Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

£35,000 a year is an above-average salary compared to wages across the UK and, if used correctly, should be more than enough to support yourself and your family.

If you live in London, this wage will be a little more challenging, being £3k under the average salary for London, so you’ll need to budget and make intelligent financial decisions.

If you live in the North, £35,000 a year will go much further, and in a rural area, costs are much lower than in cities and towns.

Either you’re a city dweller with higher prices or a country bumpkin where the green life is a cheap life.

If you want to find out the answer to ‘is 35k a good salary in the UK’, then read on as we break it down.

Table of Contents

Is 35k a good salary?

A 35k salary is just above the nation’s average for a full-time employee so yes it is a very good salary. Anything above average must be considered so.

The average yearly wage for full-time workers in London in 2022, according to Statista, was £41,866, compared with £29,521 for workers in North East England, which was the lowest in the United Kingdom in 2022.

The average wage in the UK across the entire country is £33,000, so if you’re earning £35,000, you’re £2000 a year above the average.

£35,000 usually means you will or currently work in a lower-tier management role like sub-team manager or assistant manager within a larger team. These roles will require some experience, so you may need to work up to them.

It does, however, depend on the type of work you take on as a starting teacher would expect £20,000, but a starting GP doctor would expect around £30,000.

If you’re a doctor in London, this may be slightly higher due to wages in the capital generally being much higher.

For someone with a job in consumer services like a flight attendant or at a bank, £35,000 is what you might expect after promotion from an entry-level role.

Only 24% of people in the UK get a job in the subject they studied, so a vast majority start on a lower wage and increase over time with experience.

Let the latest technology help get you there with the best money savings apps.

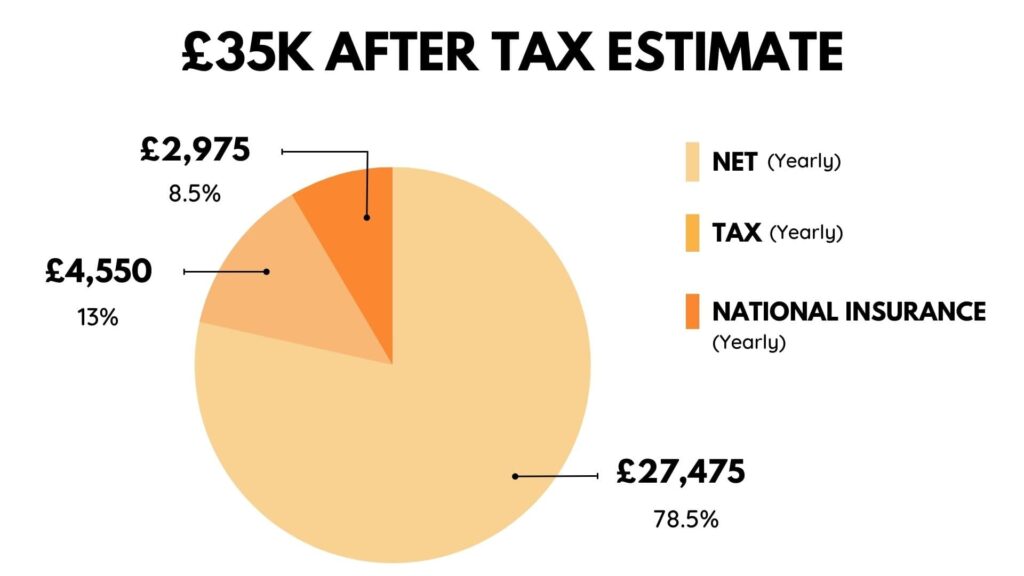

What is 35k after tax (and before)

Let’s break down a 35k salary so you know your earnings by the day, week or month.

Please note this net wage is calculated based on you being younger than 65 with no benefits, pension contributions or student loans.

Gross income of £35k per year equals:

- £16.82 per hour

- £134.62 per day

- £673.08 per week

- £1,346.16 bi-weekly

- £2,916.67 per month

Estimated Net Income after income tax and national insurance contributions:

- £13.38 per hour

- £107.02 per day

- £535.08 per week

- £1,070.16 bi-weekly

- £2,318.67 per month

If you’re wondering how bonuses are taxed, then it’s the same as your income tax but just added to your salary.

UK Salary Calculator

Results:

Can you live off a 35k salary?

Yes, you can live quite comfortably off 35k. Plenty of people make this salary work, but it’s just over average, so you will need to be careful you don’t become irresponsible with your money. It’s certainly not time for a Bentley car and Gucci handbags!

There are many variables in play for each individual or family, such as where you live, the number of children, your overall household income, debt and monthly expenses. These variables will always be unique to each person; therefore, only you will know if you can live off 35k.

If you’ve been on a higher salary and are taking a pay cut down to £35,000, your outgoings are likely to be much higher.

In this case, you may not be able live off £35,000 and would need to rearrange your finances and lower your expenses.

How much rent can I afford on a 35k salary?

If we’re looking at your income after tax, you should be able to afford something in the range of £650-£850.

If you’re in London, or a major UK city, you’d be lucky to get more than a room in a shared house as rents are expensive. In this case, look to buddy up with friends or your partner, which will give you more options and allow you to find something nicer.

This amount will go further in the North of England, but you will still need to buddy up if you want a bigger place.

When renting, I always tried to keep my rent as low as possible without compromising quality and space. Usually, this is around 30-40% of your monthly salary and operating within this bracket will mean you have enough money to pay for bills and daily expenses.

There isn’t just rent to factor into your monthly expenses; you must consider all other household bills like electricity and water. Council tax will vary by area and by the size of the property, but this information is readily available on most council websites.

Then you will have personal bills such as a mobile phone, internet and contents insurance. It all adds up!

On any salary, budgeting is essential but even more so on £35,000 as it’ll mean every penny could count when it gets to the end of the month.

We’ve got a post all about how much rent can I afford here.

Can I buy a house on 35k?

With an above-average salary, you can buy a house with 35k, but you will need a reasonable house deposit.

To determine your affordability, you would x5 your yearly income before tax. According to the Barclays mortgage calculator, you could afford somewhere between £170,000 – £190,000 if you have a 10% house deposit.

If that doesn’t cut it for where you want to live, then you could try buddying up with a partner, family member or friend on a joint mortgage to increase your affordability.

If you are a freelancer, this amount could change as you will need proof of profits for at least two years.

Another great way of making your budget stretch is shared or part ownership which helps increase your affordability as you only buy 30-40% of the house rather than the whole thing.

Tips for how to live off a 35k salary

Sometimes we need to make it work, and if 35k is your salary, then that’s what you have to do.

This section looks for tips to help you stretch your paycheque further.

Create a budget

We all know we should budget, but 82% of the UK only bothers to budget for some months. 72% of us are getting into debt to make it to the end of the month, so if you do budget well, you’re better than most of the country!

By doing a budget, you become financially responsible, and it can help identify savings, investment opportunities or potential cutbacks.

Budgeting allows you to plan for those significant life moments like buying a house or a new car. You’ll be more confident making the purchase and know the ins and outs of your bank balance each month.

You can find great budgeting apps, printables or even spreadsheets online to help you if you’re wondering where to start. We’ve also built our own smart money budget sheet, which you can get a copy of below.

Our smart money budget sheet helped me go from £20,000 in debt to buying a house in just over three years.

Save when you shop

Saving money when you shop is one of the easiest and quickest way to make a difference to your wallets.

The weekly food shop is unfortunately rising in prices so shopping at places like Aldi and Lidl, which are still good quality, can save you £300-500 a year just by shopping there. This number goes up if you have a bigger family to feed.

Saving when you shop also counts for other types of shopping, for example, clothes and electronics.

Use cashback apps like Topcashback or Quidco to get extra money off your purchases. Sometimes, you can get up to 10% back on larger purchases!

Grow your savings

If you’ve only one income, you must look to start putting some money away for a rainy day. Building an emergency fund is where to start, so if you have a financial inconvenience, it softens the blow.

Emergency funds should be between 3-6 months of full pay. Once you have this locked in, you can set some loftier goals.

If you struggle to save, use technology to help you. One great feature I use is round-up technology.

Rounding up is similar to the loose change pot we used to have on our bedroom shelves. It works by rounding up your purchases to the nearest pound and putting the remainder into a pot.

The good thing about this is its automatic saving, so you barely notice it, and it quickly builds up over time.

Let the latest technology help get you there with the best money savings apps.

FAQs

Is 35k a year middle class?

35k a year would see you as lower middle class in all areas of the UK, and it is an above-average wage that allows you to live comfortably. No official amount makes you into a class, but this is where 35k would sit if you were forced to work it out.

What areas are best to live on a 35k salary?

- West Yorkshire

- Scotland

- Kent

- Somerset

- Gloucestershire

Is a 35k salary good for a single person?

If you’re single and have relatively no debt, 35k is a solid salary. 35k will give you a roof over your head but still require you to make smart financial decisions to get by.

Conclusion

Is 35k a good salary in the UK? We’ve established that it depends on where you live, your financial situation and many other variables.

You can make 35k work even if you live in London. It comes down to how you budget, your expenses and how good you are with money.

More like this

- Is 20k a good salary?

- Is 25k a good salary?

- Is 30k a good salary?

- Is 40k a good salary?

- Is 45k a good salary?

- Is 50k a good salary?

- Is 55k a good salary?

- Is 60k a good salary?

- Is 65k a good salary?

- Is 70k a good salary?

- Is 75k a good salary?

- Is 80k a good salary?

- Is 90k a good salary?

- Is 100k a good salary?

- Why are US salaries higher than the UK?

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.