and boost returns.

-

Tax-Efficiency Matters: Utilise tax-efficient accounts like ISAs and SIPPs to maximise your investment growth.

-

Patience Pays Off: Embrace the long-term view – don’t react to market noise for better investment results.

Even if the amount you have to start with is small getting started is what’s key!

Remember when you invest your capital is at risk.

So, if you have some spare cash lying around, and you want to learn how you can invest then read on or watch our video just below!

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Table of Contents

How To Invest £1,000?

Before you decide how to invest £1,000, you need to be certain that investment is the correct route for you.

That’s why in this article I’m going to show you the best way to invest 1000 pounds.

We want to turn £1k into £10k and then turn 10k into 100k so I’m going to cover the following investment types that will help you do that!

- Investing In Yourself

- Index Funds & ETFs

- Individual Stocks

- Starting A Business

- Art

- Cryptocurrency

- Travel And Experiences

I’m also going to add a risk score and talk you through asset allocation strategies which essentially is how much you could look to allocate to each investment type.

3 things you should to do before you invest

The 3 things you should do before you invest are as follows:

Clear High-Interest Debt

Before diving into investments, focus on paying off any high-interest debts, like credit card balances or personal loans.

Reducing these financial burdens will free up more money for your investments and improve your overall financial health.

Build an Emergency Fund

Establishing an emergency fund is essential. Begin with saving at least one month’s worth of living expenses to handle unexpected setbacks.

Over time, aim to build it up to cover three to six months of expenses. This safety net ensures you won’t need to dip into your investments during emergencies, helping you stay on track.

Start with a Clear Why

Understanding your financial goals is key when you’re thinking how to invest £1k.

Whether it’s saving for a home, retirement, or a dream vacation, having a clear purpose for your investments will help you make informed decisions and stay committed to your long-term objectives.

It will also help you evaluate each investment type, establish your risk tolerance and time horizon.

Now hopefully you’ve done that – next up some key questions to ask yourself.

Questions to ask yourself before you invest £1,000

Before you invest your £1,000 it’s vital to ask yourself a few questions.

Just by asking yourself these questions you’ll get a much better chance of success.

What's your appetite to risk?

Once you gain an understanding of the options you need to then evaluate each investments risks and how you feel about them.

For example, understanding my appetite to risk meant dipping my toes in with a smaller amount and working out how I felt when stocks dropped 5% in a day – because it happens sometimes.

Was I okay with that and I could I think of the big picture or was my world feeling like it was caving in?

This is SO important as you want to set yourself to think long term but if you can’t handle a bit of volatility then the higher risk investments I’m going to cover below won’t be for you.

And if you’re still not comfortable perhaps you’re better off saving your money rather than investing it.

What's your timeframe and goals?

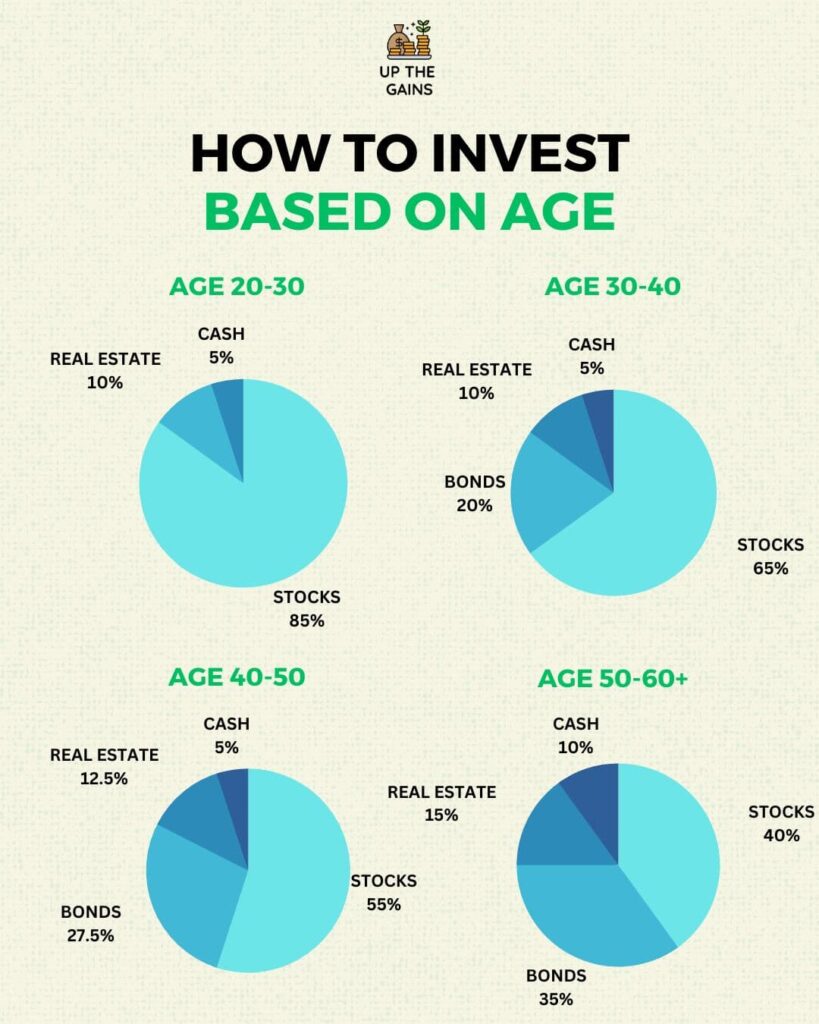

Your timeframe and goals will need to be aligned to your investment strategy and how you allocate your £1,000.

For example, investing in my 30s I’m much more risk on but this might be adjusted if I’m building wealth in my 40s for instance.

Generally the older you get the less risk you take as it becomes about capital preservation rather than accumulation.

What's your financial situation looking like?

If your financial situation is strong, you’ve got a secure income, no debts and some savings then investing is certainly a good next step on your financial journey.

But if it’s the opposite really you should look to get your house in order before taking any further risks with your budgets.

Is £1,000 enough to start investing?

Yes, absolutely £1,000 is enough to start investing but you should only invest what you’re comfortable losing.

If £1,000 is your entire savings. Perhaps start by investing £500 and keep the rest back in reserve.

Where to invest £1,000 - 7 Options

The best way to learn how to invest is to research into your options.

Let’s take a look at some of the safe and some of the riskier investment routes that are good for investing £1,000.

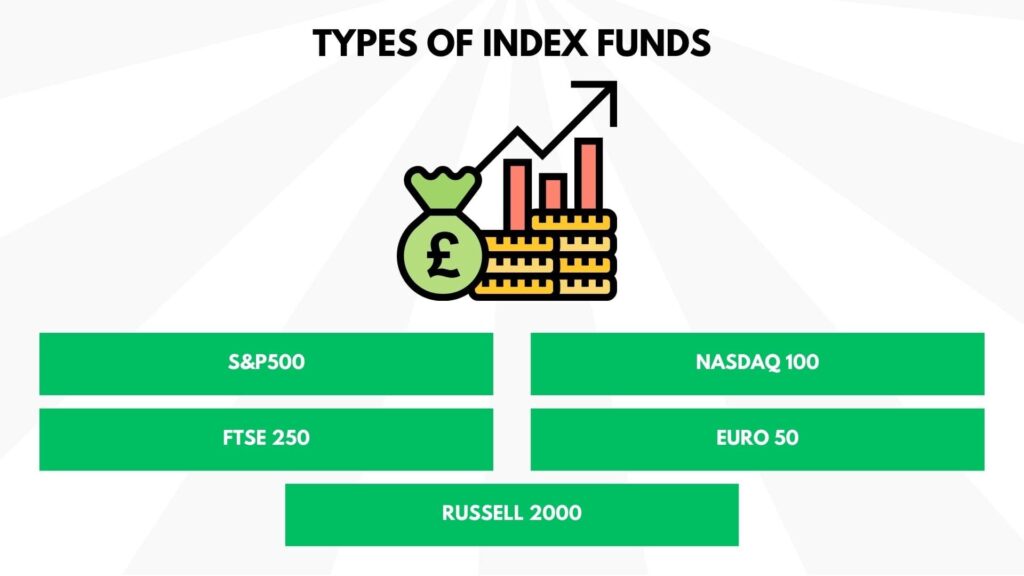

1. Index Funds & ETFs

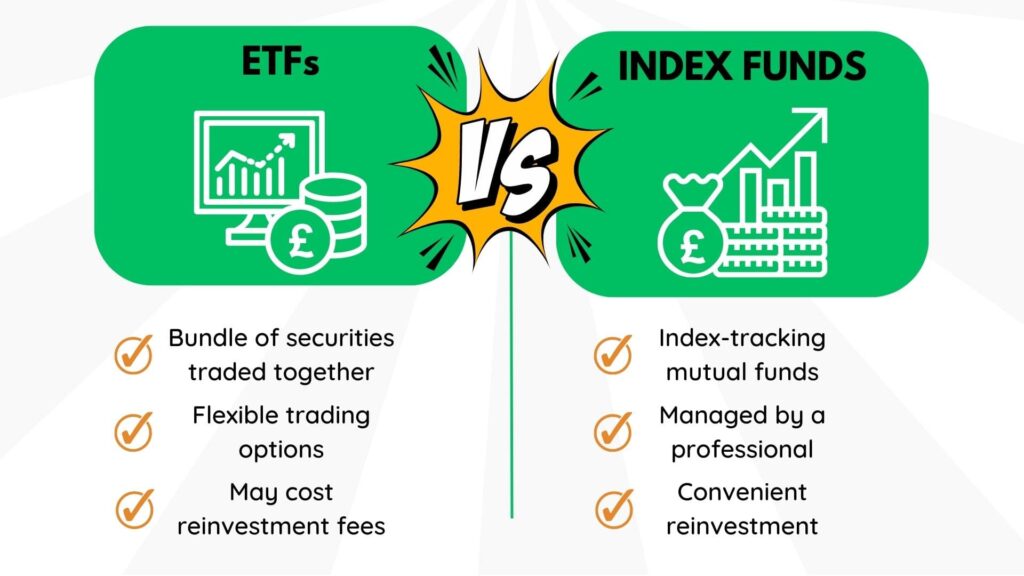

Index funds and ETFs offer a reliable and low-risk entry point for beginners.

Index funds track well-established indices such as the S&P 500, FTSE, or EURO50. Whilst ETFs are a bit more expansive and follow themes, sectors, countries or continents.

By investing in them, you essentially buy a diversified portfolio without the need to handpick individual stocks.

This approach provides stability and is an excellent starting point for building your investment portfolio.

The key benefit is that you’re always holding a basket of the largest and most stable companies within the index, which can help balance out market fluctuations.

Think of them as baskets of groceries but instead of groceries they’re companies. You buy the entire basket (the index) when you’re buying an index fund so you get a piece of everything.

ETFs are very similar but they are managed by Fund Manager who picks what goes into the ‘basket’. This means they can be more flexible and the weightings of particular companies within the basket can be very different.

2. Investing In Yourself

Investing in your personal development is a low-risk, high-reward strategy.

Studies have shown that we allocate 1-2% of our income to self-improvement over our lifetimes – which is just NUTS!

Yet, this investment can lead to significant opportunities and financial growth.

For example, a modest investment in education or skill development can lead to higher-paying job opportunities or even entrepreneurial ventures.

It’s a strategy that empowers you to increase your earning potential and enrich your career prospects.

3. Individual Stocks

Investing in individual stocks gives you direct control over your money, but it’s riskier. To succeed here, you need to get to know the companies you invest in.

Consider things like what makes the company unique, how well it’s managed, what its products or services mean in the market, and make sure your investments have a safety buffer.

While it requires more effort and knowledge, it can be rewarding when done correctly. It’s like being the captain of your own investment ship.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

4. Starting A Business

Launching your own business is an exciting but moderately risky endeavour. Statistics show that approximately 66% of new businesses fail within the first three years.

However, successful entrepreneurship can lead to substantial financial rewards.

It allows you to build something that’s entirely yours, offering flexibility and the potential for growth.

Starting a business requires identifying a market need and creating a product or service to address it, making it an investment in your entrepreneurial vision.

5. Art

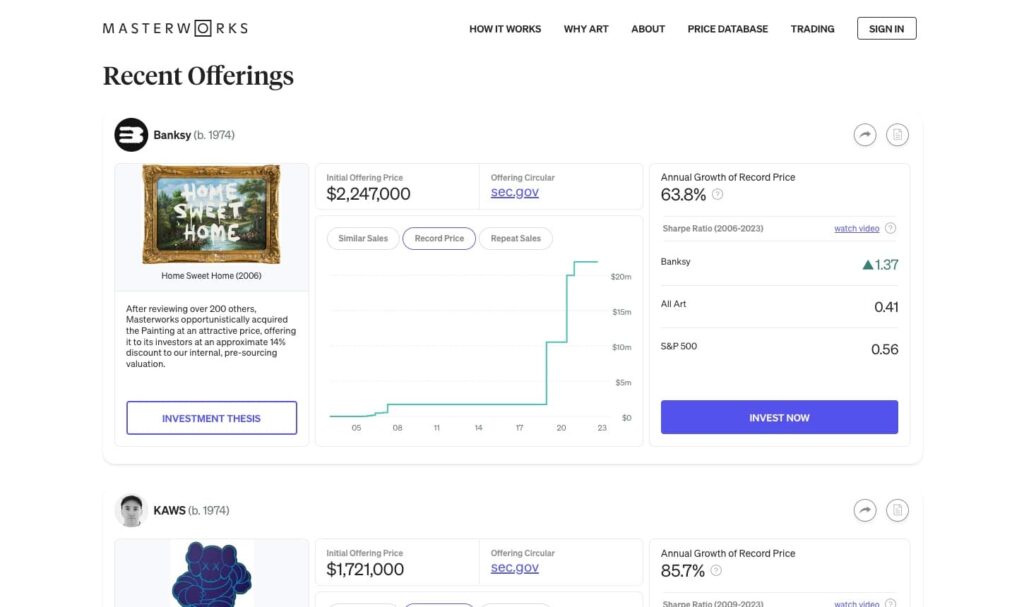

Investing in art, particularly through fractional share platforms like Masterworks, is an alternative but moderately risky investment option.

It offers the opportunity to invest in renowned artworks. Art investments have, on average, outperformed traditional investments like the S&P 500.

However, it’s essential to understand the art market and be aware of the risks associated with this unique asset class.

Art investment combines the world of finance with culture and aesthetics, making it a distinctive choice for diversifying your portfolio.

6. Cryptocurrency

Cryptocurrency investments are highly volatile and come with significant risk.

While they offer the potential for substantial returns, they are not for the faint-hearted. Understanding the cryptocurrency market and staying informed is crucial.

Many investors have experienced both gains and losses in this space, so it’s vital to approach it with caution.

Cryptocurrency represents a technological and financial revolution, but it’s essential to recognise that it operates in a rapidly changing landscape with its unique set of challenges and opportunities.

7. Travel & Experiences

They comparison is the thief of all joy but not with experiences and travel.

If you’re like me then I find travelling and experiencing new things with the people I love makes me a better person.

This has a direct impact on my daily life. Both from a happiness perspective but also from a mindset perspective.

When I go away it resets me. Allows me time to think about the big picture and also get some much-needed vitamin D.

I put this then back into my business and work which in turn makes me more money over the long term.

As an example a few months ago I was completely burnt out. Working on three businesses full time 16 hours a day, 7 days a week.

I had to take some time off. I went away with my partner for 10 days to Greece and when I got back I was revitalised and ready to go!

Sometimes investing in your memories and the way you feel has such a massive impact on you as a person.

Other alternative investments

-

Peer-to-Peer Lending: Peer-to-peer lending platforms allow you to lend your money to individuals or small businesses in exchange for interest payments. It can provide a steady stream of income, but there are also associated risks, including the potential for borrowers to default.

-

Real Estate Crowdfunding: Real estate crowdfunding platforms enable you to invest in real estate projects with relatively small amounts of capital. You can become a partial owner of properties, potentially benefiting from rental income and property appreciation.

-

Commodities: Investing in physical commodities like gold, silver, oil, or agricultural products can be a way to diversify your portfolio. You can invest directly in commodities or through exchange-traded commodities (ETCs).

-

Collectibles: Collectibles such as rare coins, stamps, vintage cars, or fine art can appreciate over time. However, these investments require expertise and may lack liquidity compared to more traditional assets.

-

Wine and Whisky: Investing in fine wine and rare whiskies has gained popularity as an alternative asset class. These investments can be enjoyable for enthusiasts and may appreciate in value.

-

Venture Capital and Startups: Investing in startups or early-stage companies can be high-risk but potentially high-reward. Angel investing or participation in venture capital funds allows you to support entrepreneurial ventures.

-

Royalties and Intellectual Property: Some investors purchase royalties from music, books, or patents. They receive a share of the income generated by these assets over time.

Open an account and enjoy social investing with a wide selection of available stocks, funds, trusts and cryptocurrency.

Types Of Accounts To Invest £1,000

There are many types of accounts you can invest your £1,000. Let’s unpack the 3 main ways if you’re planning on investing in the stock market or savings accounts.

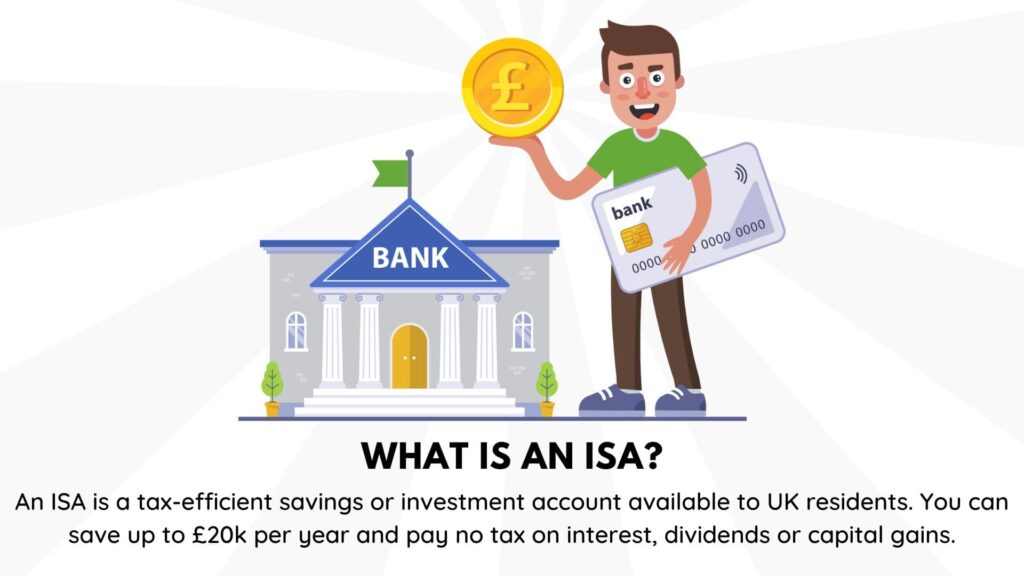

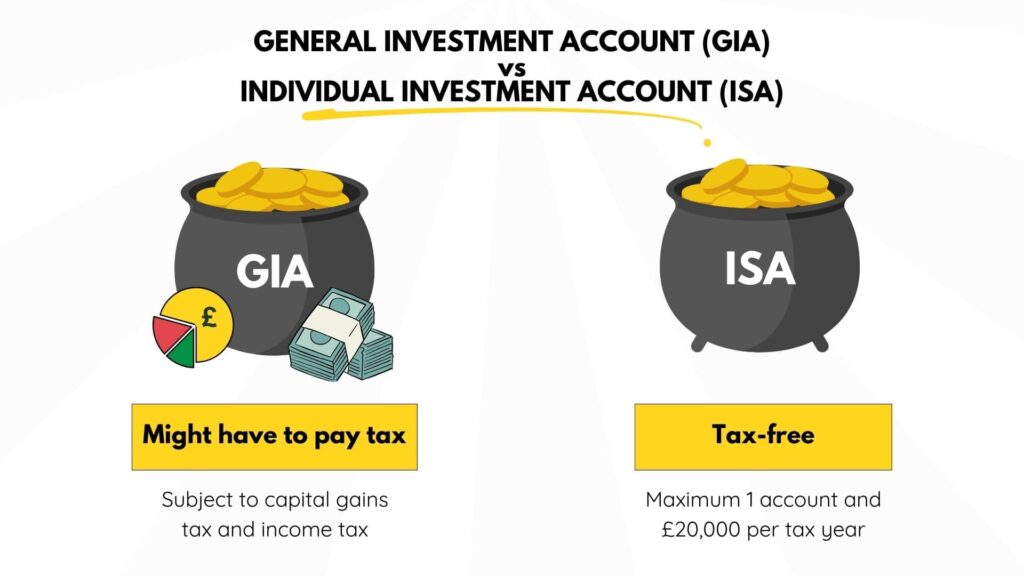

Individual Savings Account (ISA)

ISAs are one of the most popular investment accounts in the UK due to their tax advantages.

There are several types of ISAs, and the great news is that you can use the same £20,000 annual allowance across all of them:

-

- Cash ISA: Save or invest in cash-based products with tax-free interest.

- Stocks and Shares ISA: Tax-free investing in a wide range of assets, including stocks, bonds, and funds.

- Lifetime ISA (LISA): Tailored for under-40s, get a 25% government bonus on up to £4,000/year, helping you save for your first home or retirement.

- Junior ISA (JISA): For kids under 18, parents can save up to £9,000/year separately from their own allowance, with options for both investing (Stocks and Shares JISA) and saving (Cash JISA).

These ISAs offer tax-efficient ways to save and invest, helping you grow your wealth while keeping your earnings shielded from tax.

You can check out my ISAs for beginners guide here and also the best stocks and shares ISAs.

General Investment Account (GIA)

A General Investment Account, or GIA, is a straightforward taxable investment account. Unlike ISAs, gains and income from investments held in a GIA are subject to capital gains tax and income tax.

GIAs don’t have the same tax benefits as ISAs, but they offer flexibility as you can withdraw your money at any time without restrictions.

Check out our general investment account vs stocks and shares ISA guide.

Self-Invested Personal Pension (SIPP)

A Self-Invested Personal Pension (SIPP) is a type of pension account that provides individuals with greater control and flexibility over their retirement savings.

SIPPs allow you to choose from a wide range of investments, including stocks, bonds, funds, and other assets. You can tailor your investments to align with your retirement goals and risk tolerance.

Contributions to SIPPs benefit from tax relief, making them a tax-efficient way to save for retirement.

FAQs

How to invest £1,000 and make money fast?

While quick riches aren’t guaranteed, if you’re looking for potential growth, consider stocks or exchange-traded funds (ETFs). However, be prepared for market fluctuations as investments can go up and down in value.

What should I invest £1,000 in?

Diversifying your investment is a wise approach. Consider spreading your £1,000 across various assets like stocks, bonds, or a balanced portfolio of both.

Diversification helps manage risk and can provide a more stable investment experience.

How much am I taxed on a £1,000 investment?

The tax you pay on a £1,000 investment depends on the type of investment and your tax status.

For example, in the UK, stocks can incur capital gains tax if your gains exceed the annual allowance, but tax rates vary.

How To Invest £1,000 In Stocks?

To invest £1,000 in stocks, start by opening a brokerage account. Research and select stocks or ETFs that align with your investment goals and risk tolerance.

Consider a long-term strategy and be mindful of transaction costs.

Should you invest £1,000 in Bitcoin?

While Bitcoin and some forms of cryptocurrency have potential, it’s essential to recognise its high volatility.

It may not be advisable to allocate your entire £1,000 to Bitcoin alone.

Diversifying your investment across different assets can help spread risk and reduce the impact of market fluctuations.

Summary

In short, there are lots of different investment routes that you could go down if you have £1,000 that you want to invest.

In this guide we have taken a look at some of the best options.

MORE LIKE THIS

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.