Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

Moneybox and Moneyfarm are undoubtedly great products, but equally very different.

Moneybox is the winner if you’re interested in savings and ISA products, but for us, Moneyfarm wins if you’re looking for a top investment app.

Full disclosure: I have had both apps for over 12 months, so this review is 100% my personal opinion. I own a Moneybox Cash ISA and a Moneyfarm Stocks and Shares ISA.

Saving and investing has been made A LOT easier with access to incredible apps like Moneybox and Moneyfarm.

Picking the right investment account is important. You want to be sure you’re investing in the right things and keep your costs down as much as possible.

That’s why today we’re looking at Moneybox vs Moneyfarm – two of my favourite investing apps and in my opinion market leaders in the UK.

Table of Contents

Moneybox vs Moneyfarm - Introductions

Moneybox and Moneyfarm are two brilliant industry-leading apps, but before we get started, you need to know that they are very different.

Both have investment accounts available but differ in their offering which we’ll get into.

Moneybox

Moneybox is more of a budgeting app, which is great for helping you save money. It’s known for rounding up your money to the nearest pound and tucking it away into saving and investing pots.

It has a wide selection of ISAs available, including personal pensions, so it is more of a rounded personal finance option.

It can then automatically save and invest, but you must choose your investments.

You can start with a minimum investment of just £1 with Moneybox, which is excellent for those just struggling to save or want to drip feed money into their account.

Moneyfarm

Moneyfarm operates more like a Wealth Manager, focusing solely on making your money go further, with everything managed for you by its expert team, who can also speak to you on the phone.

Moneyfarm are part of the select group of robo advisers that use questions and risk appetite to establish an investment strategy for you.

Moneyfarm requires a minimum investment of £500 to get started, which means for those wanting to dip their toe in this option might not be for you.

Moneyfarm is after the more grown-up investor who wants to make their money work long-term, so it depends on where you are on your journey.

As you can see, both are great for different reasons, but this article is about which app is the best for investing, and so if you have £500 saved, then I think Moneyfarm is the better option.

What are the apps like to use?

Both apps are slick and very user-friendly, which in this day and age is vital to attract and keep customers.

You can easily navigate the investing options and dashboard to see your progress. Both have access to training and blog posts to help you learn about money.

You can download both apps and set up an account in just a few minutes on the Apple Store and Google Play.

- Moneybox is rated 4.8 out of 5 on Apple and 4.3 on the Google Play Store.

- Moneyfarm has been rated 4.7 stars out of 5 on Apple and 4.4 on the Google Play Store.

Moneybox vs Moneyfarm - Fees

Both apps allow you to pay via direct debit or manually from your bank account.

It does ask for your bank details when you sign up, but it does not store this information.

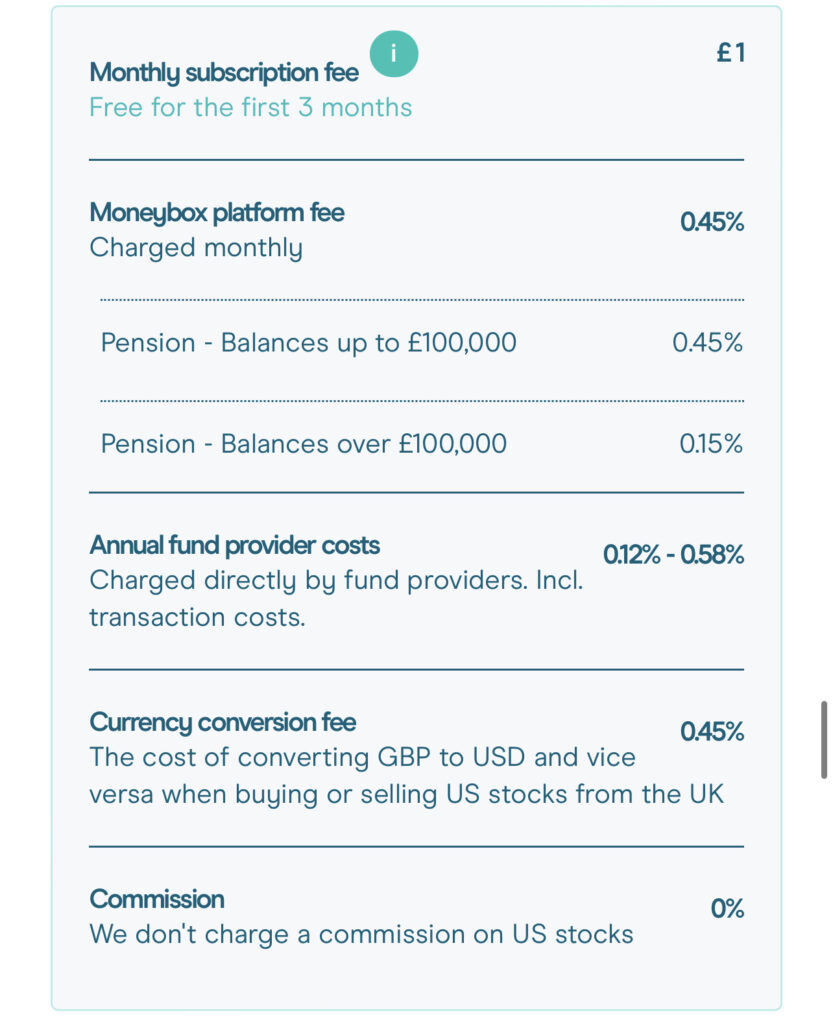

Moneybox has a £1 a month subscription fee (£0 on a personal pension) which is waived for the 1st 3 months but this can seriously add up.

For example, if you have just £100 saved with Moneybox that’s a whopping 12% of your savings a year.

Moneybox also have 0.45% annual platform fee which is charged on your investments.

Below is Moneyfarm’s platform fees which is a sliding scale depending on the amount you have invested.

| Moneyfarm | Platform Fee |

|---|---|

| From £500 | 0.75% |

| From £10k | 0.70% |

| From £20k | 0.65% |

| From 50k | 0.60% |

| From £100k | 0.45% |

| From £250k | 0.40% |

Fund Fees

Next up is fund fees. Moneyfarm’s is very simple with a straight 0.2% charged on funds that you own in a portfolio.

This means the total you could pay is 0.95% a year with no subscription fee.

Moneybox has up to a 0.58% fund fee. They also charge 0.45% per trade as a foreign exchange fee when you buy. This can add up if you’re buying regularly.

Once you add the subscription fee back in you could be paying anywhere from 1.1% to 1.5% a year which doesn’t include the individual foreign exchange fees added in.

We totally get it’s complicated, but nuts and bolts, Moneyfarm is the cheaper platform.

Moneybox vs Moneyfarm - Account Options

When it comes to the accounts on offer, both Moneybox and Moneyfarm have good access to ISAs, personal pensions and GIAs.

Here are the options that both provide in more detail:

- GIA (General Investment Account) – investing accounts which do not have tax benefits and are subject to capital gains tax

- SIPPs (Personal Pension) – Get tax contributions called tax relief on your pension payments

- Stocks and Shares ISA – Access to global markets and tax-free annual contributions of up to £20,000. The tax-free benefits of an ISA are incomparable to any other investment account.

- JISA (Junior ISA) – Invest or save up to £9000 a year on top of your personal tax allowance of £20,000. Your child can access these accounts when they are 18.

They also offer Cash ISAs, which are great for saving money and usually give higher interest rates than standard savings accounts.

Moneybox vs Moneyfarm - Where can you invest?

Moneybox Options

Moneybox currently has fewer fund investment options than its counterpart, Moneyfarm, with only three chosen portfolios.

These investment fund types are risk associated and are as follows:

- Cautious

- Balanced

- Adventurous

Moneybox does allow you to build your account style with access to over 1600 individual stocks and funds. This is good for people with some investing experience looking for broader control and choose their own investments.

For example you can buy shares in Tesla, Amazon, Apple and Microsoft and also into major funds like Vanguard, Fidelity and Blackrock.

Moneyfarm Options

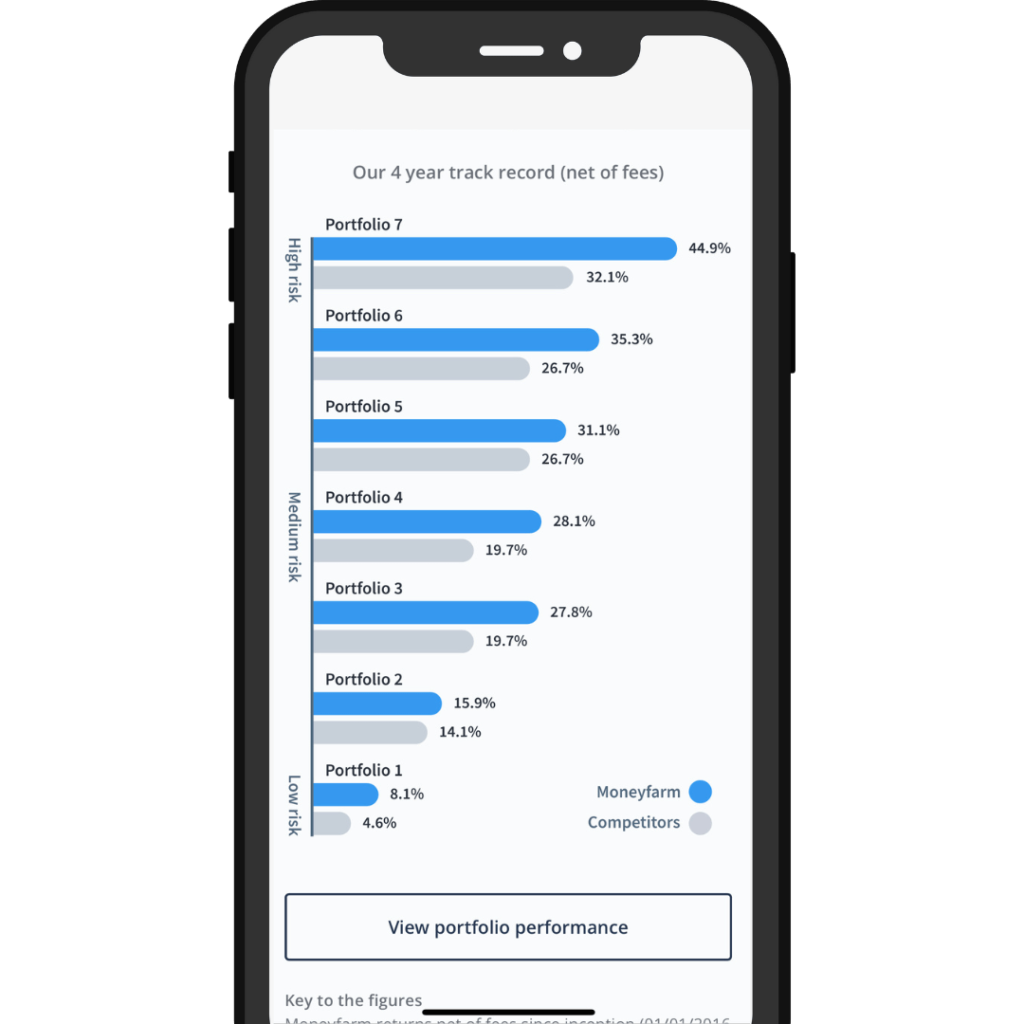

Moneyfarm has seven investment portfolios giving more comprehensive options for people with different financial situations.

These portfolios comprise different stocks and bonds weighted towards high and low-risk options on a sliding scale.

These funds are fixed, and there isn’t the option to choose individual investments like fractional shares.

They are, however, actively managed by Moneyfarm’s investment account team, so you can rest assured that someone is working to maximise your money.

These type of investment platforms like Moneyfarm are called robo advisors, and they are very popular mobile apps that allow a hands off, fully managed approach to investing.

Personally, I would rather let the experts manage the bulk of my money. I still have an account with eToro that I use to pick individual stocks, but this is more for fun, and I use Moneyfarm for a long-term approach.

Moneyfarms investment fund has beaten the market by an average of 2% a year for the past five years, so the experts are doing their jobs well!

If you’re ever worried, pick up your smartphone and chat directly through the app with their team.

Socially responsible options

Both have impressive ESG (environmental, social governance) funds. Moneybox has access to funds which provide this option, and Moneyfarm has crafted an ESG fund with average-sized risk.

These days, having a range of ethical portfolios is very important as some investors think about their investment decisions rather than overall fund performance.

Moneybox Pros & Cons

Pros

- Fantastic app for beginners to start saving and investing

- Its regulated by the Financial Conduct Authority (FCA)

- The round-up feature is brilliant for those who struggle to save and invest

- You can combine all your pensions into one

- It has had excellent customer ratings across the board, on App Store, Google Play, and Trustpilot

Cons

- Fund performance over 5 years is slightly less than Moneyfarms

- Lack of human advice

Moneyfarm Pros & Cons

Pros

- 90,000 users with over 2.4 billion in funds under management

- Free investment advice from top professionals

- 7 high-performing funds organised by risk level

- It is regulated by the Financial Conduct Authority (FCA)

Cons

- Fees are relatively fair and straightforward

- Higher minimum deposit of £500 (no minimum after that)

Moneybox vs Moneyfarm - Security

If you’re wondering is Moneybox and Moneyfarm safe then the answer is yes. They are both protected by the FSCS (financial services compensation scheme) up the value of £85,000.

Both Moneybox and Moneyfarm are protected by banking-level security, which means there is 256-bit encryption on your data held in a secure server.

There are high-level security protocols to log in and access face ID on Apple devices on both apps.

Moneybox vs Moneyfarm - What are customers saying?

It’s essential to see what the customers think of the apps they are using. As with most financial products, anything over a 4 on Trustpilot is usually a good indicator.

Moneybox has an excellent rating 4.6 out of 5 rating coming from over 1300 reviews. Main focus points are range of products available, a slick app and Lifetime ISA access. There is not much around investing.

Moneyfarm has an excellent rating of 4.1 out of 5 coming from over 780 reviews. This has dropped a lot since the market has underperformed in general, with most of the 1-star reviews talking about poor performance.

Whilst this normally would be a bad indicator, the entire market performance, including Moneybox funds, has dropped in 2022.

Looking at the overall customer satisfaction, it does seem that Moneybox is the best app to save your spare change and Moneyfarm is the winner for investment performance.

Moneybox vs Moneyfarm - Who wins?

Both are great investment apps for beginner investors. You can start investing immediately and have access to the stock market at a relatively low cost and a wide range of investment options.

Certainly, Moneyfarm is the best robo advisor we have come across on the market, but the minimum investment of £500 to get started can be a stumbling block for some.

You can find out more in our Moneyfarm review.

Overall, Moneybox’s fees are higher than Moneyfarm’s, and this can add up over time.

Moneybox has fantastic Cash and Lifetime ISAs which can provide you the full personal finance suite if you want to keep your money in one place.

Personally though I like keeping my money in separate accounts to lower risk should one go bust.

The Moneybox vs Moneyfarm winner is…

This one is too close to call. We like Moneybox for its savings accounts and Moneyfarm as an investment account. This is a personal preference and is solely down to you.

MORE LIKE THIS

Disclaimer: Past performance is not a future performance indicator and therefore it is important to your research before committing any capital. Investment products can be volatile so be sure to understand the risks.

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.