Sammie Ellard-King

I’m Sammie, a money expert and business owner passionate about helping you take control of your wallet. My mission with Up the Gains is to create a safe space to help improve your finances, cut your costs and make you feel good while doing it.

Quickfire Roundup:

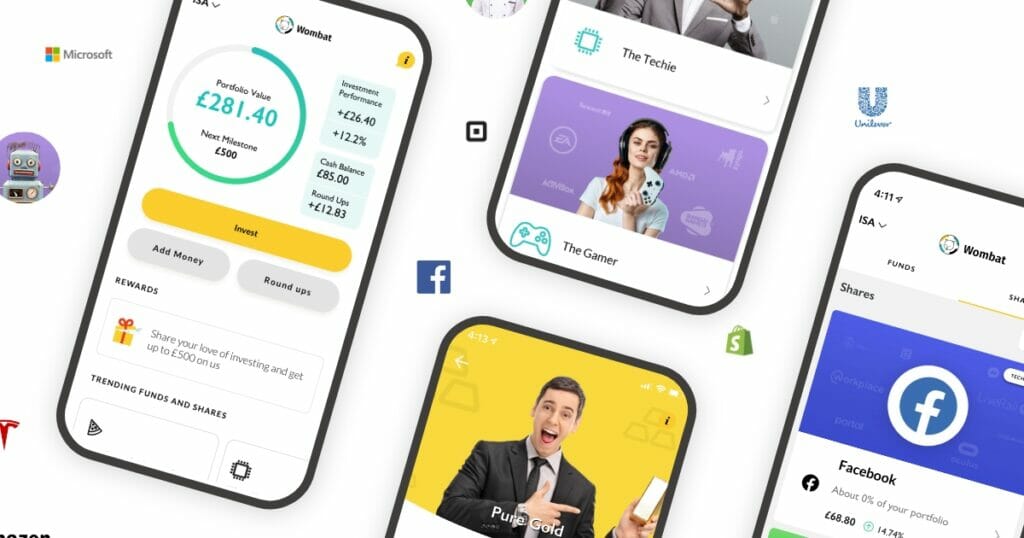

Wombat Invest is like a breath of fresh air in the investment world!

What I absolutely love about the Wombat app is how it’s tailored for beginners – no more finance jargon that sounds like alien language!

The themed portfolios are just genius; you can go green with sustainability, embrace girl power with companies led by women, or ride the tech wave. It’s like picking your adventure! Plus, the fractional shares feature is a wallet-saver; you don’t need to break the bank to own a piece of your favourite company.

Wombat also offers a general investment account and a Stocks and Shares ISA for that tax-efficient touch. It’s like having a nifty financial buddy in your pocket!

If you’re new to the world of investing, there’s a good chance you’re on the hunt for a no-nonsense but epic trading platform to start investing with.

This Wombat review will look at what this operator has to offer and see what boxes it ticks but, equally, what it doesn’t.

Before we get started, I just wanted to say that Wombat was one of the best experiences I’ve had using an app in a while.

It’s features like auto-invest and roundups which connect to your bank are really smart, the app is slick and so far I’m really enjoying using it.

If that sounds appealing, then you’re going to want to know a little more about the Wombat investing app and how it works.

Build wealth your way. Trade global stocks and ETFs for just £10. Capital at risk.

Our Rating

- Suitable For Beginners

- Useful Features

- User Experience

- Price / Fees

- Customer Feedback

- Customer Service

We’ve rated Wombat 4.54 out of 5 using our six pillar method which is an excellent score and one of our highest ratings for investing apps.

It scored highest on suitability for beginners, useful features and user experience.

Overall I’ve been really impressed with not just the company but also the team working there having interviewed Ben Vickers their Product Manager recently on our podcast.

If you’ve heard enough already then you can visit Wombat here or just below to get yourself started.

Wombat Pros & Cons

- The minimum investment of £10 really does make investing accessible to the masses

- The ability to round up and invest spare change is a great option

- Providing education to new investors is a welcome addition

- While other fees may apply, trading is commission free

- 0.1% platform fee, which is much lower than other accounts like FreeTrade and Money Box

- You have to pay a subscription fee to invest in ETFs - other providers allow you to do this for free

- The product choice is fairly limited - it would be good to see pensions, Lifetime ISAs, and Junior ISAs

- The foreign exchange fees are a little on the hefty side

- We're not big fans of the currency conversion fees which is clearly where they are making their money

Build wealth your way. Trade global stocks and ETFs for just £10. Capital at risk.

Table of Contents

Wombat Review - Company Overview

Whenever we take a look at what’s on offer with a company, we like to take a look at the company as a whole.

This Wombat review is no different, so we thought we’d take a look at some of the key points about the business.

Given the name, it’s perhaps unsurprising that there is an Australian entrepreneur behind Wombat Invest. It was Kane Harrison who founded the Wombat investing app back in 2019.

Wombat aims to make investing as simple, hands off and as low-cost as possible and it’s not designed for more experienced investors or traders.

It’s fair to say that the app is aimed pretty much at novice investors who are finding their feet, as it gives them an easy way to dip their toes in and learn all about investing in shares and ETFs (Exchange Traded Funds).

It recently won ‘Investment Tech Of The Year 2022’, at the UK FinTech Awards.

Main Features

There’s plenty of information and detail to get stuck into as part of this Wombat review.

Before we do that, though, we wanted to provide you with a clear summary of some of the main features that you’ll find when signing up with Wombat Invest.

The main benefits and features include:

- You can get started investing with as little as £10. Many platforms have minimum amounts of £100, so this is a real plus point that makes investing accessible to all

- Unlimited commission-free trading (other fees apply)

- Instant access to fractional shares. This means that you can own a fraction of a share where a full share is out of reach. This allows anyone to get involved with big named companies for a low-cost entry

- Wombat’s Standard accounts can round up your spare change. Wombat will add this straight into your cash account, or invest it

- Set up Auto Invest to automatically invest your money. Choose the amount you’d like, and what you’d like to invest in.

- The company is based in the UK, and the customer service team is available every hour of every day of the year

Build wealth your way. Trade global stocks and ETFs for just £10. Capital at risk.

Wombat Account Types

When setting up our Wombat account, we came across the Stocks and Shares ISA or the General Investment Account as two options for our accounts, but there is also an option for plans which are the instant and standard plans.

I have to say, at first, this was slightly confusing to work out, and I had to fully read both pages to work out what I wanted to do.

After some digging it still wasn’t clear so I had to just download the app and try to open an account, which I didn’t mind doing as I was going to anyway but something the company might want to bare in mind in the future.

To download via the website you enter your mobile number and get a text with the direct link code. SMS marketing via brands is the in thing again, so we really liked this feature.

Once I had downloaded the app, we were taken to a page that offers the first £10 investment on Wombat, which is always lovely!

There are three options to choose from to open a Wombat account, the Instant GIA, or Standard GIA or Standard Stocks and Shares ISA.

The app can be downloaded on both iOS and Android devices and once you’ve done this, opening an account is straightforward.

You’ll need to provide your personal details, including your national insurance number, make a deposit (minimum £10) and then decide which of the three accounts you want.

If, however, you do struggle, what’s refreshing is that customer support is available 365 days a year, 24/7.

We never had the need to tap into this, but when you look at some of the ratings Wombat has received, people are incredibly positive about the customer service.

The accounts come with different fees, which we will explore a little later, but here’s a look at the other key differences:

Wombat GIA Instant plan

Once you’ve signed up for the Instant plan, you’re given access to:

- 500+ popular stocks and shares across the US market

- Cashback on your orders (T&C’s Apply)

- Access to fractional shares

- Access to the learning hub where you receive articles to educate you on the world of investing

Wombat GIA Standard plan

- You can invest in 40+ fractional shares with Wombat’s Standard accounts, including UK, US & EU shares.

- Access to ETF themes (more on these in a moment)

- Access to the learning hub where you receive articles to educate you on the world of investing

- Access to the roundup and auto-invest feature so that your spare change can be used to invest

Wombat Stocks and Shares ISA

If you opt for the stocks and shares ISA it’s worth noting that if you already have one then you can only pay into one a year.

- Access to everything on the standard plan

- £20,000 free a year from capital gains and income tax (Tax treatment depends on your individual circumstances and may be subject to change in the future)

- Access to the learning hub where you receive articles to educate you on the world of investing

Capital at Risk

Build wealth your way. Trade global stocks and ETFs for just £10. Capital at risk.

What are these themed ETFs?

With the Standard GIA and the stocks and shares ISAs, there are a total of 29 ETFs that you can invest in. .

Wombat recognised that ETFs could get a little confusing when you’re trying to decide where, what and when to invest.

For that reason, in order to simplify it all, Wombat places its ETFs into what it called themes.

These are the themes that are available:

- Technology – The Innovator, The Battery Room, The Techie, The Space Age, The Robo, The Gamer, The Blockchain, The AI, Powering the Internet

- Ethical Investing – The Innovator, Women in Power, The Future of Food, The Electric Car Revolution, The Goodies, Medical Cannabis, The Green Machine

- Global Brands – The British Bulldog, Fly the Flag, All American, The World’s Greatest, the High-Ender

- Diversification – Women in Power, The Adventurer, The Lifestyler, The Balanced

- Food and Drinks – The Snack Attack, The Future of Food, The Foodie

- Commodities – Pure Gold, The Money Maker

- Scientific – The Healthcare Innovators

- Model Portfolios – The Adventurer

User Experience

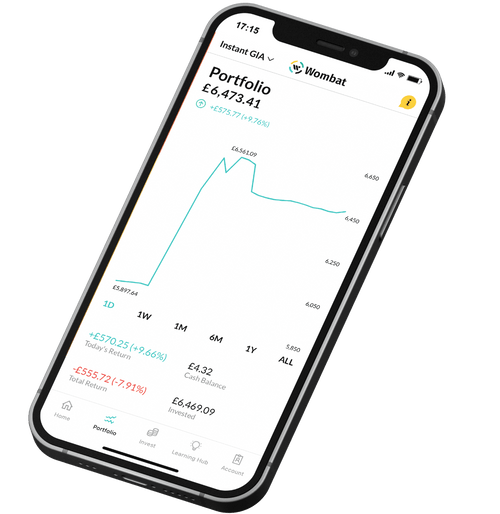

Having had a play on the app, we’ve found that the user experience is slick and easy to navigate.

The app is easy to jump from your portfolio the other sections by using the navigation bar at the bottom.

Placing trades is really simple and you can set up monthly direct debits into your chosen funds which we really like as it promotes regular investing.

The design is also visual and unique which and we’ve found it displays everything you need.

Wombat Fees

| Wombat Invest Instant Plan | Wombat Invest Standard Plan | |

|---|---|---|

| Monthly Fee | FREE | £1 |

| Other Fees | 0.65% FX fee and currency conversion fees | 0.10% platform fee 0.65% fee and currency conversion fees in investing in shares |

| General Investment Account (GIA) | ||

| Stocks and Shares ISA | ||

| Fractional US Shares | ||

| Fractional UK and EU Shares | ||

| Themes (ETFs) | ||

| Learning Hub | ||

| Round Ups |

Anyone that takes the time to read a Wombat review will be keen to know about the fees that are involved.

When it comes to Wombat Invest, the fees that you’ll be charged depend upon the account type that you’ve chosen:

Instant Plan fees

With the Instant plan, there is no monthly charge, and there is no platform fee. However, as the Instant plan only has access to US shares, money needs to be converted from GBP to USD. Wombat charges a currency conversion fee of 0.65% for this.

Also, as the Instant plan only has access to US shares, money needs to be converted from GBP to USD. Wombat charges a currency conversion fee for this.

Standard and Stocks and Shares ISA fees

If you opt for the Standard plan, you’ll find that there is a monthly fee of £1. On top of this, there is also a 0.10% platform fee, and trades are subject to a 0.75% foreign exchange fee if you’re investing in foreign shares.

There’s also a 0.7-0.75% fund manager fee which applies to ETFs only..

The big thing to take into account here is that by opting for the Standard plan, you are giving yourself many more opportunities to invest with ETFs and UK, US & EU fractional shares.

Next up in the Wombat review is what we like and what we don’t like.

Build wealth your way. Trade global stocks and ETFs for just £10. Capital at risk.

What Wombat Customers Are Saying?

If you head over to the homepage of Wombat, you’ll find that it proudly displays its Trustpilot reviews, and it has good reason to. With 4.3 stars out of 5, Wombat is classed as being excellent.

A whopping 78% of reviews refer to it as being either excellent or great. A mere 6% of people have rated it as bad.

The positive Wombat reviews focus on how easy the service is to use. They also heap praise on the customer service that’s on offer.

When taking a look at the negative comments, the main issue seems to centre around the fact that it takes a while to withdraw your funds.

Overall though, there’s no denying the fact that existing Wombat customers are more than happy with the service that they’re receiving, and this really helps to instil confidence if this is something that you’re considering for yourself.

Wombat Alternatives

The most similar apps that we’ve reviewed to Wombat are the following:

Conclusion

We really enjoyed using Wombat and think it’s an interesting play for investors that enjoy easy, hands-off, but very fun investing.

It has all the bells and whistles for those who are just starting out and are trying to simplify investing as much as they can.

When you look at some of the features compared to the like of FreeTrade, you can see that they differ by having the auto-invest and roundup features.

Personally, they are very similar in a lot ways, but Wombat just edges it for me for the overall experience.

The app isn’t for the individual stock picker or short-term investor who likes to move their portfolios around a lot, but that’s not the type of audience they’re looking to attract here.

I’m very interested in seeing what features they add over the next couple of years, but overall, Wombat is a decent little app and certainly one we have enjoyed holding an account with.

We hope you enjoyed our Wombat review. If you’d like to check out some more of our reviews then scroll down.

You can also check out all of our best investing apps right here. Wombat has made the list!

Share this article with friends

Disclaimer: Content on this page is for informational purposes and does not constitute financial advice. Always do your own research before making a financially related decision.