Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Are you sitting on a pile of 30k in savings? That’s impressive! But, did you know that investing that money can potentially lead to an even bigger sum? Yes, you read that right!

With that kind of money, you’re in a prime position to explore investment opportunities in the both the stock market and property.

Of course, investing such a substantial amount of money requires responsible decision-making. You need to determine your investment goals and assess your risk tolerance before committing your hard earned cash!

Without a solid strategy and a diversified portfolio, your 30k could easily slip through your fingers. So, it’s important to plan ahead and make informed investment choices. Don’t let this opportunity go to waste!

How you got your 30k is not our business. We’re here to tell you how and where you could potentially invest it.

30k is a potentially life changing amount if you put it to use in the right way. That’s why it’s important to understand your options.

What works for one person won’t for the other but getting the picture clear and the start of a plan in place is super important!

Luckily, there are plenty of viable investment options that we’ll explore together in this article.

Table of Contents

How To Invest 30k?

There are various ways to invest 30k, depending on your investment goals and risk tolerance. Here are some options to consider:

Stocks: You can invest in individual stocks or a diversified portfolio of stocks through a brokerage account. It’s important to do your research and choose stocks that align with your investment objectives and risk tolerance.

Bonds: You can invest in bonds, which are fixed-income securities that pay interest, through a brokerage account or a bond mutual fund. Bonds can offer a more stable return compared to stocks, but may offer lower returns.

Real Estate: You can invest in real estate through buying property or investing in real estate investment trusts (REITs). Buying property can be a long-term investment and requires research and expertise, while REITs offer a more diversified and liquid option.

Mutual Funds and ETFs: You can invest in mutual funds or exchange-traded funds (ETFs) that hold a basket of stocks or bonds. These investment options can offer diversification and professional management.

Cryptocurrency: You can invest in cryptocurrency, such as Bitcoin or Ethereum, through a cryptocurrency exchange. This investment option can be highly volatile and requires careful consideration of risks and potential rewards.

It’s important to do your research and if you are unsure in anyway consult with a financial advisor before investing your 30k.

Whether you decide to use an advisor or not, make sure you have a clear investment strategy and diversify your portfolio to manage risk.

Before you even begin to think about investing – make sure you’ve also done the following!

Pay off outstanding debt – One thing that can puncture an otherwise healthy investment strategy is mounting debt. Make sure you’re all clear before following through on your investment options.

Create an emergency fund – It can all go wrong at any minute. It’s definitely wise to stash away some of your 30k before you throw away all your money. This way, if your investment options don’t work out, you at least have some of your 30k left to start again. This should be 3-6 months worth of pay.

Listen to this podcast episode 🎙️

Join us with Tykr Founder Sean Tepper who’s SaaS platform is getting him 50%+ returns on his investments.

We discuss how Tykr works, how it helps you pick your investments and how it’s grown to over 10,000 customers.

Hit play just below or for links to the full show on your favourite platforms click Sean’s name just above.

Is 30k a Good Investment Amount?

With 30k, you’re in an exceptional position to invest – more than most people can save in a year. The median annual earnings according to Statista for a full-time employee in 2022 was £33k!

But having 30k doesn’t guarantee success. It can be squandered just as easily as 10k or 20k. That’s why it’s crucial to plan wisely and diversify your portfolio to maximise returns and minimise risks.

Investing in various vehicles, including stocks, bonds, real estate, and mutual funds or ETFs, can help create a diversified portfolio. But even with high-risk tolerance, consider low-risk projects to avoid disappointment.

Remember, you’ve already proven your patience by saving 30k. Now is the time to make smart investment decisions and watch your money grow.

Is Investing Right For You?

Whether investing is right for you or not depends on several factors, including your financial goals, risk tolerance, and personal circumstances.

Investing can be an excellent way to grow your wealth and achieve long-term financial goals, such as retirement, financial freedom or buying your first home, but it’s not without risks.

It’s essential to educate yourself on the potential risks and rewards of investing and make informed decisions based on your unique circumstances.

Some questions to ask yourself before investing include:

- What are your financial goals?

- What is your investment timeline?

- How much risk are you willing to take?

- What is your investment knowledge and experience?

- Do you have emergency savings to cover unexpected expenses?

If you’re unsure about investing, it may be wise to consult with a financial advisor or do more research before making any decisions. Investing can be a great way to build wealth, but it’s important to do it responsibly and with caution.

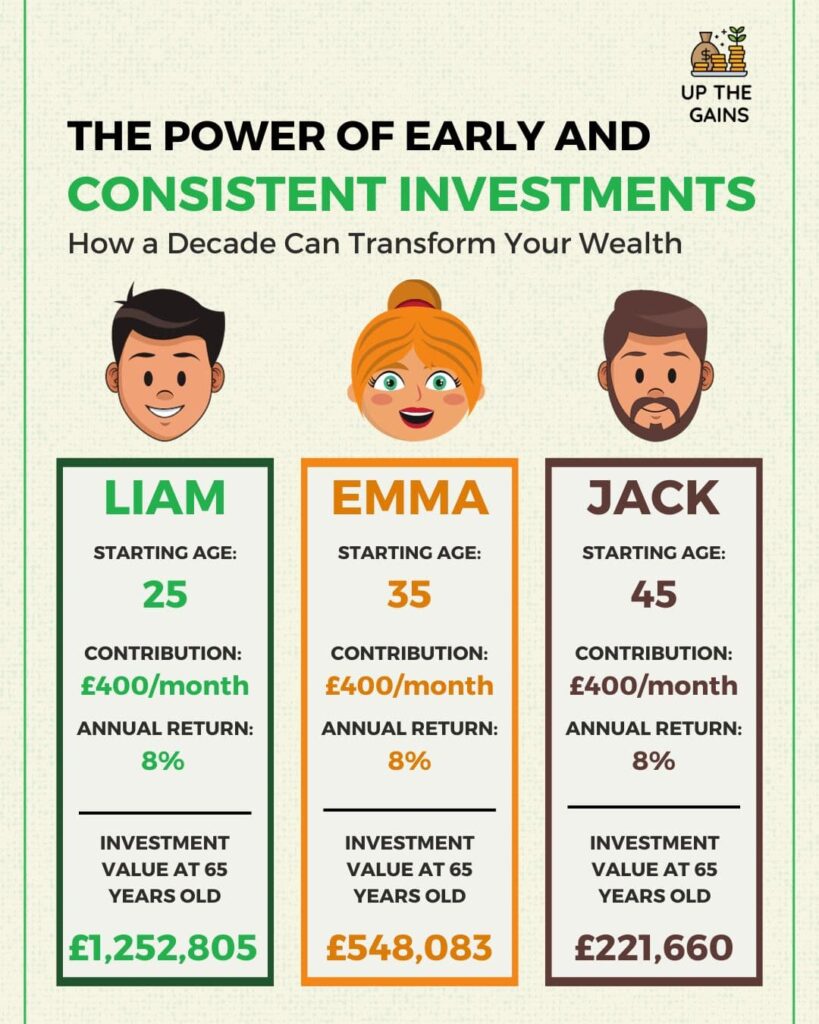

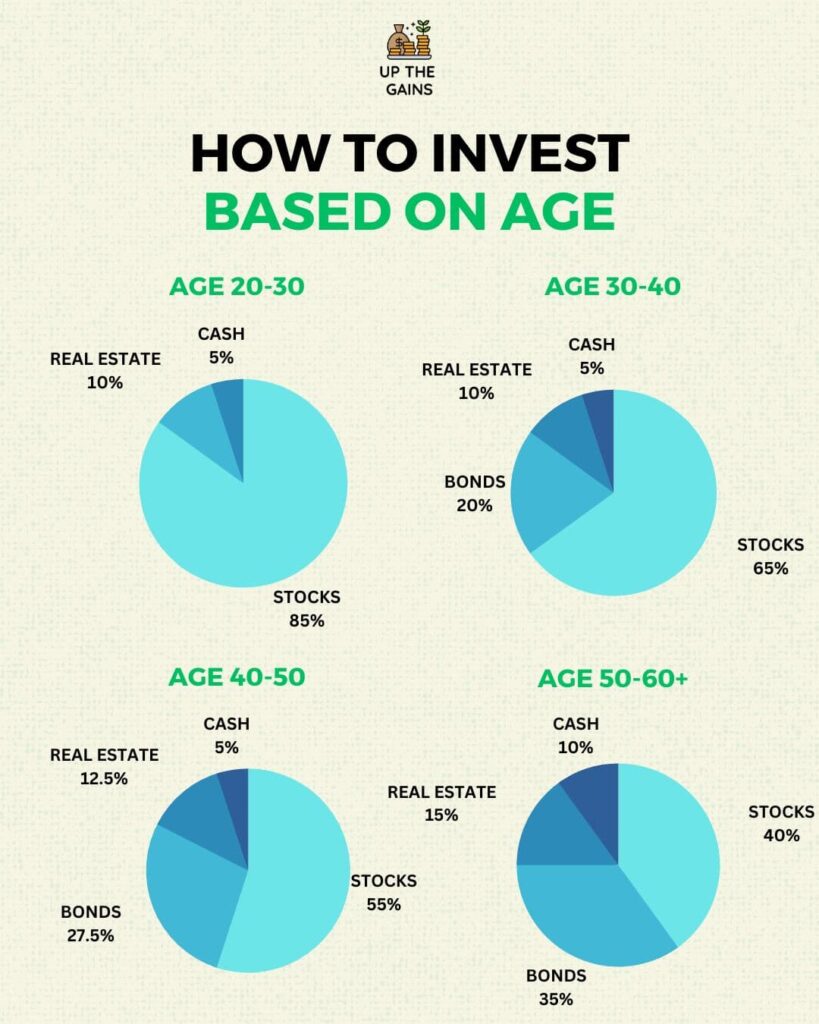

Lastly, for this section, it’s important to understand what age you are. Your age affects your goals, decisions and risk.

For example, building wealth in your 20s is very different to your 30s or 40s.

If you’re interested in finding out how much you can make with your investments have a play around with our compound interest calculator.

What Is the Best Way to Invest Money?

How to invest 30k depends entirely on you and what kind of investment you want to make. Below we’ve listed some of the best ways to invest 30k.

Property / Real Estate

Real estate is one of the best investment options because people will always need houses. If you invest in a property that you want to rent out and manage to find good tenants, it could give you a steady cash flow every month.

Plus, houses are physical assets that are going to generally increase in value over time (depending on where and what you buy). While the value of a house can still drop at points, it’s usually guaranteed to pick back up again.

The best way to do this would be to invest in buy-to-let property. Although the average house price was £296,000 in 2022, you could use some of your 30k to secure the investment.

30k could get you particularly far with off-plan property investment, especially in rural areas or even major cities like Liverpool, Manchester, and Glasgow.

Another way to invest 30k in real estate would be via a Real Estate Investment Trust (REIT). Through this, you can become a shareholder in several properties.

Stocks and ETFs

When it comes to investing 30k, the stock market is always a top contender. With its diverse array of options, including stocks and ETFs, you can invest in growth stocks, blue chip or ones that pay great dividend income.

Like mutual funds, diversification is key when investing in stocks and ETFs. You can select from an array of industries, such as tech companies, healthcare, real estate, utilities, and consumer goods, to name a few.

With retail investing, you have the power to take control of your investments and make informed decisions with your 30k.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

How to Spread Investment Risk

Spreading investment risk is crucial to mitigate potential losses and achieve long-term financial goals. One effective way to do this is by diversifying your portfolio across various investment vehicles, such as stocks, bonds, real estate, and commodities.

You can also spread risk by investing in different sectors and geographical regions. It’s essential to regularly review and rebalance your portfolio to ensure it remains diversified and aligned with your financial goals and risk tolerance.

How Do I Invest 30k in an ISA?

Investing 30k in an ISA can be a great way to take advantage of tax-free savings and grow your wealth over time. Here are some steps to consider:

Choose the right type of ISA: You can choose between a Cash ISA or a Stocks and Shares ISA. A Cash ISA can be a good option if you want to earn interest on your savings without risking your capital. If you are comfortable with some level of risk, a Stocks and Shares ISA can offer higher potential returns.

Select an ISA provider: There are many providers to choose from, including banks, investment firms, and robo-advisors. Do your research and compare fees, investment options, and customer reviews to find the right provider for you.

Decide on your investment strategy: Consider your financial goals, risk tolerance, and investment timeline. Determine how you want to allocate your 30k across different investments, such as stocks, bonds, and funds.

Monitor your investments: Keep track of your ISA investments and regularly review your portfolio to ensure it remains aligned with your financial goals and risk tolerance. Consider making adjustments as needed.

The 20k tax allowance for ISAs is a great incentive for savers and investors to take advantage of tax-free savings.

However, it’s important to keep in mind that this allowance is limited and may not be enough to fully diversify your investment portfolio. In this case, you may need to invest elsewhere alongside your ISA to spread your risk and potentially achieve higher returns.

One option to consider is investing in a Self-Invested Personal Pension (SIPP), which also offers tax benefits and can help you save for retirement.

You can also invest in a general investment account (GIA) outside of your ISA but remember that these accounts are subject to capital gains tax.

If you want to know more about ISAs check out our article called ‘ISAs For Beginners – What You Need To Know‘

FAQs

How much money does the average 30-year-old have saved in the UK?

At 30, you should have at least saved up enough money to equal your annual salary. However, this is not always the case.

Almost half of the people under 30 don’t have any savings at all. So, it’s no surprise that many 30-year-olds in the UK don’t have a substantial amount in their savings account.

How do you save 30k in the UK?

Of course, the best way to save 30k would be to have a comfortable job that allows you to put away around £500 per week.

You would then have to put this money in an account that offers good interest rates, such as an ISA account. Once you start to save money, you should aim to pay off any debt you have accrued up to that point.

Final Thoughts

So, how to invest 30k depends on how much profit you look to make, how long you want to invest for, and what you want to invest in.

One thing that remains the same across the board, however, is that you need to maintain your portfolio and don’t put all your eggs in one basket.

Remember, it’s always best to consult with a financial advisor before making any investment decisions.

MORE LIKE THIS

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.