Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Investing £40,000 wisely requires a balanced and diversified approach. Start with setting clear financial goals and time frames. Allocate a portion of the funds towards a high-yield savings account for immediate liquidity and emergency needs.

Consider investing in low-cost index funds, ETFs, or mutual funds to take advantage of stock market growth while minimising risk, and don’t overlook the potential of bonds for stable returns.

If you’re comfortable with higher risk for potentially higher return, allocate a small percentage towards individual stocks or cryptocurrencies.

Investing 40k should be easy – right? You’ve already managed to get hold of 40k and hopefully proven you can be more than responsible with your money. So, what can go wrong?

Well, saving 40k was only half the battle: now you’ve got to figure out how to invest 40k wisely. It’s not a small amount of money and could potentially grow to be a sizeable pot if you if pick the right investments.

To invest smartly you need a plan. Understand what it is you want to achieve, what is actually possible and how are you going to do it.

That’s what we’re going to unpack in this article.

Table of Contents

How To Invest 40k?

Investing is all about putting your money to work in a variety of vehicles with the expectation of growing it over time. These vehicles, or asset classes, are varied and each comes with its own level of risk and potential return.

Here’s a list of some key asset classes you can consider:

-

Stocks: Also known as equities, stocks represent a piece of ownership in a company. When you buy a stock, you’re essentially buying a tiny slice of that company. It’s like owning a little piece of a giant money-making machine! The catch? If the machine breaks down, your piece might not be worth much.

-

Bonds: Bonds are essentially loans you give to entities such as governments or corporations. They promise to pay you back with interest after a certain period of time. While they’re not as exciting as stocks, they’re also generally not as risky. It’s like lending money to a friend, but with a contract and a much higher chance of getting paid back!

-

Exchange-Traded Funds (ETFs): ETFs are baskets of different stocks or bonds that you can buy and sell on the stock exchange, just like individual stocks. They’re a great way to diversify your portfolio without having to buy each stock or bond individually. Think of them as a pre-made salad mix – you get a bit of everything in one package.

-

Mutual Funds: Similar to ETFs, mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. The main difference is that they’re generally managed by a professional fund manager. It’s like having a personal chef prepare that salad for you.

-

Property: This could mean buying a house, commercial real estate, or even farmland. While it requires more hands-on management than other investments, it can provide steady income in the form of rent and potential price appreciation. It’s like owning a golden goose, but instead of golden eggs, it lays rent checks.

-

Commodities: These include physical assets like gold, silver, oil, and even agricultural products. They can be a good hedge against inflation but can be volatile. It’s like owning a piece of the Earth itself, but remember, even Mother Nature has her mood swings.

-

Cryptocurrencies: These are digital or virtual currencies that use cryptography for security. They’re high-risk and volatile, but they have the potential for high returns. It’s like being in a financial Wild West – exciting, but you might want to be ready for a few duels.

Remember, diversification is key in investing. Don’t put all your eggs (or pounds) in one basket. Instead, spread your money across different asset classes to balance risk and potential return.

How To Invest 40k In The Stock Market?

First things first – you need an investment account. From this account, you can start branching off your 40k into different investments. One of the best options for how to invest 40k would be to set up a stocks and shares ISA (more on this later).

Alternatively, you could download and set up an investing app. These handy tools allow you to invest in different areas via your phone.

For example, you could spread your 40k across commodities, mutual funds, and stocks all from the comfort of your smartphone.

Some of the best investment apps include:

- eToro

- Moneyfarm

- Freetrade

- Trading212

- IG

Not only do these apps provide you with a safe platform to invest 40k, but the likes of Moneyfarm provide you with a wide selection of educational content and support.

It’s like having your own financial advisor in your pocket!

30 million users worldwide enjoy social investing with over 3000 of stocks, funds, trusts and cryptocurrency available.

Use their social features and copy trading to follow and invest with the best investors on the app.

- 0% commission on real stocks and ETFs

- Social Investing

- Copy the top investors in the world

- Regulated by the Financial Conduct Authority (FCA)

- Lack of research

Is £40k A Good Investment Amount?

40k is a great investment amount, regardless of your risk tolerance and investment goals (it’s better than having 10k saved, anyway).

With it, you can put forward substantial chunks to different investment clauses. Plus, you could also hold some money back in your savings account in case of an emergency.

It gives you enough to invest in quick, risky investments as well as longer, safer ones, too. Short-term loans tend to require greater risk tolerance but offer much greater returns.

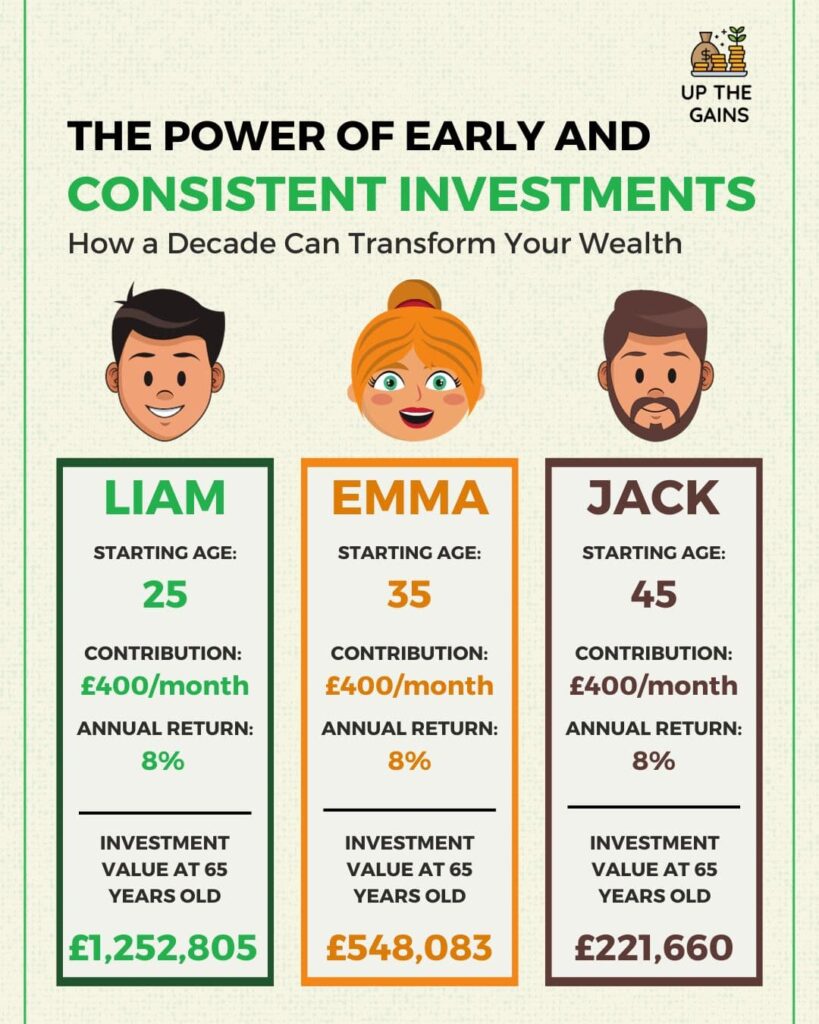

Long investments – that can sometimes be decades-long – go up and down in terms of inflation, but are generally a lot safer. Once you start earning compound interest, your savings will grow incrementally larger.

Is Investing Right For You?

What’s the use in having your 40k sitting under your mattress when you could be transforming it into mega bucks on the stock market (as a retail investor) or through real estate?

You can determine how best to invest 40k by considering the following factors:

Your goals – How much money are you aiming to transform your 40k into? If you’re looking to steadily build wealth, you should put your savings into an account or a stock and shares ISA.

Timeframe – Again, how long you’ve got to invest should determine what kind of investment is right for you. A stocks and shares ISA is a long-term commitment, while a bonds EFT is suitable for short-term investing.

Risk Tolerance – How much risk do you feel you can take? Your risk tolerance can determine precisely the kind of investment you should make.

Background – If you’re someone who’s been used to investing on a low income and have come into money then how are going to scale this up. Are you ready for investing bigger amounts and potential losses?

What Is The Best Way To Invest Money?

As I’ve made clear already: 40k gives you more than enough to put your money into an array of investment options.

Not only that, but you can split up 40k into decent-sized chunks to guarantee maximum returns on each investment that you make.

But what are the best ways to invest 40k?

Index funds

An index fund is a passive means of investing in stocks. It is basically a portfolio of different investments designed to match a financial market index.

Your money gets added to a pool (alongside the money of other investors) and your profit grows as the tracked market index increases.

Index funds have low fees, and low trading costs, and are an excellent choice for long-term investing.

Given the range of investments, index funds are also considered safe. They don’t rely on the success of a single stock share.

Learning how to invest in an index fund is pretty easy just see our guide there.

Cryptocurrency

Cryptocurrency indeed presents a considerable risk-reward proposition – it can be a quick way to shrink your £40k savings, but also an opportunity to diversify and potentially grow them.

Taking a deep dive into research is crucial before investing any portion of your savings into cryptocurrencies. It’s like playing a high-stakes game, where understanding the rules could make the difference between growing your wealth and watching it disappear.

Despite the volatility and uncertainties, cryptocurrencies have proven to be a potentially profitable investment avenue in 2023. It’s like riding a roller coaster; it can be scary, but the thrill and the view from the top might be worth it.

However, if you’re feeling lost in the maze of blockchain and altcoins, consulting with a financial advisor who has a solid understanding of cryptocurrencies could be beneficial.

It’s like hiring a tour guide for a trip into the wild – they’ll help you avoid the pitfalls and point out the sights worth seeing. But remember, at the end of the day, it’s your journey to take.

Real estate

While 40k might not be enough for you to buy a property outright, you can definitely use some of your savings to invest in real estate.

For example, you could become a shareholder in a Real Estate Investment Trust (REIT). These companies own income-producing real estate, which includes both residential and commercial properties.

Around 90% of a REIT’s annual income goes toward shareholder dividends. This means that each shareholder receives a steady income from the trust each year.

Besides REIT, there’s a range of other crowdfunding real estate investment options available. This includes:

- Crowdestate

- Reinvest

- Bulkestate

- Property Partner

- Housers

Individual Stocks

Individual stock picking is choosing specific stocks to invest in. Here’s the punchy version:

Research: Be a business detective, scouring company fundamentals and industry trends.

Analysis: Turn into a financial Sherlock Holmes, dissecting balance sheets, income statements, and key ratios to deduce a stock’s worth.

Risk Assessment: Check your stock’s “weather forecast” by understanding its risks – both company-specific and market-wide.

Buy and Monitor: If it checks out, buy the stock, but keep an eye on it – monitor quarterly reports and market news.

Remember, this is high-stakes, as you’re putting your eggs in fewer baskets. It’s risky but potentially rewarding.

For example, I have 15% of my total wealth individual stocks (this is not financial advice just an example) and in my portfolio I have 23 individual stocks.

It’s like having my own handpicked fund but you do need to stay on top it a lot more which for me is fun but not for everyone.

EFTs

Exchange-Traded Funds (EFTs) allow investing in various asset classes through one simple investment. With an EFT, you gain a varied portfolio of investments in leading stock markets.

Best of all, your EFT is overseen and managed by a financial expert. So, not only do you gain a well-diversified portfolio, but your money is also in the hands of experts.

You can invest in foreign market EFTs as well as commodity EFTs, which allows you to invest in gold, silver, and oil. You can also buy dividend stocks through EFTs.

EFTs are flexible in that they can be bought and sold throughout the day (as long as the market is open). This is unlike mutual funds. Bond EFTs are available for those looking to make a short-term investment.

How To Spread Investment Risk

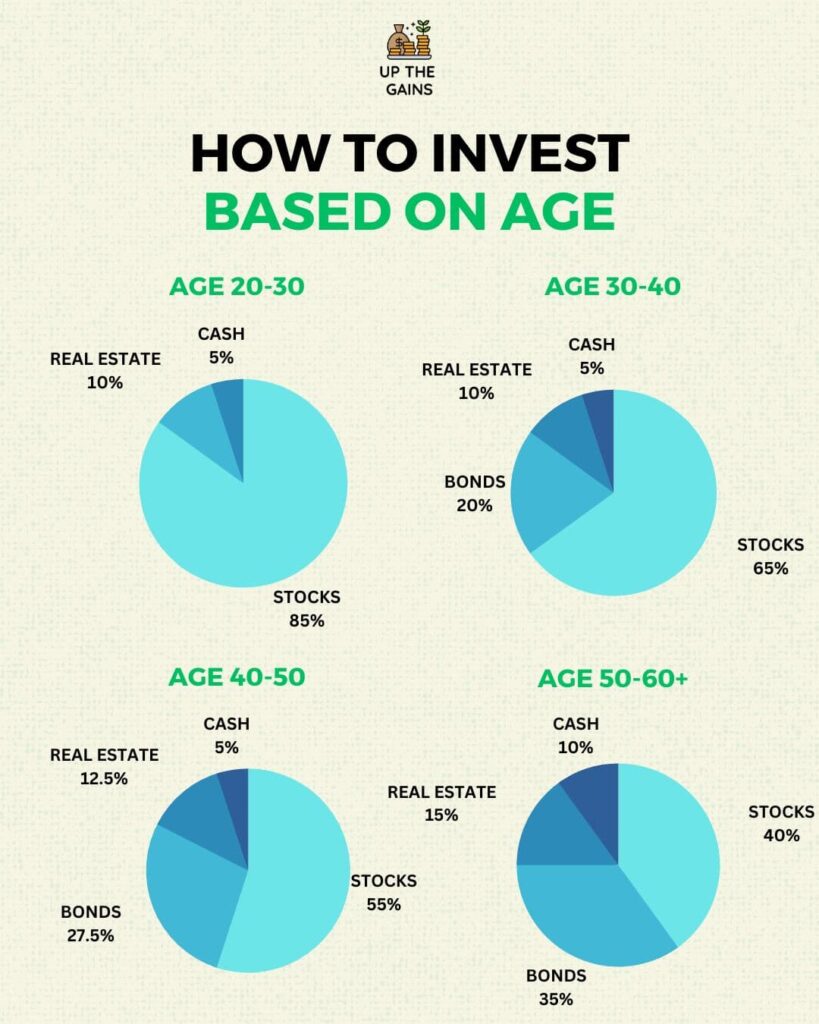

The best way to spread investment risk is always to maintain a well-diversified portfolio. Many investors make the mistake of only investing in a few stocks that they feel are low risk.

It’s important to not only invest in a range of different stocks, shares, and bonds but also have a range of risky investments as well as safer ones.

Markets are unpredictable, so you need to expect the unexpected. While you may lose money on a safe investment, you may make more money from a risky investment.

EFTs are good because they allow you to invest in various asset classes at once.

It’s also vital that you invest in various geographical markets – not just the UK and the US.

How To Invest £40k In An ISA

If you want to invest 40k in an ISA, you’ve got several options to consider. A cash ISA allows you to gain some of your earned interest tax-free.

Cash ISAs are great for savings and emergency funds to get higher interest rates!

A stocks and shares ISA, on the other hand, allows you to invest in the stock market – again, without paying tax.

However, you will still have to pay some taxes. As of 2023/2024, the limit for ISAs is £20k. This means that you’re only tax-free up to the £20k mark.

Still, an ISA would be a good way to invest at least some of your 40k.

You can sign up for an ISA via a high street bank, building society, stockbroker, and other financial institutions.

FAQs

How much interest will 40k earn over a year?

With 40k in the bank and a strong interest rate of 7%, you could earn upwards of £2,200 a year in interest. However, finding a bank that offers a fixed interest rate of 7% is difficult.

First Direct offers it, but most other banks are generally below 7%. If you were to put your money in a bank that offers a more typical rate (such as 4.25%), you’d earn around £1,360.

Is 40k a lot of money?

40k is a lot of money, whether you’ve got it in savings or if 40k is your annual income. It’s above the median annual salary for 2022 of 33k a year.

If you’ve got 40k ready to invest, then you’ve got a clear advantage over those on a 33k salary with fewer savings. 40k is a lot to play with and gives you the option to invest in several different areas.

Final Thoughts

UK investors have a lot of options when it comes to how to grow their cash – from investing in a growth stock to crypto, there are many answers to the ‘how to invest 40k’ question.

Download an investing app, and start growing your 40k today. Or, put it in high-yield savings accounts, such as a cash ISA.

In fact, you should check out our recent podcast episode with Sam North, Head of Trading at eToro. We speak all about how to trade and invest like a pro.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.