Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

£50,000 is a fantastic salary and is more than enough to support yourself. It is well above the median wage for the UK, but it will differ depending on your current family and financial situation.

If you live in London, you could expect £50,000 to go quite a long way but compared with places in the North, £50,000 will go much further.

So, is £50k a good salary in the UK? Let’s find out below.

Table of Contents

Is 50k A Good Salary UK?

A 50k salary is above the nation’s average for a full-time employee.

The average yearly salary for full-time workers in London in 2022, according to Statista, was £41,866, compared with £29,521 for workers in North East England, which was the lowest in the United Kingdom in 2022.

Most people will naturally start much lower to this if they leave university or go straight to work after school. £50,000 tends to be either a mid-tier or senior management position depending on the organisation, and therefore will need relatively good experience to get there.

Only 24% of people in the UK get a job in the subject they studied, so a vast majority will be paid less when leaving university.

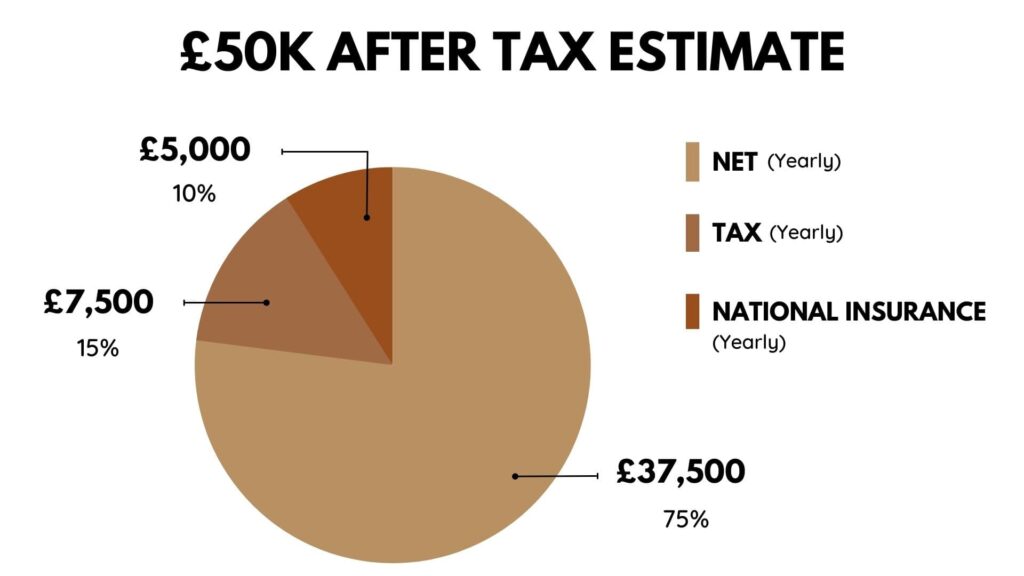

Breaking down a £50k salary

You’ve landed a 50k salary, but how does it break down?

This net wage is calculated based on you being younger than 65 with no student loan, pension deductions or benefits.

Gross income of £50k per year equals:

- £24.03 per hour

- £192.31 per day

- £961.54 per week

- £1,923.08 bi-weekly

- £4,166.67 per month

Estimated Net Income after income tax and national insurance contributions

- £18.27 per hour

- £146.25 per day

- £731.23 per week

- £1,462.46 bi-weekly

- £3168.67 per month

UK Salary Calculator

Results:

Can you live off a 50k salary?

The short answer is yes, the majority of us can live off 50k. By any means, it’s not a tiny amount, but it’s how you use it that matters most.

Many variables are in play, such as location, family size, household income, debt and monthly expenses. This is unique to each person; therefore, only you will know if you can live off 50k.

If you’ve been on a higher salary and are taking a pay cut, you may be accustomed to a higher amount meaning your outgoings may be much higher.

In this case, you may not be able live off £50,000 and would need to rearrange your finances to suit your new salary.

How much rent can I afford on a 50k salary?

Renting is challenging as it depends a lot on your expenses. There isn’t just rent to factor in here, as you will need to consider household bills like council tax, gas and electricity too.

Remember things like internet, mobile phone, insurance and transport bills. It all adds up, so it’s essential to budget for these costs before you work out your available cash for rent.

Usually, it’s around 30-40% of your salary for rent. Try to keep this as low as possible. Operating within this bracket leaves you some cash left over each month.

Considering your monthly income after tax, this bracket is around £900-£1100.

In London the cost of living is higher so you’d be lucky to get more than a studio flat but if you’re sharing you could get a lovely room within a decent sized apartment.

In the North of England this will go a lot further and in some places can even get you a 3 bedroom house.

Can I buy a house with a 50k salary?

Yes, you could easily buy a house with a 50k salary. According to onlinemortgage.co.uk, you could afford somewhere between £225,000 – £300,000 if you have a 10% house deposit.

Usually, in the UK, you can x5 your yearly income before tax, which you can afford. If you live with your partner and add to a joint mortgage, your affordability would increase if your partner works.

It’s important to note if you’re freelance that this amount could change as lenders are less favourable to people with their own businesses.

Depending on where you buy £250,000 can go quite a long way. Again in London, you’d be lucky to find anything at all, but if you’re looking in more rural areas, then flats are a great option and even small cottages.

Tips with how to live off a 50k salary

Sometimes we need to make it work, and if 50k is your salary, then that’s what you have to do. This section looks for tips to help you stretch your paycheque further.

Do a budget

BORING! We know budgeting isn’t cool, but it is vital! Without one, you’re playing the dark, and while that may work for some for most, it doesn’t!

If you’re living paycheck to paycheck and struggling to get to the end of the month, then a budget can help you solve this.

Understanding your outgoings allows you to assess your current financial situation and plan ahead for more significant purchases or life decisions.

You can find many seriously great budgeting apps, printables or even spreadsheets online to help you.

Pay off Debt

If you’re earning £50,000 a year, you should be looking to clear any debts you may have. This is where a budget comes in handy as you allocate money to pay down your debt.

Targeting any high-interest debt first is crucial, so you reduce your payments faster. Money given in interest is money you could have used elsewhere.

Many of us pay the minimum balance, and whilst this is contributing, you’re often just paying back the interest. The key here is to overpay where you can and get on top of it. You’ll feel a million times better if you do!

Use credit cards correctly

Using credit cards correctly is something I could go on about all day. I’ve done it so I’m no saint but now I barely use them for anything other than points or if there’s a cashback offer on something I was already going to buy.

I pay them down immediately – don’t wait. That’s the trap they lure you in, and bam, you spend your life paying down purchase interest. Don’t do this!

It’s also vital for your credit that you don’t max out your credit card. Agencies like Experian and Equifax will encourage you to keep under 30% of your total credit balance.

By doing this, it shows you’re responsible with debt and can clear it if you need to.

My tip is to buy something on it every month. Have a regular bill that you pay, like Amazon Prime or BT. As soon as it comes out, pay it off that day. This will really show you’re responsible and help increase your credit score.

If you have credit card debt with interest coming out each month, look to balance transfer onto a new provider and start paying it off.

Grow your savings

Savings are part of every financial strategy. I want to make sure I have a safety net, and this is something you should consider especially earning £50k+ a year.

Building yourself an emergency fund is a great place to start, and most people say this should be 6 months’ worth of pay, but really, 3 months is a great place to start.

If you struggle to save, use technology to help you. We’ve made a list of the best money-saving apps you can get started with immediately.

I use the round-up feature with my bank to put money aside. This basically takes any purchase and puts the loose change away for me. For example, if I spend £1.50 on something, my bank rounds up the purchase to £2.00, placing the 50p into a savings pot for me.

Consider investing

If you’ve never invested, then it should be on your radar for a £50,000 salary. Making money work for you is the fastest way to get ahead, and you do this by investing it.

Sure there are risks, but if you invest for the long term, many of those risks are mitigated. The stock market is built to rise over time, so you will get results if you pick well and follow a tried and tested strategy.

If you want to avoid learning about investing, let apps like Moneyfarm and Nutmeg do the hard work for you. These brands are called robo-advisors, and they take care of everything for you with algorithms tailored to each individual.

Stop waiting and start investing with the best UK investing apps on the market right now.

We've covered all levels with expert managed and DIY options available.

FAQs

Is 50k a year middle class?

50k a year would see you as middle class in all areas of the UK, and it is an above-average wage that allows you to live comfortably. No official amount makes you into a class, but £50,000 a year is an excellent wage.

What areas are best to live on a 50k salary?

- Yorkshire

- Cotswolds

- Cornwall

- Devon

- Lancashire

Is a 50k salary good for a single person?

If you’re single and have relatively no debt, 50k is an excellent salary. This will allow you to pay your rent and still have enough left to enjoy time with friends and family, invest and even put money away.

Conclusion

So, Is 50k a good salary in the UK? We’ve established that it depends on where you live, your financial situation and many other variables.

You can easily make 50k work even in the capital, but if you’re supporting a large family on just this wage, it can become challenging, depending on your situation.

- Is 20k a good salary?

- Is 25k a good salary?

- Is 30k a good salary?

- Is 35k a good salary?

- Is 40k a good salary?

- Is 45k a good salary?

- Is 55k a good salary?

- Is 60k a good salary?

- Is 65k a good salary?

- Is 70k a good salary?

- Is 75k a good salary?

- Is 80k a good salary?

- Is 90k a good salary?

- Is 100k a good salary?

- Why are US salaries higher than the UK?

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.