Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

According to Statista, the median annual earnings for the United Kingdom was 33k in 2022. So, 75k is more than double the national average salary!

Based on the same statistics, the average salary for those living in London was £41,866. Britain’s capital, of course, has a higher cost of living.

However, £75k is still over £20k higher than the London annual salary average. So, you can still class this as a good salary, even in London.

75k isn’t just a “good” salary. Earning anything above £70k a year would put you in the top 5% of UK earners. So, that extra 5k makes £75k one of the best salaries you can land in the country.

However, council tax, living expenses, and the way you invest your money will of course still impact how far your salary stretches.

So, ‘is 75k a good salary?’ Definitely, but it still depends on how you spend it.

Table of Contents

Breaking down a 75k salary

You’re probably wondering how a 75k salary breaks down month by month, week by week, and so on.

Gross salary (before tax) of £75k per year equals:

- £37.50 per hour

- £300 per day

- £1,442 per week

- £2,884 bi-weekly

- £6,250 per month

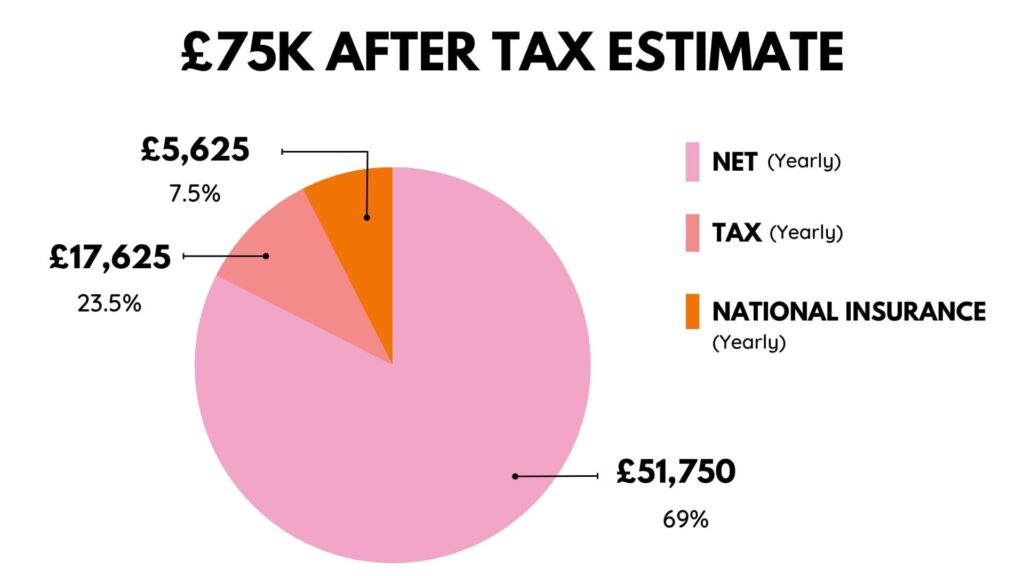

Estimated net income after you pay Income Tax and National Insurance contributions:

- £25 per hour

- £198 per day

- £989 per week

- £1,978 bi-weekly

- £4,284 per month

The above estimates are based on data from our UK Salary Calculator which you can use below.

If you earn £75,000, it is estimated that you’ll take home £51,413 after you’ve paid Income Tax and made your National Insurance contributions.

UK Salary Calculator

Results:

Can you live off a 75k salary?

Yes, you can comfortably live off a £75k salary – especially if you choose to live outside of London.

London salaries are much higher in comparison to the rest of the UK but then again so are the costs!

With a 75k salary being much higher than the national average, a single person can definitely enjoy quality housing, an expensive social life, and regular holidays for £75k a year. This is regardless of which region of the UK you stay in.

However, the ongoing cost of living crisis has impacted the perception of what kind of average yearly wage you require to live comfortably in the UK.

In January of 2023, a survey conducted by Reed in The Telegraph concluded that Londoners require a £65,000 wage to combat the rising cost of living.

Although £75,000 puts you £10,000 above that estimate, it doesn’t exactly reflect everyone’s living situation and annual expenses.

Factors that impact your ability to ‘live off a 75k salary’ include your taste in clothes, your social life, how often you like to travel abroad, and whether or not you have children.

Of course, it takes a lot of effort to earn a £75k average income. It is far from the starting salary for UK workers and is more likely to be the salary of those in a senior position.

Earning above £70k places you in the top 5% of UK workers. It is, therefore, very difficult to work your way up to this kind of yearly income.

How much rent can I afford with a 75k salary?

With a £75k salary, you could afford a one-bedroom flat in any major city in the UK.

The maximum recommended rent budget of a person on 75k in the UK is between £1,285 and £1,713.

This is based on the idea that you shouldn’t exceed 30-40% of your gross income on rent.

The estimated budget is calculated based on your takings after taxes.

Given that the average rent for London is currently between £1,500 – £1,600, it’s safe to assume you’ll be able to find accommodation anywhere in the UK, since London is possibly the most expensive spot to rent.

Of course, your rental options become more luxurious when you have a partner or flatmate to split the costs with.

If you’ve got a high median household income, rent will of course be more affordable for you. If you’re a single person, rent and living expenses will be higher.

Can I afford a house with a 75k salary?

A 75k salary guarantees that you’ll be able to afford a house in the UK.

It would be possible to buy a house worth over £370,000, as long as you have money saved for a deposit.

The mortgage you’ll be able to borrow is also sizeable. Given that the average mortgage are typically granted at a rate of five times your annual salary, you’ll be able to bag a mortgage worth £375,000.

Of course, this mortgage estimate would increase if both you and your partner are full-time workers and you sign up for a joint mortgage.

It may still be difficult to land a house in the centre of a major city when on 75k.

However, you’ll have a greater chance of securing a three-bedroom house in north-east England, for example.

Tips for living off a 75k salary

Chief executives and senior managers often take home 75k and above – but that doesn’t mean they’re financially comfortable for life.

Despite being above the nation’s average, you’ve still got to be responsible with your cash.

Here are some practical tips on how to live off a 75k salary:

Pay off debt immediately

As a full-time employee earning 75k, you may neglect to pay off your debt to enjoy your significant income to the max.

However, ignoring high-interest debt will eventually shrink the value of your income.

Invest

A good way to make your high-income stretch even further would be to invest in lucrative businesses.

Once your basic necessities are covered, you should avoid spending all of your disposable income on luxuries.

Budget

Even when you’re on a good salary, budgeting is important. With more money in your account, you’ll be more inclined to spend more – and buy more expensively.

This could see your good salary slipping away at a fast rate.

Increase your income

Learning new skills or side hustles can help you improve your quality of life. For example there are tonnes of ways to make money online or if you’re in the capital we have a list of ways to make money in London.

FAQs

How much should I be earning at the age of 40 in the UK?

Ideally, you should be earning £727 a week at the age of 40. This is the median wage for those over 40.

You can expect your wage to peak around middle age, and the possibility of you earning £75k a year becoming increasingly possible.

What is a middle-class wage in the UK?

An average middle-class family earn £33,519 per year. A salary that exceeds £70k is considered to be an upper-middle-class wage.

So, those who exceed £75k can definitely consider themselves on the higher end of the middle-class bracket.

Final Thoughts

So, is 75k a good salary? Yes. This kind of earning puts you well above the nation’s average. It also allows you to pay for both basic necessities and luxury items comfortably.

But, is 70k a year middle class? It’s actually an upper-middle-class wage and can guarantee you a comfortable house and living standards.

- Is 20k a year a good salary?

- Is 25k a year a good salary?

- Is 30k a year a good salary?

- Is 35k a year a good salary?

- Is 40k a year a good salary?

- Is 45k a year a good salary?

- Is 50k a year agood salary?

- Is 55k a year a good salary?

- Is 60k a year a good salary?

- Is 65k a year a good salary?

- Is 70k a year a good salary?

- Is 80k a year a good salary?

- Is 90k a year a good salary?

- Is 100k a year a good salary?

Share on social media

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.