Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

This one is easy for me. Moneyfarm is cheaper and has far better portfolio performance and higher ratings.

Moneyfarm offers financial advice, has a very easy-to-use app and for me is the best robo advisor on the market right now.

If you’re on the fence then let’s get into why Moneyfarm wins this one!

Full Disclosure: I own a Moneyfarm Stocks and Shares ISA and have done for over 12 months. I’m very happy with both the product and the performance of the fund.

I do however really like what Nutmeg stands for which is essentially a robo-advisor service just like Moneyfarm which allows beginner investors to get access to top-quality investment products.

Nutmeg’s performance however has been questionable in comparison to Moneyfarm and other robo-advisors so there is a bit of work for them to do there.

So, let’s get into it as we put Moneyfarm vs Nutmeg!

|

4.6

|

3.8

|

|

|

|

|

- Free financial advice

- Expert managed portfolios

- Ethical investing option

- High 1st Deposit

- Expert managed portfolios

- Owned by J.P Morgan

- Ethical Investing Option

- Higher Fees

Table of Contents

Moneyfarm VS Nutmeg

Both of these investment apps are distinguished robo-advisors, which, in case you’re not familiar, serve as online brokers offering financial counselling and investment management services with limited human involvement.

Tailored for the contemporary digital era, they operate on a “set-and-forget” investment model. Upon registration and direct debit setup, these apps assume responsibility for managing your investments.

Both apps are cross-platform, compatible with Apple iOS and Android, and also offer web-based access for added convenience.

If you’re interested in one of these apps. You can check out our full Moneyfarm review or the full Nutmeg review here.

The downside to both of these apps is you need £500 to open an account!

If that’s not for you then check out Wealthify which is another brilliant investment app and also allows you to invest for £1. Here is our full Wealthify review here too.

Key Features - Nutmeg vs Moneyfarm

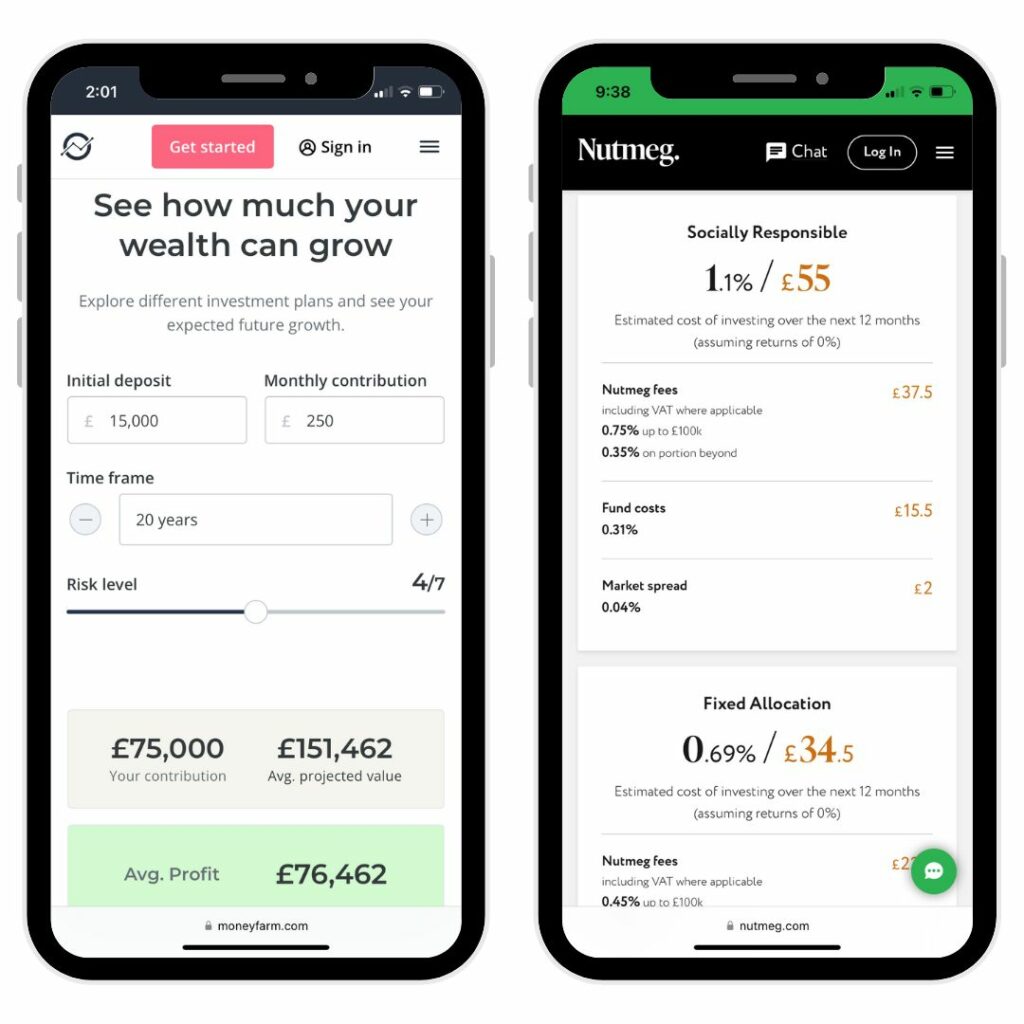

| Moneyfarm | Nutmeg | |

|---|---|---|

| Minimum Investment | £500 | £500 (£100 for JISA and LISA) |

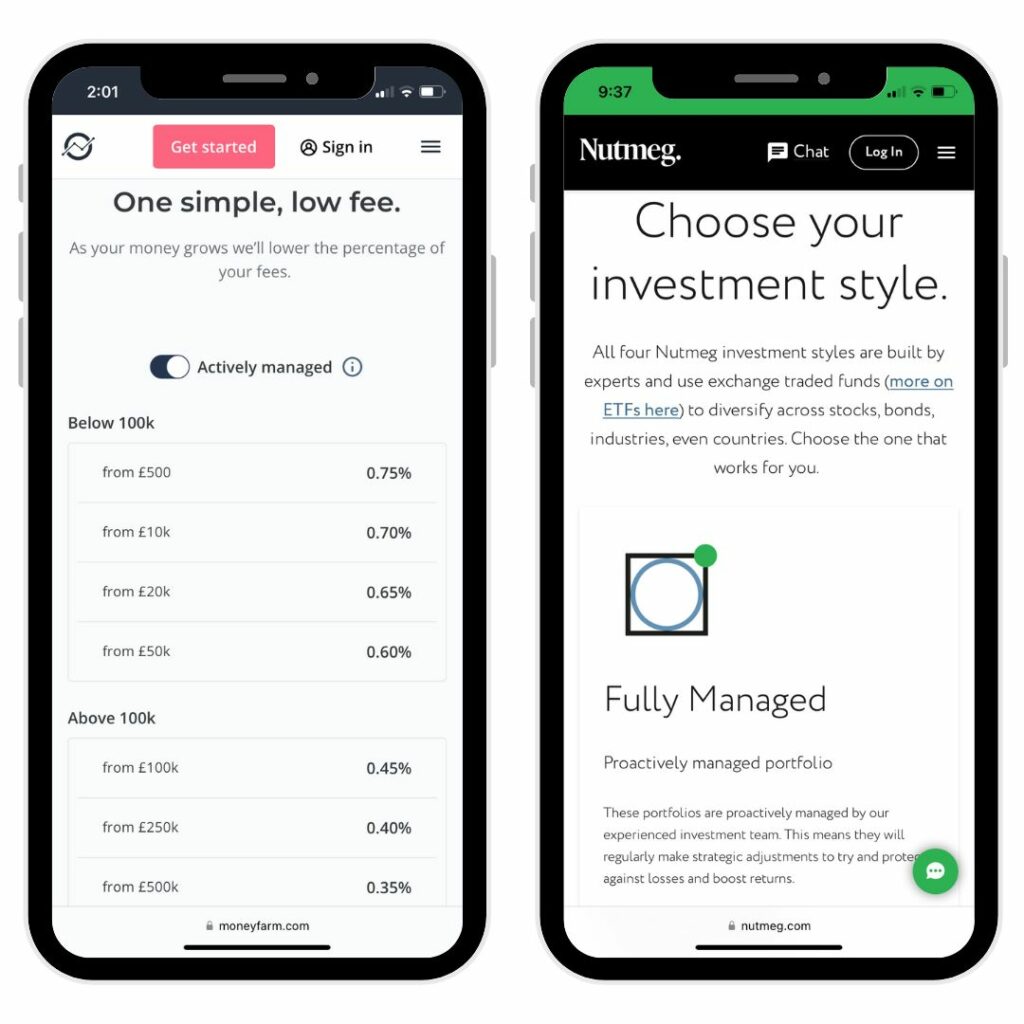

| Management Fees | Up to £10,000 - 0.75% £10,001 to £20,000 - 0.70% £20,001 to £50,000 - 0.65% £50,001 to £100,000 - 0.60% £100,001 to £250,000 - 0.45% £250,001 to £500,000 - 0.40% Over £500,000 - 0.35% The fee you pay is based on the total value if your portfolio and so if you invest £75,000 you will pay a total fee of 0.60% Additional underlying fund charges | Up to £100,000 - 0.75% Over £100,000 - 0.35% |

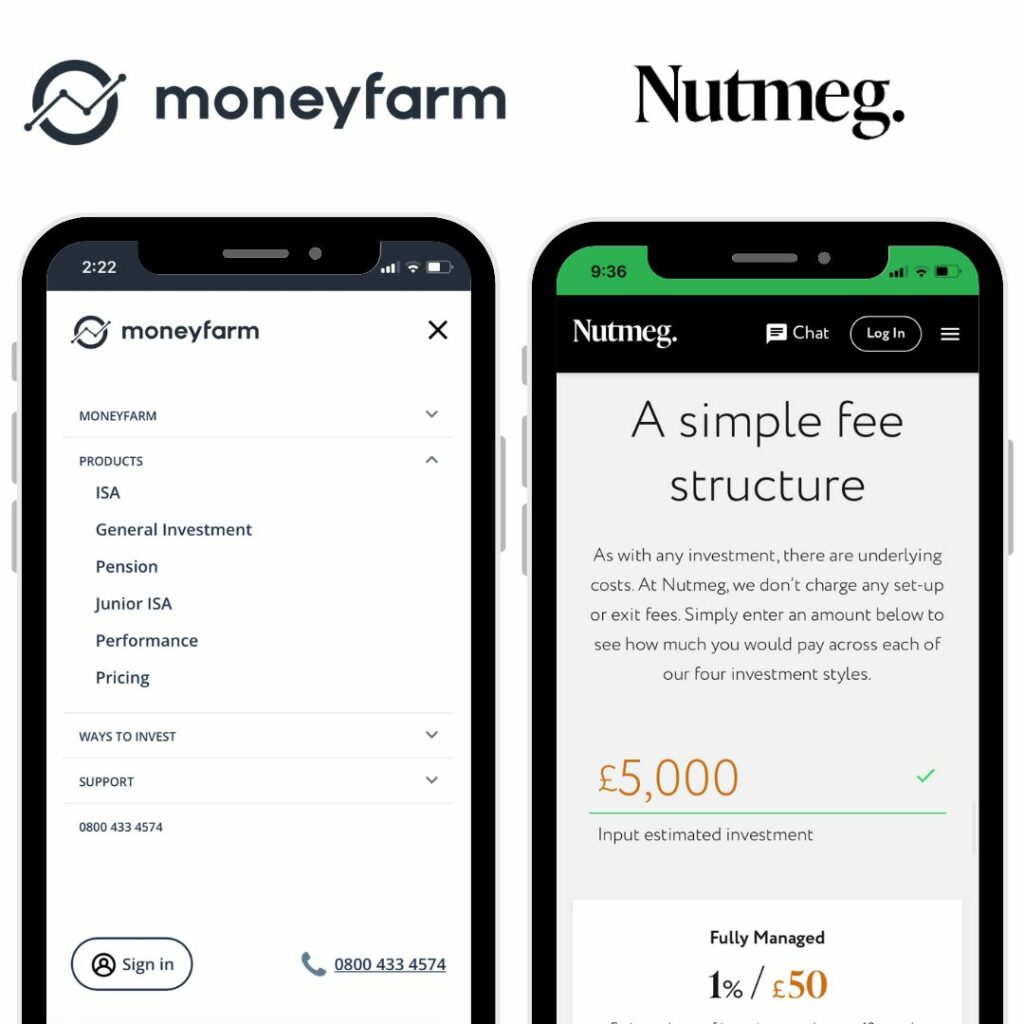

| Products | ISA, General Investment Account, Junior ISA and SIPP | ISA, General Investment Account, Junior ISA and SIPP |

| Number Of Portfolios | 7 | 10 |

| Ethical Portfolios | 7 | 10 |

| Money To The Masses offer | No management fees for 12 months | No management fees for 12 months |

Moneyfarm vs Nutmeg - Minimum Investment Amount

As we discussed briefly both Moneyfarm and Nutmeg is a whopping £500 to open an account. Whilst this deters a lot of people they’ve done it to ensure their users are serious about investing with them.

After the initial outlay though you can put a minimum of £25 as a direct debit each month which is a lot more reasonable.

Moneyfarm vs Nutmeg - User Experience

The beauty of both of these apps is you need relatively no experience to get started investing which for me is a big tick! The more people we can get investing and into the markets over the long term the better for us all.

After asking you a series of questions to establish your risk appetite and investing style you’re matched with a portfolio that’s best suited to you.

The difference between Moneyfarm and Nutmeg is that Moneyfarm offer free financial advisor services from a real human which sets them apart for me.

In terms of the user experience, it’s super easy to navigate around both the app and web versions with a visual dashboard which allows you to see your live portfolio, its performance and the amount you have invested.

Moneyfarm vs Nutmeg - Account Options

Moneyfarm and Nutmeg both offer the exact same account types which makes them a fantastic selection for both ISAs (individual savings account) SIPPs (self-invested person pension) and JISAs (Junior ISAs).

Stocks and Shares ISA

This means you have access to tax wrappers with the Stocks and Shares ISA providing up to £20,000 per annum tax-free contributions which are free from capital gains tax.

So, as your money grows you don’t have to pay tax!

Pensions

With a pension, you can invest tax-free too. You also get 25% tax relief as a bonus on your contributions which is because you’ve already paid income tax on the money.

You can’t withdraw a personal pension until you’re 55 (soon to be 57) so remember any contributions are out of bounds if you need to dip back in.

Also, remember with pensions you will be subject to tax when it comes to withdrawing it. You can take a 25% lump sum tax-free but then anything else is subject to income tax thresholds.

You can check out our best personal pensions here.

Junior ISAs

If you’ve got kids and want to get them started early you can open a Junior ISA. On top of your £20k ISA allowance, you can invest £9,000 per year on top per child.

They can then access the money when they turn 18. What a way to set them up for life!

GIAs (General Investment Accounts)

A general investment account is a fantastic option for those who perhaps already have a Stocks and Shares ISA and are looking for wider investment opportunities.

The account doesn’t have any tax benefits and returns are subject to capital gains tax so make sure you factor this in.

Nutmeg also offers a Stocks and Shares Lifetime ISA with the ability to put £4,000 per year and you receive a £1,000 government bonus.

It’s important to note that the bonus inside Lifetime ISAs can only be used towards your first home or for retirement.

Investment options

After you’ve selected an account it’s now time to select your investments. Both Moneyfarm and Nutmeg are known for keeping it simple.

Moneyfarm Investment options

There are four options for your investment strategy:

Active management – an actively managed portfolio where the funds are managed by Moneyfarm’s experts

Thematic Investing – where you invest in themes such as technology or clean energy

ESG Socially Responsible – ethical investing for example no tobacco or fossil fuel providers

Fixed allocation portfolios – where the investments don’t change a lot and are mainly fixed

Moneyfarm then has 7 different risk levels which you can access. You are asked questions and they suggest a level for you but you can also change this.

It’s essentially low to high risk and the allocations within the actively managed portfolios will change to suit.

Plus you have your own investment consultant to speak with if you need advice on what’s best for you.

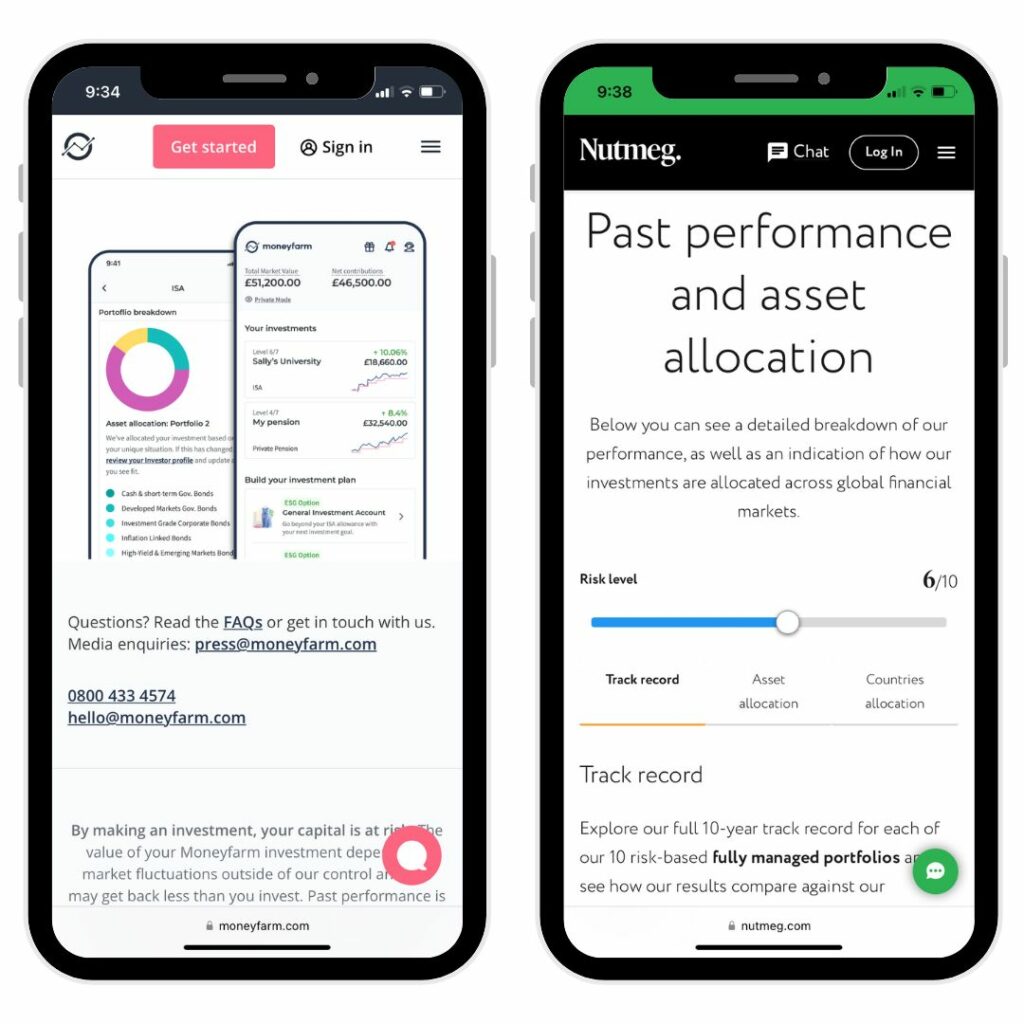

Each person is different when it comes to risk and you can see the past performance to help you make investment decisions.

The socially responsible investment options also make Moneyfarm very attractive here and it’s also cheaper here too.

Nutmeg Investment Options

Fully managed portfolio – experts will manage your portfolio

Smart Alpha – J.P Morgan’s experienced investors manage your portfolio

Socially responsible portfolios – ethical portfolios

Fixed allocation portfolio – investments tend not to change

Both of these accounts are pretty similar but with Nutmeg you have the opportunity for a fully managed portfolio with Smart Alpha that’s managed by J.P. Morgan experts.

Whilst this might sound great, its past performance hasn’t been as good as the name suggests.

Monyefarm and Nutmeg offer socially responsible investing which is where you can invest your money in the knowledge that you have no fossil fuels, tobacco or harmful products.

Moneyfarm vs Nutmeg - Socially responsible portfolio

If you’re interested in being a part of saving the world and investing in socially responsible companies then this is an option for you.

There’s not lots of options here it’s quite simple you just select a socially responsible portfolio and start investing.

The businesses selected within this have generated a good ESG (environmental social governance) score and focus their efforts on improving the planet or by providing services which are helpful to humans.

Portfolio performance

| Moneyfarm | Nutmeg Fully Managed | |

|---|---|---|

| Moneyfarm Portfolio 1/Nutmeg Portfolio 1 | - 8.1% | - 5.4% |

| Moneyfarm Portfolio 2/Nutmeg Portfolio 2 | - 9.0% | - 10.04% |

| Moneyfarm Portfolio 3/Nutmeg Portfolio 3 | - 9.3% | - 12.2% |

| Moneyfarm Portfolio 4/Nutmeg Portfolio 4 | - 9.0% | - 13.2% |

| Moneyfarm Portfolio 5/Nutmeg Portfolio 5 | - 11.6% | - 12.6% |

| Moneyfarm Portfolio 6/Nutmeg Portfolio 6 | -11.8% | - 11.6% |

| Moneyfarm Portfolio 7/Nutmeg Portfolio 7 | - 12.4% | - 11.0% |

Customer Reviews

When looking at articles across the internet and the major review sites both are ranked quite equally. That being said, there are more positive notes coming out of Moneyfarm.

The negative comments you can find are mainly about portfolio performance heavily weighted to 2022 which is where financial markets underperformed as a whole.

Clearly, there is still some work to do in teaching individuals to have a longer-term mindset.

Nutmeg

Trustpilot score – 3.7 from 1537 reviews

Apple Store – 4.8 from 15,018 reviews

Google Play – 4.3 from 9 reviews

Moneyfarm

Trustpilot score – 3.7 from 871 reviews

Apple Store – 4.7 from 1708 reviews

Google Play – 4.2 from 5642 reviews

Moneyfarm vs Nutmeg - Are they safe?

Yes, both apps are regulated by the FCA (financial conduct authority) and have FSCS (financial services compensation scheme) protection up to the value of £85,000 should either of the operations go bust.

After that, there is banking-level security to log in and your data is stored securely.

Moneyfarm vs Nutmeg Alternatives

Being part of the robo-advisor clan means there aren’t many other alternatives in the market which are true competitors.

The biggest competitor in the UK is probably Wealthify which is another great company backed by Aviva.

We have a dedicated Moneyfarm vs Wealthify review for you to check out.

Equally if you’re looking for the best investing apps for beginners then head to our page there.

This features the like of InvestEngine, Moneybox and more.

You can also check our Moneyfarm vs Moneybox review here too!

FAQs

Is Moneyfarm better than Nutmeg?

Yes, if you look at performance and the fees then Moneyfarm can be considered better than Nutmeg. This however will always be a personal opinion and you will need to form your own opinion however the data doesn’t lie!

Are Nutmegs fees too high?

Nutmeg’s fee structure is somewhat questionable in comparison to the other robo-advisors in the industry. UK investors are blessed with a wide range of investment account providers and right now for me, Nutmeg needs to work on its fee structure.

Nutmeg vs Moneyfarm - Who Wins?

When it comes to comparing the two investment service providers there is a lot to like about both of them. They are both excellent options and are two of the very best robo-advisor platforms there are on the market.

For my investment portfolio, I’m very happy with Moneyfarms Stocks and Shares ISA and really like how their investment team operates. For me, it is one of the best investing apps out there right now.

That being said I think because Moneyfarm offers you access to a qualified financial advisor to levels unseen across the industry for free a part of their service swings it for them.

The investment performance on the stock market for Nutmeg hasn’t been that great and its fund fees are higher. Moneyfarm has cheaper fixed allocation portfolios, trading fees and a cheaper management fee which with the performance factored in makes this a no-brainer!

MONEYFARM IS THE WINNER!!

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.